How To Manage Money When Starting A Business

Launching a business demands meticulous financial management to avoid early pitfalls. Mastering cash flow, budgeting, and strategic investment are crucial for survival and growth.

Many startups fail due to mismanagement of funds, making financial literacy a non-negotiable skill for entrepreneurs. This article provides immediately actionable strategies to secure your business's financial future.

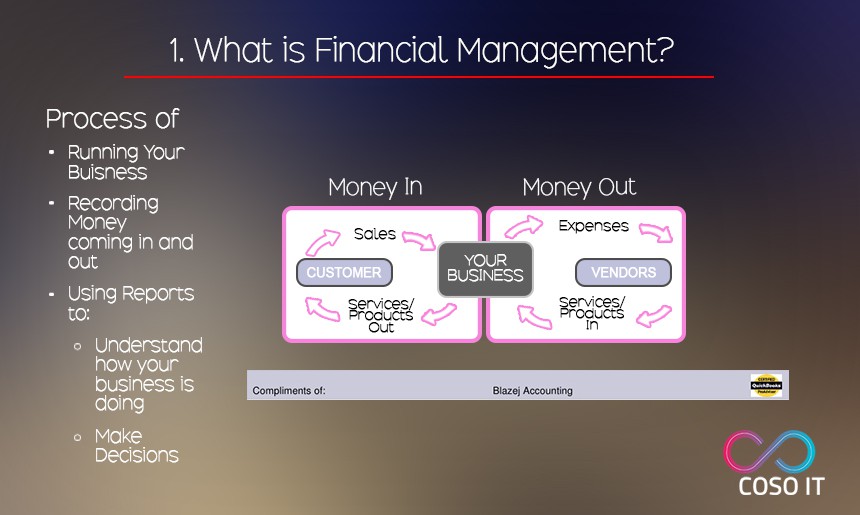

Mastering Cash Flow: Your Business's Lifeline

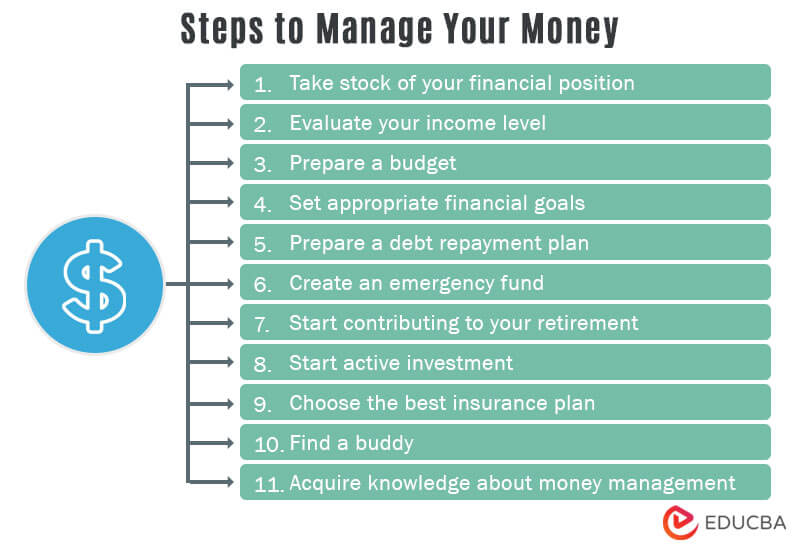

Effective cash flow management is paramount. Monitor income and expenses daily to identify potential shortfalls. Cash flow forecasting, projecting income and expenses, helps anticipate and prepare for future needs.

Invoice promptly and offer early payment discounts to accelerate income. Negotiate extended payment terms with suppliers to delay expenses. Implement strict credit control policies for customers.

