How To Make A Business Budget Plan

Imagine you're a baker, kneading dough in a sun-drenched kitchen. The aroma of cinnamon and sugar fills the air, promising delightful pastries. But beneath the surface of this idyllic scene lies a crucial element: managing your ingredients, costs, and profits. Just as a baker needs a recipe, every business needs a budget.

A business budget plan isn't just about crunching numbers; it's a roadmap to financial success. It helps you understand where your money comes from, where it goes, and how to make informed decisions to achieve your business goals. Think of it as your business's financial GPS, guiding you towards profitability and sustainability.

Why a Budget Matters

Creating a budget plan is essential because it acts as a proactive tool. It helps you anticipate future financial needs, identify potential problems before they arise, and make necessary adjustments to stay on track. Without a budget, you're essentially navigating your business without a map.

The Significance of Planning

Planning is at the heart of every successful business endeavor. A well-structured budget forces you to think strategically about your income, expenses, and investments. According to the Small Business Administration (SBA), businesses with a solid business plan, including a budget, are more likely to secure funding and achieve long-term growth.

Financial Control

A budget empowers you to gain control over your finances. It enables you to track your spending, identify areas where you can cut costs, and allocate resources more efficiently. This financial awareness is critical for making sound business decisions and maximizing profitability.

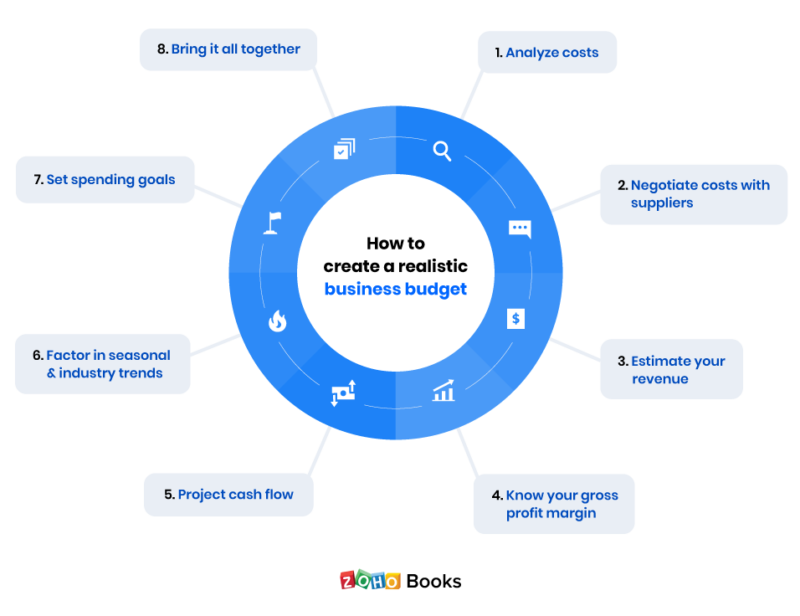

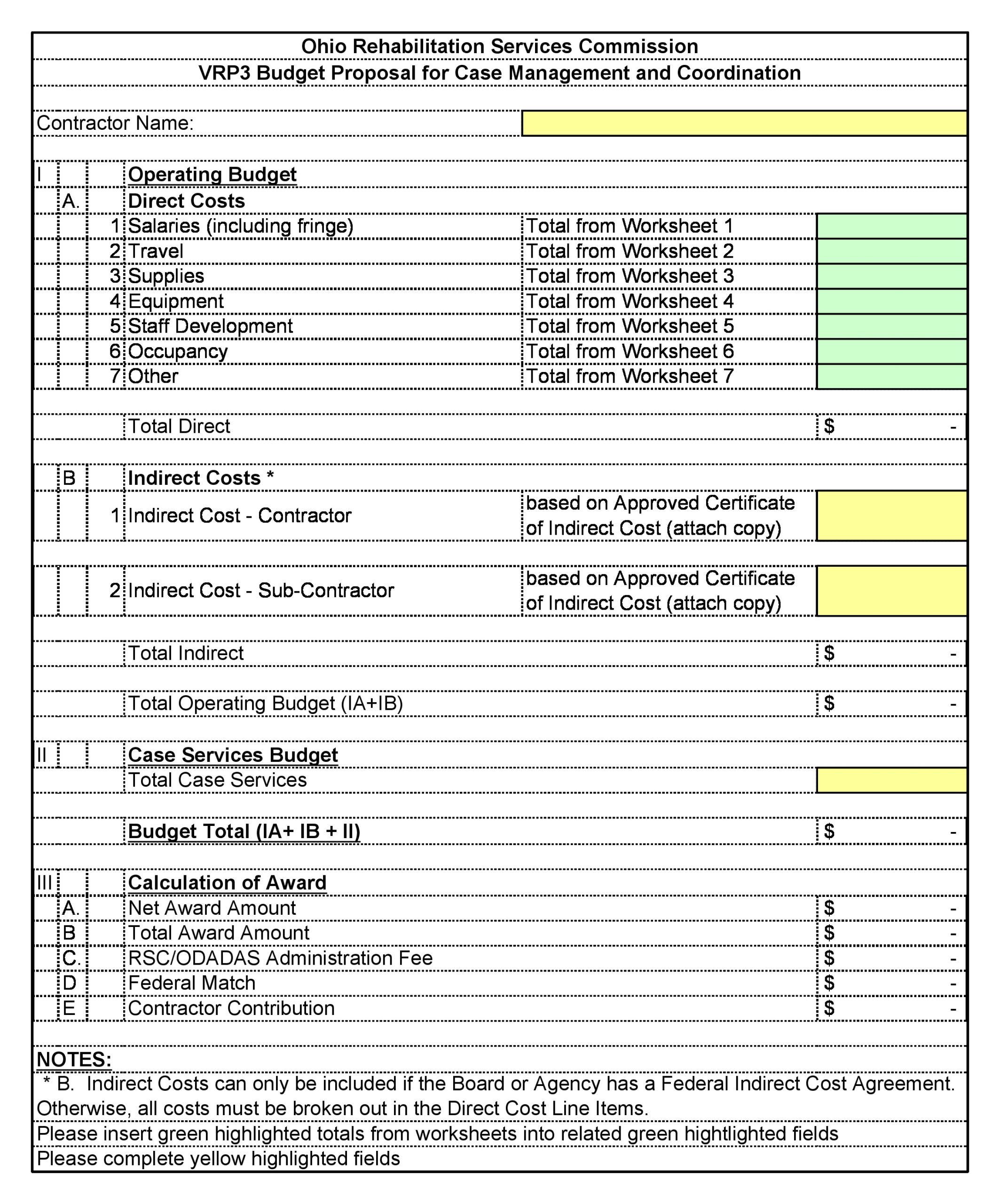

Creating Your Budget Plan: A Step-by-Step Guide

Building a budget plan may seem daunting, but it's a manageable process if broken down into clear steps. Here’s how you can create a budget plan tailored to your business needs.

