How To Know If A Company Is Profitable

Is the company you're eyeing a goldmine or a money pit? Don't get burned; understanding a company's profitability is crucial before investing or even accepting a job offer.

This article provides a concise guide to assess a company's financial health, empowering you to make informed decisions based on key financial metrics. We'll cut through the jargon and provide actionable insights to help you quickly determine if a company is truly making money.

Decoding Profitability: Key Metrics

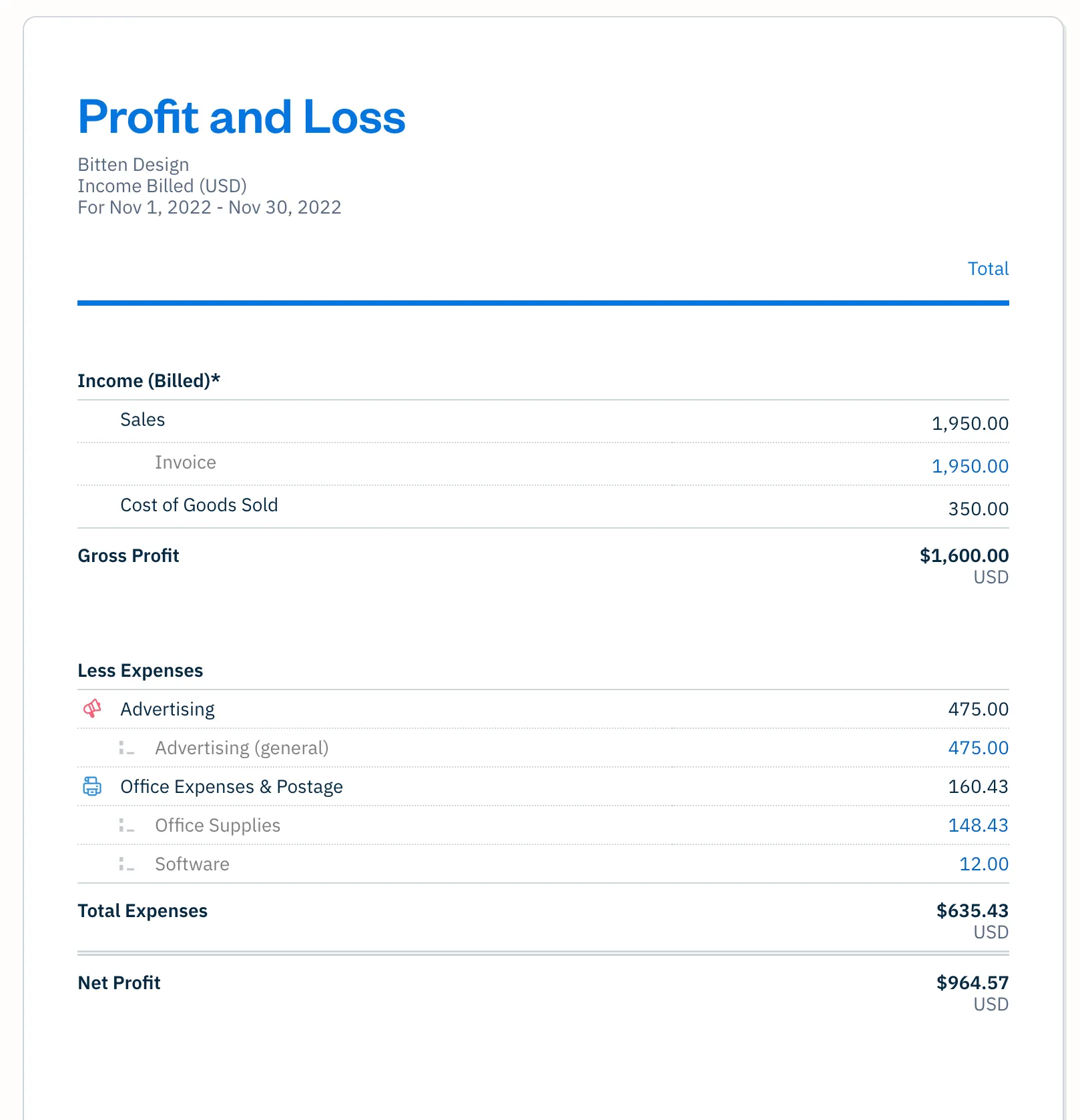

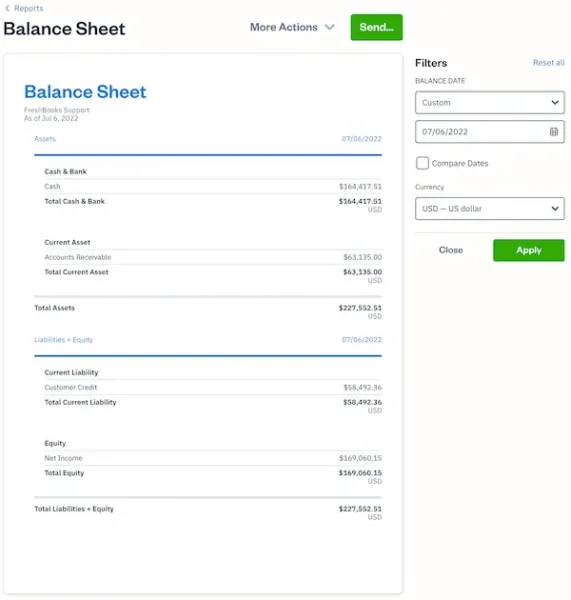

The first step is understanding the key financial statements: the income statement, balance sheet, and cash flow statement. Publicly traded companies in the US are required to file these reports with the Securities and Exchange Commission (SEC), typically through 10-K (annual) and 10-Q (quarterly) filings.

