How To Know If My Account Is Checking Or Savings

Navigating the world of personal finance can often feel like deciphering a complex code, particularly when differentiating between seemingly similar accounts like checking and savings. Many individuals find themselves unsure about which type of account they possess, leading to potential confusion and missed financial opportunities. This article aims to provide clarity on how to definitively determine whether your account is a checking or savings account.

The distinction between checking and savings accounts is crucial for managing finances effectively. Knowing the type of account you have is essential for understanding its features, usage limitations, and potential for earning interest. This information is vital for making informed decisions about your money and avoiding unnecessary fees or restrictions.

Key Identifiers: Account Features

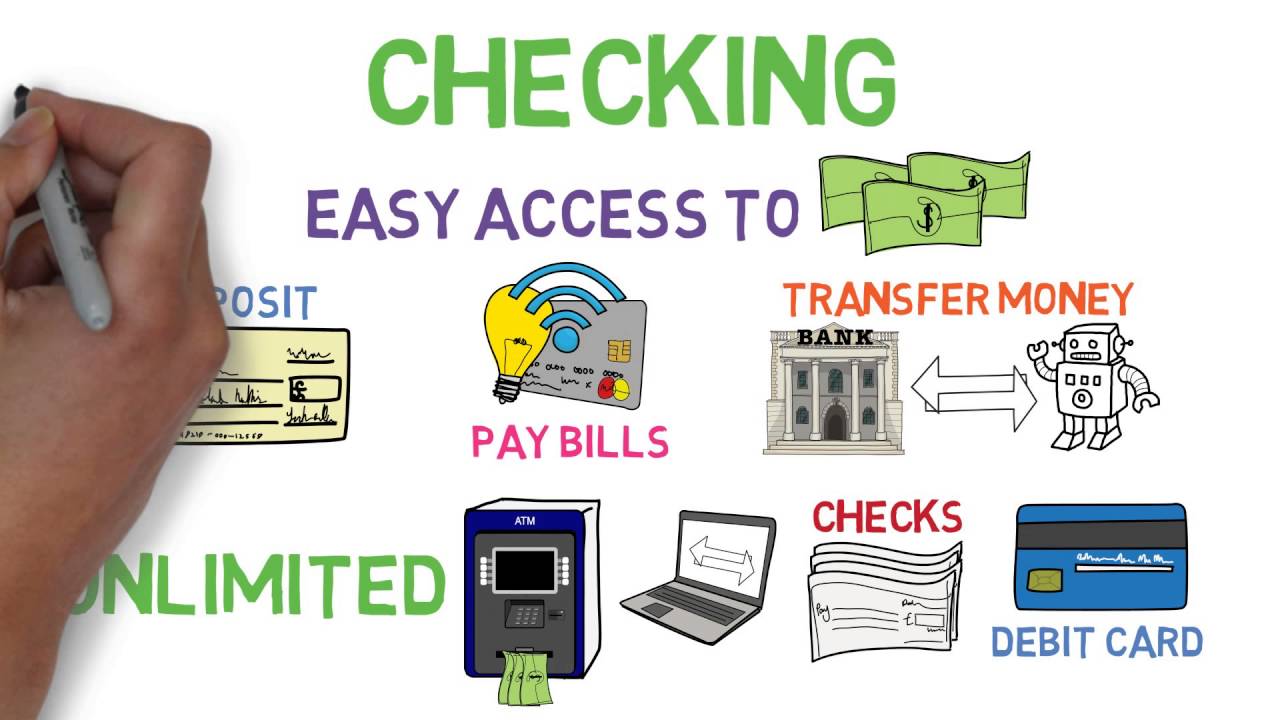

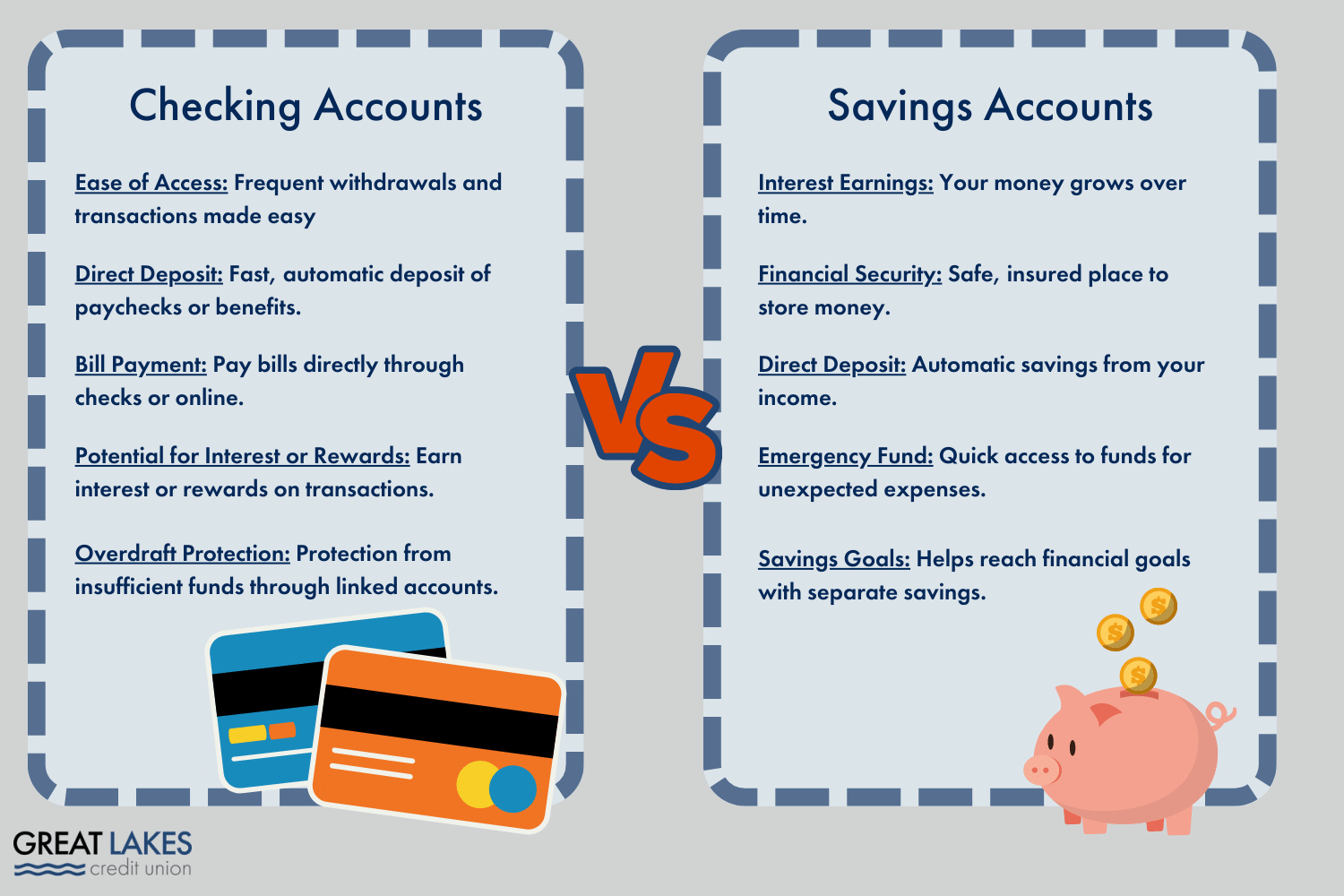

One of the most straightforward ways to identify your account type is by examining its features. Checking accounts are designed for everyday transactions and easy access to funds.

They typically come with debit cards and check-writing privileges. You can usually withdraw funds at ATMs, make online payments, and transfer money easily.

Savings accounts, on the other hand, are primarily intended for storing money and earning interest. They might have limitations on the number of withdrawals or transfers you can make per month.

Accessing funds might be slightly less convenient compared to checking accounts. Savings accounts often have higher interest rates.

Analyzing Account Statements

Your monthly account statements are a treasure trove of information. Carefully review your statements for clues about your account type.

Look for terms like "checking," "savings," or abbreviations such as "CK" or "SAV." The statement will also detail the features associated with your account, like debit card transactions or interest earned.

Pay attention to the fees charged. Checking accounts sometimes have monthly maintenance fees that can be waived if you meet certain criteria, while savings accounts might charge fees for exceeding withdrawal limits.

Debit Cards and Checks

The presence of a debit card or checkbook is a strong indicator of a checking account. Debit cards allow you to make purchases directly from your account, and checks allow you to pay bills or transfer money.

Savings accounts typically do not offer these options. However, some banks might offer ATM cards for savings accounts, allowing limited withdrawals.

Examine your debit card closely. It will often be linked to your checking account and may display the word "checking" or an abbreviation thereof.

Contacting Your Bank

If you're still unsure after reviewing your statements and account features, contacting your bank directly is the most reliable solution. Customer service representatives can quickly confirm your account type and clarify any questions you may have.

You can call the bank's customer service line, visit a branch in person, or send a secure message through online banking. Be prepared to provide identifying information, such as your account number and personal details, to verify your identity.

Don't hesitate to ask for a clear explanation of your account's features, fees, and any applicable restrictions. Reputable banks are committed to providing clear and transparent information about their products and services.