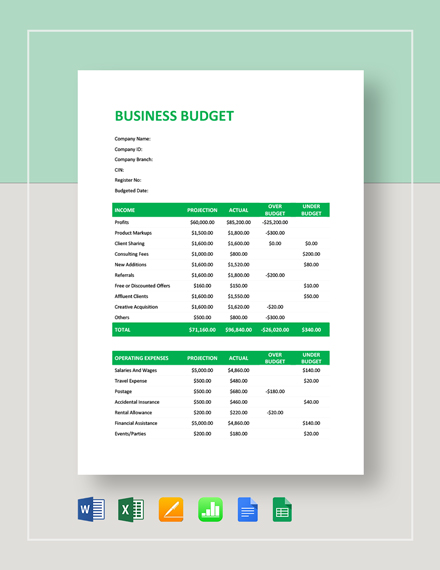

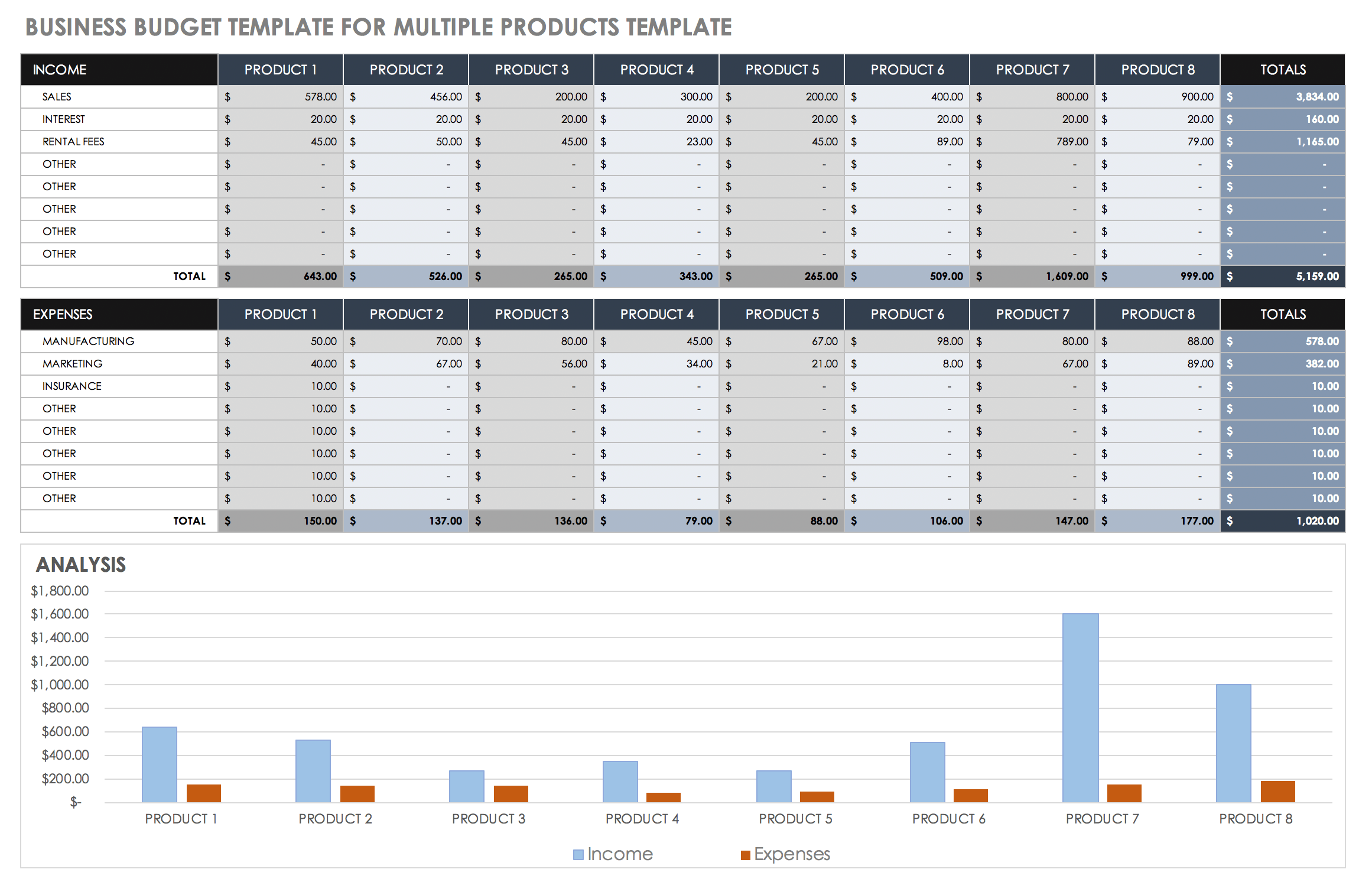

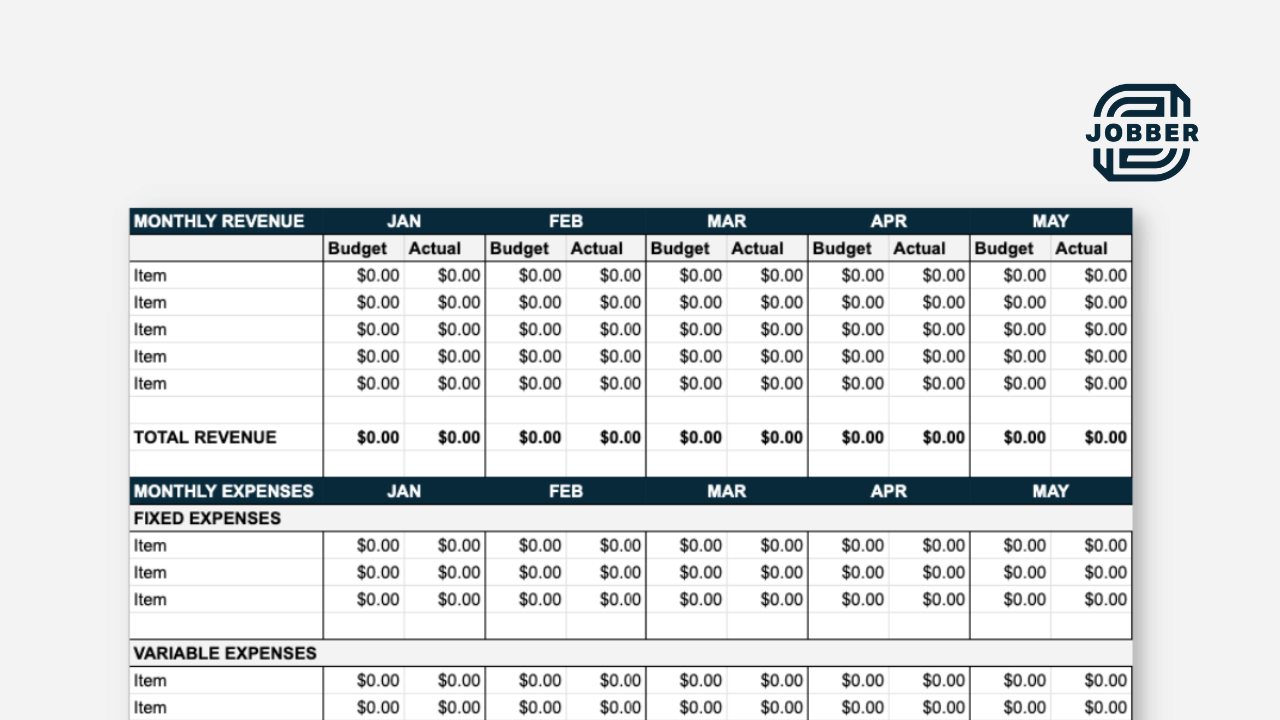

Step 1: Estimate Your Income

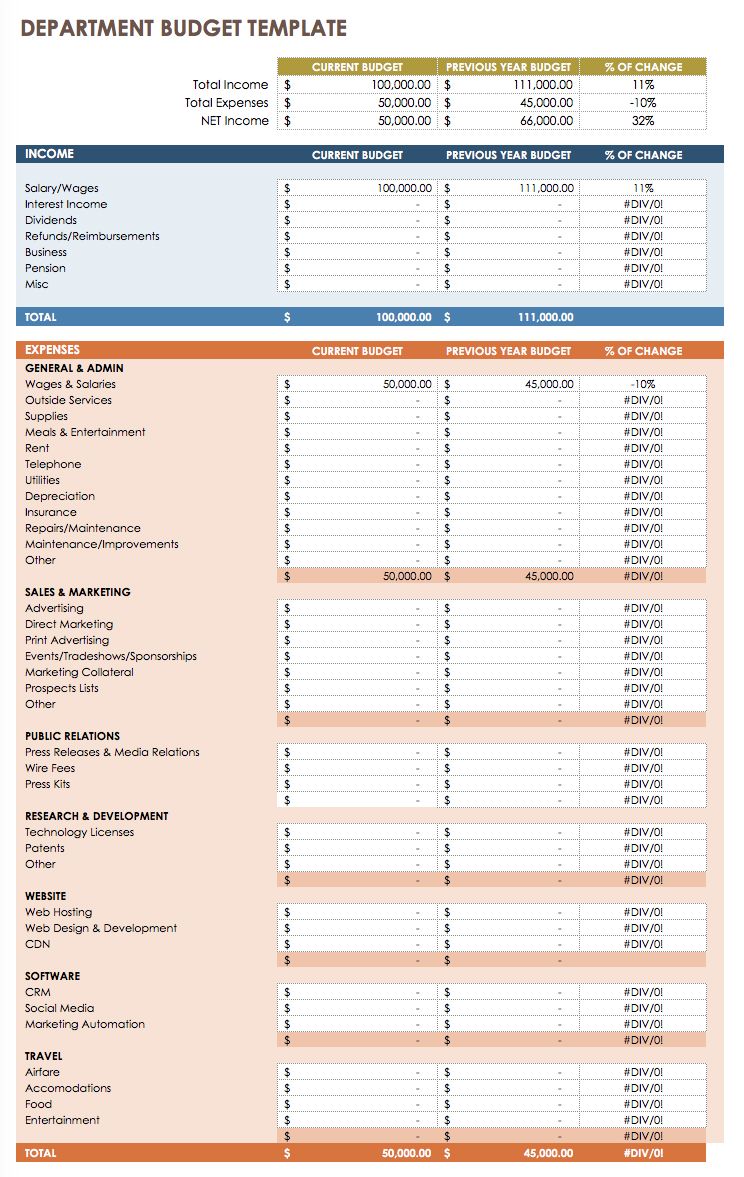

Start by forecasting your expected revenue for the upcoming period, usually a month, quarter, or year. Review past sales data, market trends, and any anticipated changes in your business to make informed estimates. Be realistic and consider potential fluctuations in demand.

