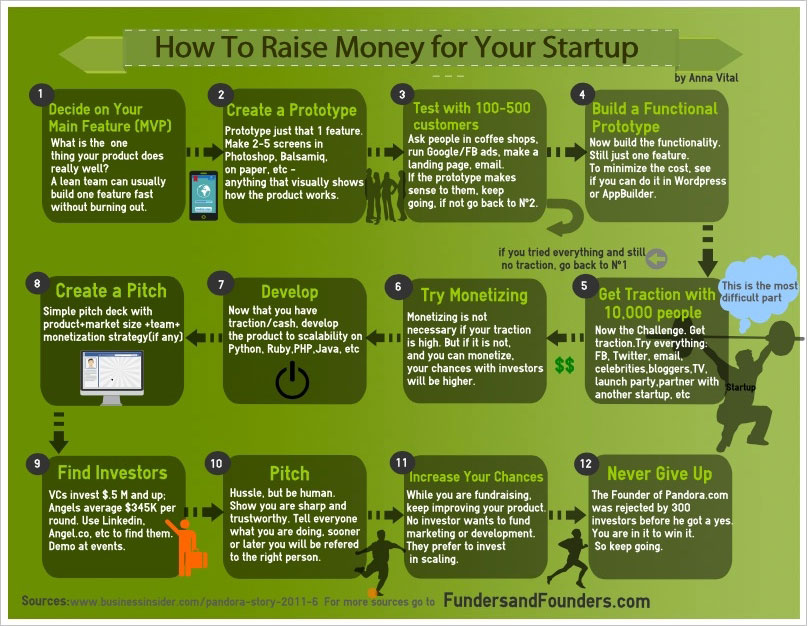

How To Raise Funds For Business Start Up

Securing initial funding stands as a crucial hurdle for budding entrepreneurs. Navigating the complex landscape of financing options requires a strategic approach. From bootstrapping to venture capital, understanding the various avenues can significantly impact a startup's trajectory.

This article delves into the primary methods for raising funds for a business startup. It explores the pros and cons of each approach. The aim is to provide a comprehensive guide for entrepreneurs seeking to fuel their ventures.

Bootstrapping: The Self-Funded Path

Bootstrapping, or self-funding, represents the most common initial funding source. It involves using personal savings, loans from family and friends, or revenue generated from early sales. This approach allows founders to retain complete control of their company.

The advantages include avoiding debt and equity dilution. However, it can limit growth due to constrained resources and may put personal finances at risk. Many successful companies, like Dell in its early days, started through bootstrapping.

Loans: Debt Financing

Small business loans from banks and credit unions offer another funding option. These loans typically require collateral and a strong credit history. The Small Business Administration (SBA) guarantees loans offered by participating lenders, reducing risk for the bank.

While loans provide access to larger sums of capital, they come with interest payments and repayment schedules. Failure to repay can lead to asset seizure. According to the SBA, approximately 30% of new businesses fail within the first two years, highlighting the risk associated with debt.

Angel Investors: Early-Stage Support

Angel investors are high-net-worth individuals who invest in early-stage companies. They typically provide smaller amounts of funding than venture capitalists. In exchange, they receive equity in the company.

Angel investors often bring valuable experience and mentorship, in addition to capital. Finding the right angel investor who aligns with your vision is crucial. AngelList is a popular platform connecting startups with angel investors.

Venture Capital: High-Growth Potential

Venture capital firms invest in companies with high growth potential. They typically invest larger sums of money than angel investors. In exchange, they receive a significant equity stake and often a seat on the board of directors.

Securing venture capital is a competitive process. Companies must demonstrate a strong business plan and a clear path to profitability. Venture capitalists often focus on specific industries or stages of development.

Crowdfunding: Leveraging the Crowd

Crowdfunding platforms like Kickstarter and Indiegogo allow entrepreneurs to raise funds from a large number of individuals. In exchange for their contributions, backers typically receive rewards or early access to the product.

Crowdfunding can be a great way to validate a product idea and build a community. However, it requires significant marketing and promotion. Successful campaigns often involve compelling storytelling and a strong social media presence.

Grants: Non-Dilutive Funding

Government and private organizations offer grants to support startups. Grants are non-dilutive, meaning they do not require giving up equity. These can come from federal agencies like the National Institutes of Health (NIH) for biotech startups, or local economic development organizations.

Grants are often highly competitive and require a detailed application process. Eligibility criteria vary depending on the grant program. Grants.gov is a central source for information on federal grants.

Incubators and Accelerators: Ecosystem Support

Incubators and accelerators provide startups with resources, mentorship, and networking opportunities. Many also offer seed funding in exchange for equity. Programs like Y Combinator and Techstars are highly selective and prestigious.

These programs typically last for a few months. They culminate in a demo day where startups pitch their ideas to investors. Participation in an incubator or accelerator can significantly increase a startup's chances of success.

Choosing the right funding strategy depends on several factors. These includes the startup's industry, stage of development, and financial needs. A well-defined business plan and a clear understanding of the funding landscape are essential for success.

![How To Raise Funds For Business Start Up [Infographic]- 10 Ways to Fund Your Startup](http://dsim.in/blog/wp-content/uploads/2017/10/fund-your-startup.png)