How To Make Multiple Revenue Streams

In today's volatile economic landscape, relying on a single source of income can feel like walking a tightrope without a safety net. Layoffs, industry shifts, and unexpected personal circumstances can quickly destabilize financial security. Consequently, the pursuit of multiple revenue streams has transitioned from a niche strategy for entrepreneurs to a mainstream imperative for individuals seeking stability and long-term financial well-being.

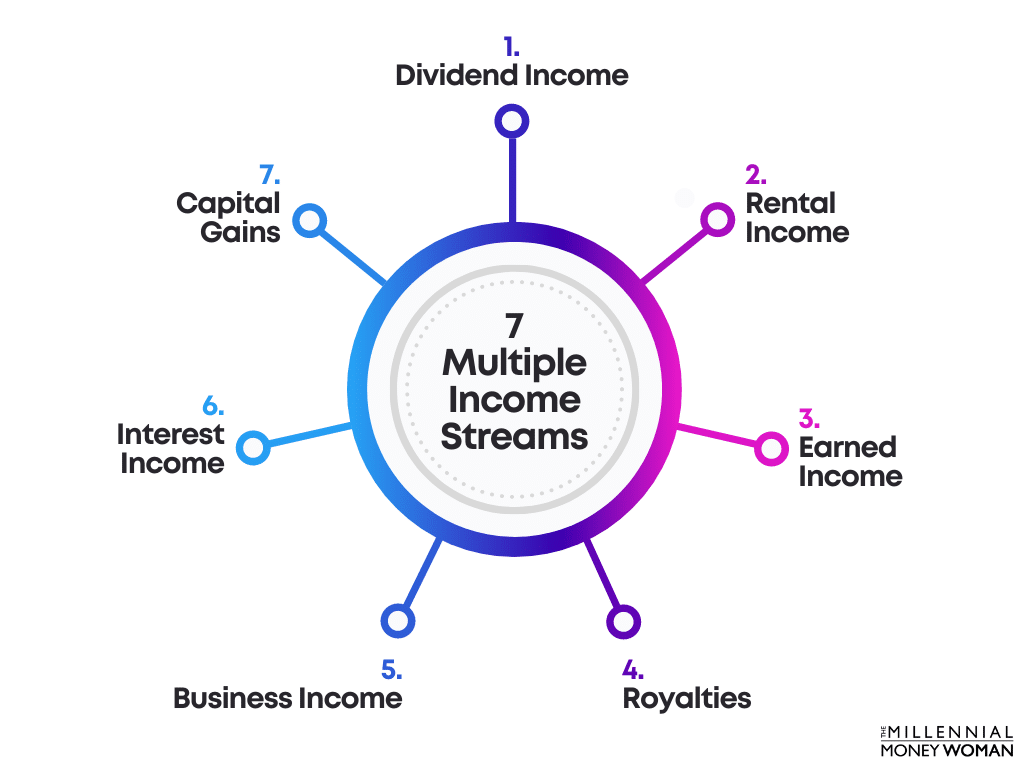

This article explores the diverse avenues available for building multiple income streams, providing practical insights and highlighting strategies for success. We will delve into both active and passive income models, examining their respective advantages and disadvantages, and offering guidance for individuals seeking to diversify their financial portfolios. We aim to provide a framework for assessing personal skills, identifying opportunities, and implementing sustainable strategies for creating a more resilient financial future.

