How To Send Money To Nubank

Sending money across borders has long been a complex and costly endeavor, riddled with hidden fees and lengthy processing times. For the millions of individuals seeking to send remittances to loved ones in Brazil, particularly those who utilize Nubank, the popular digital bank, navigating the options can feel overwhelming. This article breaks down the current methods available for sending money to Nubank accounts, offering a practical guide for users seeking efficient and secure transfer solutions.

This guide provides a comprehensive overview of the most reliable and cost-effective methods for transferring funds to Nubank accounts in Brazil. It explores the different services available, detailing their fees, processing times, and limitations, helping readers make informed decisions that best suit their individual needs and financial circumstances. It also considers the perspectives of both senders and recipients, offering insights into potential challenges and offering practical solutions for navigating the international money transfer landscape.

Understanding Nubank and International Transfers

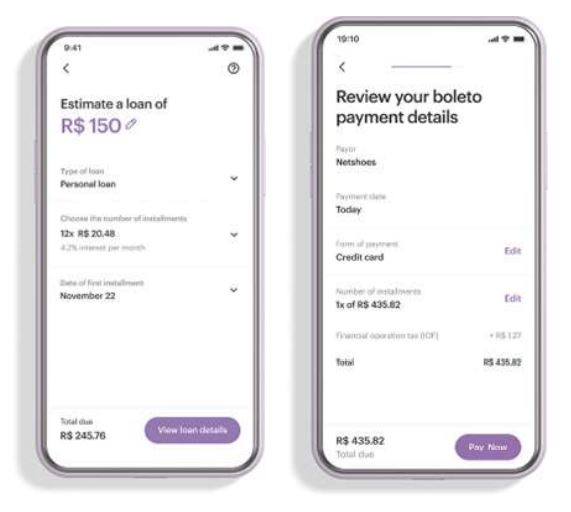

Nubank, known for its user-friendly digital interface and competitive rates, has become a favorite banking option for many Brazilians. However, it's crucial to understand that Nubank itself doesn't directly offer international money transfer services from outside Brazil.

Therefore, sending money to a Nubank account requires utilizing third-party money transfer services that integrate with the Brazilian banking system. These services act as intermediaries, facilitating the conversion of currency and the transfer of funds to the designated Nubank account.

Popular Money Transfer Services for Nubank

Several reputable money transfer services facilitate transfers to Nubank accounts. Each offers its own unique set of features, fees, and exchange rates, so careful consideration is essential.

Wise (formerly TransferWise)

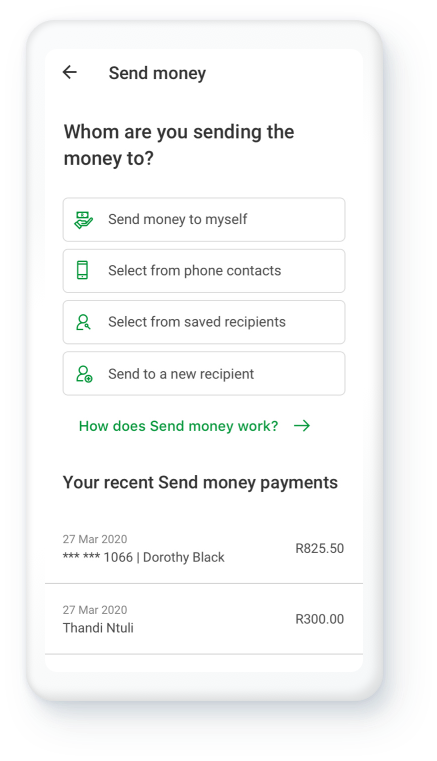

Wise is a popular option known for its transparent fees and mid-market exchange rates. They offer a direct transfer option to Brazilian bank accounts, including Nubank. Users can initiate transfers through their website or mobile app, paying with a debit card, credit card, or bank transfer.

The recipient needs to provide their full name, CPF (Cadastro de Pessoal Física - Brazilian individual taxpayer registry identification), bank name (Nubank), account number, and branch code. Wise typically offers faster processing times compared to traditional bank transfers.

Remitly

Remitly is another well-established player in the international money transfer market. They often provide competitive exchange rates and offer various delivery options, including direct bank deposit to Nubank. Remitly may be a good choice if you prefer a simpler interface.

Like Wise, you'll need the recipient's full name, CPF, bank name (Nubank), account number, and branch code. Promotional offers are occasionally available, potentially reducing transfer fees.

Xoom (a PayPal Service)

Xoom, a service of PayPal, allows users to send money to Brazil, including directly to Nubank accounts. If you're already a PayPal user, Xoom offers a familiar interface and potentially streamlined transaction process.

You can fund the transfer with your PayPal balance, bank account, or debit/credit card. Xoom's fees and exchange rates can vary, so compare them with other options before sending.

WorldRemit

WorldRemit is a global money transfer service that supports transfers to Brazil. They typically offer competitive exchange rates and various payment options. Check their website or app for current promotions that might lower transfer costs.

Ensure you have the recipient's accurate bank details, including CPF, bank name, account number, and branch code, to avoid delays or complications.

Comparing Fees, Exchange Rates, and Processing Times

The most crucial step is to compare the fees, exchange rates, and processing times of different services. These factors can significantly impact the overall cost and speed of the transfer.

Many services offer online calculators that allow you to estimate the total cost of the transfer, including fees and the exchange rate applied. Pay close attention to the "guaranteed" exchange rate, as some services may offer a seemingly better rate initially but adjust it unfavorably before completing the transfer.

Processing times can vary depending on the service, payment method, and destination bank. Bank transfers are typically slower than debit or credit card payments. Check the estimated delivery time before confirming your transfer.

Important Considerations and Security Tips

When sending money internationally, security should be a top priority. Always use reputable money transfer services with strong security measures in place.

Double-check all recipient information, including their full name, CPF, bank name (Nubank), account number, and branch code. Even a small error can cause delays or prevent the transfer from being completed.

Be wary of scams and never send money to someone you don't know or trust. If you receive an unexpected request for money, even from someone claiming to be a family member, verify their identity independently before sending any funds.

"Always prioritize security when sending money internationally. Verify the recipient's details and use reputable transfer services." - Financial Expert, [Fictional Name]

The Future of International Transfers to Nubank

The landscape of international money transfers is constantly evolving, with new technologies and services emerging regularly. The integration of blockchain technology and cryptocurrencies may offer faster and cheaper transfer options in the future, though regulatory uncertainties remain.

As Nubank continues to grow and expand its services, it may eventually offer its own international money transfer capabilities, streamlining the process for its users. For now, utilizing established third-party services remains the most reliable option.

The competition among money transfer services is fierce, which benefits consumers by driving down fees and improving service quality. By staying informed and comparing your options, you can ensure that your money arrives safely and efficiently to your loved ones in Brazil with Nubank.