How To Tell If A Company Is Profitable

Imagine strolling down Main Street, the aroma of freshly brewed coffee wafting from a cozy cafe, a bustling bookstore beckoning from across the way. Each storefront represents a dream, a venture, a hope. But beyond the inviting facade, how can you tell if these businesses, or any company for that matter, are truly thriving, not just surviving?

This article serves as your guide to understanding the key indicators of profitability. We'll delve into financial statements and critical metrics, empowering you to assess a company's financial health with confidence.

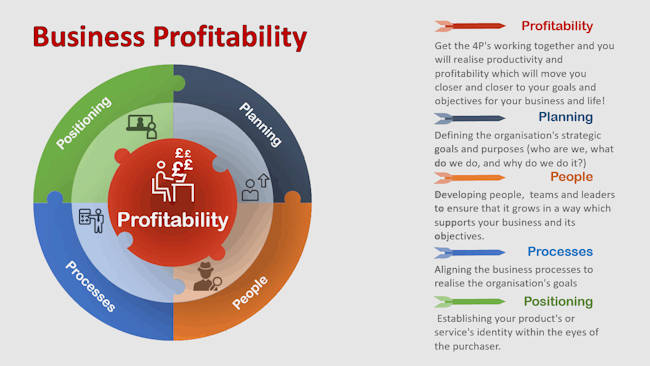

Understanding the Basics: Profitability Defined

Profitability, at its core, is a measure of a company's ability to generate profit relative to its revenue, assets, and equity. A profitable company effectively manages its expenses and generates more revenue than it spends.

It's not just about bringing in money; it's about efficiently converting resources into earnings. Think of it as a well-oiled machine, where every part works in harmony to produce a valuable output.

Key Financial Statements: Your Treasure Map

The journey to assessing profitability begins with understanding a company's financial statements. These reports, like maps, guide you through the financial landscape.