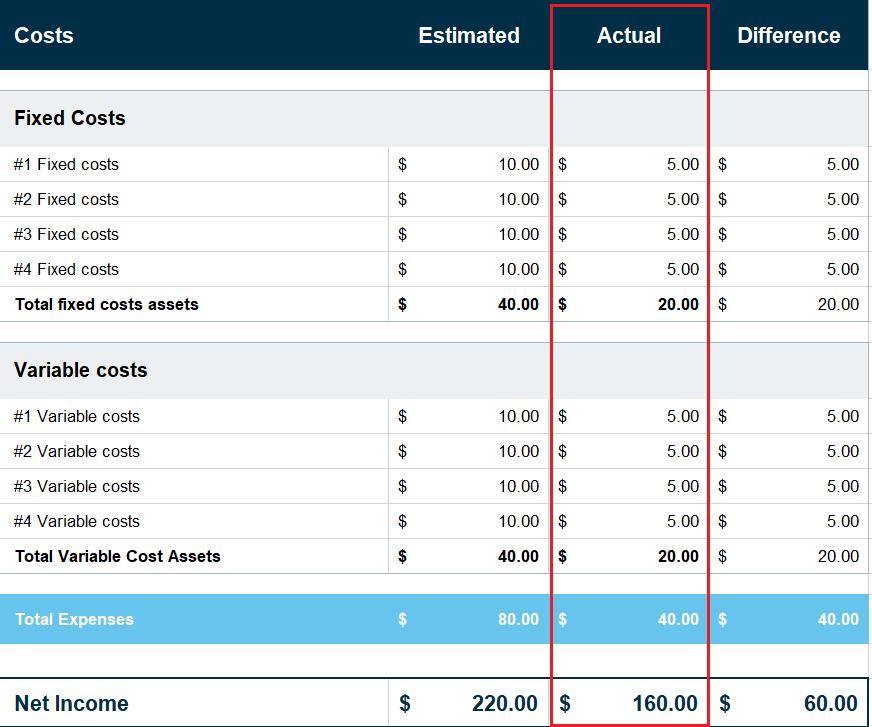

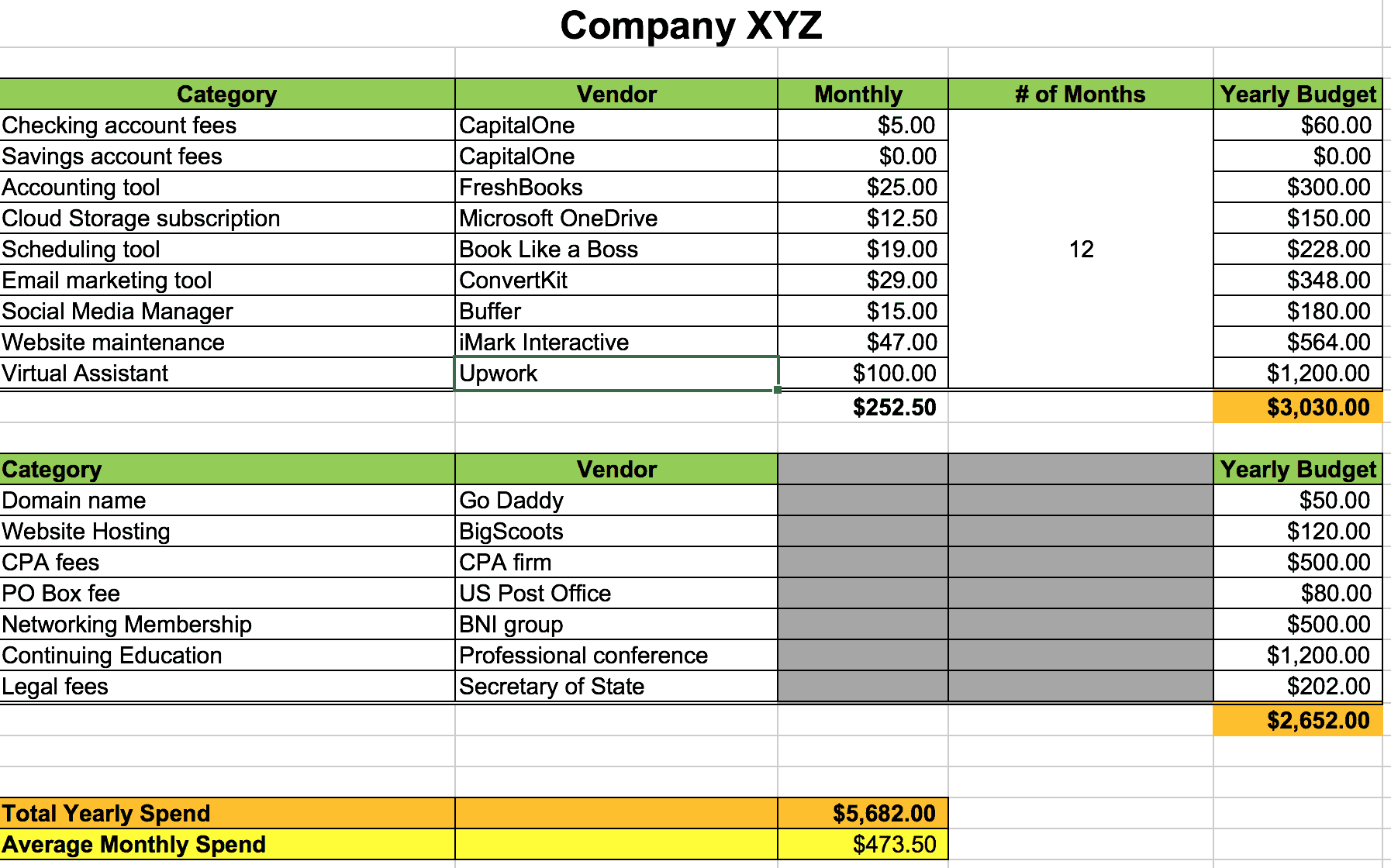

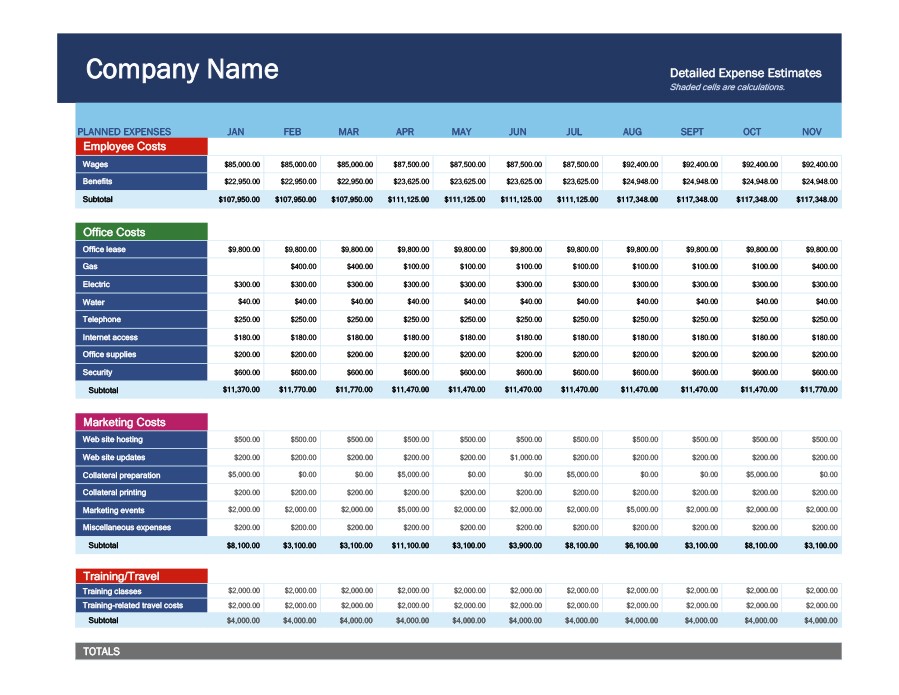

Step 2: Identify Fixed Costs

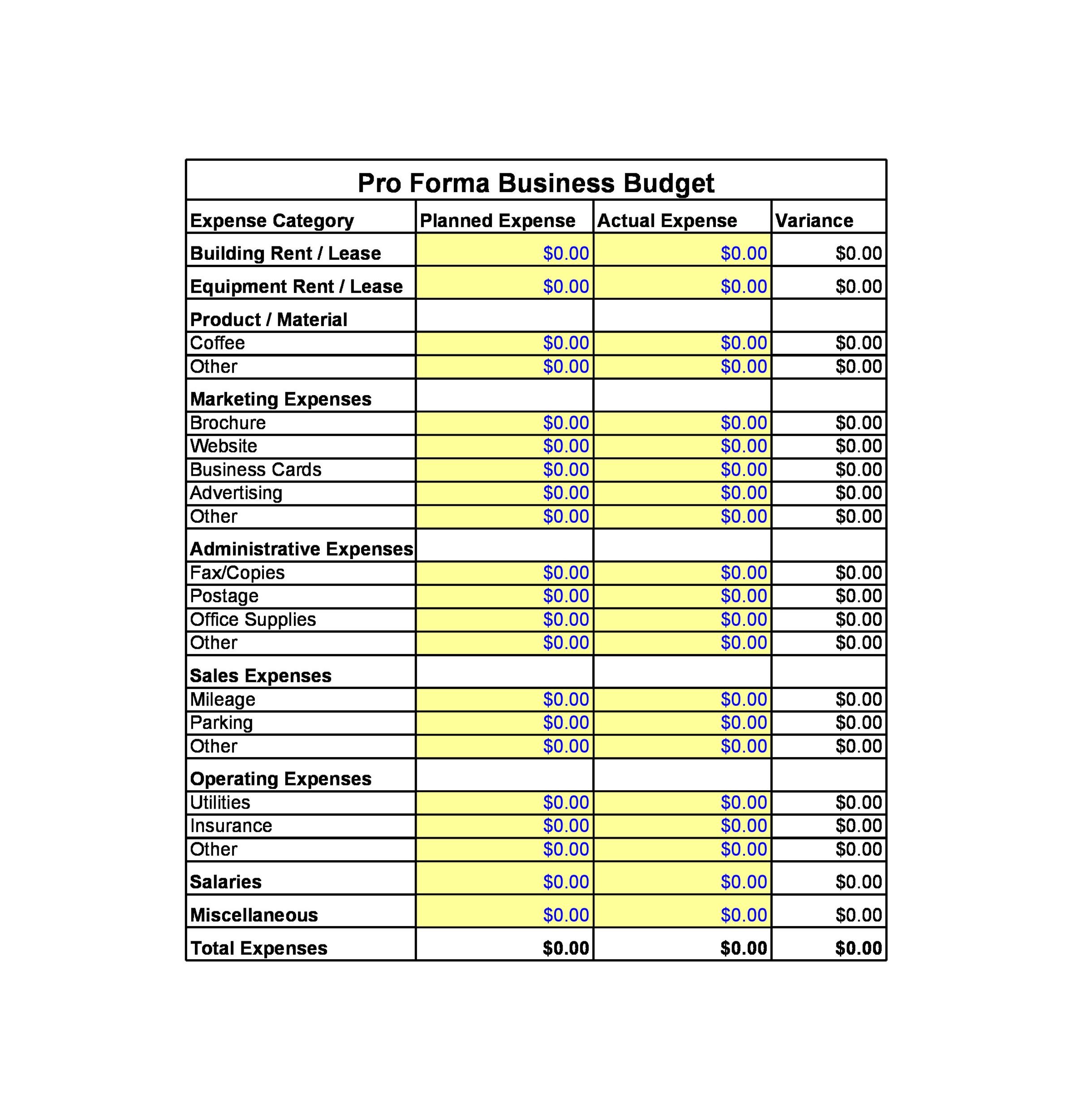

Fixed costs are expenses that remain consistent regardless of your sales volume. These typically include rent, salaries, insurance premiums, and loan payments. Accurately identifying these costs provides a stable foundation for your budget.

