How To Prepare For A Great Depression

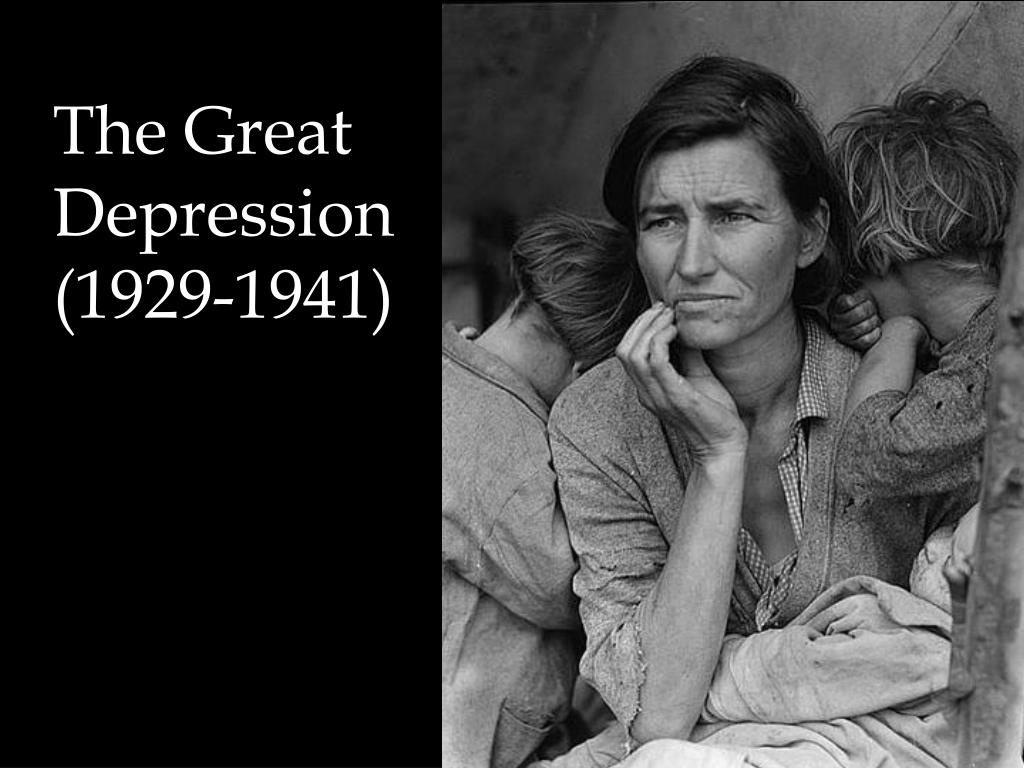

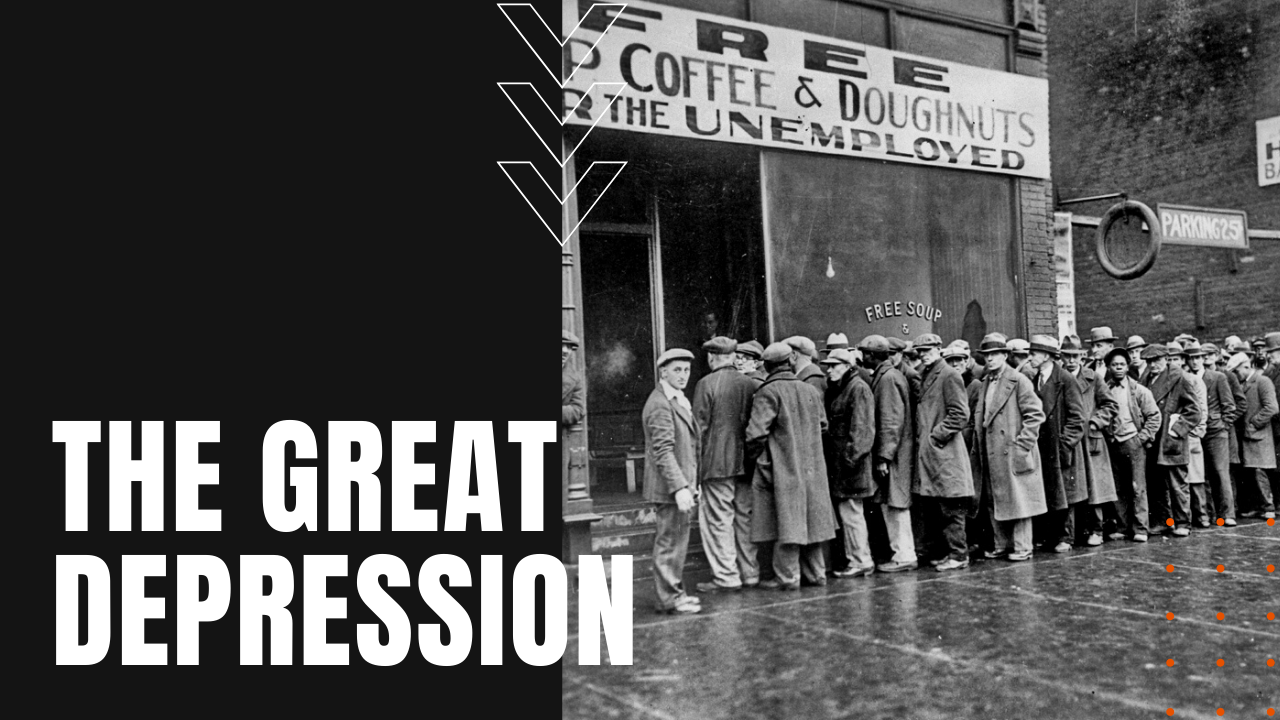

Imagine waking up to headlines screaming of economic turmoil, stock markets plummeting, and a pervasive sense of uncertainty hanging in the air. The breadlines of the 1930s might seem like a distant memory, but the possibility of severe economic hardship, even a modern-day Great Depression, is a concern that lingers in the minds of many. While predicting the future is impossible, preparing for potential financial storms can provide peace of mind and resilience.