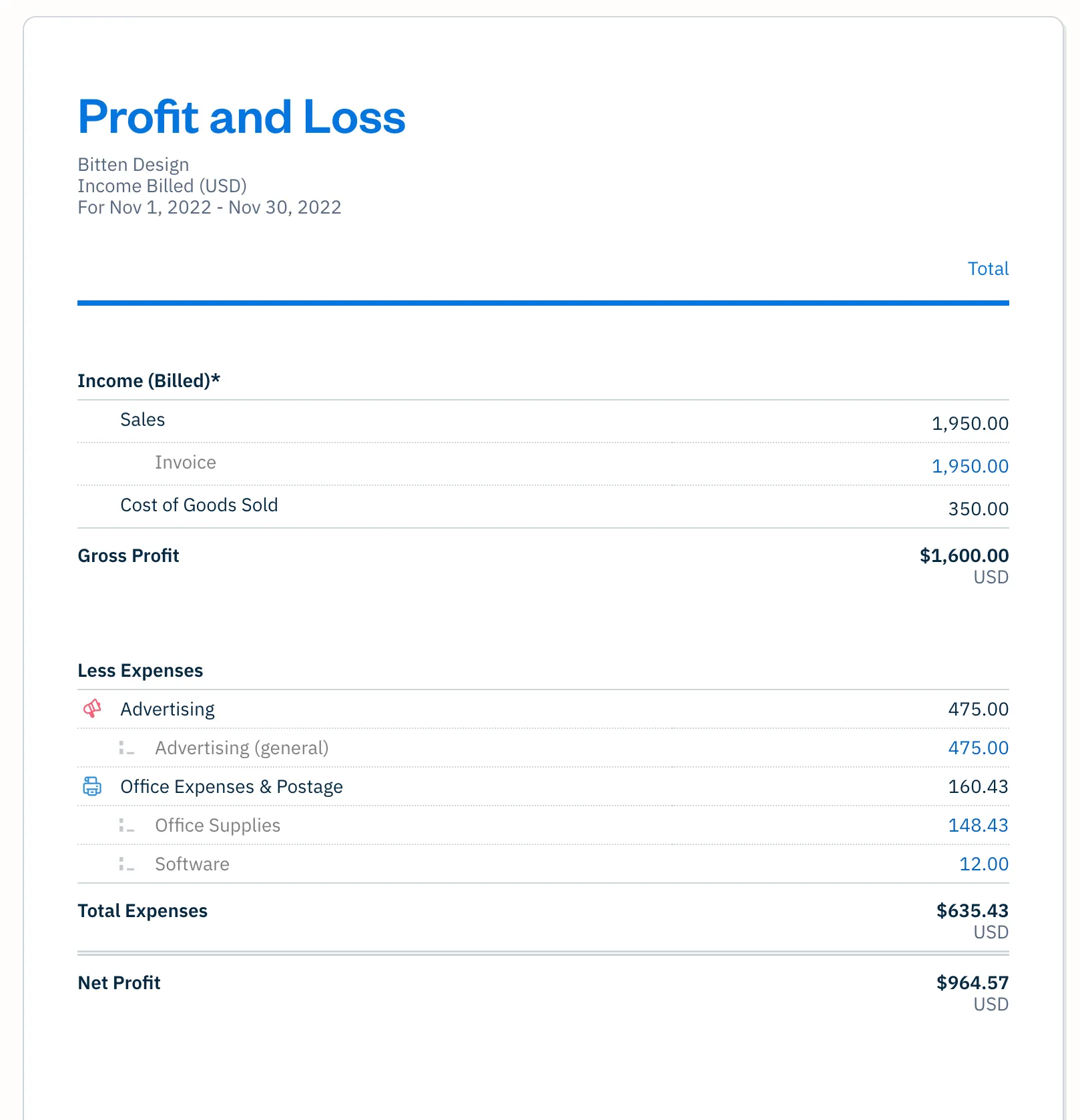

The Income Statement: The Profit and Loss Report

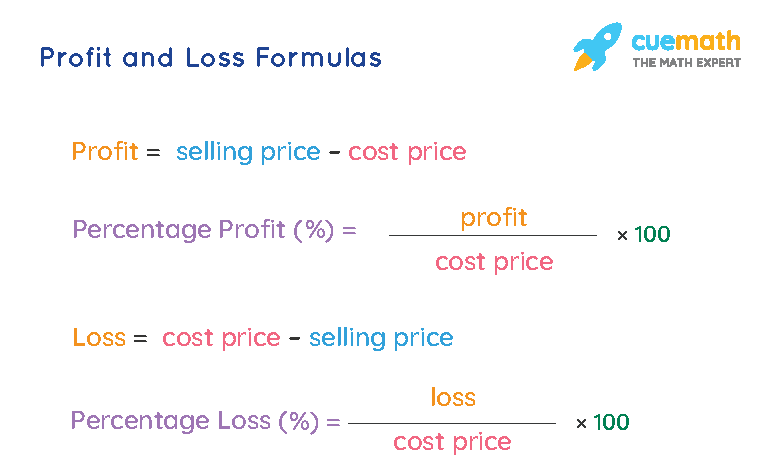

The Income Statement, also known as the Profit and Loss (P&L) statement, summarizes a company's financial performance over a specific period. It reveals the revenue earned and the expenses incurred to generate that revenue.

