How To Transfer Ira To Robinhood

Imagine a sunny Saturday morning, a warm cup of coffee in hand, and the feeling of empowerment as you take control of your financial future. You've heard the buzz about Robinhood and its user-friendly platform, and you're considering moving your IRA there to potentially grow your retirement savings with greater flexibility. The idea of simplifying your investments and exploring new opportunities is exciting, but the process of transferring an IRA can seem daunting.

This article will guide you through the steps of transferring your IRA to Robinhood, offering clarity and confidence as you navigate the process. We'll break down the jargon, highlight key considerations, and equip you with the knowledge to make informed decisions about your financial future.

Understanding IRA Transfers

An IRA, or Individual Retirement Account, is a tax-advantaged savings account designed to help you save for retirement. Transferring an IRA involves moving your retirement funds from one financial institution to another without triggering any tax penalties.

There are two main types of IRA transfers: direct transfers and rollovers. A direct transfer, also known as a trustee-to-trustee transfer, occurs when your current institution directly sends the funds to Robinhood.

A rollover, on the other hand, involves you receiving the funds directly, and you then have 60 days to deposit them into a new IRA. However, rollovers have limitations and can trigger tax consequences if not handled correctly, making a direct transfer the preferred method.

Why Consider Robinhood?

Robinhood has gained popularity for its commission-free trading and user-friendly mobile app, making investing accessible to a broader audience. The platform offers a range of investment options, including stocks, ETFs, and options.

For some, the streamlined interface and commission-free structure may be attractive reasons to consolidate their investments on Robinhood. Consider your investment style, risk tolerance, and long-term financial goals when evaluating whether Robinhood is the right fit for your retirement savings.

