How To Set A Stop Loss On Webull

For investors navigating the often-volatile world of stock trading, risk management is paramount. One crucial tool for mitigating potential losses is the stop-loss order. This mechanism automatically sells a stock when it reaches a pre-determined price, limiting downside risk.

This article provides a step-by-step guide on how to effectively set a stop-loss order on the Webull trading platform, a popular choice among both novice and experienced traders. Understanding and utilizing this feature can be a key element in preserving capital and optimizing investment strategies.

Understanding Stop-Loss Orders

A stop-loss order is essentially an instruction to your broker to sell a security when it reaches a specified price. This price, known as the stop price, acts as a trigger. Once the market price hits or falls below this level, the order is activated and becomes a market order, aiming to sell the shares as quickly as possible at the prevailing market price.

There are several types of stop-loss orders, including market stop-loss, limit stop-loss, and trailing stop-loss orders. Each type offers different levels of control and can be tailored to various trading strategies and risk tolerances.

Setting a Stop-Loss Order on Webull: A Step-by-Step Guide

Webull offers a user-friendly interface for setting stop-loss orders. Here's a detailed guide on how to implement this risk management tool on the platform:

1. Accessing the Trading Interface

First, open the Webull app on your mobile device or access the desktop platform. Navigate to the stock or security you wish to trade. This can typically be done by searching for the ticker symbol in the search bar and selecting the corresponding asset.

Once you've found the desired stock, tap on the "Trade" button to initiate the order process. This will bring up the order entry screen where you can specify the details of your trade.

2. Choosing the Order Type

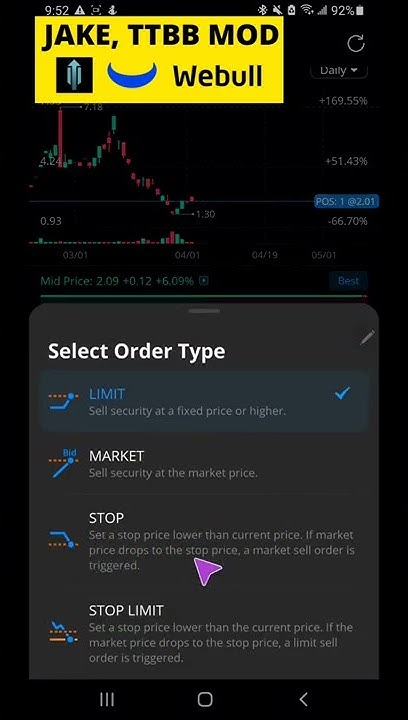

On the order entry screen, you'll see various order types. Locate and select "Stop Order" or "Stop Limit Order." The choice between these two depends on your desired level of control over the execution price.

A "Stop Order" converts to a market order once the stop price is triggered, guaranteeing execution but not necessarily at the exact stop price. A "Stop Limit Order," on the other hand, becomes a limit order, guaranteeing a specific price but not necessarily execution.

3. Setting the Stop Price

This is a crucial step. Enter the price at which you want the order to be triggered. Consider your risk tolerance and the volatility of the stock when setting this price. A lower stop price will protect against larger losses but may be triggered more easily by normal market fluctuations.

Webull displays the current market price of the stock, which can help you determine an appropriate stop price. Consider using technical analysis tools, such as support and resistance levels, to inform your decision.

4. Specifying the Order Quantity

Enter the number of shares you want to sell when the stop price is reached. This should correspond to the total number of shares you want to protect with the stop-loss order. You can choose to sell all or a portion of your holdings.

Double-check the quantity to ensure accuracy. An error in this field could lead to unintended consequences.

5. (Optional) Setting a Limit Price (For Stop Limit Orders)

If you chose a "Stop Limit Order," you'll also need to specify a limit price. This is the minimum price at which you're willing to sell your shares once the stop price has been triggered. The order will only be executed if the market price is at or above the limit price.

Setting a limit price offers more control but also carries the risk that the order may not be filled if the market price drops quickly below the limit price after triggering the stop. Carefully consider the potential trade-offs.

6. Choosing the Time in Force

Select the "Time in Force" for your order. Common options include "Day" and "Good Till Cancelled (GTC)." A "Day" order expires at the end of the trading day if it's not filled. A "GTC" order remains active until it's either filled or manually cancelled.

Choosing the appropriate time in force depends on your trading strategy and how frequently you monitor your positions. For longer-term investments, a "GTC" order may be suitable. For short-term trades, a "Day" order might be preferable.

7. Reviewing and Submitting the Order

Before submitting the order, carefully review all the details. Ensure that the order type, stop price, quantity, limit price (if applicable), and time in force are all correct. Webull provides a summary of the order details for your confirmation.

Once you're satisfied with the details, tap the "Place Order" button to submit your stop-loss order. You'll receive a confirmation message indicating that the order has been successfully placed.

Modifying or Cancelling a Stop-Loss Order

You can modify or cancel a stop-loss order at any time before it's triggered. To do so, navigate to the "Orders" section of the Webull app or platform. Locate the pending stop-loss order and select the option to modify or cancel it.

If modifying, you can adjust the stop price, quantity, or other parameters. If cancelling, the order will be immediately removed from the system.

Considerations and Risks

While stop-loss orders can be valuable risk management tools, it's important to understand their limitations. A stop-loss order is not a guaranteed way to prevent losses. In highly volatile markets, the price can gap down below the stop price, resulting in a sale at a less favorable price.

Furthermore, "stop-hunting" can occur, where market makers intentionally drive the price down to trigger stop-loss orders before reversing direction. This can lead to unexpected and unwanted sales.

Conclusion

Setting a stop-loss order on Webull is a straightforward process that can significantly enhance your risk management strategy. By following the steps outlined in this guide, investors can effectively protect their capital and mitigate potential losses in the stock market.

However, it's crucial to understand the limitations and potential risks associated with stop-loss orders. Employing them judiciously, in conjunction with other risk management techniques, can contribute to more informed and disciplined trading decisions. Always do your own research and consider consulting with a financial advisor before making any investment decisions.