How To Remove Myself From A Business Partnership

Navigating the complexities of a business partnership can be rewarding, but also present challenges when one partner decides to exit. The process of removing oneself from a business partnership requires careful planning and execution to minimize legal and financial repercussions.

Understanding the steps involved is crucial for ensuring a smooth transition and protecting personal and business interests.

Understanding Your Partnership Agreement

The first step is a thorough review of the partnership agreement. This document outlines the procedures for partner withdrawal, including notice periods, valuation methods for the departing partner’s share, and any restrictive covenants.

Without a written agreement, state law, typically the Uniform Partnership Act (UPA), will govern the dissolution process.

Key Agreement Components

Pay close attention to clauses addressing dissolution procedures, valuation of assets, and dispute resolution.

The agreement may also detail how the remaining partners can buy out the departing partner's share or whether the entire business will be dissolved.

Providing Notice of Withdrawal

Formal notification is a critical step. Most partnership agreements require a written notice of intent to withdraw, delivered to all other partners.

The notice should clearly state the intention to withdraw, the effective date, and any proposed terms for the withdrawal process.

Consulting with an attorney to draft or review this notice is highly recommended to ensure it complies with the partnership agreement and applicable laws.

Valuation and Buyout Negotiations

Determining the fair value of the departing partner’s share is often the most contentious aspect of the withdrawal process. Valuation methods specified in the partnership agreement, such as appraisals or formulas based on revenue, should be followed.

If the agreement is silent on valuation, negotiations with the remaining partners will be necessary to reach a mutually acceptable value.

Professional business valuation services can provide an objective assessment of the business’s worth.

Legal and Financial Considerations

Engage legal counsel to guide you through the withdrawal process and ensure compliance with all applicable laws and regulations. An attorney can help navigate complex legal issues, such as liability for existing business debts and obligations.

Additionally, consult with a financial advisor to understand the tax implications of the buyout and to plan for the financial consequences of leaving the partnership.

Executing the Withdrawal Agreement

Once the valuation and buyout terms are agreed upon, a formal withdrawal agreement should be drafted and executed. This document should clearly outline the terms of the partner's departure, including the purchase price for their share, the payment schedule, and any releases of liability.

It should also address the transfer of ownership and any ongoing obligations of the departing partner, such as confidentiality agreements or non-compete clauses.

Post-Withdrawal Obligations

Even after formally withdrawing from the partnership, certain obligations may persist. These could include fulfilling existing contracts, maintaining confidentiality, or adhering to non-compete agreements.

Ensure a clear understanding of these ongoing responsibilities to avoid potential legal disputes. Communicate clearly with clients and vendors about the change in partnership structure.

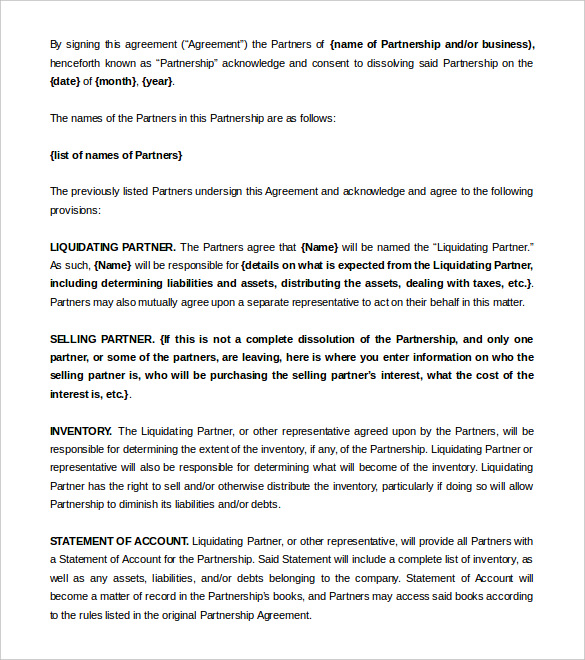

Dissolution vs. Continuation

The withdrawal of a partner may or may not result in the dissolution of the entire partnership. The partnership agreement typically outlines the circumstances under which the business will continue or dissolve upon a partner’s departure.

If the remaining partners intend to continue the business, they may need to form a new legal entity or amend the existing partnership agreement.

If the partnership is dissolved, assets must be liquidated, debts paid, and remaining proceeds distributed according to the partnership agreement or applicable state law.

Seeking Professional Advice

Removing oneself from a business partnership is a complex process with significant legal and financial implications. Seeking professional advice from attorneys, accountants, and business valuation experts is essential to ensure a smooth and legally sound transition.

Thorough preparation and careful execution of the steps outlined above can help protect your interests and minimize potential disputes.