Step-by-Step Guide to Transferring Your IRA to Robinhood

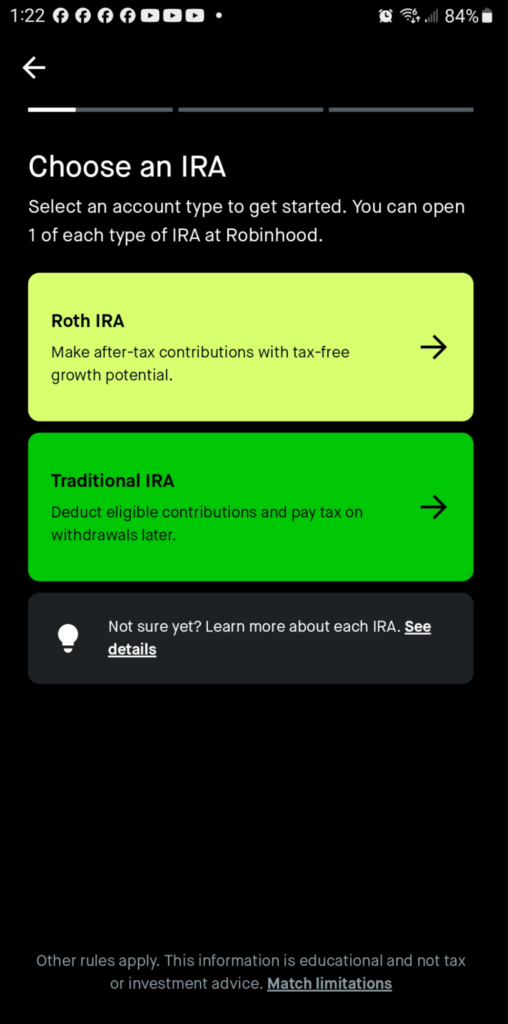

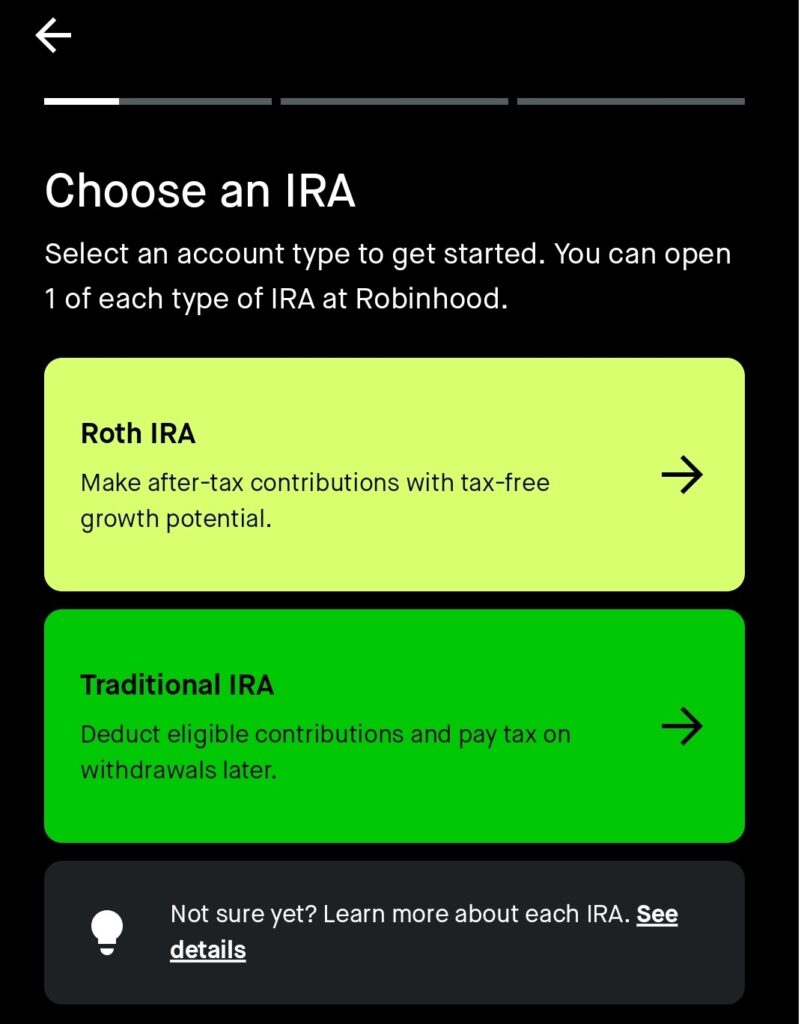

Before initiating the transfer, open an IRA account with Robinhood. You'll need to provide personal information, including your Social Security number and employment details, and select the type of IRA you want to open (Traditional, Roth, or SEP). Ensure the IRA type you are opening with Robinhood matches the IRA type you are transferring to avoid unexpected tax consequences.

