How To Raise Money For Your New Business

Securing funding is a crucial first step for any aspiring entrepreneur looking to turn a business idea into reality. Navigating the landscape of financing options can seem daunting, but understanding the available avenues and crafting a compelling pitch are key to success.

This article will explore various methods for raising capital for a new business, from bootstrapping to venture capital, offering practical advice for entrepreneurs at all stages.

Understanding Your Funding Needs

Before approaching any potential investor, it's essential to clearly define your funding requirements. Create a detailed business plan, outlining projected expenses, revenue forecasts, and a clear understanding of your target market.

Bootstrapping: Funding From Within

Bootstrapping, or self-funding, involves using personal savings, loans from friends and family, and revenue generated by the business itself to finance growth. It allows entrepreneurs to maintain complete control and avoid diluting equity.

However, bootstrapping can limit growth potential and put significant financial strain on the founder. It also requires meticulous financial management and a willingness to reinvest profits.

Small Business Loans: Traditional Funding

Banks and credit unions offer various loan products designed for small businesses. These loans typically require collateral and a strong credit history.

The Small Business Administration (SBA) guarantees loans made by participating lenders, reducing risk and making it easier for small businesses to qualify. SBA loans often come with favorable terms, such as lower interest rates and longer repayment periods.

Crowdfunding: Leveraging the Power of the Crowd

Crowdfunding platforms like Kickstarter and Indiegogo allow entrepreneurs to raise money from a large number of people, typically in exchange for rewards or equity. This method can be particularly effective for businesses with a strong social mission or innovative product.

Successful crowdfunding campaigns require significant marketing efforts and a compelling story. It's also crucial to fulfill promises made to backers.

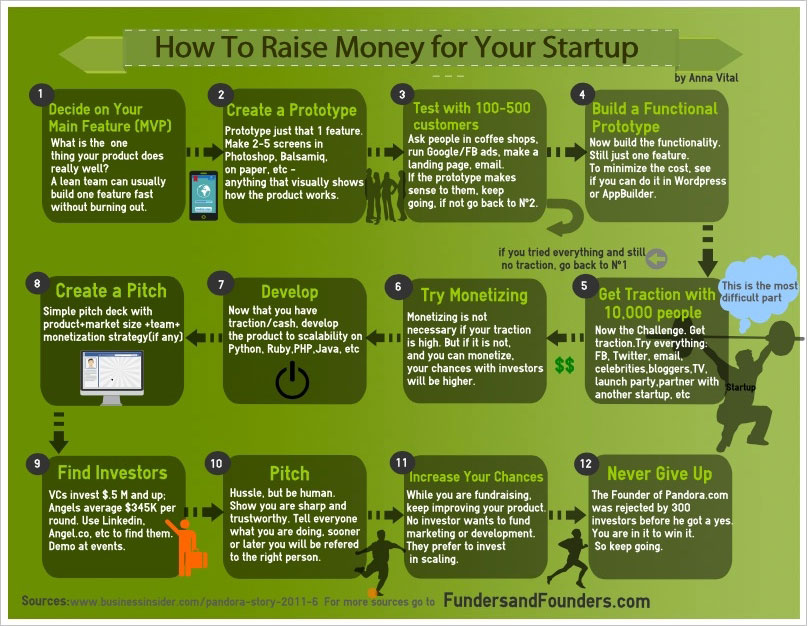

Angel Investors: Early-Stage Support

Angel investors are high-net-worth individuals who invest their own money in early-stage companies. They often provide mentorship and guidance in addition to capital.

Finding angel investors requires networking and attending industry events. A strong pitch deck and a clear understanding of your market are essential for attracting their attention.

Venture Capital: High-Growth Potential

Venture capital (VC) firms invest in high-growth companies with the potential for significant returns. VC funding is typically larger than angel investments and comes with greater expectations for growth and profitability.

Securing venture capital is a competitive process that requires a proven business model, a strong management team, and a clear exit strategy. VC firms typically take a significant equity stake in the company.

Grants and Competitions: Non-Dilutive Funding

Various government agencies and organizations offer grants and competitions for small businesses. These funds are typically non-dilutive, meaning entrepreneurs don't have to give up equity.

The application process for grants and competitions can be lengthy and competitive. However, the benefits of securing non-dilutive funding can be significant.

Crafting a Compelling Pitch

Regardless of the funding source, a compelling pitch is essential for success. Your pitch should clearly articulate your business idea, target market, competitive advantage, and financial projections.

Be prepared to answer tough questions and demonstrate a deep understanding of your industry. Practice your pitch and seek feedback from trusted advisors.

The Importance of Due Diligence

Before accepting funding from any source, carefully review the terms and conditions. Seek legal and financial advice to ensure you understand the implications of the agreement.

Due diligence is a critical step in the funding process. It protects both the entrepreneur and the investor.

Navigating the Fundraising Journey

Raising money for a new business can be a challenging but rewarding experience. By understanding the available funding options, crafting a compelling pitch, and conducting thorough due diligence, entrepreneurs can increase their chances of success.

The journey of securing funding is often as valuable as the capital itself. Embrace the process, learn from your experiences, and never give up on your vision.