If I Stop Paying My Credit Cards What Happens

The weight of credit card debt can feel crushing, a relentless tide threatening to pull you under. But what happens if you simply stop fighting? Deliberately ceasing payments on your credit cards sets in motion a chain of consequences that can significantly impact your financial life for years to come.

This article breaks down the specific ramifications of defaulting on your credit card obligations. We’ll explore the immediate effects on your credit score, the escalation of debt through fees and interest, and the aggressive collection tactics that creditors may employ. Furthermore, we will examine the potential legal actions and long-term financial fallout that could ensue, providing a clear understanding of the risks involved.

Immediate Impact: Credit Score Devastation

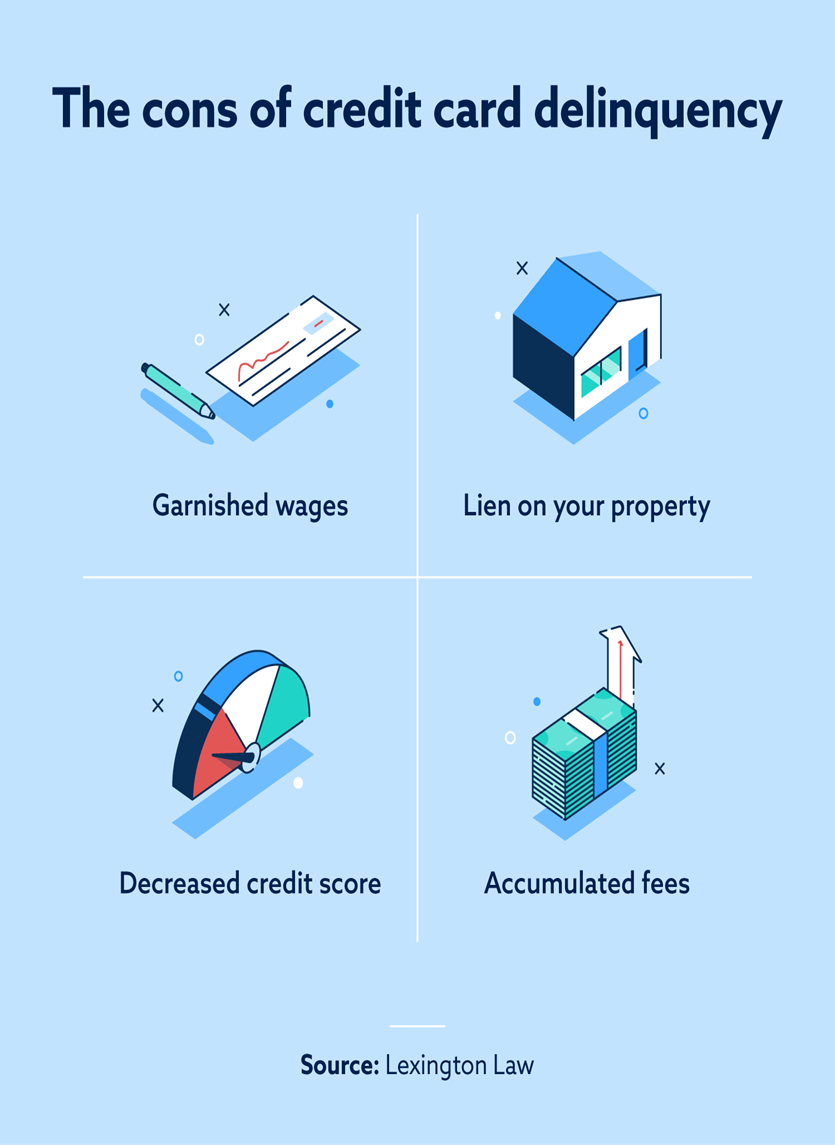

The first and most immediate consequence of missing a credit card payment is a negative hit to your credit score. Payment history accounts for a significant portion of your credit score, and even a single missed payment can cause a substantial drop, particularly if your credit score was previously high.

According to FICO, a leading credit scoring agency, the extent of the drop depends on factors like how late the payment is and your overall credit profile. Experian reports that a 30-day late payment can stay on your credit report for up to seven years.

This lower credit score then impacts your ability to secure loans, rent an apartment, or even obtain certain jobs in the future.

