Huntington Bank Second Chance Checking

For individuals navigating the complexities of financial recovery, access to basic banking services can be a critical first step. Huntington Bank’s Second Chance Checking account aims to provide just that, offering a pathway for those who may have been previously denied standard checking accounts due to past financial difficulties.

This account seeks to address the needs of individuals who are looking to rebuild their financial stability by providing them with a safe and reliable platform for managing their money.

Second Chance: An Opportunity for a Fresh Start

Huntington Bank’s Second Chance Checking account is designed to offer a solution for individuals who have faced challenges opening a traditional checking account. The program is structured to provide an avenue for customers to manage their finances, despite prior banking issues.

The availability of such accounts can significantly impact individuals who have been marginalized from traditional banking systems.

Key Features and Benefits

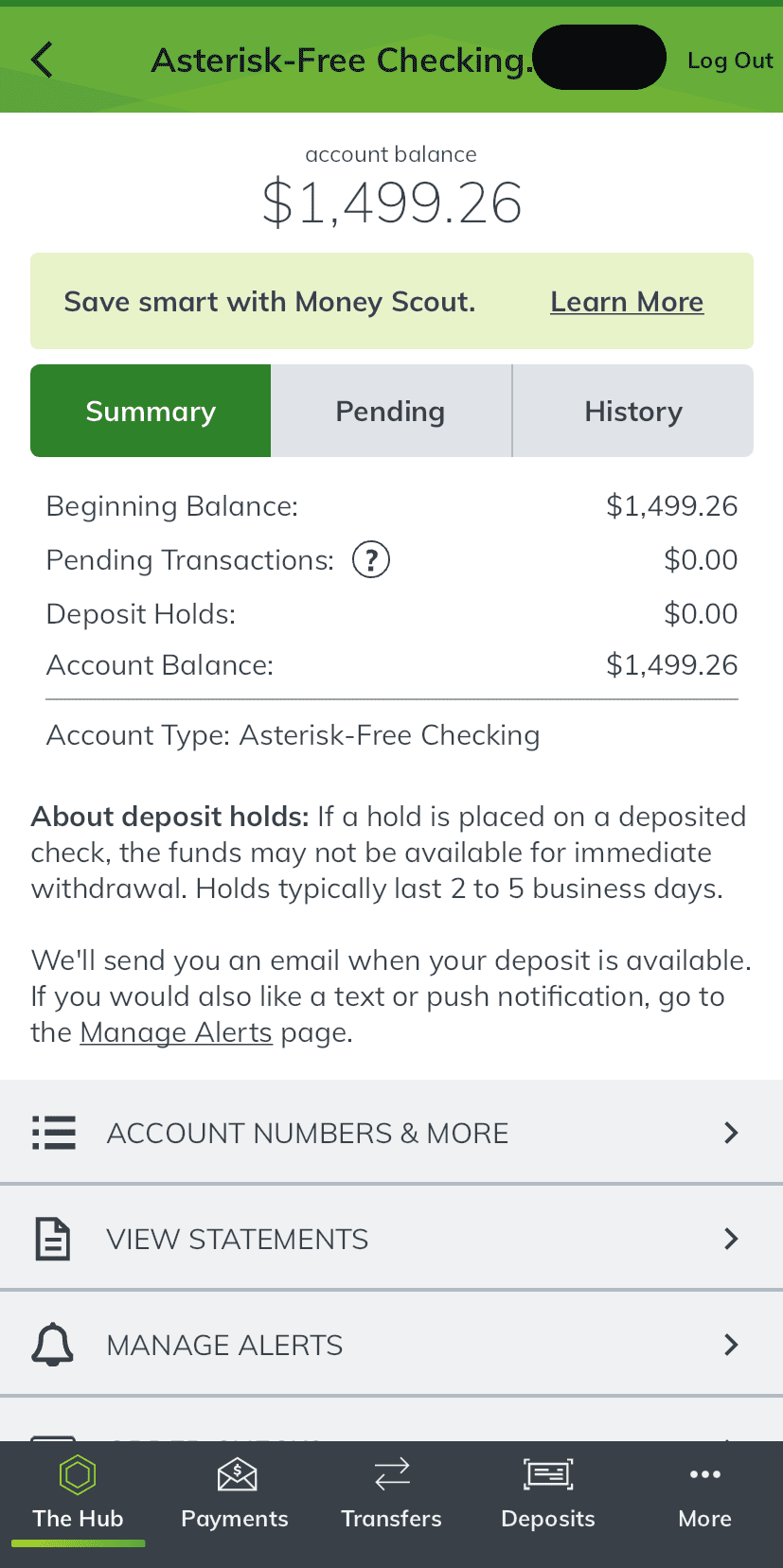

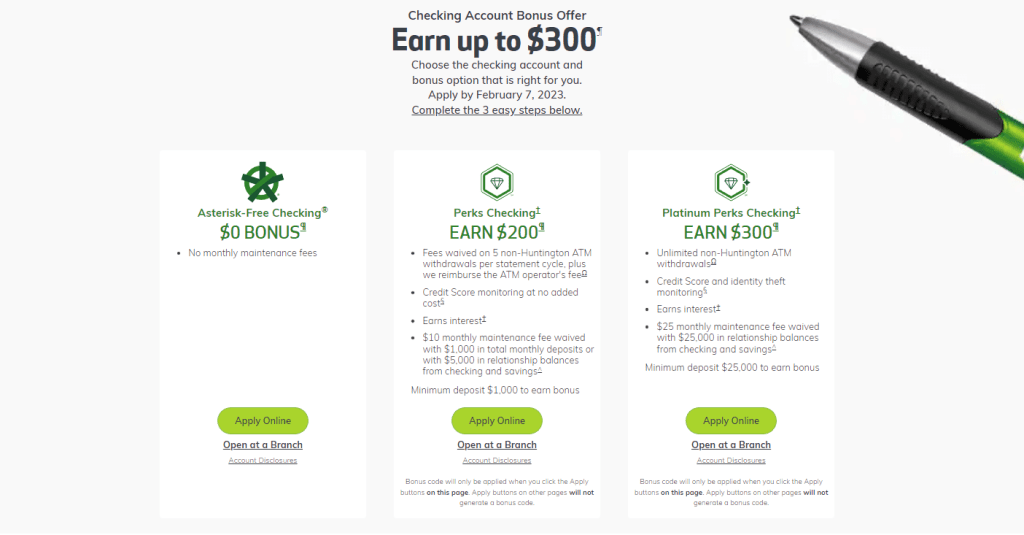

The Second Chance Checking account has specific features that are designed to make it accessible and manageable. This includes a low monthly maintenance fee that is typically waived under certain conditions, such as maintaining a minimum daily balance or receiving qualifying direct deposits.

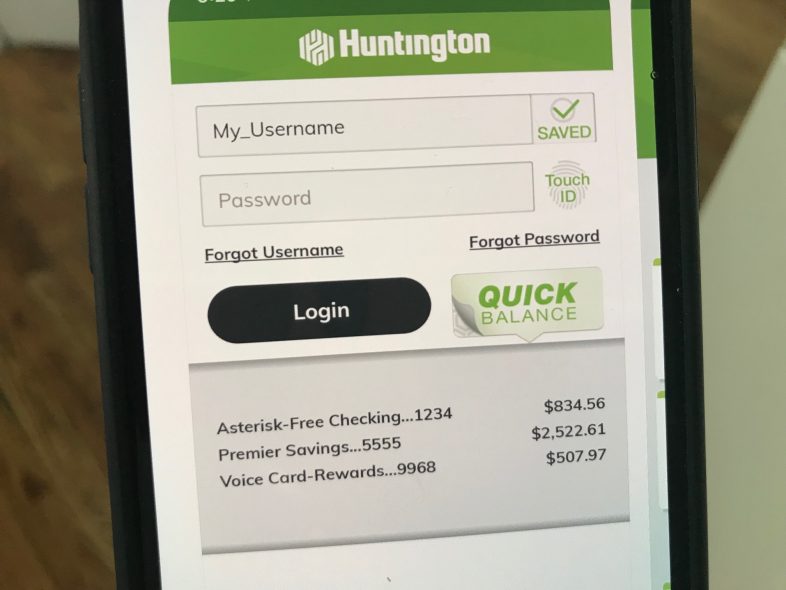

Customers have access to mobile and online banking services, including bill pay and mobile check deposit. This allows for convenient and accessible banking, regardless of location.

Debit card access is another standard feature, enabling customers to make purchases and withdraw cash from ATMs. Huntington Bank also offers financial education resources to help account holders improve their money management skills.

Impact and Significance

