How To Remove A Business Partner From An Llc

Navigating the complexities of business partnerships can be challenging, particularly when it comes to dissolving relationships within a Limited Liability Company (LLC). Removing a business partner from an LLC requires careful consideration of legal frameworks, operating agreements, and potential financial implications. Understanding the process is crucial for ensuring a smooth and equitable transition for all parties involved.

The process of removing a partner from an LLC, while potentially contentious, can be managed effectively with proper planning and adherence to established legal guidelines. This article outlines the key steps involved, common pitfalls to avoid, and resources available to assist in this complex undertaking.

Understanding the Operating Agreement

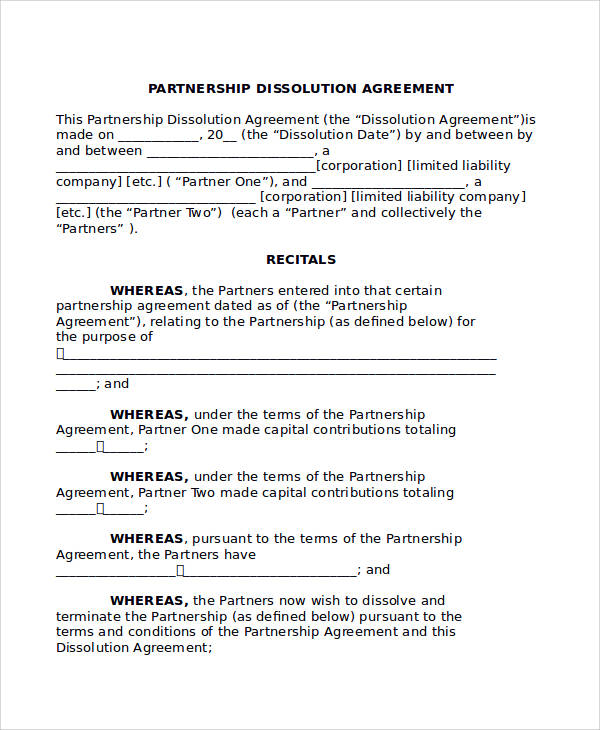

The foundation for removing a partner lies within the LLC's operating agreement. This document, drafted during the LLC's formation, typically outlines the procedures for member withdrawals, buyouts, and involuntary removals.

It's the first place to look. The operating agreement should ideally address scenarios such as death, disability, bankruptcy, or simply a desire to leave the business.

If the operating agreement lacks clear provisions, state laws governing LLCs will take precedence, often leading to more complex and potentially less favorable outcomes.

Voluntary Withdrawal vs. Involuntary Removal

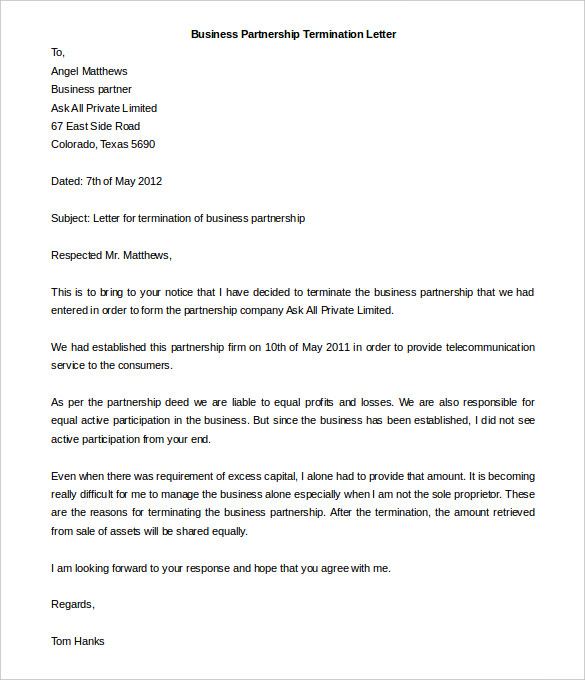

A partner's departure can be either voluntary or involuntary, each triggering different procedures. Voluntary withdrawal occurs when a partner chooses to leave the LLC.

The operating agreement usually specifies the notice period required and any restrictions on transferring their membership interest. In contrast, involuntary removal involves forcing a partner out due to misconduct, breach of contract, or other specified reasons.

