How To Prepare For Economic Depression

Imagine the aroma of freshly baked bread wafting from your kitchen, not as a weekend indulgence, but as a comforting symbol of self-sufficiency. Picture your garden, bursting with vibrant vegetables, a testament to your resourcefulness. These aren't scenes from a rustic dream, but potential realities as we navigate an increasingly uncertain economic landscape.

This article explores practical strategies for preparing for a potential economic downturn, focusing on building resilience and safeguarding your financial well-being. While economic forecasts fluctuate, understanding how to bolster your personal economy offers peace of mind and empowers you to weather any storm. We'll delve into actionable steps you can take today to create a more secure future for yourself and your family.

Understanding Economic Downturns

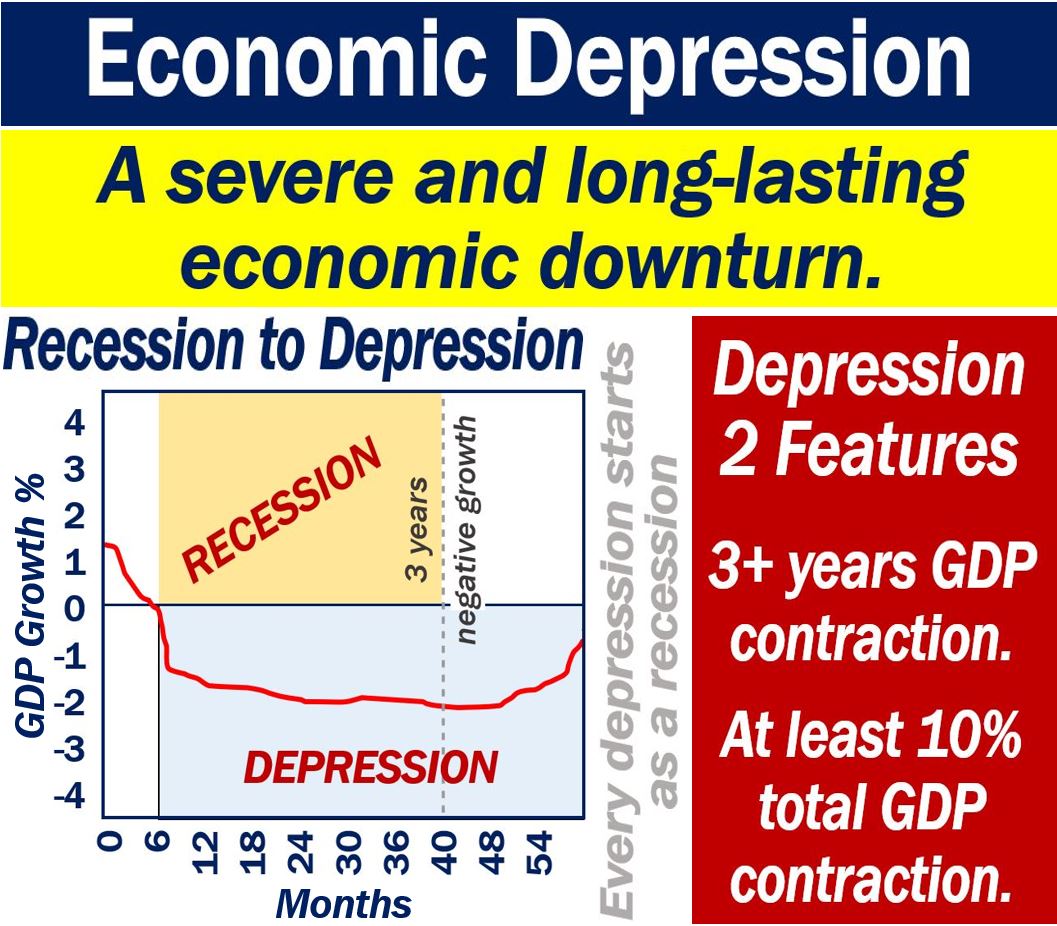

Economic depressions, while infrequent, are characterized by a prolonged and severe contraction in economic activity. This often includes high unemployment, significant declines in GDP, and widespread financial instability.

Historically, events like the Great Depression of the 1930s serve as stark reminders of the potential impact. According to the National Bureau of Economic Research, that period saw a drastic decline in economic output and a surge in unemployment.

Although predicting the future is impossible, understanding the signs and preparing accordingly is prudent.

Building Financial Resilience

Emergency Fund

A robust emergency fund is your first line of defense. Aim to save 3-6 months' worth of living expenses in a readily accessible account.

This cushion provides a buffer against job loss, unexpected medical bills, or other financial emergencies, preventing you from accumulating debt during tough times. Consider high-yield savings accounts for better returns.

Debt Management

Reducing or eliminating high-interest debt is crucial. Focus on paying down credit cards and other loans with high APRs.

Explore options like balance transfers or debt consolidation to lower your interest rates and streamline your payments. A debt-free life brings significant financial freedom.

Diversify Income Streams

Relying solely on one income source can be risky. Explore opportunities to diversify your income.

This could involve starting a side hustle, freelancing, investing in dividend-paying stocks, or developing a passive income stream through online courses or digital products. Multiple income streams provide a safety net.

Budgeting and Financial Tracking

Create a detailed budget to track your income and expenses. Identify areas where you can cut back and save money.

Utilize budgeting apps or spreadsheets to monitor your spending habits and ensure you're living within your means. Regular financial reviews help you stay on track.

Investing in Self-Sufficiency

Food Security

Consider starting a garden, even a small one, to grow your own fruits and vegetables. Learn basic canning and food preservation techniques.

Stockpiling non-perishable food items and essential supplies can provide a buffer against food shortages and price increases. Self-sufficiency reduces your reliance on external systems.

Essential Skills

Acquire skills that could be valuable in a downturn, such as basic home repair, cooking from scratch, or first aid.

These skills not only save you money but also increase your self-reliance and ability to help others in your community. Knowledge is power, especially in challenging times.

Community Building

Connect with your neighbors and build strong community ties. A supportive community can provide emotional and practical assistance during times of hardship.

Share resources, skills, and knowledge with your neighbors. Collaboration strengthens resilience.

Protecting Your Mental Well-being

Economic uncertainty can be stressful. Prioritize your mental and emotional well-being by practicing self-care, seeking support from loved ones, and limiting exposure to negative news.

Maintain a positive outlook and focus on what you can control. Remember, resilience is as much about mental strength as it is about financial preparedness.

Preparing for an economic downturn is not about panicking; it's about empowering yourself. By taking proactive steps to build financial resilience, invest in self-sufficiency, and nurture your mental well-being, you can navigate uncertainty with greater confidence and emerge stronger on the other side. The journey towards security starts with a single step – a seed planted in your garden, a dollar saved, a skill learned. Embrace the power within you to create a brighter future, no matter what the economic climate may hold.

![How To Prepare For Economic Depression [Economics] What is Economic Depression? - Class 12 Teachoo](https://d1avenlh0i1xmr.cloudfront.net/b627c738-a0db-444d-acf8-0db6aeb5e54c/slide12.jpg)