How To Organize Finances For A Small Business

For many small business owners, the thrill of entrepreneurship can quickly be overshadowed by the daunting task of managing finances. A solid financial foundation is crucial for survival and growth, but knowing where to start can be overwhelming.

This article outlines essential steps for small business owners to organize their finances effectively. It covers separating personal and business funds, creating a budget, tracking expenses, managing cash flow, and seeking professional advice.

Separate Personal and Business Finances

Mixing personal and business finances is a common mistake that can lead to accounting nightmares and legal complications. The first step towards organized finances is establishing a clear separation.

Open a separate business bank account and obtain a business credit card. This ensures that all business transactions are easily identifiable and traceable.

Create a Realistic Budget

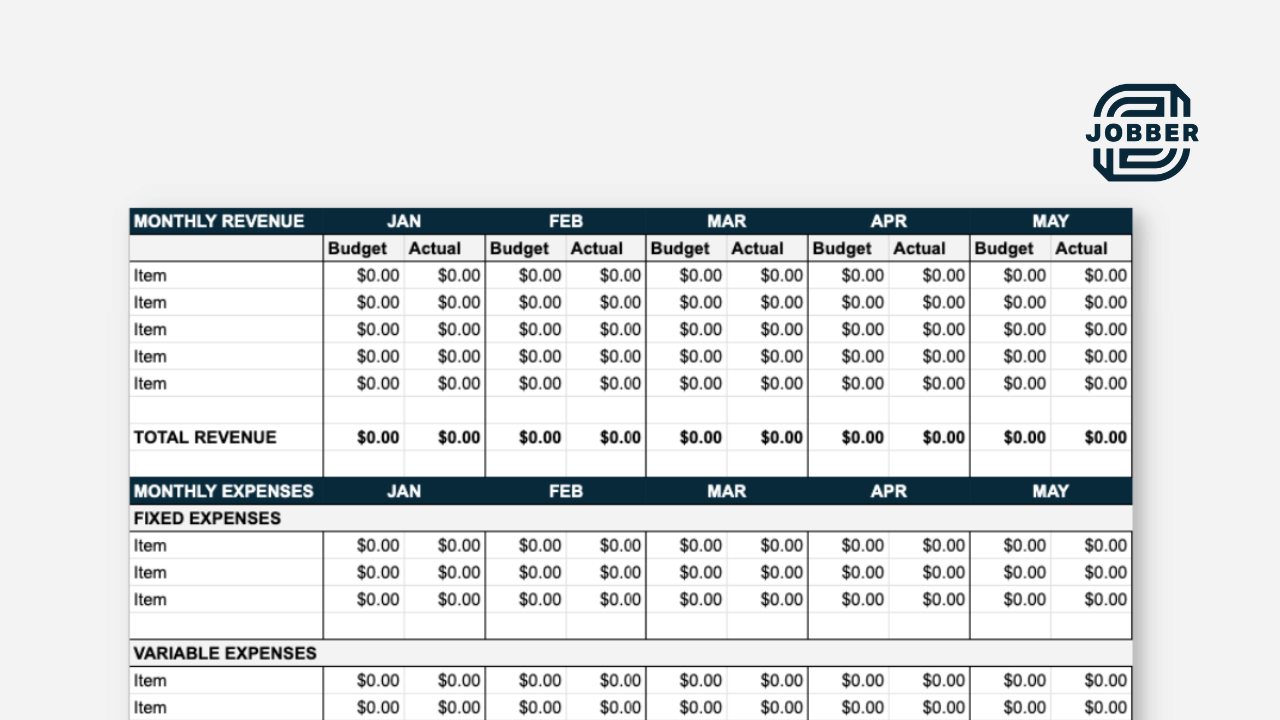

A budget is a roadmap for your business finances, outlining expected income and expenses over a specific period. It provides a framework for making informed financial decisions.

Start by projecting your sales revenue based on historical data and market trends. Then, list all your fixed expenses, such as rent, salaries, and insurance, and variable expenses, such as marketing and supplies.

Regularly compare your actual performance against your budget and adjust your spending accordingly. According to the Small Business Administration (SBA), consistent budgeting can improve profitability by 10-20%.

Track Expenses Meticulously

Knowing where your money is going is essential for controlling costs and identifying areas for improvement. Expense tracking doesn't need to be complex.

Use accounting software, spreadsheets, or even a dedicated expense tracking app to record every business expense. Categorize expenses for better analysis and ensure you keep all receipts for tax purposes.

"Effective expense tracking is like having a magnifying glass on your spending habits," says Sarah Jones, a financial advisor specializing in small businesses. "It allows you to see where you can trim the fat and reinvest in growth."

Manage Cash Flow Effectively

Cash flow, the movement of money in and out of your business, is the lifeblood of any small business. Poor cash flow management can lead to financial distress even if the business is profitable.

Forecast your cash inflows and outflows regularly to identify potential shortfalls. Negotiate payment terms with suppliers and consider offering early payment discounts to customers to improve cash flow.

The National Federation of Independent Business (NFIB) reports that cash flow problems contribute to over 80% of small business failures. Building a cash reserve can help weather unexpected expenses or slow sales periods.

Seek Professional Advice

Navigating the complexities of small business finances can be challenging, especially for those without a financial background. Don't hesitate to seek professional advice from an accountant or financial advisor.

A qualified professional can help you set up your accounting system, prepare financial statements, and develop tax strategies. They can also provide valuable insights into your business performance and help you make informed financial decisions.

Consider the return on investment of such services. While there is a cost, professional financial guidance can save you time and money in the long run, ensuring compliance and optimizing financial strategies for growth.

Leveraging Technology

Numerous software solutions and online tools are available to streamline financial management tasks. These technologies can automate processes, reduce errors, and provide real-time insights into your financial performance.

Explore options like QuickBooks, Xero, or FreshBooks, which offer features such as invoicing, expense tracking, and financial reporting.

"Technology is a game-changer for small business financial management," notes David Lee, a consultant specializing in small business technology. "It empowers owners to take control of their finances and make data-driven decisions."

By implementing these strategies, small business owners can establish a solid financial foundation, improve profitability, and increase their chances of long-term success. Taking control of your finances is an investment in the future of your business.