Importance Of Budget In Organization

Organizations nationwide face increasing pressure to optimize resources and maintain fiscal stability. A meticulously crafted budget is no longer optional; it’s the cornerstone of survival and growth.

The budget serves as a financial roadmap. It details anticipated revenues and expenses. It guides decision-making and ensures accountability across all departments.

The Budget: A Financial Compass

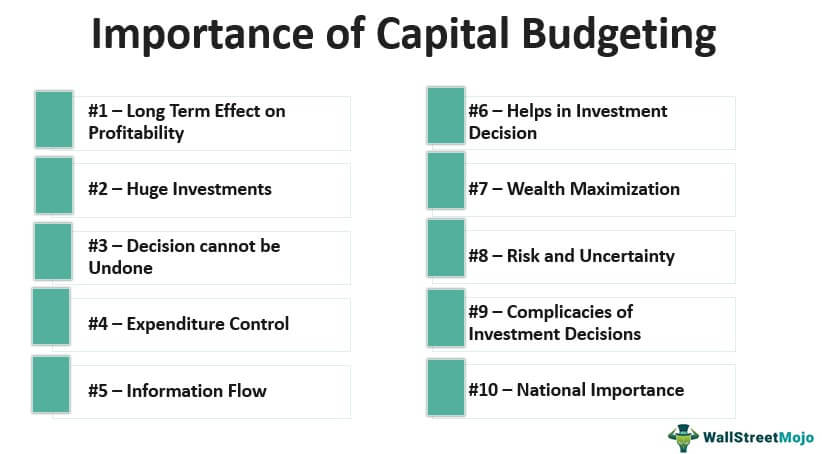

A well-defined budget allows organizations to proactively manage their finances. It dictates resource allocation, identifies potential funding shortfalls, and drives strategic investments.

Failure to implement a budget can lead to disastrous consequences. These range from cash flow crises to missed opportunities for expansion.