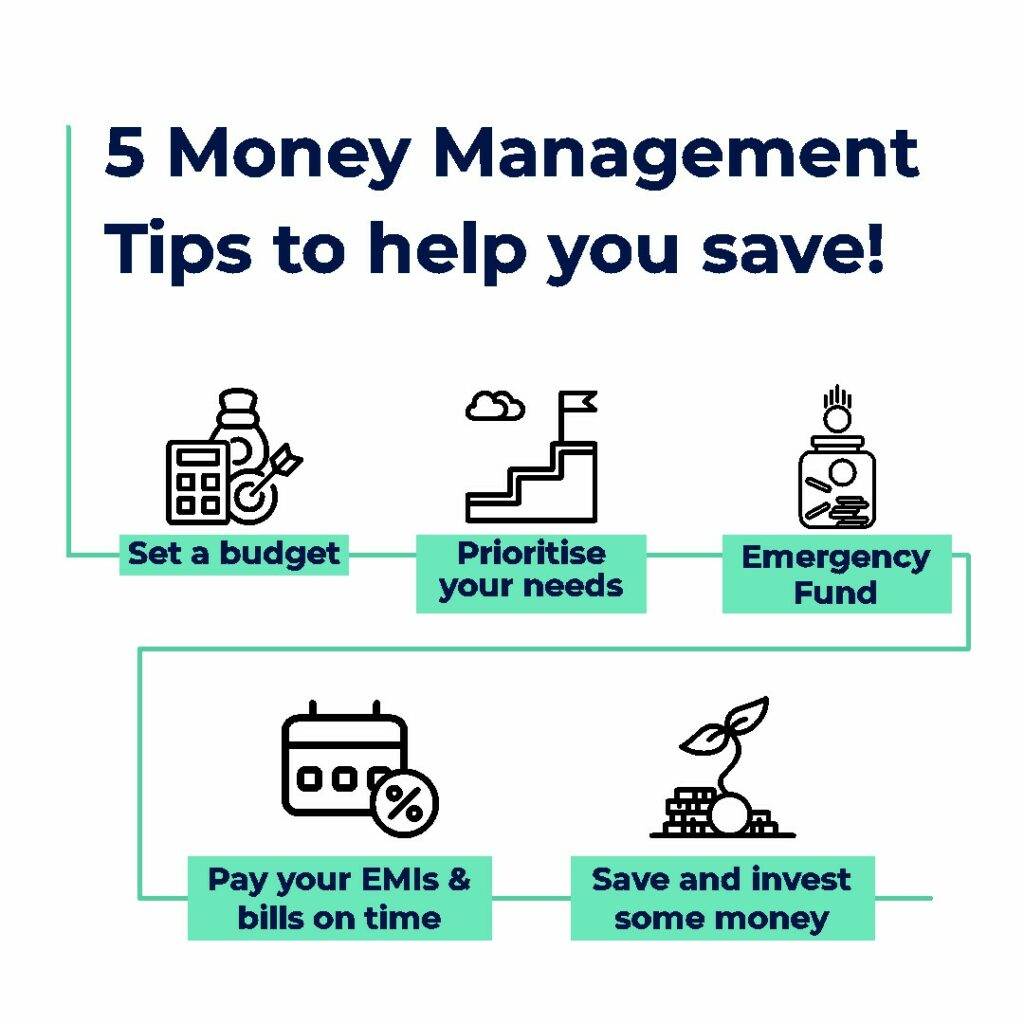

Budgeting Like a Pro: Planning for Success

Create a detailed budget encompassing all anticipated revenues and expenditures. A realistic budget serves as a roadmap and benchmark for performance. Regularly review and adjust the budget based on actual results.

Allocate funds strategically, prioritizing essential expenses like rent, utilities, and payroll. Avoid unnecessary spending, especially in the early stages. Seek free or low-cost business tools and resources.

Strategic Investment: Fueling Growth Wisely

Carefully evaluate investment opportunities, prioritizing those with a clear return on investment (ROI). Focus on investments that directly contribute to revenue generation or cost reduction. A well-considered investment strategy safeguards your capital.

Consider bootstrapping your business to minimize reliance on external funding. Explore government grants and loans designed for startups. Seek advice from experienced financial advisors before making significant investment decisions.

Tracking Expenses: Every Penny Counts

Implement a system for meticulously tracking all business expenses. Utilize accounting software or spreadsheets to categorize and analyze spending. This provides valuable insights into spending patterns and areas for improvement.

Maintain accurate records for tax purposes and potential audits. Regularly reconcile bank statements to identify discrepancies and prevent fraud. Accurate expense tracking is critical for financial control.

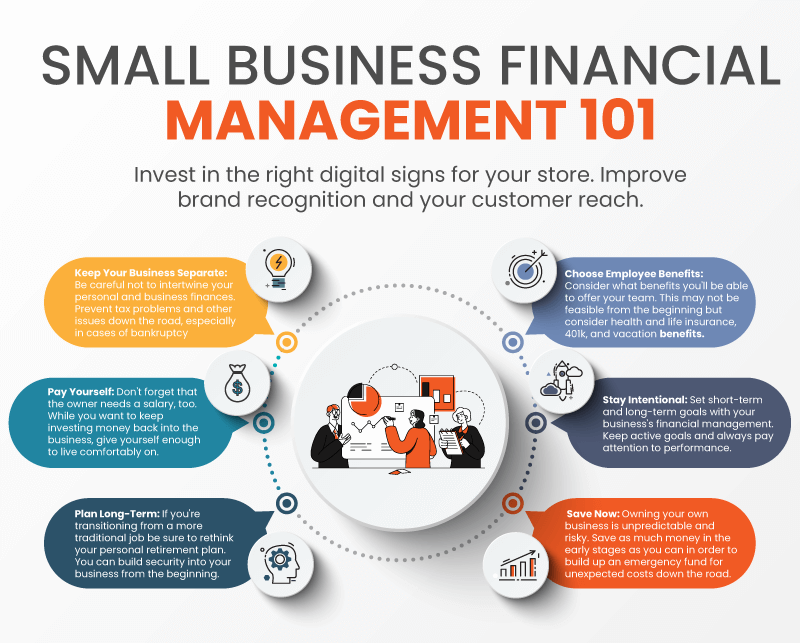

Separating Business and Personal Finances

Open a separate business bank account to maintain clear financial boundaries. Avoid using personal funds for business expenses, and vice versa. This simplifies accounting and tax preparation.

Pay yourself a regular salary to ensure personal financial stability. Properly separating personal and business funds provides a clean and auditable financial structure.

Funding Options: Navigate the Landscape

Understand the different funding options available, including bootstrapping, loans, and venture capital. Bootstrapping uses personal savings and revenue to fund the business. Loans require repayment with interest.

Venture capital involves selling equity in exchange for funding. Each option has its own advantages and disadvantages, requiring careful consideration. Choose funding that aligns with your business's long-term goals and risk tolerance.

"Financial literacy is not a luxury; it's a necessity for entrepreneurs," says Sarah Chen, a financial consultant specializing in startups.

Explore small business grants offered by government agencies and private organizations. These grants often provide non-repayable funding for specific purposes. Research eligibility requirements and application deadlines carefully.

Looking Ahead: Continuous Financial Monitoring

Financial management is an ongoing process. Regularly review your financial performance, analyze key metrics, and adjust your strategy as needed. Seek professional advice from accountants or financial advisors to ensure long-term financial health. Continuous monitoring and adjustments are key.

Stay updated on relevant tax laws and regulations. Attend workshops and webinars to enhance your financial literacy skills. Prioritize financial education and seek expert guidance to navigate the complexities of business finance.