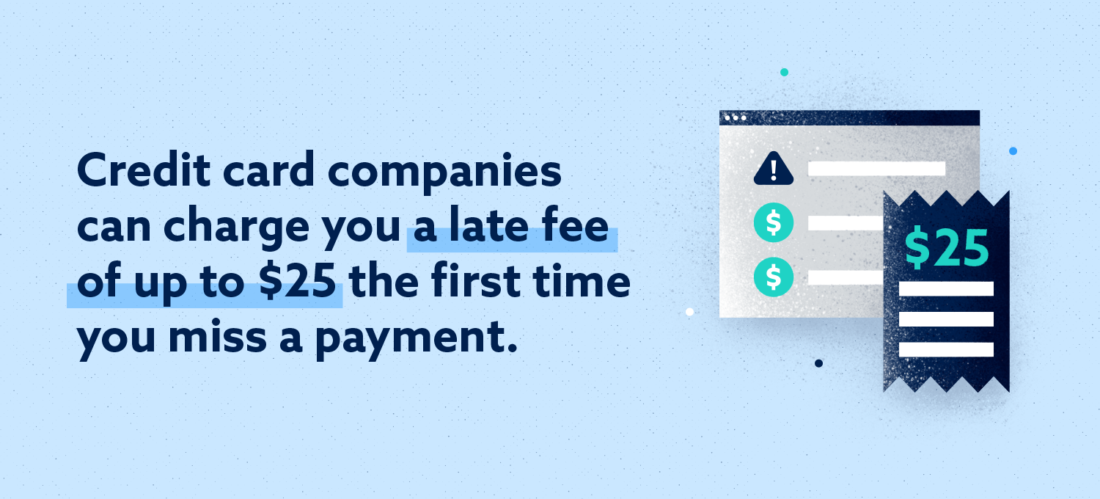

Escalating Debt: Fees and Interest

Missing a payment doesn't just damage your credit; it also makes the debt itself grow larger. Credit card companies typically charge late payment fees, which can range from $25 to $40, depending on the card agreement and the number of times you’ve been late previously.

Furthermore, your interest rate may increase to a penalty APR, a significantly higher rate that applies to your outstanding balance. This higher rate means that more of your future payments will go toward interest, and less toward paying down the principal, making it even harder to escape the debt cycle.

The Consumer Financial Protection Bureau (CFPB) warns consumers to be wary of these penalty APRs as they add to the burden of debt.

Collection Agency Involvement: Relentless Pursuit

If you continue to miss payments, your credit card company will likely turn your account over to a collection agency. These agencies specialize in recovering debts, and they often employ more aggressive tactics than the original creditor.

You can expect frequent phone calls, letters, and potentially even legal action. The Fair Debt Collection Practices Act (FDCPA) protects consumers from abusive, unfair, or deceptive debt collection practices, but understanding your rights is crucial to avoid being harassed.

Ignoring these collection efforts will not make the debt disappear; it will only escalate the situation.

Legal Action: Lawsuits and Wage Garnishment

If the collection agency is unsuccessful in recovering the debt through standard means, they may choose to file a lawsuit against you. If they win the lawsuit, they can obtain a court order to garnish your wages or levy your bank account.

Wage garnishment involves your employer withholding a portion of your paycheck to pay the debt. The amount that can be garnished is typically limited by state and federal law, but it can still significantly impact your income and ability to meet your other financial obligations.

Failure to respond to a lawsuit can result in a default judgment, which essentially guarantees the collection agency's victory. Seeking legal advice at this stage is strongly recommended.

Long-Term Financial Fallout: Lingering Effects

The consequences of defaulting on credit cards extend far beyond the immediate impact. The negative information on your credit report, including missed payments, collection accounts, and judgments, can remain for seven years or longer, affecting your ability to secure loans, mortgages, and even employment.

Furthermore, the stress and anxiety associated with debt collection and potential legal action can take a toll on your mental and physical health. The National Foundation for Credit Counseling (NFCC) emphasizes the importance of addressing debt problems proactively to avoid the long-term consequences.

Rebuilding your credit after a default is a long and arduous process, requiring discipline and consistent effort.

Alternatives to Default: Seeking Help

Before resorting to simply stopping payments, explore alternative solutions. Contact your credit card company to discuss hardship programs, which may offer temporary reductions in interest rates or payment amounts. Credit counseling agencies, like the NFCC, can provide guidance and assistance in creating a debt management plan.

Consider consolidating your debt with a personal loan or a balance transfer credit card with a lower interest rate. Bankruptcy should only be considered as a last resort, as it has significant and lasting consequences.

Taking proactive steps to address your debt is always preferable to ignoring the problem and facing the severe consequences of default.

Conclusion: A Path Forward

Deciding to stop paying your credit cards is a decision with far-reaching and detrimental consequences. The damage to your credit score, the escalation of debt through fees and interest, the aggressive collection tactics, and the potential for legal action can all significantly impact your financial future.

While the weight of debt can feel overwhelming, remember that there are resources available to help you navigate these challenges. Taking proactive steps to seek help, explore alternative solutions, and rebuild your credit is essential for regaining control of your financial life and securing a more stable future. Ignoring the problem will only exacerbate it; taking action, however difficult, is the first step towards a better tomorrow.