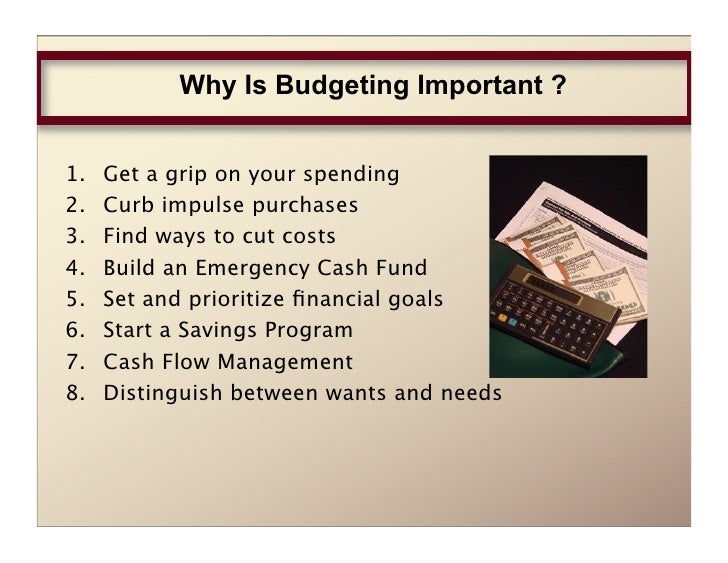

Key Benefits of Budgeting

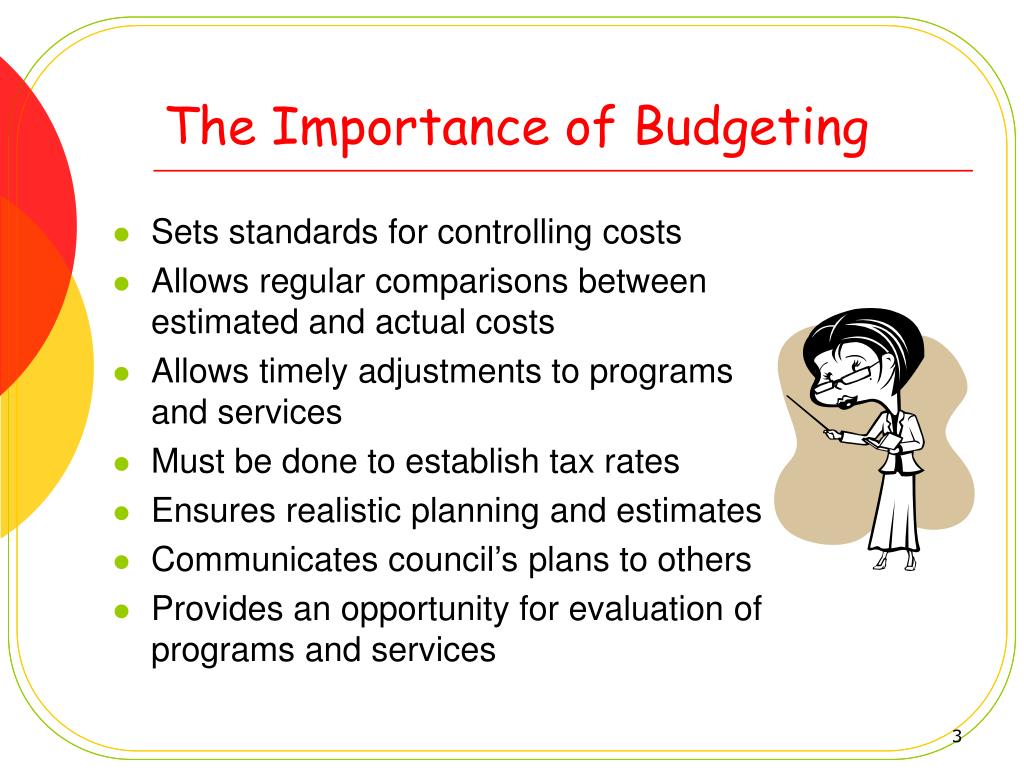

Effective budgeting offers several critical advantages.

Firstly, it enables informed decision-making. Management can prioritize projects based on available resources and expected returns.

Secondly, it promotes financial accountability. Each department understands its spending limits and is responsible for adhering to them.

Thirdly, it facilitates performance evaluation. Actual results can be compared against the budget to identify areas of success and areas requiring improvement.

Consequences of Neglecting the Budget

Ignoring the budget's crucial role can have severe repercussions.

Overspending is a common problem when budgets are not in place. This can quickly deplete reserves and create financial instability.

Missed opportunities also arise. Without a clear understanding of available funds, organizations may fail to capitalize on valuable investments or partnerships.

Furthermore, it undermines investor confidence. Stakeholders are less likely to invest in an organization that lacks financial discipline.

Real-World Impact

Numerous studies highlight the importance of budgeting. According to a recent survey by Deloitte, organizations with robust budgeting processes are 25% more likely to achieve their financial goals.

Smaller businesses also benefit significantly. A study by the Small Business Administration found that businesses with budgets are more likely to survive their first five years.

Examples abound of companies that have turned around their fortunes through effective budgeting. General Electric (GE), for example, implemented rigorous budgeting during a period of restructuring. This effort dramatically improved its financial performance.

Practical Steps for Implementation

Developing and implementing a budget requires a systematic approach.

First, gather data. This includes historical financial statements, industry trends, and economic forecasts.

Second, set realistic goals. Establish clear objectives for revenue growth, expense reduction, and profitability.

Third, involve all departments. Encourage input from across the organization to ensure buy-in and accuracy.

Fourth, monitor and adjust. Regularly review the budget against actual performance and make adjustments as needed. Flexibility is key.

"A budget isn't about restricting; it's about empowering you to make the best financial decisions." - Dave Ramsey, Financial Expert

Software solutions can streamline the budgeting process. Several platforms, such as QuickBooks and SAP, offer budgeting tools that automate data collection and reporting.

Looking Ahead

The need for effective budgeting will only intensify in the face of economic uncertainty. Organizations must prioritize financial planning to navigate challenges and seize opportunities.

Regular budget reviews and updates are essential. They help organizations adapt to changing market conditions and ensure continued financial stability.

Investing in budgeting training for employees can significantly improve its efficacy. Equip them with the skills they need to manage their budgets effectively.