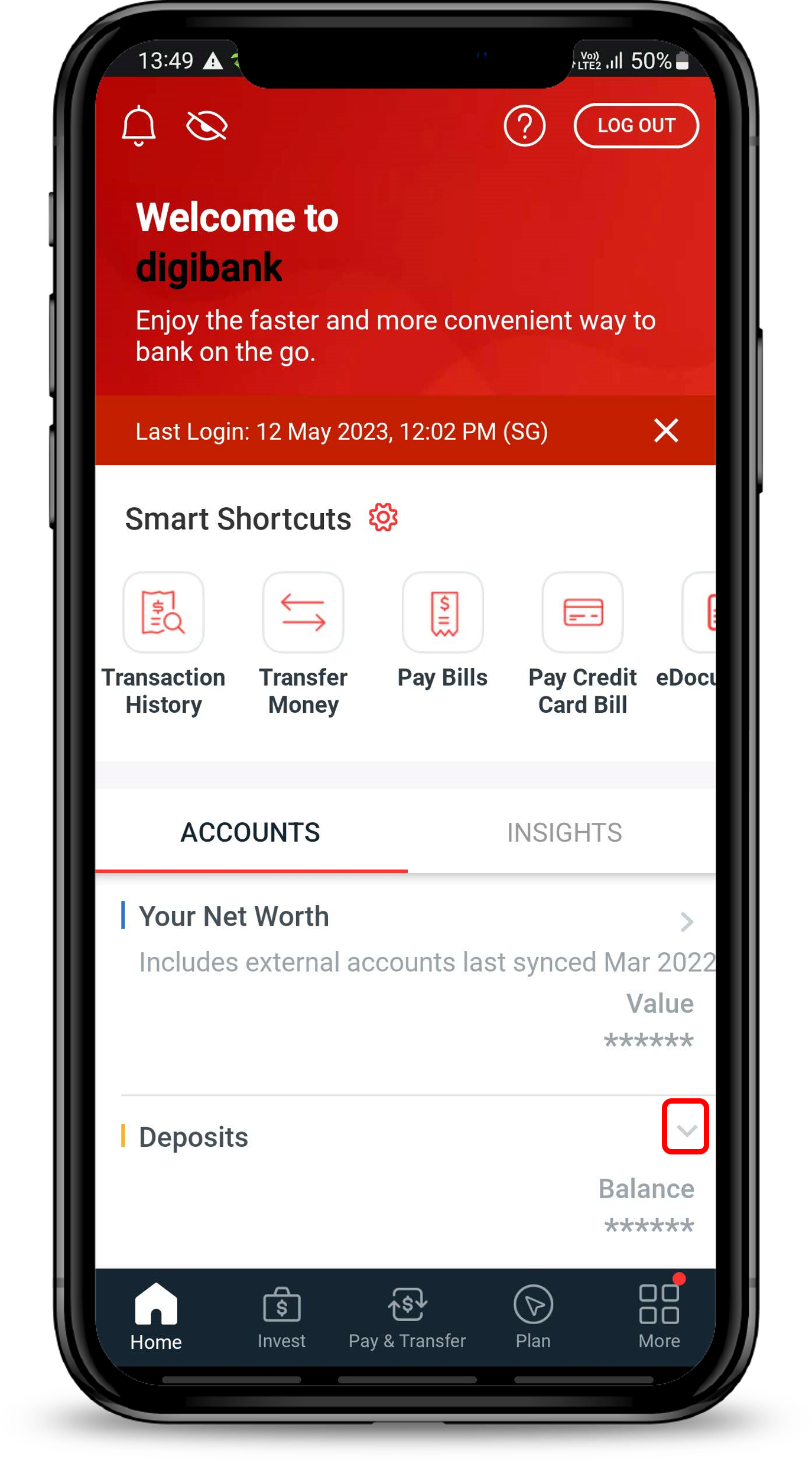

Online Banking Portals

Most banks offer online banking portals that provide comprehensive information about your accounts. Log in to your online banking account and navigate to the account summary page.

The account type, such as "checking" or "savings," should be clearly displayed. You can also access detailed information about your account balance, transaction history, and any applicable fees.

Explore the different sections of your online banking portal to familiarize yourself with all the available features and information. Many banks also offer mobile apps that provide similar access and functionality.

Understanding Interest Rates

Another crucial difference between checking and savings accounts lies in the interest rates they offer. Savings accounts are specifically designed to help you grow your money, so they typically offer higher interest rates than checking accounts.

Checking accounts might offer minimal or no interest at all. Some high-yield checking accounts offer competitive interest rates, but they often come with specific requirements, such as maintaining a minimum balance.

Compare the interest rates offered by different accounts to understand which one is best suited for your financial goals. Remember that interest rates can fluctuate, so it's important to stay informed and periodically review your options.

The Implications of Knowing Your Account Type

Knowing whether your account is a checking or savings account has significant implications for your financial management. It helps you understand how to effectively use each account for its intended purpose.

Using a savings account for frequent transactions can result in fees or restrictions, while using a checking account for long-term savings might not maximize your earnings potential. Understanding the purpose and features of each account allows you to make informed decisions and optimize your financial strategy.

By being proactive and taking the steps outlined in this article, you can confidently identify your account type and make the most of your financial resources.

:max_bytes(150000):strip_icc()/checking-vs-savings-accounts-4783514-ADD-V3-8bb1de3ef0a848e0bd7b65ef146ab924.jpg)