How To Measure Company Performance

Imagine stepping into a bustling office, the air thick with the murmur of phone calls and the tap-tap-tapping of keyboards. Sunlight streams through the windows, illuminating charts plastered on the walls – graphs depicting soaring revenues and meticulously tracked customer satisfaction scores. But beneath the surface buzz, a crucial question lingers: How do we truly measure the heartbeat of this organization? How do we know if we’re not just busy, but truly thriving?

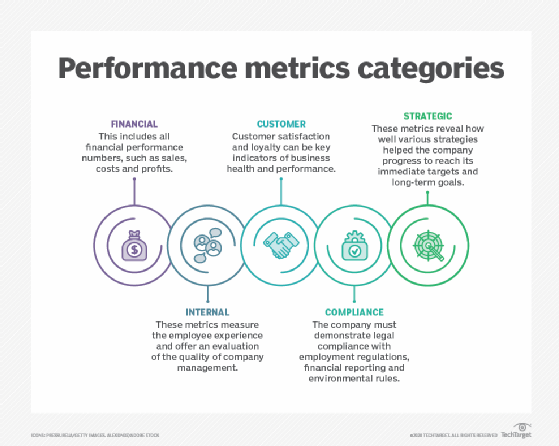

Measuring company performance isn't just about looking at the bottom line; it’s about understanding the holistic health of an organization, from its financial stability and customer loyalty to its operational efficiency and employee satisfaction. This article will guide you through key metrics and frameworks, providing a comprehensive understanding of how to gauge your company's success and chart a course for continuous improvement.

The Foundation: Financial Performance

Financial performance is the bedrock of any company’s evaluation. Revenue growth, profitability, and cash flow are key indicators.

Let's start with revenue. A consistent increase in revenue signals a growing demand for your products or services.

Profitability metrics, like net profit margin (net income divided by revenue), indicate how efficiently a company is generating profit. Net profit margin is a crucial metric.

Cash flow, the lifeblood of any business, reveals the movement of cash both into and out of the company. Positive cash flow ensures the company can meet its obligations and invest in future growth.

Beyond the Numbers: Operational Efficiency

Operational efficiency focuses on how well a company uses its resources to produce goods or services. It's all about streamlining processes and minimizing waste.

Inventory turnover, for example, measures how quickly a company sells and replenishes its inventory. A higher turnover rate generally indicates efficient inventory management.

Another crucial metric is the cycle time, which measures the time it takes to complete a process, from start to finish. Reducing cycle time can lead to significant cost savings and improved customer satisfaction.

Finally, consider capacity utilization, which assesses how much of a company's production capacity is being used. Low capacity utilization might indicate overinvestment in assets or underutilized resources.

Customer Centricity: Measuring Satisfaction and Loyalty

Happy customers are loyal customers, and loyal customers drive long-term profitability. Measuring customer satisfaction is therefore paramount.

Net Promoter Score (NPS), a widely used metric, measures customer loyalty and willingness to recommend a company's products or services. It's based on a simple question: "On a scale of 0 to 10, how likely are you to recommend this company to a friend or colleague?"

Customer satisfaction scores (CSAT) are another valuable tool, often collected through surveys after a purchase or service interaction. These scores provide insights into specific aspects of the customer experience.

Churn rate, the percentage of customers who stop using a company’s products or services within a given period, is a critical indicator of customer retention. A high churn rate can signal underlying problems with product quality, customer service, or pricing.

The Human Element: Employee Engagement and Productivity

A company is only as strong as its people. Employee engagement and productivity are vital to overall performance.

Employee satisfaction surveys can gauge employee morale, identify areas for improvement, and foster a more positive work environment. Happy employees are more productive and engaged.

Absenteeism rates can indicate potential problems with employee well-being or job satisfaction. High absenteeism can disrupt productivity and increase costs.

Consider also employee turnover rate, the percentage of employees who leave the company within a given period. High turnover can be costly, requiring significant investment in recruitment and training.