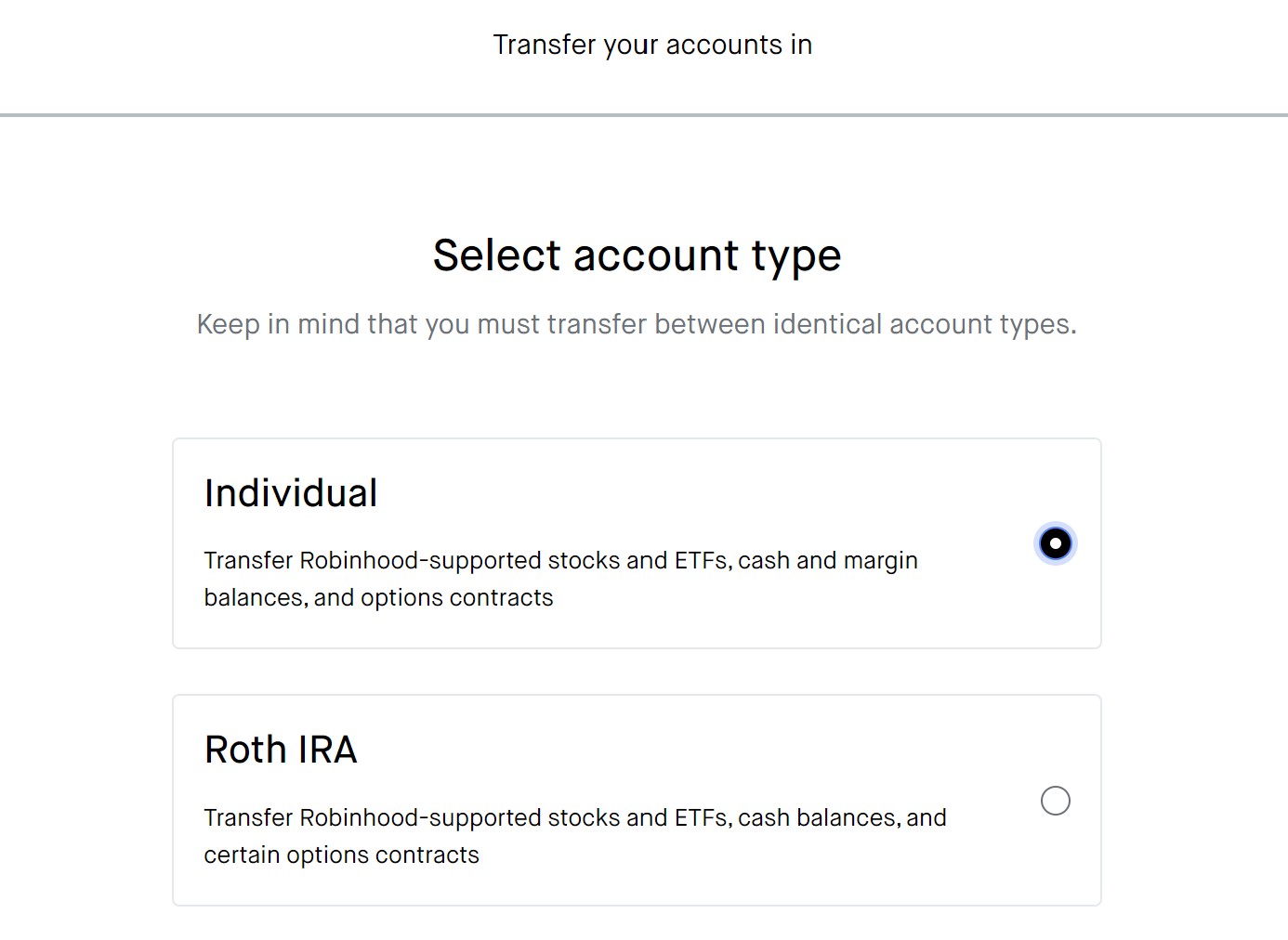

Once your IRA account is open, you can start the transfer process through the Robinhood app. Navigate to the "Transfers" section, typically found in your account settings, and select "Initiate Transfer."

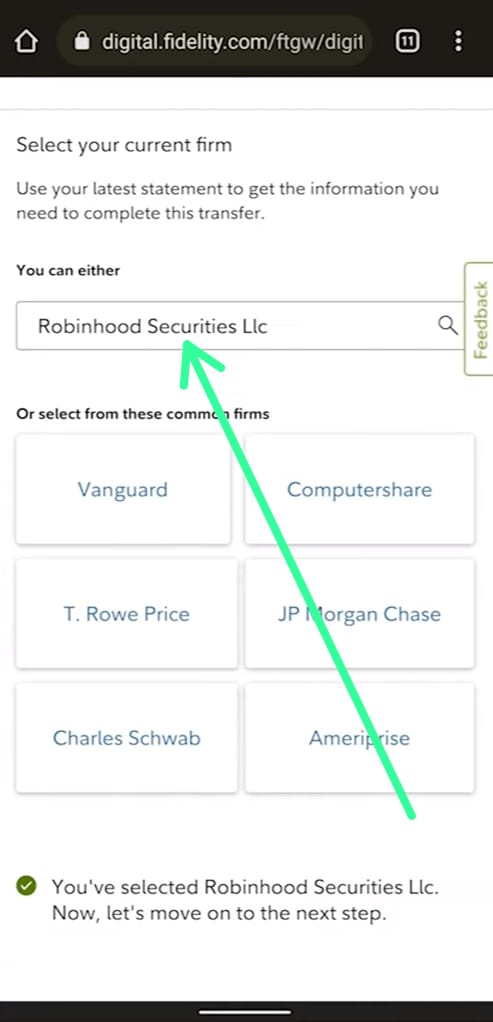

You will be prompted to provide information about your existing IRA account, including the name of the financial institution, your account number, and the account type. Double-check all the information you enter to avoid delays or complications with your transfer request.

