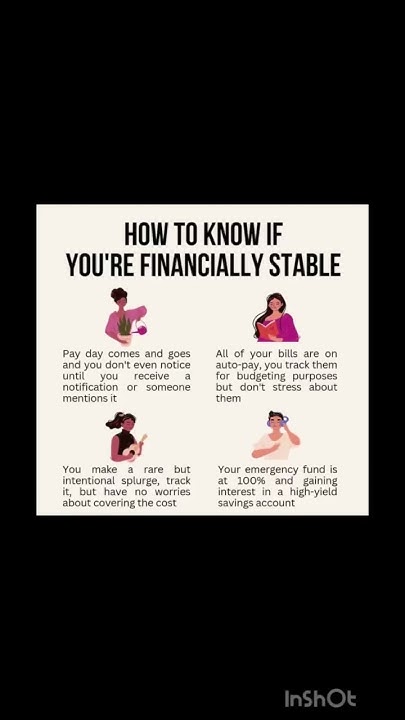

How To Know If You Re Financially Stable

Many people aspire to financial stability, but determining if you've achieved it can be elusive. It's more than just having a good income; it's about building a secure financial foundation that can withstand unexpected events and support your long-term goals. Assessing your financial health involves examining several key indicators and adopting a proactive approach to money management.

This article will explore the key signs of financial stability, offering practical guidance for individuals seeking to understand their current financial standing and build a more secure future. We'll delve into the importance of budgeting, emergency funds, debt management, and long-term investment strategies, drawing on insights from financial experts and reputable organizations.

Key Indicators of Financial Stability

Financial stability isn't a fixed state but rather a dynamic process that requires continuous monitoring and adjustments. Consider these key indicators to get a clearer picture of your financial well-being.

Effective Budgeting and Spending Habits

A cornerstone of financial stability is understanding where your money goes. Budgeting allows you to track income and expenses, identify areas where you can cut back, and allocate funds towards savings and debt repayment. Experts at the Consumer Financial Protection Bureau (CFPB) emphasize the importance of creating a realistic budget that aligns with your financial goals.

Having a surplus each month after covering essential expenses is a strong indicator of financial health. This surplus can then be channeled towards savings, investments, or debt reduction.

A Robust Emergency Fund

Unexpected expenses are a part of life. A well-funded emergency fund can prevent you from accumulating debt when these situations arise. Financial advisors often recommend having three to six months' worth of living expenses saved in a readily accessible account.

This fund should be separate from your other savings and investments and easily accessible without penalty. The existence of an emergency fund provides a crucial safety net during job loss, medical emergencies, or unexpected home repairs.

Manageable Debt Levels

Debt can be a powerful tool for building wealth, but it can also be a significant burden if not managed carefully. Assess your debt-to-income ratio to determine if your debt levels are sustainable. According to Experian, a healthy debt-to-income ratio is typically below 43%.

Prioritize paying off high-interest debt, such as credit card balances, to minimize interest charges and free up cash flow. Debt consolidation and balance transfer options can also be helpful strategies for managing debt effectively.

Long-Term Investment Strategy

Investing is crucial for building long-term wealth and achieving financial goals like retirement. Diversify your investments across different asset classes, such as stocks, bonds, and real estate, to reduce risk. Consider consulting with a financial advisor to create an investment strategy that aligns with your risk tolerance and time horizon.

Start investing early, even if it's just a small amount, to take advantage of the power of compound interest. Regular contributions to retirement accounts like 401(k)s and IRAs can significantly boost your savings over time.

Adequate Insurance Coverage

Insurance protects you from significant financial losses due to unexpected events like illness, accidents, or property damage. Ensure you have adequate health, auto, homeowner's, and life insurance coverage.

Regularly review your insurance policies to ensure they meet your changing needs and circumstances. Consider purchasing umbrella insurance for additional liability protection.

Assessing Your Current Financial Situation

Taking stock of your current financial situation is the first step towards building financial stability. Start by calculating your net worth, which is the difference between your assets (what you own) and your liabilities (what you owe).

Regularly review your credit report to identify any errors or fraudulent activity. A good credit score is essential for obtaining loans, mortgages, and other financial products at favorable interest rates. The Federal Trade Commission (FTC) provides resources for checking your credit report and disputing errors.

Maintaining Financial Stability

Once you've achieved financial stability, it's crucial to maintain it through ongoing monitoring and adjustments. Regularly review your budget, savings, and investment strategies to ensure they align with your goals. Stay informed about changes in the economy and financial markets that could impact your financial well-being.

Seek professional advice from a financial advisor if you need help managing your finances or making investment decisions. Financial advisors can provide personalized guidance based on your individual circumstances and goals.

Conclusion

Financial stability is a journey, not a destination. It requires careful planning, consistent effort, and a willingness to adapt to changing circumstances. By focusing on budgeting, saving, debt management, and long-term investing, you can build a solid financial foundation and achieve your financial goals. Understanding and actively managing your finances empowers you to navigate life's challenges with confidence and security.