Frameworks for Comprehensive Assessment

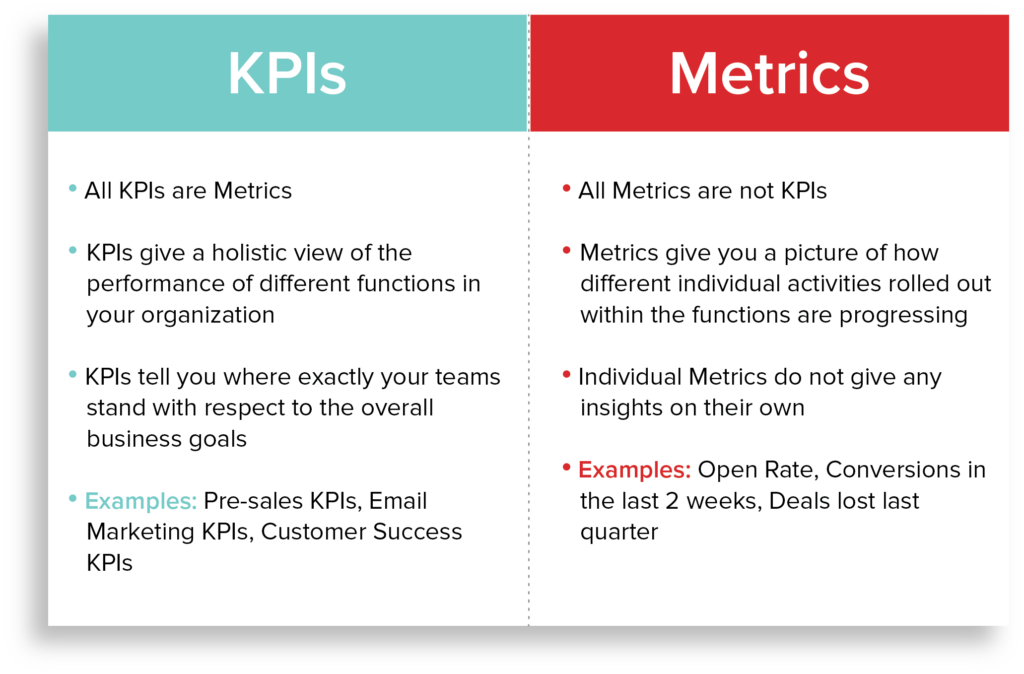

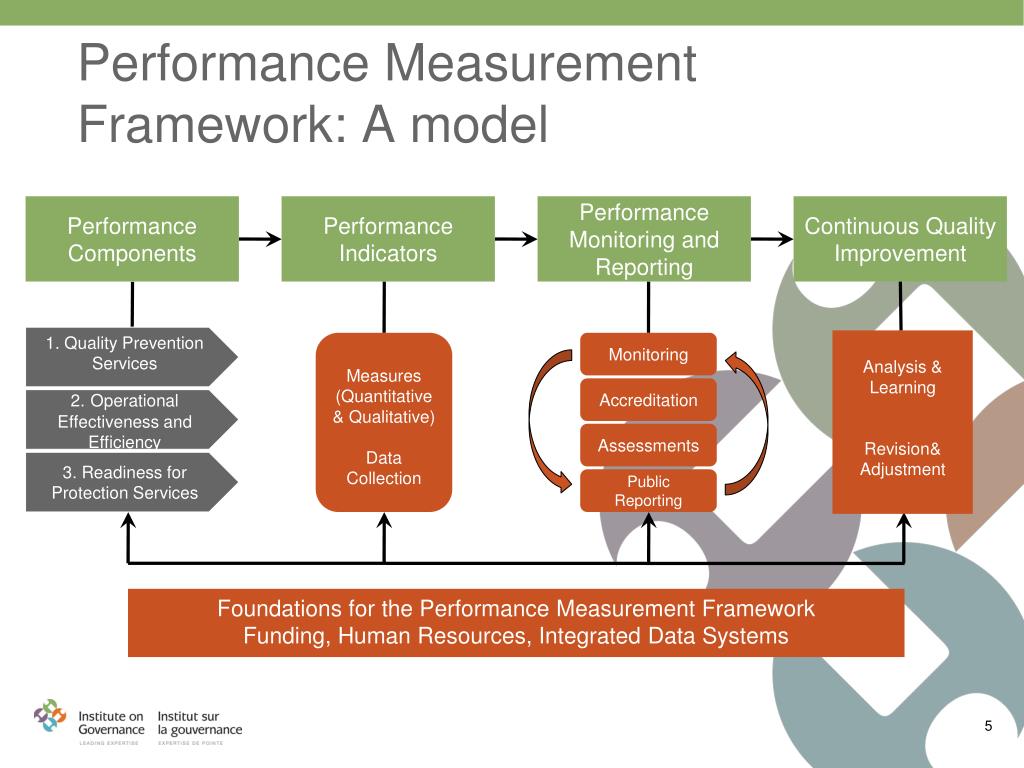

While individual metrics provide valuable insights, frameworks offer a structured approach to measuring and improving company performance.

The Balanced Scorecard, developed by Robert Kaplan and David Norton, is a popular framework that considers financial, customer, internal process, and learning & growth perspectives. It ensures a holistic view of performance, moving beyond purely financial metrics.

Another framework is the Triple Bottom Line, which considers a company's impact on people, planet, and profit. This framework emphasizes social and environmental responsibility alongside financial performance.

