How To Prevent Fraud In Small Business

The dream of entrepreneurship, fueled by innovation and hard work, can quickly turn into a nightmare when fraud strikes. Small businesses, often operating on tight margins and lacking robust internal controls, are particularly vulnerable. The consequences can be devastating, ranging from significant financial losses to reputational damage and even closure.

This article delves into practical strategies for preventing fraud in small businesses. It provides actionable insights and emphasizes the importance of proactive measures to safeguard assets and maintain financial integrity. Implementing these steps can significantly reduce the risk of becoming a victim of internal or external fraud schemes.

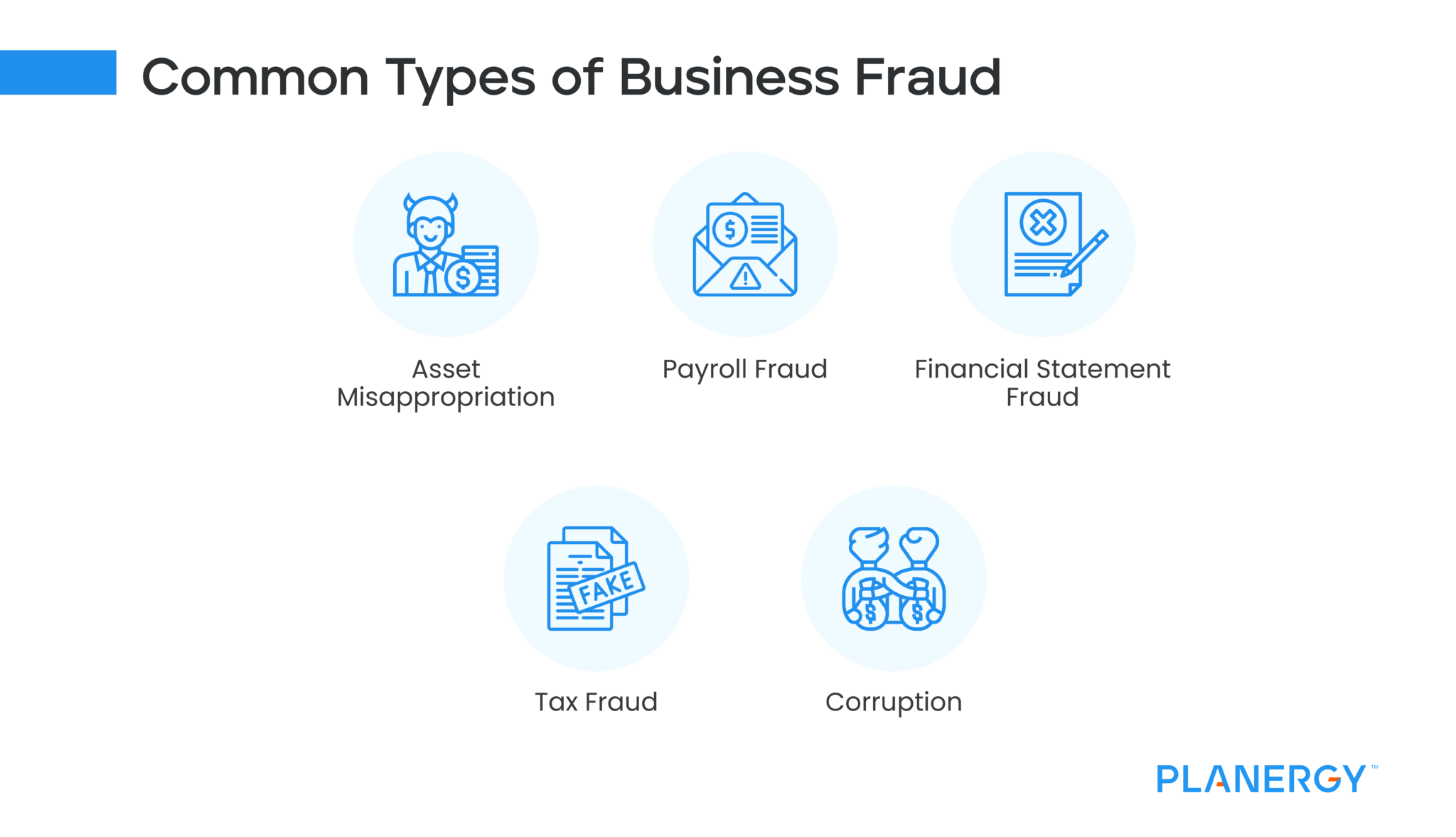

Understanding the Landscape of Fraud

Fraud in small businesses can take many forms, including embezzlement, asset misappropriation, and financial statement fraud. According to the Association of Certified Fraud Examiners (ACFE), small businesses are disproportionately affected by fraud due to limited resources and a lack of segregation of duties.

The ACFE's 2022 Report to the Nations found that small businesses with fewer than 100 employees suffered median losses of $150,000 due to fraud, often undetected for extended periods. This highlights the urgent need for preventative measures.

Internal Controls: The First Line of Defense

Establishing strong internal controls is paramount. These controls are processes designed to provide reasonable assurance regarding the reliability of financial reporting, effectiveness and efficiency of operations, and compliance with applicable laws and regulations. Effective internal controls make it more difficult for fraudsters to operate undetected.

One crucial aspect is segregation of duties. This involves dividing responsibilities among different employees so that no single individual has complete control over a financial transaction. For example, the person who approves invoices should not also be the person who disburses payments.

Another key control is regular reconciliation of bank accounts and financial records. This helps identify discrepancies and irregularities that could indicate fraudulent activity. Implement mandatory vacation policies and cross-training to ensure that critical functions are covered in the absence of an employee.

Background Checks and Employee Screening

Thorough background checks on potential employees are essential. While not foolproof, background checks can uncover past criminal activity or other red flags. Verify references and check credentials to ensure accuracy of information provided by job applicants.

