I Have A Business Idea But No Money

The entrepreneurial spirit burns bright in countless individuals, fueled by innovative ideas and a desire to build something from the ground up. However, for many aspiring business owners, a significant hurdle stands in the way: a lack of capital. This pervasive challenge forces promising ventures to stall before they even have a chance to take flight, leaving potential economic growth and job creation unrealized.

This article delves into the multifaceted problem of having a great business idea but limited financial resources. We will explore the various avenues available to entrepreneurs in this predicament, assess the challenges inherent in each approach, and examine the broader implications for innovation and economic development. It is a story of ambition, resilience, and the persistent quest for opportunity in the face of financial constraints.

Bootstrapping: The Self-Funded Path

Bootstrapping, or self-funding, is often the first port of call for entrepreneurs lacking access to significant capital. This approach relies on personal savings, revenue generated from initial sales, and bartering to minimize expenses. It demands extreme frugality and a relentless focus on profitability from day one.

The advantages of bootstrapping are clear: complete control over the business and avoidance of debt or equity dilution. However, growth can be slow and limited, and personal finances are often put at considerable risk. Many businesses fail because they lack the funding for crucial marketing, product development, or expansion.

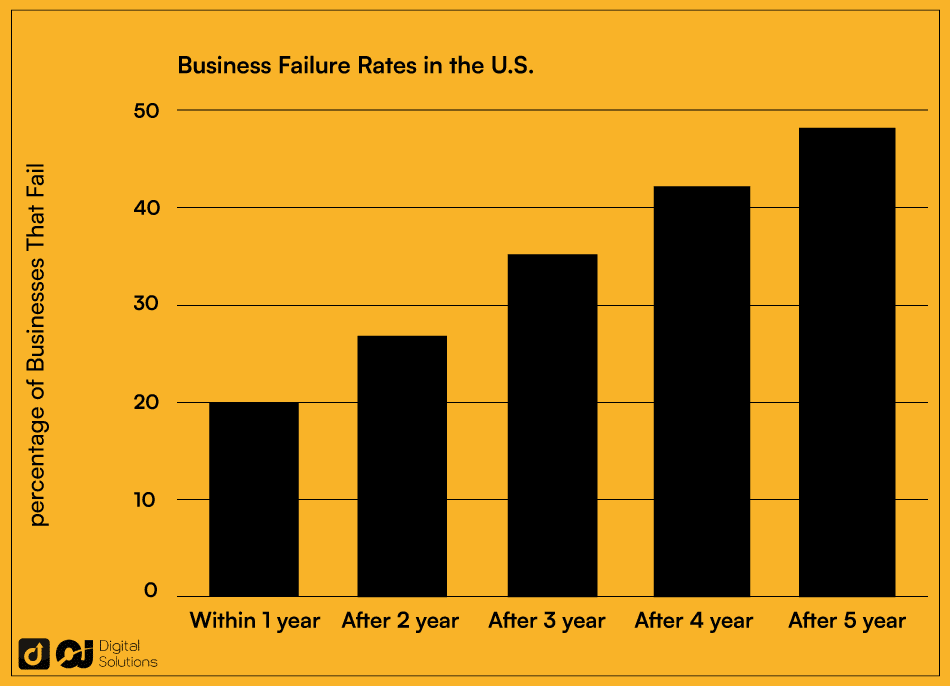

According to a 2023 report by the Small Business Administration (SBA), a significant percentage of small businesses start with less than $10,000 in capital, demonstrating the prevalence of bootstrapping. The report also highlights that bootstrapped businesses often face higher rates of closure within the first few years due to cash flow problems.

Seeking External Funding: A Complex Landscape

When bootstrapping proves insufficient, entrepreneurs often turn to external funding sources, which can be complex and competitive. These options include loans, grants, angel investors, and venture capital.

Loans and Grants

Small business loans from banks and credit unions can provide a much-needed influx of capital. However, securing a loan often requires a strong credit history, collateral, and a detailed business plan. Government grants, offered by agencies like the SBA, are highly sought after but often have strict eligibility requirements and intense competition.

Microloans, offered by non-profit organizations and community development financial institutions (CDFIs), are specifically designed for entrepreneurs with limited access to traditional financing. These loans typically have smaller amounts and more flexible terms.