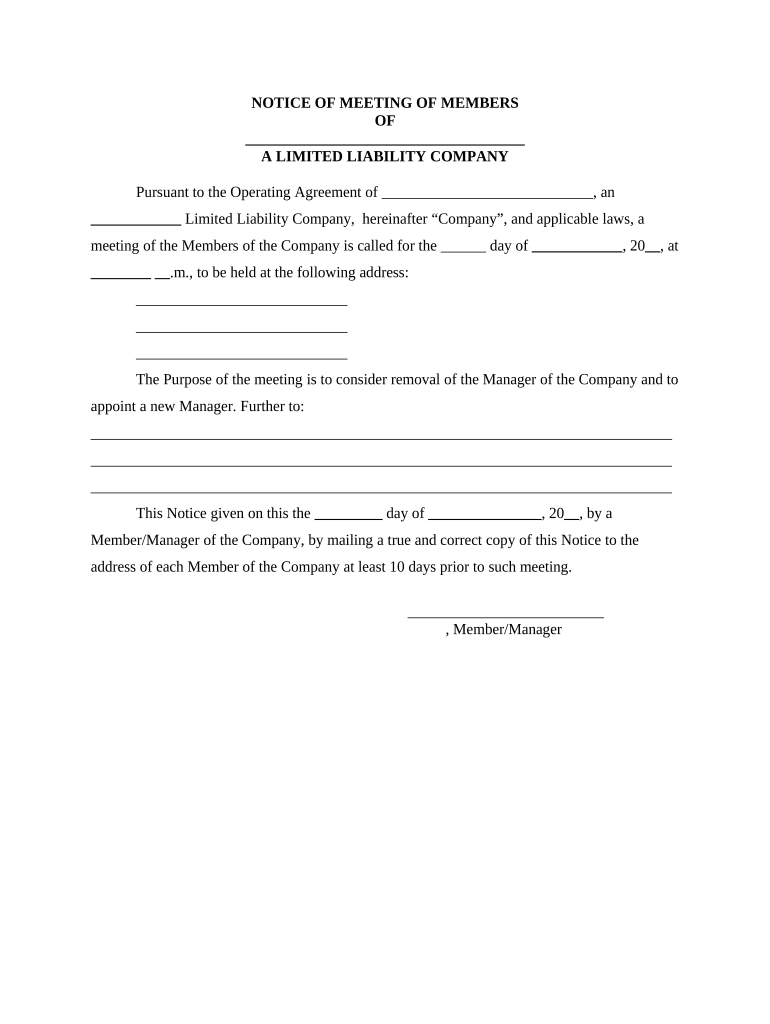

Involuntary removal is generally more difficult, often requiring a unanimous or supermajority vote from the remaining members, as well as proof of just cause.