Consider implementing a code of ethics and requiring employees to sign it. This reinforces the organization's commitment to ethical behavior and provides a framework for reporting suspected wrongdoing. A robust whistleblower policy also provides a safe avenue for employees to report concerns without fear of retaliation.

Technology and Cybersecurity

In today's digital age, cybersecurity is an integral part of fraud prevention. Small businesses are increasingly targeted by cybercriminals who seek to steal financial information or disrupt operations. Invest in security software, firewalls, and anti-malware protection.

Educate employees about phishing scams and other online threats. Implement strong password policies and multi-factor authentication to protect sensitive data. Regularly back up data to prevent data loss in the event of a cyberattack.

Implement robust access controls. Limit employee access to systems and data based on their job responsibilities. Audit user access privileges regularly and revoke access when employees leave the company.

Regular Audits and Oversight

Even with strong internal controls in place, regular audits are necessary. An independent audit can help identify weaknesses in the system and provide recommendations for improvement. Consider both internal and external audits.

Implement a fraud risk assessment to identify potential vulnerabilities. This assessment should consider all aspects of the business, from accounting and finance to operations and human resources. Update the assessment regularly to reflect changes in the business environment.

Senior management must set the tone at the top. A strong commitment to ethical behavior from leadership sends a clear message to employees that fraud will not be tolerated. Regularly communicate the importance of fraud prevention and encourage employees to report any suspicious activity.

Looking Ahead: A Culture of Integrity

Preventing fraud in small businesses requires a multi-faceted approach, combining strong internal controls, diligent employee screening, robust cybersecurity, and regular oversight. Creating a culture of integrity is essential. Encourage open communication and promote a workplace where employees feel comfortable reporting concerns.

By taking proactive steps to prevent fraud, small businesses can protect their assets, maintain their reputation, and ensure their long-term success. Investment in fraud prevention is an investment in the future of the business.

.png)