How To Sell My Hvac Business

The decision to sell an HVAC business is a monumental one, laden with complexities that extend far beyond simply listing assets and accepting an offer. For many owners, the business represents decades of hard work, personal sacrifice, and deep connections within their community. Navigating this transition requires meticulous planning, a thorough understanding of market dynamics, and a strategic approach to maximizing value and ensuring a smooth handover.

This article delves into the crucial steps involved in selling an HVAC business, from initial valuation to final closing, offering insights and guidance to help owners navigate this intricate process successfully. It explores key considerations such as preparing the business for sale, identifying potential buyers, negotiating deal terms, and managing the emotional aspects of parting with a long-held enterprise.

Preparing Your HVAC Business for Sale

Before even considering contacting brokers or prospective buyers, a comprehensive assessment of the business is paramount. This involves scrutinizing financial records, operational processes, and customer relationships.

Cleaning up the financials is crucial. According to BizBuySell, businesses with transparent and well-documented financial statements attract more buyers and command higher valuations.

This includes ensuring accurate profit and loss statements, balance sheets, and cash flow projections for at least the past three years. Recurring revenue streams, such as maintenance contracts, should be clearly highlighted as these are particularly attractive to potential buyers.

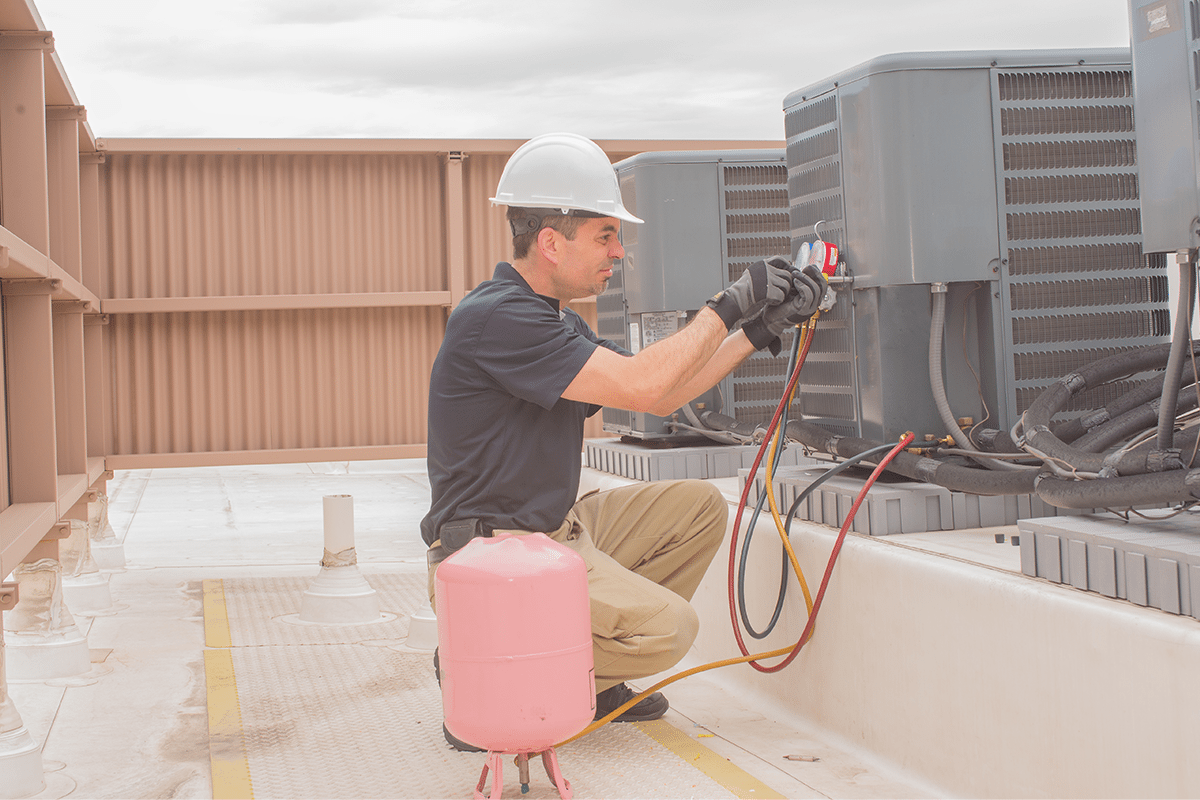

Optimizing operational efficiency is another critical step. Identify areas for improvement, such as streamlining dispatch processes, implementing energy-efficient technologies, and enhancing customer service protocols. Implementing a robust CRM system can significantly boost efficiency and provide valuable data for prospective buyers.