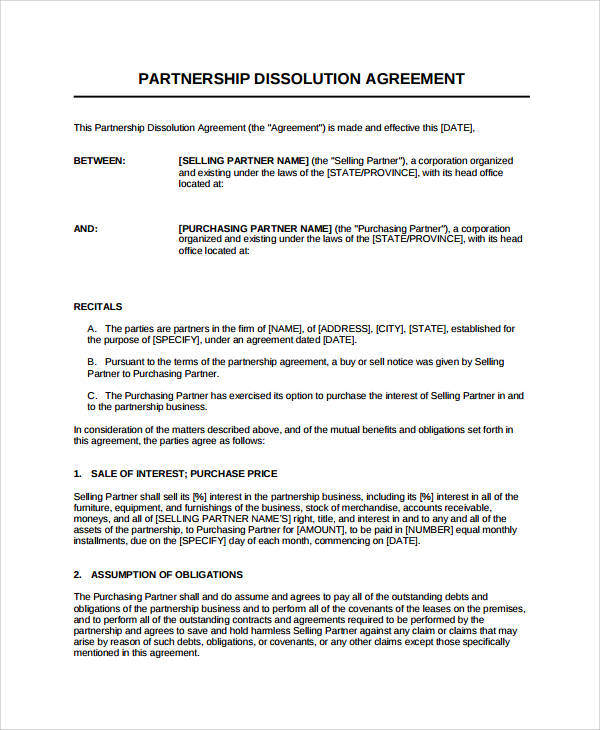

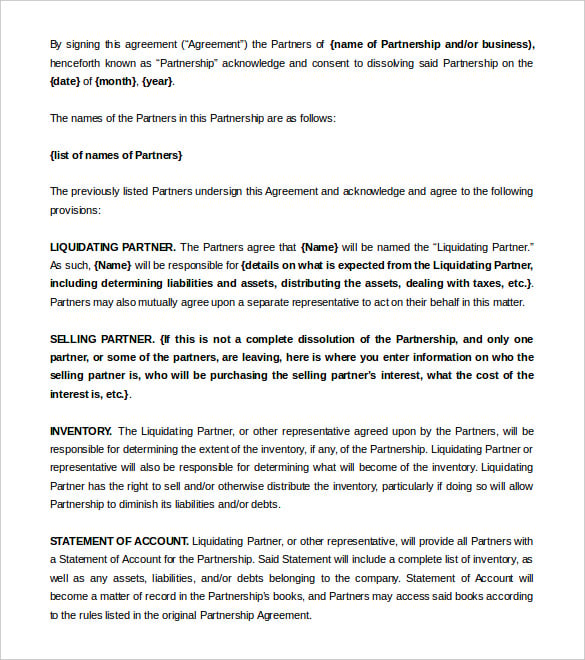

The Buyout Process

When a partner exits, their ownership interest must be addressed. A buyout is a common mechanism, where the remaining members purchase the departing partner's share of the LLC.

The operating agreement often dictates how the value of the departing member's interest is determined, potentially involving independent appraisals or a pre-agreed formula. Reaching a fair valuation is crucial to avoid legal disputes.

Financing the buyout can be another hurdle, requiring the remaining members to secure loans or use company profits.

Legal and Financial Considerations

Removing a partner necessitates consulting with legal and financial professionals. An attorney can review the operating agreement, advise on state laws, and help navigate the legal complexities of the removal process.

A CPA or financial advisor can assist in valuing the departing partner's interest and structuring the buyout to minimize tax implications. Failing to address these aspects can lead to costly litigation and financial penalties.

It's important to document every step of the process meticulously. This protects the LLC from future claims.

Alternative Dispute Resolution

Before resorting to litigation, consider alternative dispute resolution methods such as mediation or arbitration. These processes can provide a less adversarial and more cost-effective way to resolve disagreements.

A neutral third party can facilitate negotiations and help the parties reach a mutually agreeable solution. Mediation, in particular, can be a valuable tool for preserving relationships and avoiding the public scrutiny of a court battle.

Arbitration, on the other hand, results in a binding decision by the arbitrator, offering a more definitive resolution.

The Importance of Communication

Throughout the entire process, open and honest communication is essential. While tensions may be high, maintaining respectful dialogue can help minimize conflict and facilitate a smoother transition.

Consider scheduling regular meetings to discuss progress, address concerns, and keep all parties informed. Transparency is key to building trust and preventing misunderstandings.

Ignoring communication can exacerbate existing problems and lead to a breakdown in negotiations.

Consequences of Improper Removal

Failing to follow proper procedures for removing a partner can have serious consequences. The departing partner may sue the LLC for breach of contract, breach of fiduciary duty, or other claims.

A court may order the LLC to pay damages, reinstate the partner, or even dissolve the company entirely. Therefore, seeking legal counsel and adhering to the operating agreement are critical to avoid these pitfalls.

The potential cost of litigation far outweighs the expense of seeking professional guidance upfront.

Moving Forward

Removing a partner from an LLC is a complex process requiring careful planning, legal expertise, and open communication. By understanding the operating agreement, exploring alternative dispute resolution methods, and seeking professional guidance, businesses can navigate this challenging situation effectively.

While emotionally difficult, a well-managed partner removal can ultimately strengthen the LLC and pave the way for future success. Remember, the ultimate goal is a fair and legally sound resolution that protects the interests of all parties involved.

Consult with an attorney specializing in business law and a qualified financial advisor. They can guide you through the specific requirements of your LLC and your state's laws.