This article explores practical steps you can take to safeguard your financial well-being and navigate the complexities of a significant economic downturn. It's not about fear-mongering, but about empowering you with knowledge and strategies to weather any storm, big or small.

Understanding the Potential Landscape

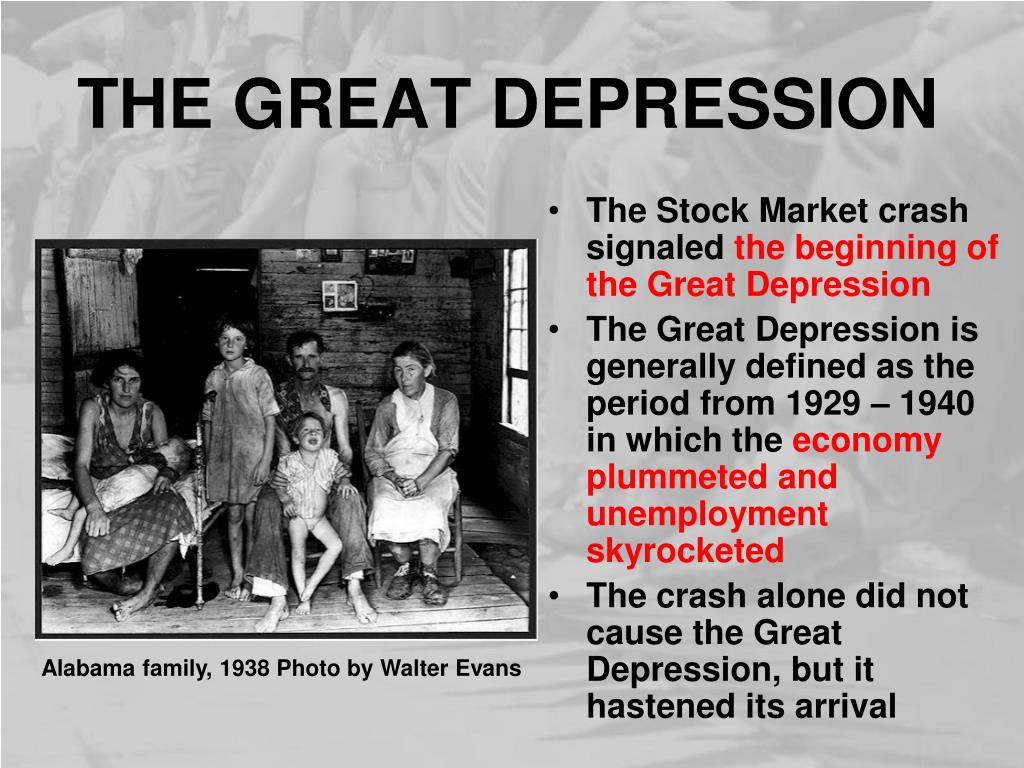

The term "Great Depression" conjures images of widespread unemployment and poverty. While a repeat of that specific historical event might be unlikely, significant economic recessions can still have devastating consequences. Job losses, business closures, and reduced access to credit are all potential realities.

Economic indicators like GDP growth, unemployment rates, and inflation are crucial to monitor. Organizations like the International Monetary Fund (IMF) and the World Bank regularly publish economic forecasts that provide valuable insights.

Building a Financial Fortress

The cornerstone of any preparedness plan is a solid financial foundation. This involves several key elements: emergency savings, debt management, and diversified income streams.

An emergency fund acts as a buffer against unexpected job loss or expenses. Aim to save at least 3-6 months' worth of living expenses in a readily accessible account. As a safety net, this is invaluable.

Prioritize paying down high-interest debt, such as credit card balances. High debt burden can be crippling during an economic downturn. Consider debt consolidation or balance transfer options to lower interest rates.

Explore opportunities to diversify your income. This could involve starting a side business, freelancing, or investing in income-generating assets. Multiple income streams reduce your reliance on a single source and offer more stability.

Investing Wisely

Investment strategies require careful consideration, especially during uncertain times. Diversification across different asset classes is paramount. Don't put all your eggs in one basket.

Consider a mix of stocks, bonds, real estate, and commodities. Real estate, when carefully chosen, can provide a relatively stable investment. Commodities such as precious metals are often seen as a safe haven during economic uncertainty.

Seek advice from a qualified financial advisor who can help you tailor an investment strategy to your specific needs and risk tolerance. Remember that past performance is not indicative of future results.

Strengthening Your Community

Economic hardship often brings communities together. Building strong relationships with neighbors and local organizations can provide support and resilience during challenging times.

Participate in community initiatives, volunteer your time, and support local businesses. A strong community can provide a safety net and a sense of solidarity.

Consider bartering skills and resources with neighbors. Sharing resources can help stretch budgets and foster a sense of cooperation.

Looking Ahead

Preparing for a potential Great Depression is about more than just stockpiling resources. It's about building financial resilience, strengthening your community, and adopting a mindset of preparedness. It's about taking proactive steps to protect yourself and your loved ones.

While the future is uncertain, knowledge is power. By understanding the potential risks and implementing practical strategies, you can increase your ability to weather any economic storm and emerge stronger on the other side.

This preparation is not about living in fear, but about empowering you to navigate any future economic landscape with confidence and resilience. Investing in your preparedness is an investment in your future security and peace of mind.