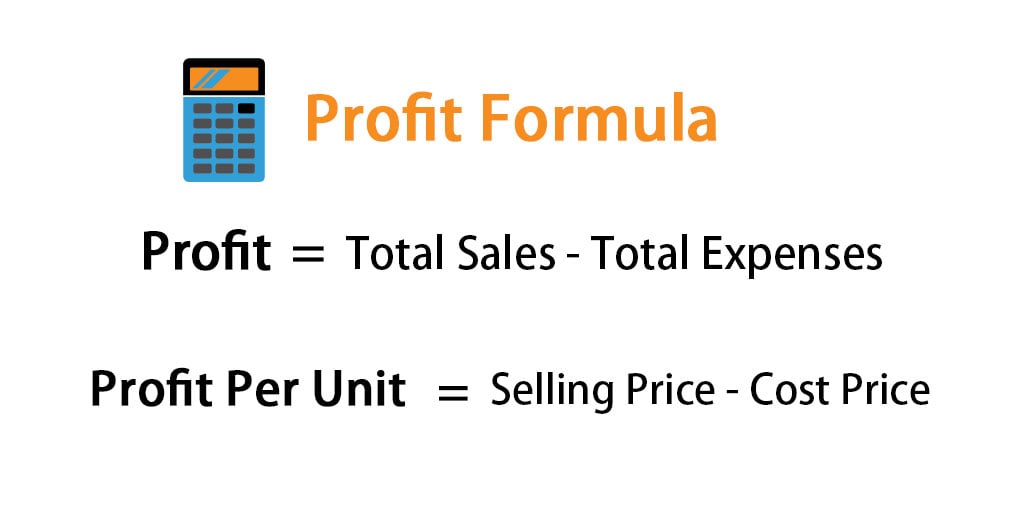

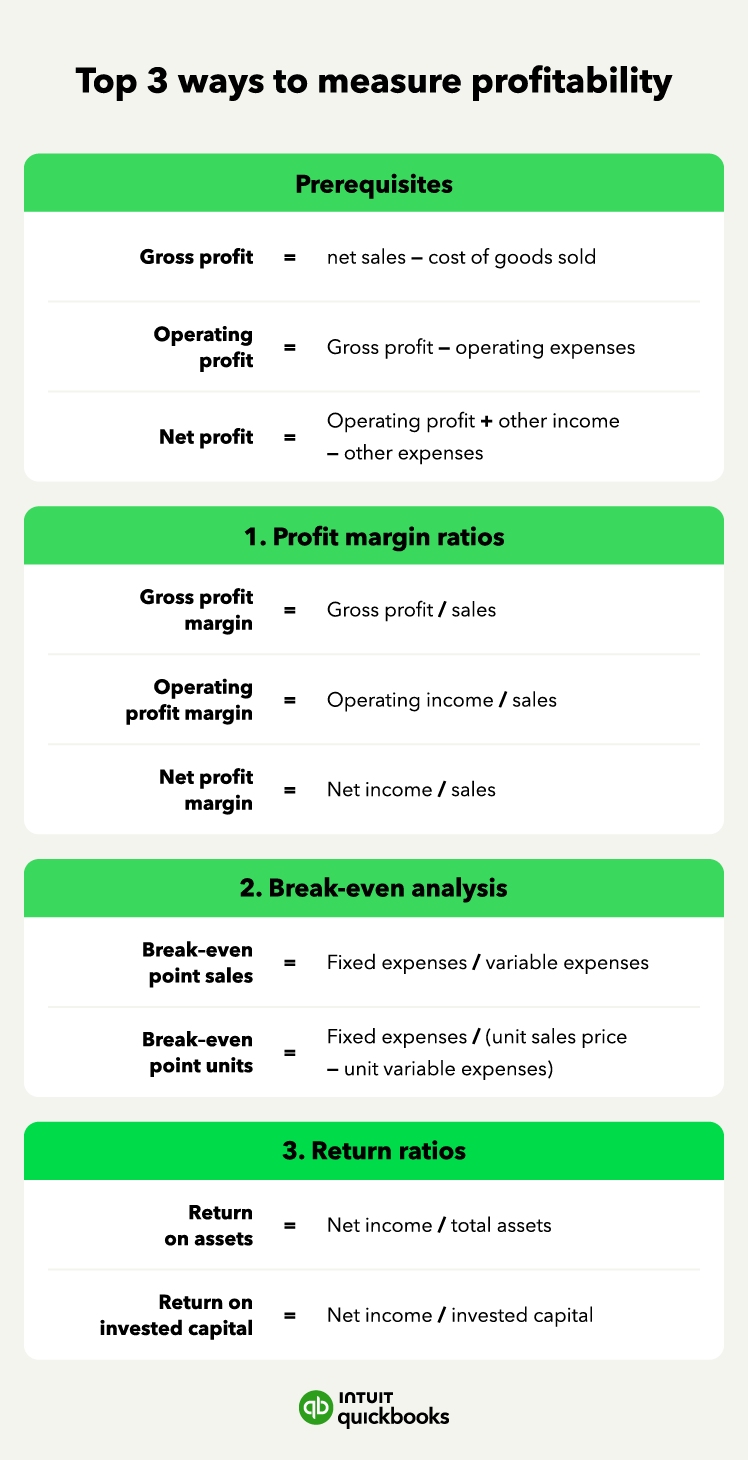

Key figures to watch include: Gross Profit (Revenue - Cost of Goods Sold), Operating Profit (Gross Profit - Operating Expenses), and Net Profit (Profit after all expenses, including taxes and interest).

The Balance Sheet: A Snapshot of Assets and Liabilities

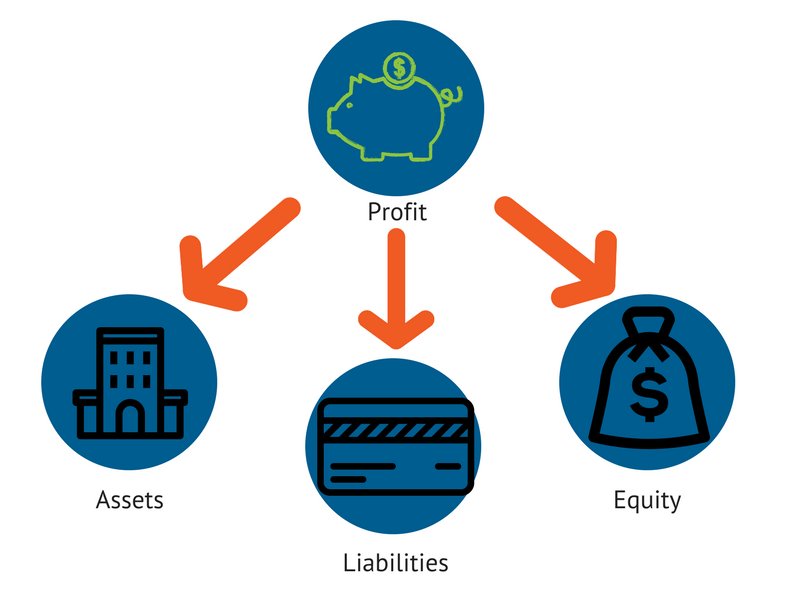

The Balance Sheet provides a snapshot of a company's assets, liabilities, and equity at a specific point in time. It illustrates what a company owns (assets) and what it owes (liabilities).

Equity represents the owners' stake in the company. Examining trends in these areas can indicate whether a company is growing its asset base and managing its debt effectively, both crucial for long-term profitability.

The Cash Flow Statement: Tracking the Money

The Cash Flow Statement tracks the movement of cash both into and out of a company. It categorizes cash flows into operating, investing, and financing activities.

A healthy cash flow from operating activities signals that the company is generating cash from its core business operations, a vital sign of sustainable profitability.