Step 3: Determine Variable Costs

Variable costs fluctuate with your sales volume. Common examples include raw materials, inventory, shipping, and sales commissions. Understanding these costs helps you predict expenses based on projected sales levels. Keep in mind that these costs can be impacted by supply chain issues, as noted in a recent report by the National Federation of Independent Business (NFIB).

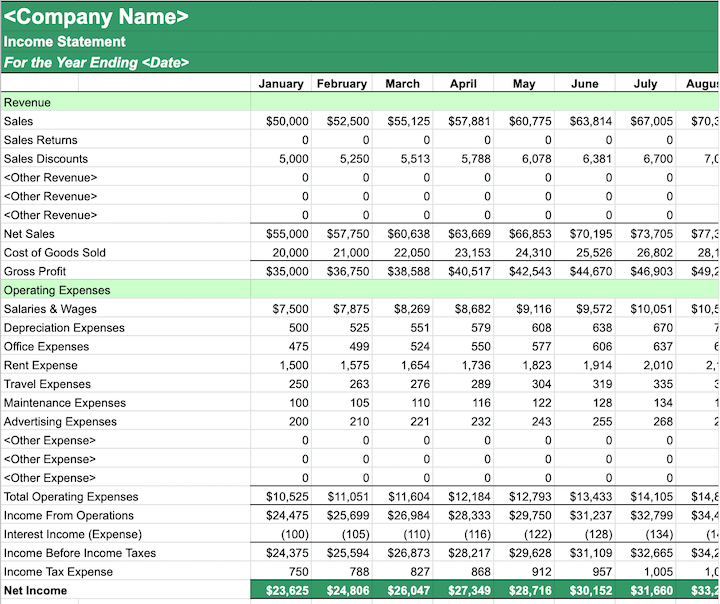

Step 4: Calculate Your Profit Margin

Your profit margin is the percentage of revenue that remains after deducting all expenses. Calculating this margin helps you determine if your business is profitable and how much room you have for growth. Aim for a healthy profit margin that allows you to reinvest in your business.