The introduction of Second Chance Checking accounts by banks like Huntington can have a positive impact on individuals' financial well-being. Access to a checking account is essential for managing income, paying bills, and building a financial history.

These accounts can prevent individuals from relying on costly alternative financial services like payday loans or check-cashing services, which can perpetuate cycles of debt. Financial literacy resources help users avoid predatory lenders and learn money management skills.

By offering this service, Huntington Bank potentially improves credit scores and overall financial health.

“We believe everyone deserves a second chance,”a Huntington Bank spokesperson noted in a statement about their commitment to financial inclusion.

Eligibility and Enrollment

Eligibility for Second Chance Checking typically involves a review of the applicant's banking history. While specific criteria may vary, these accounts are generally available to individuals who have had past banking issues, such as overdrafts or account closures.

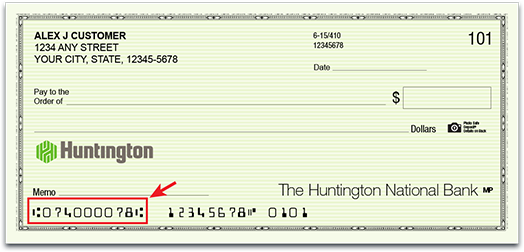

Enrollment usually requires an application process similar to opening a traditional checking account. Applicants may need to provide identification, proof of address, and other standard documentation.

Huntington Bank encourages prospective customers to speak with a branch representative to determine their eligibility and learn more about the account’s terms and conditions.

Looking Ahead

The Second Chance Checking account represents a step towards greater financial inclusion. By offering opportunities for individuals to rebuild their banking relationships, Huntington Bank contributes to community economic development.

The success of such initiatives hinges on clear communication, accessible resources, and a commitment to helping customers achieve their financial goals.