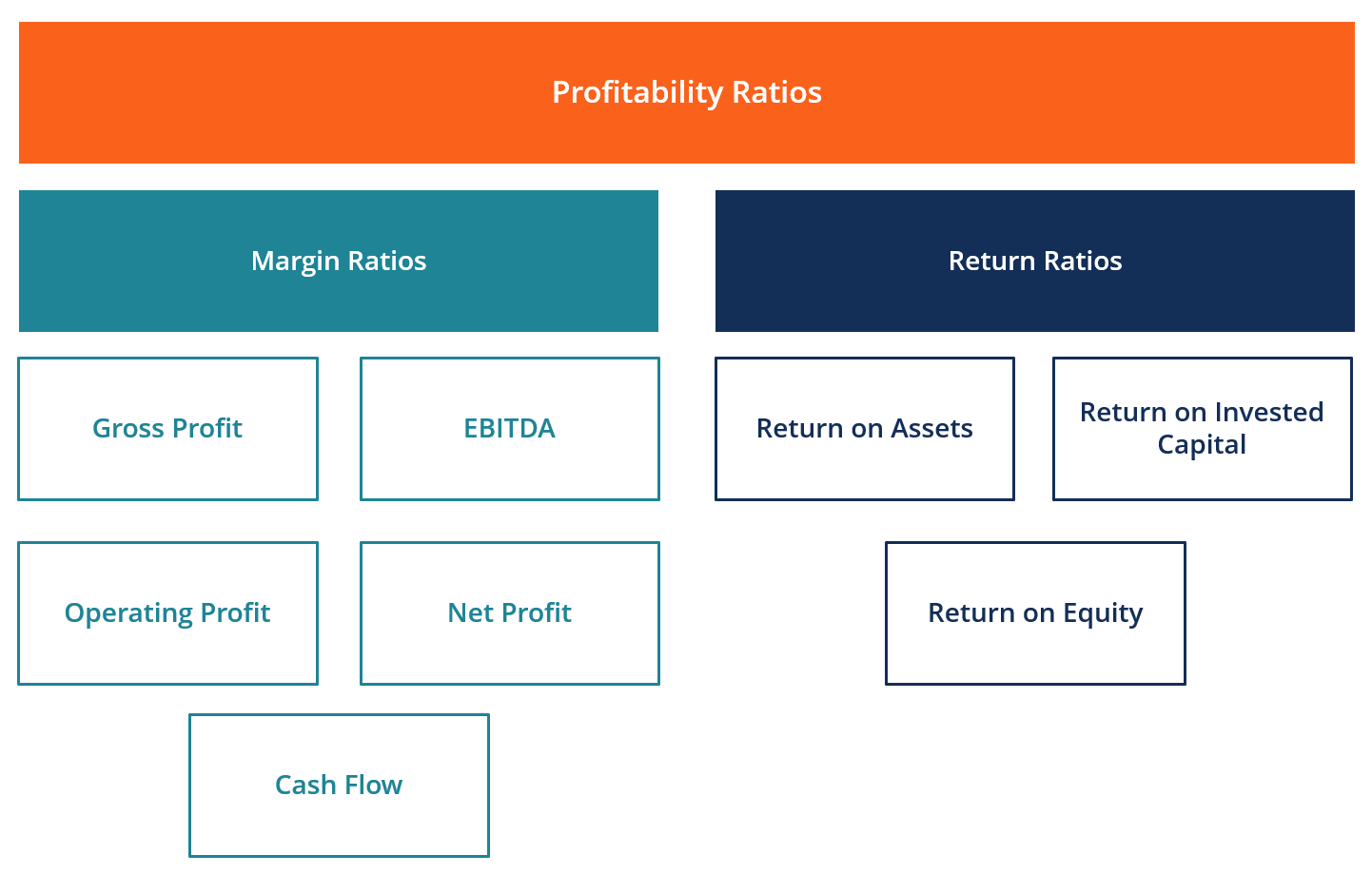

Profitability Ratios: Decoding the Numbers

Financial ratios provide deeper insights into a company's profitability by comparing different line items from the financial statements. They offer a standardized way to evaluate performance across different companies and industries.

Gross Profit Margin: How Efficient is Production?

The Gross Profit Margin (Gross Profit / Revenue) measures the percentage of revenue remaining after deducting the cost of goods sold. A higher margin indicates that a company is efficiently managing its production costs.