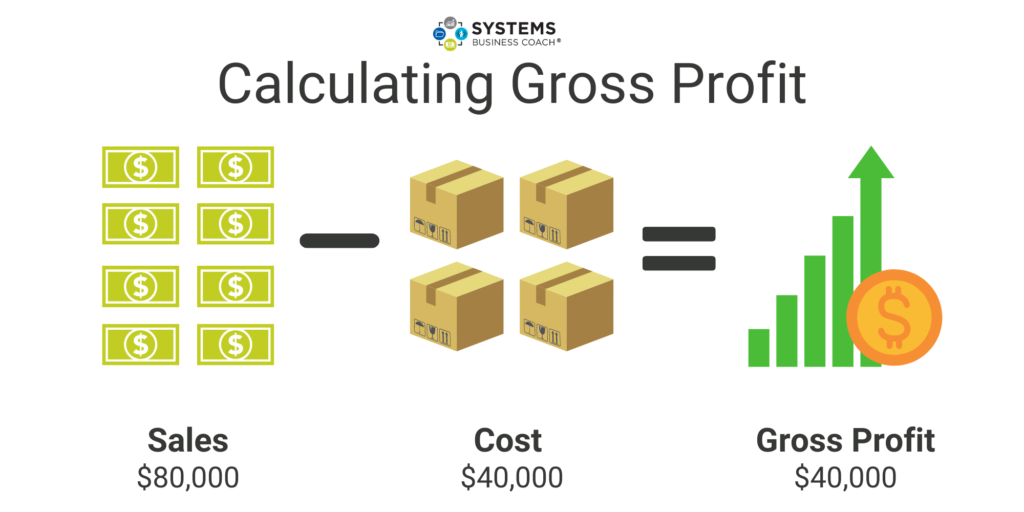

Gross Profit Margin

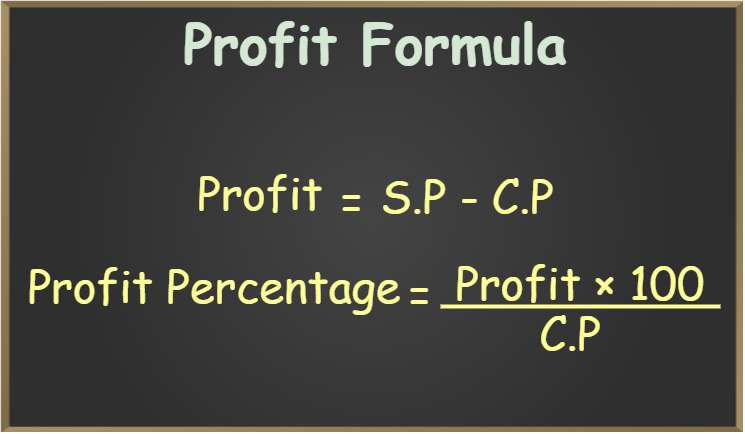

This metric reveals the profitability of a company's core operations. It's calculated by subtracting the cost of goods sold (COGS) from revenue and dividing by revenue: (Revenue - COGS) / Revenue. A higher gross profit margin indicates greater efficiency in producing and selling goods or services.

Operating Profit Margin

Operating profit margin shows profitability after deducting operating expenses like salaries, rent, and marketing. This metric is calculated as Operating Income / Revenue. A higher operating margin suggests better control over operational costs.

Net Profit Margin

This is the bottom line: how much profit a company makes for every dollar of revenue after all expenses, including taxes and interest, are paid. The formula is Net Income / Revenue. Comparing this margin to industry averages will show the company competitiveness.