Robinhood will then guide you through the steps of submitting a transfer request to your current financial institution. You may need to download and complete a transfer form, which you can typically find on Robinhood's website or within the app.

Carefully review the transfer form before submitting it, ensuring that all information is accurate and complete. Any errors or missing information could delay or even cancel your transfer request.

After submitting the transfer request, your current financial institution will review and process it. The timeframe for completing an IRA transfer can vary, typically ranging from a few days to a few weeks, depending on the institution's policies and procedures.

You can track the progress of your transfer within the Robinhood app or by contacting Robinhood's customer support. It's also a good idea to check with your current financial institution to confirm they have received and are processing your transfer request.

Important Considerations Before Transferring

Before initiating an IRA transfer, it's crucial to understand any potential fees associated with the transfer. Some financial institutions may charge a transfer fee for moving your funds to another institution. Review your current account agreement or contact your institution to inquire about any applicable fees.

Additionally, be aware of any potential penalties for early withdrawal from your existing IRA account. While a direct transfer doesn't typically trigger penalties, withdrawing funds and not reinvesting them within 60 days (rollover) can lead to significant tax consequences.

Consider the investment options available on Robinhood and ensure they align with your investment goals and risk tolerance. Research the available stocks, ETFs, and other investment products before transferring your funds to make sure you are comfortable with the investment choices.

If you hold complex or illiquid assets in your current IRA, such as limited partnerships or private equity, transferring them to Robinhood may not be possible. Robinhood primarily supports publicly traded securities, and some assets may not be transferable.

Tax Implications of IRA Transfers

A direct IRA transfer is generally a tax-free event, meaning you won't owe any taxes on the transferred funds. However, it's crucial to follow the proper procedures to ensure the transfer qualifies as a tax-free event.

As mentioned earlier, rollovers can have tax implications if not handled correctly. If you receive the funds directly and fail to reinvest them within 60 days, the distribution will be considered taxable income, and you may also be subject to a 10% early withdrawal penalty if you are under age 59 1/2.

Consult with a qualified tax advisor to discuss your specific situation and ensure you understand the tax implications of transferring your IRA. A tax advisor can provide personalized guidance based on your individual circumstances and help you avoid any potential tax pitfalls.

Alternatives to a Full IRA Transfer

If you're unsure about transferring your entire IRA to Robinhood, consider transferring a portion of your funds to test the platform and its investment options. This allows you to experience Robinhood's features without fully committing your retirement savings.

Another option is to open a separate taxable brokerage account with Robinhood and invest a portion of your savings there. This allows you to explore Robinhood's platform without impacting your existing retirement accounts.

You could also consider a partial transfer to diversify your retirement savings across multiple platforms. This can provide you with access to a wider range of investment options and potentially mitigate risk.

Staying Informed and Seeking Professional Advice

The world of finance is constantly evolving, so it's essential to stay informed about changes that may affect your retirement savings. Keep up with industry news, read financial publications, and consult with a financial advisor to stay on top of your financial goals.

Consider seeking professional advice from a qualified financial advisor before making any significant changes to your retirement accounts. A financial advisor can assess your individual circumstances, help you develop a personalized retirement plan, and provide ongoing support and guidance.

Remember that transferring an IRA is a significant financial decision, so take your time, do your research, and make sure you're comfortable with the process before proceeding.

A Step Towards Financial Empowerment

Transferring your IRA to Robinhood can be a step toward greater control and flexibility in managing your retirement savings. By understanding the process, considering the potential benefits and drawbacks, and seeking professional advice when needed, you can make informed decisions that align with your long-term financial goals.

As you explore the possibilities, remember that financial planning is a journey, not a destination. Embrace the opportunity to learn, grow, and adapt your strategies as your circumstances evolve. And with a little planning and effort, you can build a secure and fulfilling retirement.

Take a deep breath, gather your information, and embark on this journey with confidence. Your future self will thank you for taking the initiative to shape your financial destiny.

![How To Transfer Ira To Robinhood [Expired] Robinhood Gold 2% IRA Transfer Bonus (Unlimited Cash Bonus](https://www.doctorofcredit.com/wp-content/uploads/2024/01/robinhood-retirement-ira-1024x701.png)