Operating Profit Margin: Efficiency in Operations

The Operating Profit Margin (Operating Profit / Revenue) reveals the percentage of revenue remaining after deducting operating expenses. It shows how effectively a company manages its day-to-day operations.

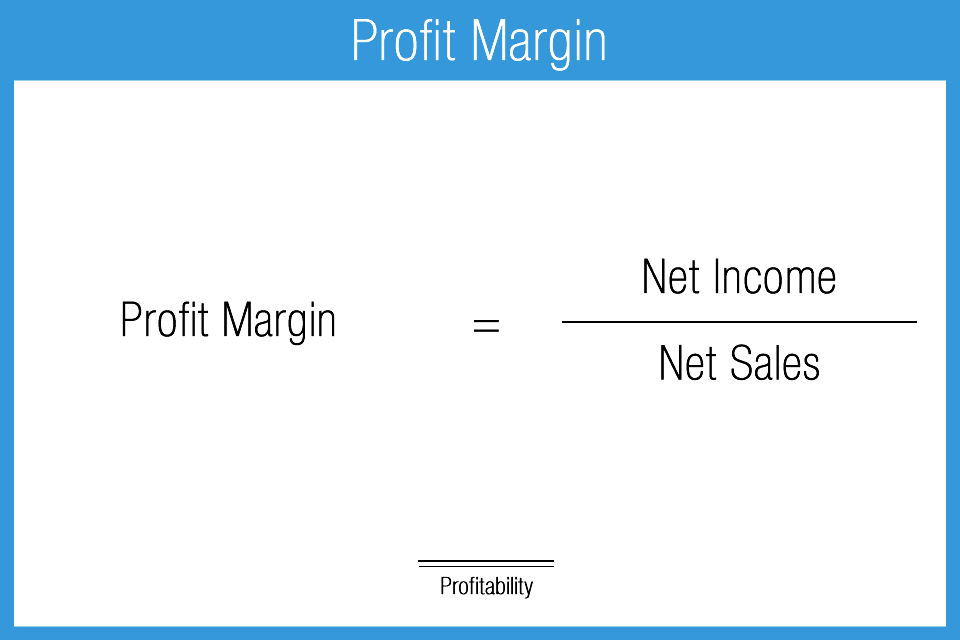

Net Profit Margin: The Bottom Line

The Net Profit Margin (Net Profit / Revenue) shows the percentage of revenue that translates into profit after all expenses, including taxes and interest. It's a crucial indicator of overall profitability. According to data from the U.S. Small Business Administration (SBA), average net profit margins vary widely across industries.

Return on Assets (ROA): How Effectively are Assets Used?

Return on Assets (ROA) (Net Profit / Total Assets) measures how effectively a company is using its assets to generate profit. A higher ROA suggests that the company is generating more profit per dollar of assets invested.

Return on Equity (ROE): Returns for Shareholders

Return on Equity (ROE) (Net Profit / Shareholder's Equity) measures the return generated for shareholders based on their investment. It's a key metric for investors evaluating a company's profitability.

Beyond the Numbers: Qualitative Factors

While financial statements and ratios provide valuable insights, it's essential to consider qualitative factors as well. These include the company's industry position, competitive landscape, management quality, and brand reputation.

A strong brand, innovative products, and effective leadership can all contribute to sustainable profitability, even if the numbers don't always tell the whole story immediately. Reading industry reports and company news can give you a more holistic view.