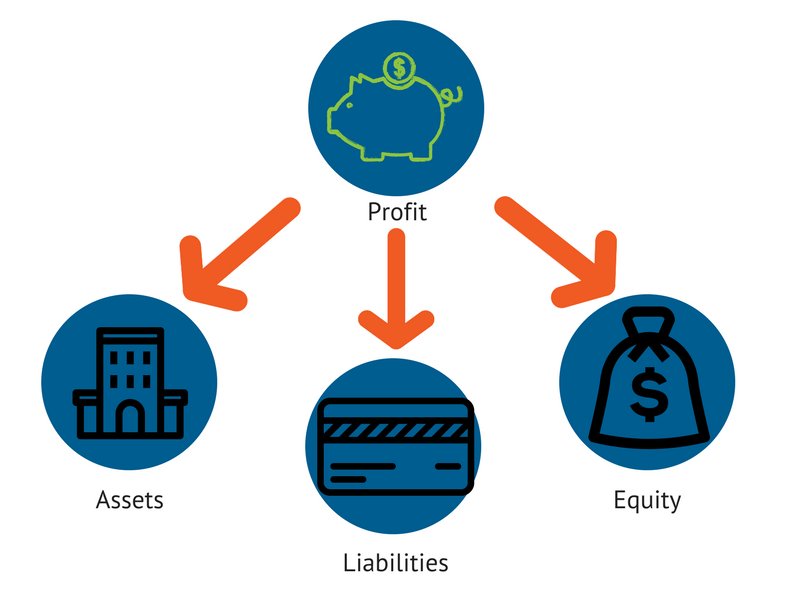

Return on Equity (ROE)

ROE measures how efficiently a company uses shareholder investments to generate profits. Calculated as Net Income / Shareholder Equity, ROE indicates how much profit each dollar of equity generates. A higher ROE is generally more desirable.

Cash Flow

Profitability on paper doesn't always equal cash in the bank. Analyze the cash flow statement to see how much cash a company is actually generating from its operations. Positive cash flow is crucial for long-term sustainability.

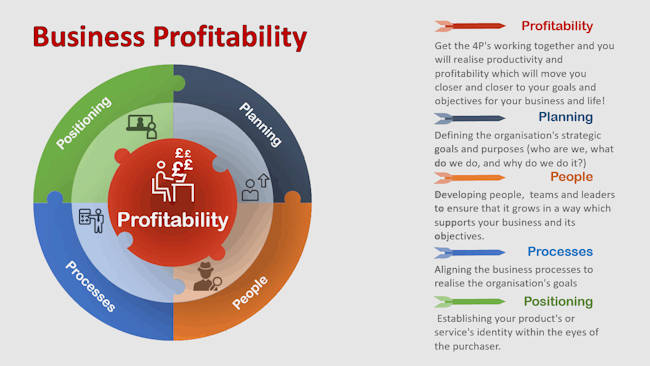

Beyond the Numbers: Qualitative Factors

While financial metrics are essential, don't ignore qualitative factors. Consider the company's industry, its competitive landscape, and its management team.

A company operating in a growing industry with a strong competitive advantage is more likely to be profitable long-term. Look for experienced and competent management that is driving growth.

Where to Find the Data

For publicly traded companies, annual reports (10-K filings) and quarterly reports (10-Q filings) filed with the SEC via the EDGAR database are the primary sources. Financial news websites like Yahoo Finance and Google Finance often present this information in an easily digestible format.

Privately held company information is more difficult to access. Consider looking into rating agencies, industry reports, and credit rating. Dun & Bradstreet can sometimes provide financial profiles for private companies for a fee.

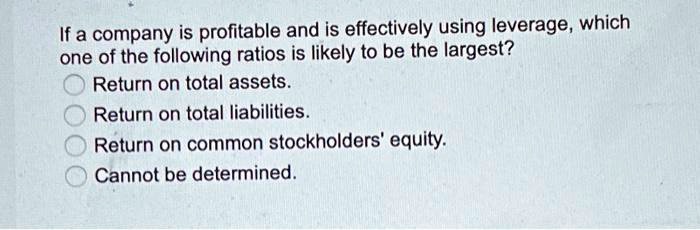

Comparative Analysis is Key

Don't analyze these ratios in isolation. Compare a company's profitability metrics to those of its competitors and industry averages. This benchmark provides context and reveals whether the company is performing well relative to its peers.

A company with a higher profit margin than its competitors is generally considered more profitable.

Next Steps

Use these metrics to critically evaluate the companies you're interested in. Remember, profitability is just one piece of the puzzle; consider other factors like debt levels, growth potential, and management quality before making any investment or career decisions.

Continue to monitor the company's performance over time. Look at the latest quarterly reports and read financial news to stay informed about any changes or challenges that could impact its profitability.