Understanding Active and Passive Income

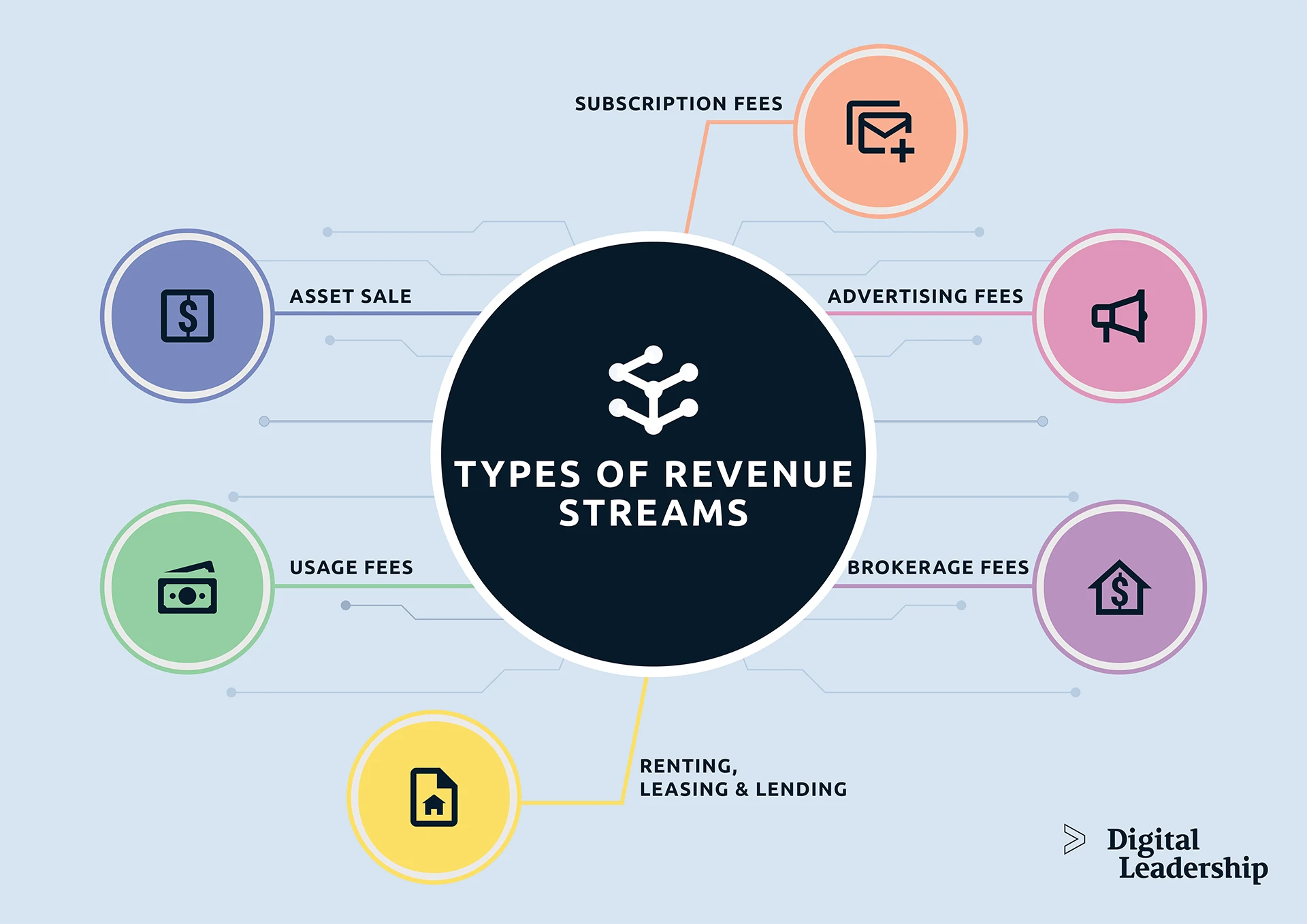

The foundation of building multiple revenue streams lies in understanding the difference between active and passive income. Active income requires direct, ongoing effort in exchange for payment. Passive income, on the other hand, generates revenue with minimal ongoing effort after the initial setup.

Examples of active income include freelance work, consulting, or a part-time job. While these options provide immediate financial relief, they often demand a significant time commitment.

Passive income strategies, such as rental properties, dividend-paying investments, or online courses, require upfront investment but offer the potential for recurring revenue with less direct involvement. According to a 2023 report by Statista, passive income is growing among millennials and Gen Z, "with many starting side hustles to supplement their primary income."

Exploring Active Income Streams

The gig economy offers a plethora of opportunities for generating active income. Platforms like Upwork, Fiverr, and TaskRabbit connect freelancers with clients seeking services in various fields, from writing and graphic design to virtual assistance and web development. Flexibility is a major advantage, allowing individuals to work around their existing schedules.

Consulting, leveraging existing expertise to advise businesses or individuals, can be a lucrative option. IBISWorld reports a steady growth in the consulting industry, reflecting the increasing demand for specialized knowledge and guidance.

Consider teaching or tutoring if you have expertise in a particular subject. Online platforms make it easier than ever to reach a global audience and share your knowledge.

Building Passive Income Streams

Investing in dividend-paying stocks or bonds is a classic passive income strategy. While market fluctuations can impact returns, a diversified portfolio can provide a consistent stream of income. Speaking to a qualified financial advisor is highly recommended before making any investments.

Real estate investment, particularly rental properties, can generate substantial passive income. However, it requires significant capital and ongoing management responsibilities. Outsourcing property management can alleviate some of the burden, but at a cost.

Creating and selling digital products, such as online courses, ebooks, or software, is another popular option. Once created, these products can generate passive income with minimal ongoing effort, though effective marketing is crucial.

Strategies for Success

Regardless of the chosen income streams, careful planning and execution are essential. Start by assessing your skills, interests, and available time. Identify opportunities that align with your strengths and market demand.

Prioritize tasks and manage your time effectively. Building multiple income streams requires discipline and organization. Use tools like calendars, project management software, and time-tracking apps to stay on track.

Reinvest a portion of your earnings back into your income streams. This could involve upgrading equipment, hiring help, or marketing your products or services. Reinvestment fuels future growth.

Regularly evaluate your progress and make adjustments as needed. Not all income streams will be equally successful. Be prepared to pivot or discontinue those that are not performing well.

Seek advice from mentors or join online communities of entrepreneurs and freelancers. Learning from others' experiences can save you time and money.

The Future of Income Diversification

The trend toward multiple income streams is likely to continue, driven by economic uncertainty and the increasing accessibility of online platforms. Technological advancements will further democratize access to opportunities and empower individuals to create their own income-generating ventures. The rise of the creator economy and the increasing acceptance of remote work are accelerating this trend.

As automation and artificial intelligence continue to reshape the job market, diversifying income streams will become even more critical for long-term financial security. Embracing lifelong learning and adapting to new technologies will be crucial for staying ahead of the curve.

By proactively exploring and cultivating multiple revenue streams, individuals can build a more resilient and prosperous future, navigating economic challenges with greater confidence and control.