Angel Investors and Venture Capital

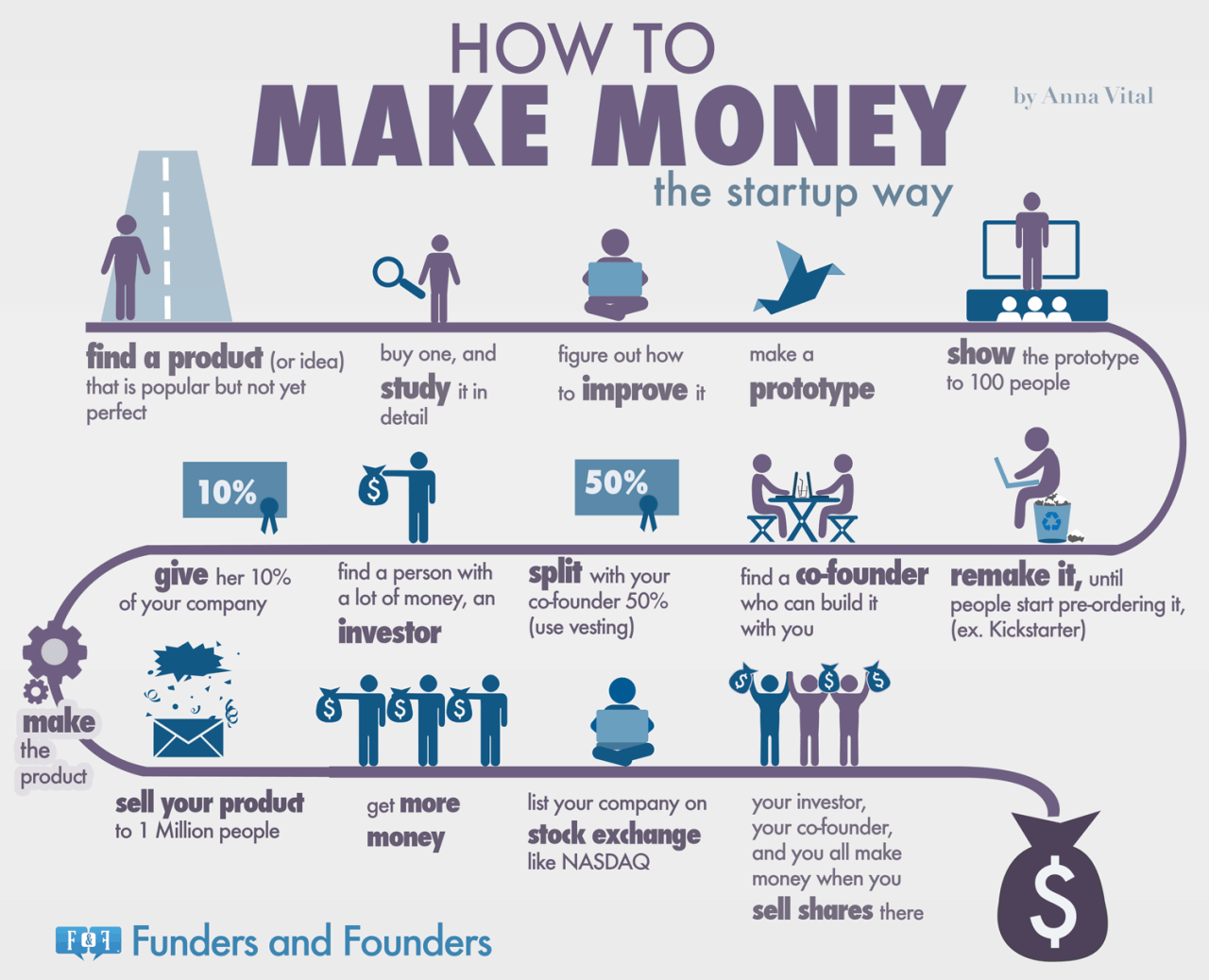

Angel investors are high-net-worth individuals who provide capital in exchange for equity in the company. They often bring not only funding but also valuable mentorship and industry connections. Venture capitalists (VCs) are firms that invest in high-growth potential startups, typically seeking significant returns on their investment.

Securing funding from angel investors or VCs is a demanding process involving pitching, due diligence, and negotiation. It often requires giving up a significant portion of ownership and control. According to data from the National Venture Capital Association (NVCA), only a small percentage of startups receive venture capital funding, highlighting the competitive nature of this funding source.

Crowdfunding: Leveraging the Power of the Crowd

Crowdfunding platforms like Kickstarter and Indiegogo have emerged as alternative funding sources, allowing entrepreneurs to raise capital from a large number of individuals online. This approach can be particularly effective for innovative products or services that resonate with a specific audience.

Crowdfunding offers the advantage of raising funds without giving up equity or taking on debt. However, it requires a compelling campaign, effective marketing, and the ability to deliver on promises made to backers. Success is far from guaranteed, and failed campaigns can damage a company's reputation.

The Broader Impact and Future Outlook

The difficulty in accessing funding disproportionately affects certain groups, including women, minorities, and entrepreneurs in underserved communities. This lack of access hinders innovation and economic growth, perpetuating inequalities. Addressing this challenge requires a multifaceted approach, including increased access to microloans, mentorship programs, and financial literacy education.

Organizations like Kiva and Accion are actively working to provide financial support to underserved entrepreneurs. Government initiatives, such as the SBA's 7(a) loan program, also play a crucial role in facilitating access to capital.

Looking ahead, the rise of fintech and alternative lending platforms is creating new opportunities for entrepreneurs to access funding. However, it is crucial to ensure that these platforms operate responsibly and transparently. By fostering a more inclusive and accessible funding ecosystem, we can unlock the full potential of entrepreneurial innovation and create a more equitable economy. The future success of many innovative ideas depends on it.