Addressing any outstanding legal or regulatory issues is essential. This includes ensuring compliance with all local, state, and federal regulations pertaining to HVAC services, licensing, and environmental standards. Any potential liabilities, such as pending lawsuits or unresolved customer complaints, should be addressed proactively.

Valuing Your HVAC Business

Determining the fair market value of your HVAC business is a crucial step in the sales process. Several valuation methods can be employed, each with its own strengths and weaknesses.

One common approach is the asset-based valuation, which calculates the net value of all tangible assets, such as equipment, vehicles, and inventory. This method is often used as a baseline valuation, particularly for businesses with significant physical assets.

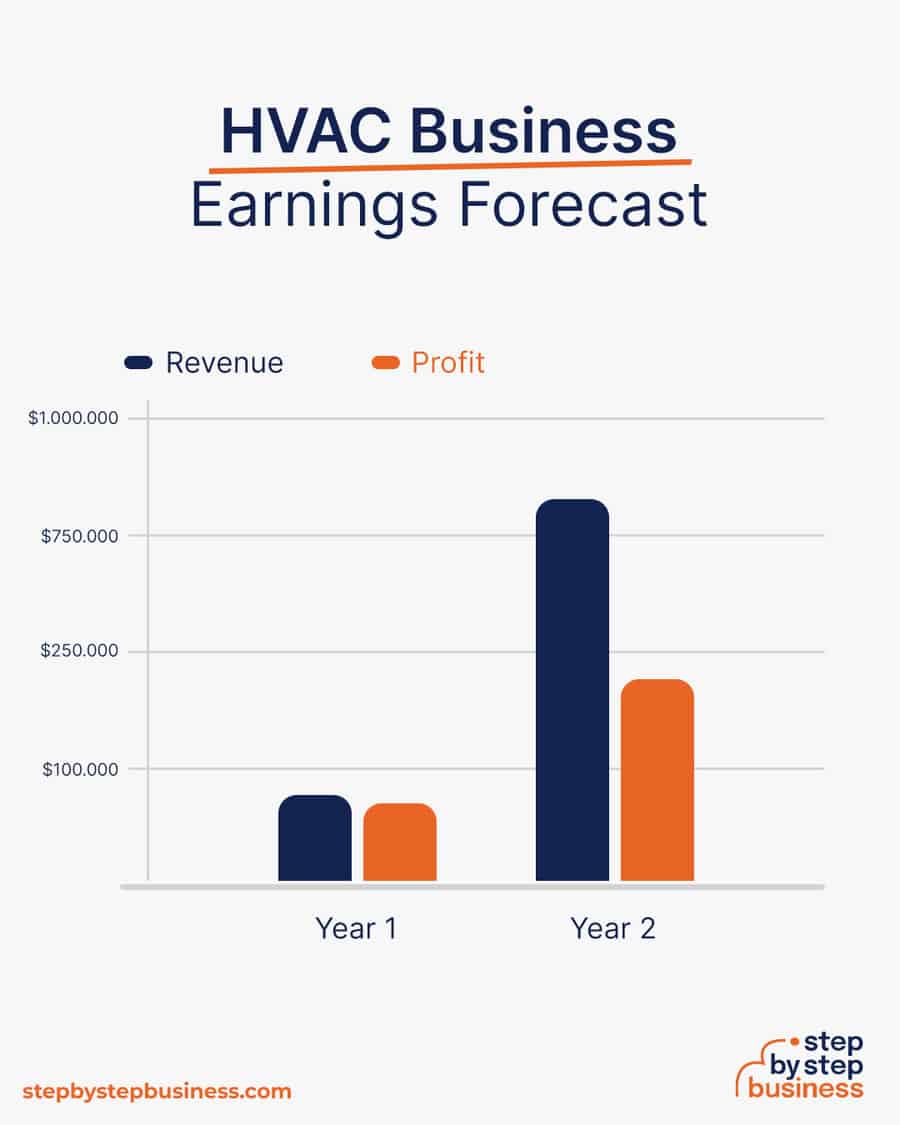

The earnings-based valuation focuses on the business's profitability and cash flow. This method typically involves multiplying the company's EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) by a relevant industry multiple. The multiple used will depend on factors such as the company's size, profitability, and growth prospects.