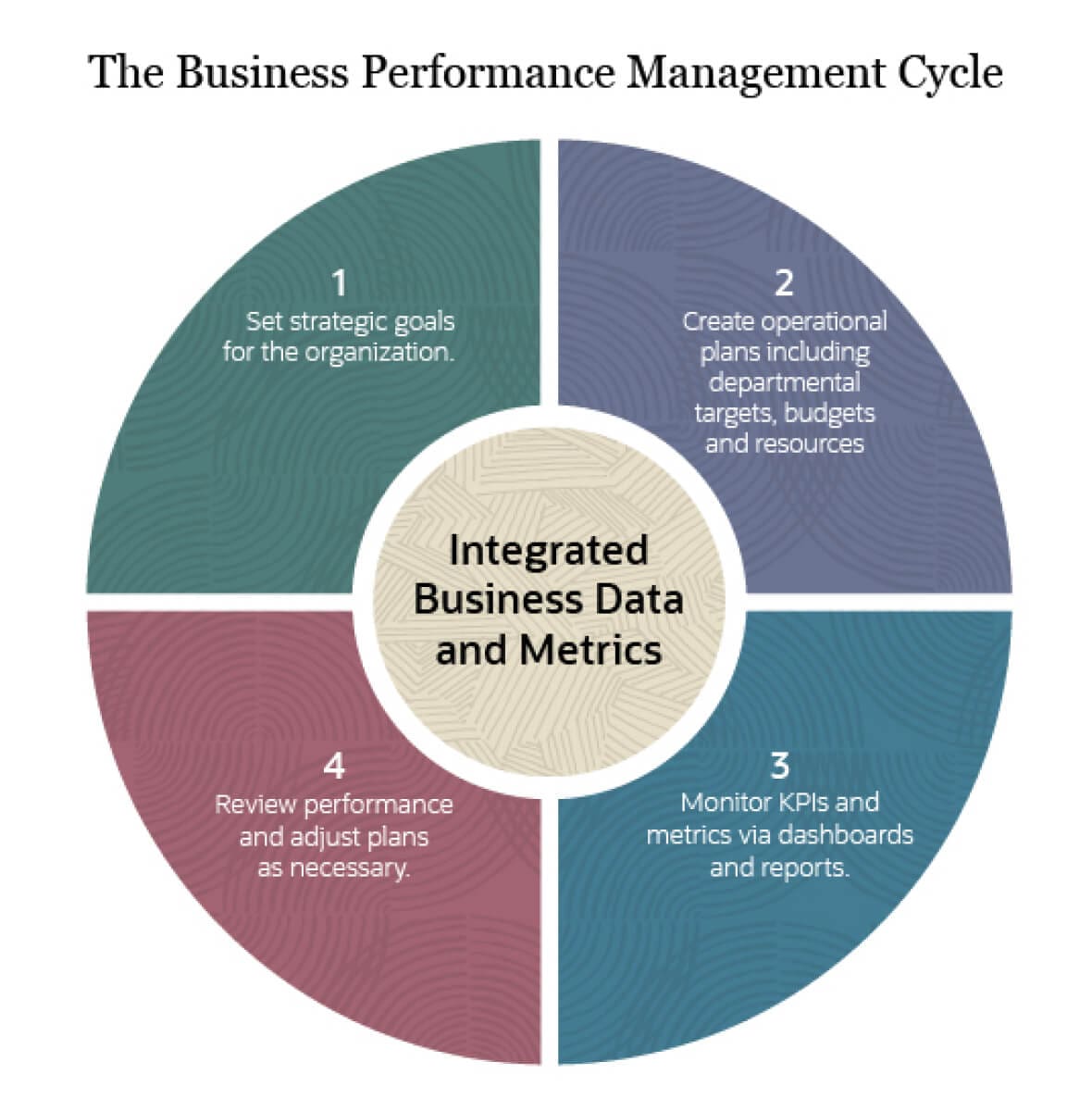

Using these frameworks requires regularly monitoring, analyzing, and acting on the information gathered. This creates a cycle of continuous improvement, helping the company adapt to changing market conditions and achieve its strategic goals.

Looking Ahead: A Culture of Continuous Improvement

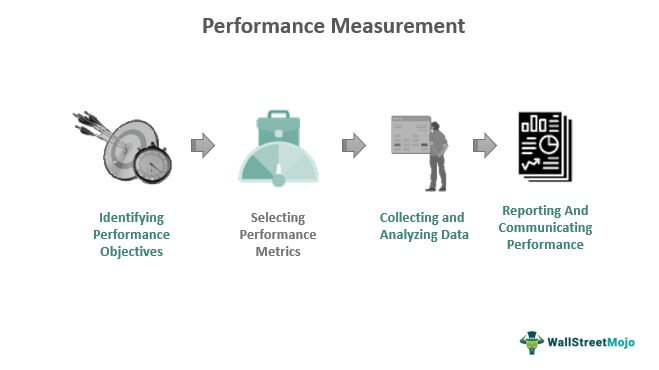

Measuring company performance is not a one-time event; it's an ongoing process. It requires a commitment to data-driven decision-making and a willingness to adapt and improve.

By focusing on the right metrics, embracing comprehensive frameworks, and fostering a culture of continuous improvement, companies can unlock their full potential and achieve lasting success. It's about creating an environment where every individual understands their role in driving performance and contributing to the overall health of the organization. Ultimately, it's about building a company that not only thrives financially but also creates value for its customers, employees, and the community it serves.