Conclusion: A Holistic View

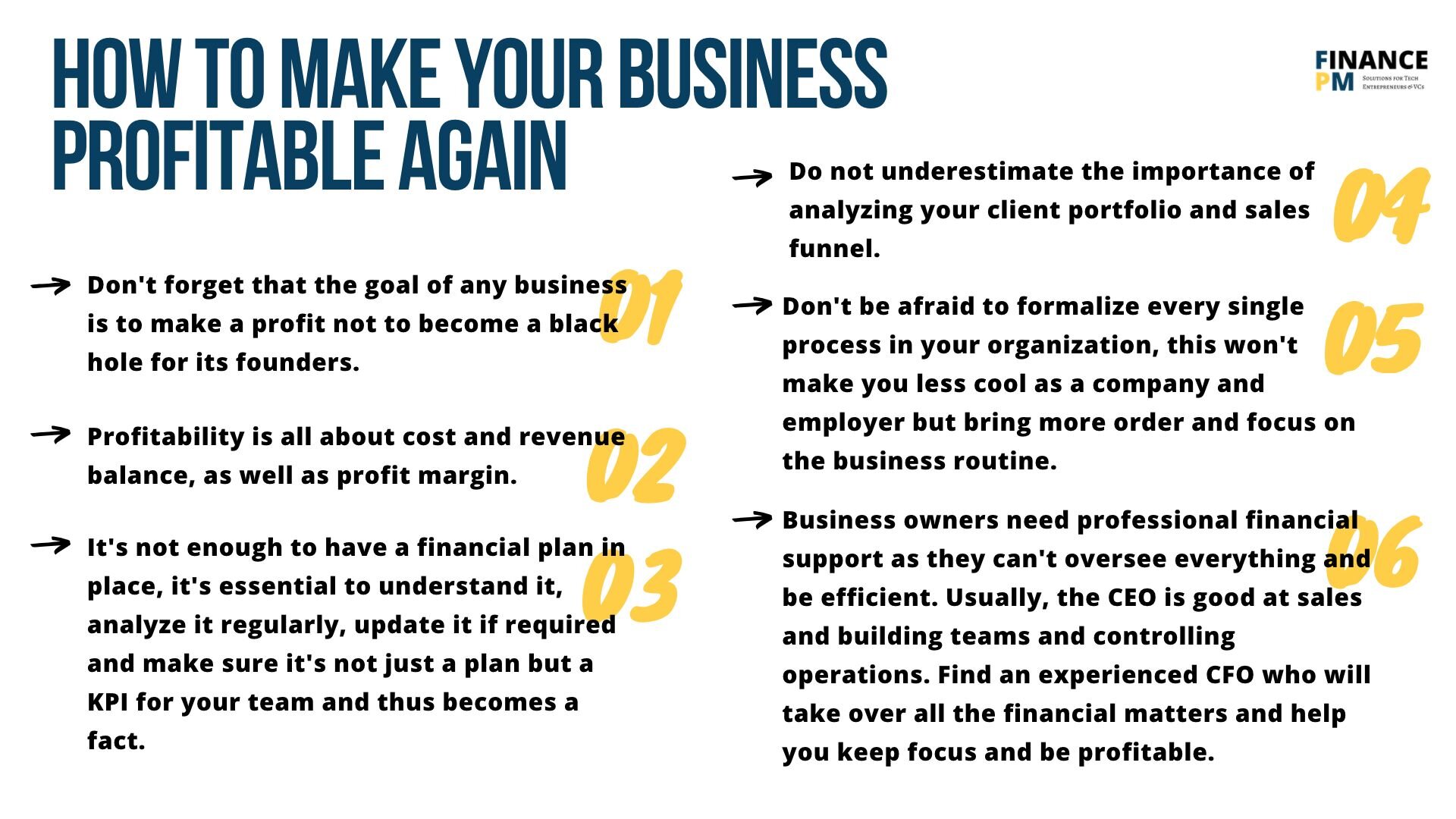

Determining whether a company is profitable requires a comprehensive approach, combining financial analysis with an understanding of the business context. By mastering the art of reading financial statements, calculating key ratios, and considering qualitative factors, you can gain a clearer picture of a company's true financial health and potential for long-term success.

Ultimately, understanding profitability is about empowering yourself to make informed decisions, whether you're an investor, an entrepreneur, or simply a curious observer of the business world. And with that knowledge, you can navigate the complexities of the marketplace with confidence.