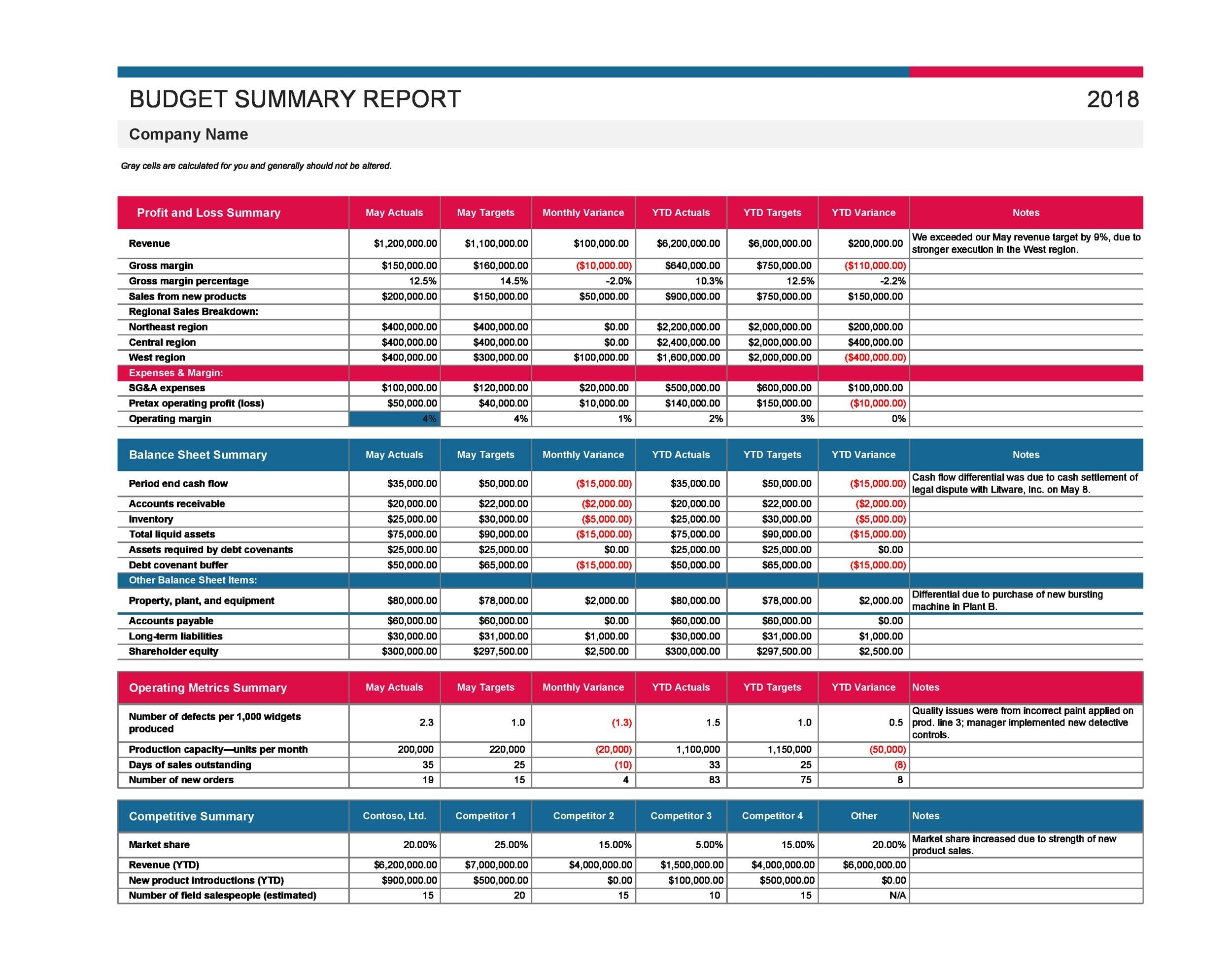

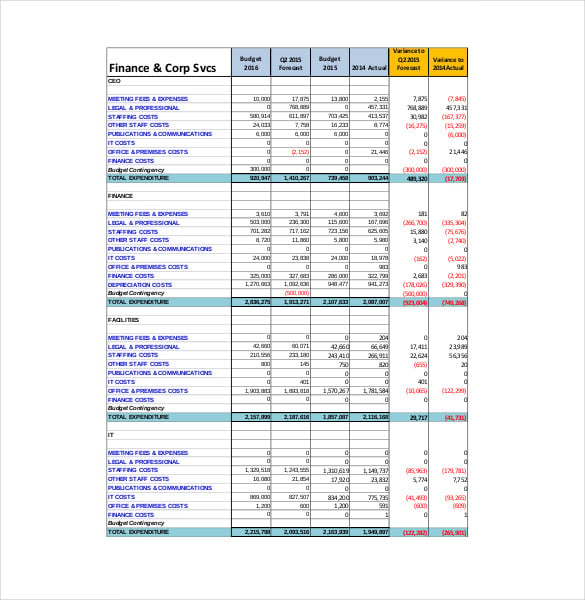

Step 5: Monitor and Adjust Your Budget

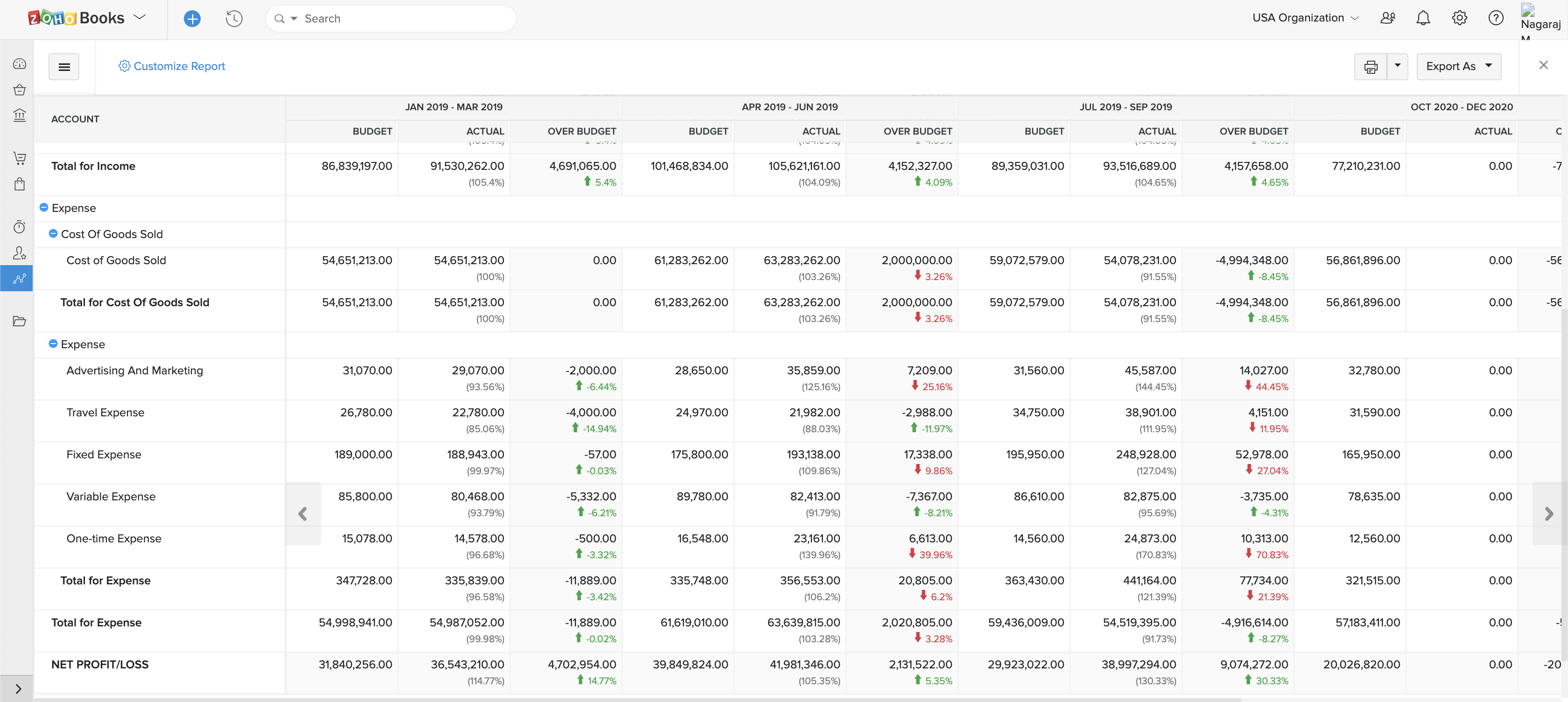

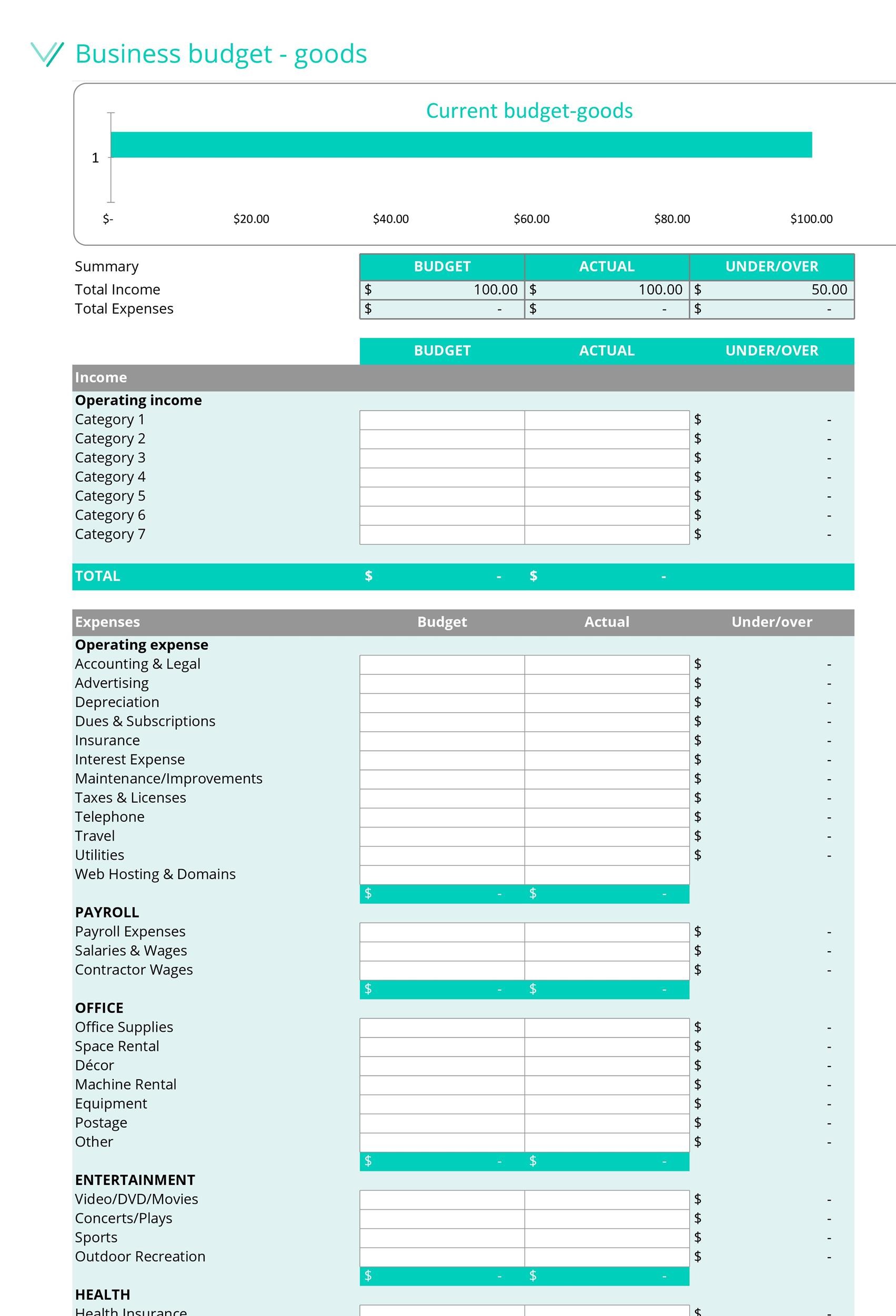

A budget is not a static document; it's a living tool that needs regular monitoring and adjustment. Compare your actual performance against your budgeted figures. Identify any discrepancies and make necessary changes to your budget based on market conditions and business performance. The U.S. Chamber of Commerce often emphasizes the importance of adapting to changing economic landscapes.

Tools and Resources

There are many tools and resources available to simplify the budgeting process. Spreadsheet software, such as Microsoft Excel or Google Sheets, can be used to create and manage your budget. Numerous accounting software programs like QuickBooks and Xero also offer budgeting features. Consider free templates from organizations like Score.org for getting started.

Budgeting can seem intimidating at first, but with careful planning and consistent effort, it becomes an invaluable tool for managing and growing your business. Just like that baker meticulously measuring ingredients, a well-crafted budget sets the stage for a recipe for success.