A market-based valuation analyzes recent sales of comparable HVAC businesses in the same geographic area. This method provides valuable insights into the prevailing market conditions and the prices that buyers are willing to pay for similar businesses.

Consulting with a qualified business appraiser is highly recommended. A professional appraiser can provide an objective and defensible valuation, taking into account all relevant factors and industry benchmarks. Seeking advice from a professional is paramount in determining a fair market value.

Finding the Right Buyer

Identifying the right buyer is crucial for a successful sale. Several potential buyer types exist, each with its own motivations and priorities.

Strategic buyers, such as larger HVAC companies or private equity firms, are often willing to pay a premium for a business that complements their existing operations or provides access to new markets. They may be looking to expand their geographic reach, acquire specialized expertise, or consolidate their market share.

Financial buyers, such as private equity firms, are primarily interested in the business's financial performance and growth potential. They typically look for businesses with strong cash flow, a proven track record, and a solid management team.

Individual buyers, such as entrepreneurs or existing HVAC technicians, may be looking to acquire a smaller business as a stepping stone to ownership. They may be attracted to the opportunity to work independently and build their own business.

Working with a business broker can significantly streamline the buyer identification process. A broker has an extensive network of contacts and can help you identify qualified buyers who are actively seeking to acquire HVAC businesses. Brokers also understand the nuances of the industry and can assist with negotiations and due diligence.

Negotiating the Deal

Negotiating the deal terms is a critical phase of the sales process. It is important to have a clear understanding of your objectives and be prepared to compromise on certain points.

Key deal terms include the purchase price, payment terms, closing date, and any contingencies or warranties. The purchase price is often the most contentious issue, but other factors, such as the allocation of assets and liabilities, can also be significant.

Payment terms can vary widely, ranging from all-cash deals to seller financing arrangements. Seller financing can be attractive to buyers who may not have access to traditional financing, but it also carries some risk for the seller.

Contingencies are conditions that must be met before the sale can be finalized. Common contingencies include satisfactory due diligence, financing approval, and lease assignments. Warranties are guarantees that the seller makes about the business's financial performance or operational condition.

Legal counsel is essential during the negotiation process. An experienced attorney can review the purchase agreement, identify potential risks, and ensure that your interests are protected.

The Emotional Side of Selling

Selling a business that you have poured your heart and soul into can be an emotionally challenging experience. It is important to acknowledge these emotions and prepare for the transition.

Many owners experience a sense of loss or grief when they sell their business. The business may have been a central part of their identity, and letting go can feel like losing a part of themselves.

It is important to have a plan for what you will do after the sale. This could involve pursuing new business ventures, spending more time with family, or engaging in philanthropic activities. Having a clear sense of purpose can help ease the transition.

Communicating with employees is also crucial. Be transparent about your plans and provide reassurance that the business will be in good hands. Offering incentives or retention bonuses can help ensure a smooth transition and retain valuable employees.

Looking Ahead

Successfully selling an HVAC business requires careful planning, meticulous execution, and a strong understanding of the market. By preparing the business for sale, accurately valuing it, identifying the right buyer, negotiating favorable deal terms, and managing the emotional aspects of the transition, owners can maximize their chances of a successful outcome.

The HVAC industry continues to evolve, with increasing demand for energy-efficient solutions and smart home technologies. Businesses that have embraced these trends are likely to command higher valuations and attract a wider range of buyers.

Ultimately, the decision to sell an HVAC business is a personal one. However, by taking a strategic and proactive approach, owners can ensure that they are well-positioned to achieve their financial and personal goals.

_WebP.webp)