In A Classified Balance Sheet Assets Are Usually Classified As

Breaking: Confusion and inconsistencies plague the treatment of asset classifications in classified balance sheets, raising concerns about financial transparency.

This issue, centered around how assets are categorized – particularly whether they adhere to standard accounting practices – has triggered scrutiny from financial analysts and regulators, demanding immediate clarification. This impacts both internal decision-making and external stakeholder understanding of an organization's financial health.

What's the Core Issue?

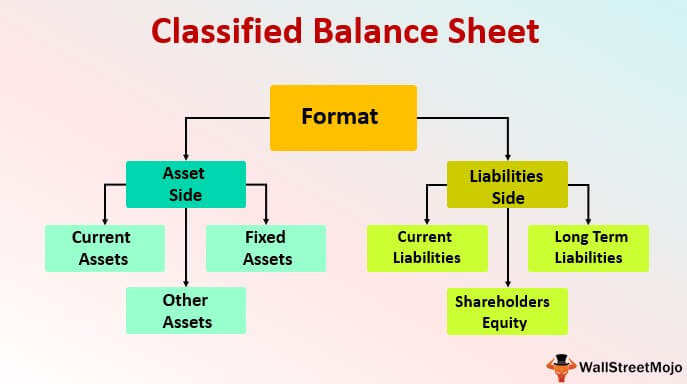

The primary concern revolves around the classification of assets within classified balance sheets, with an especial focus on adherence to Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS). GAAP typically requires assets to be classified as either current or non-current, based on their liquidity and expected conversion to cash. The problem surfaces when entities, particularly those dealing with sensitive or proprietary assets, deviate from these standard classifications.

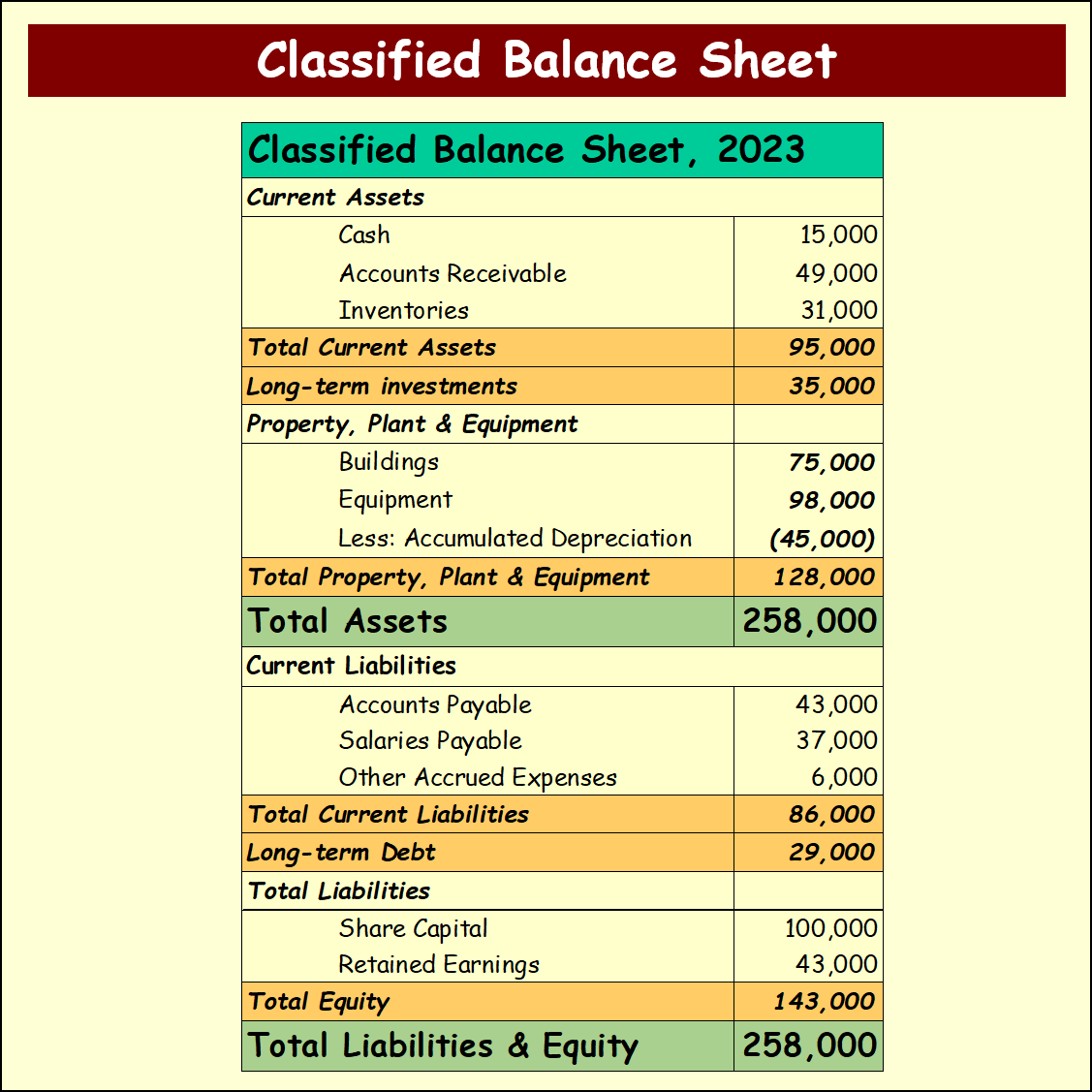

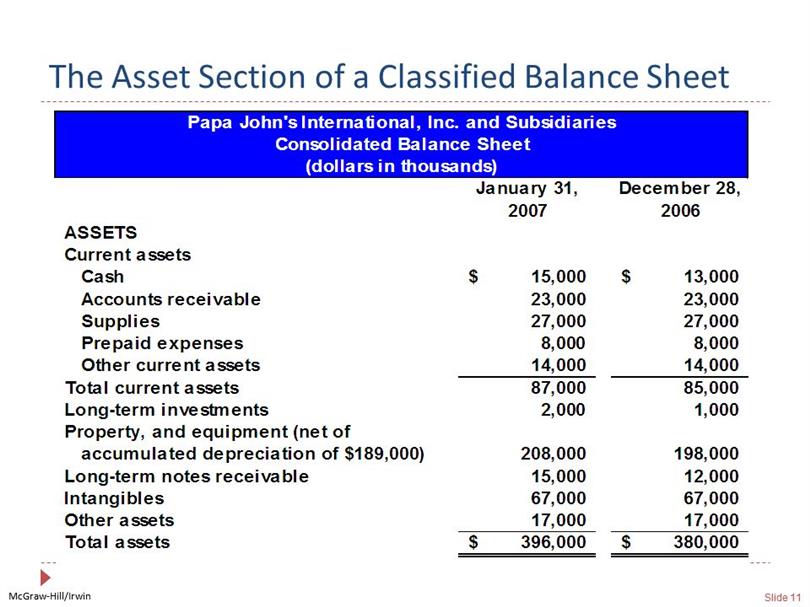

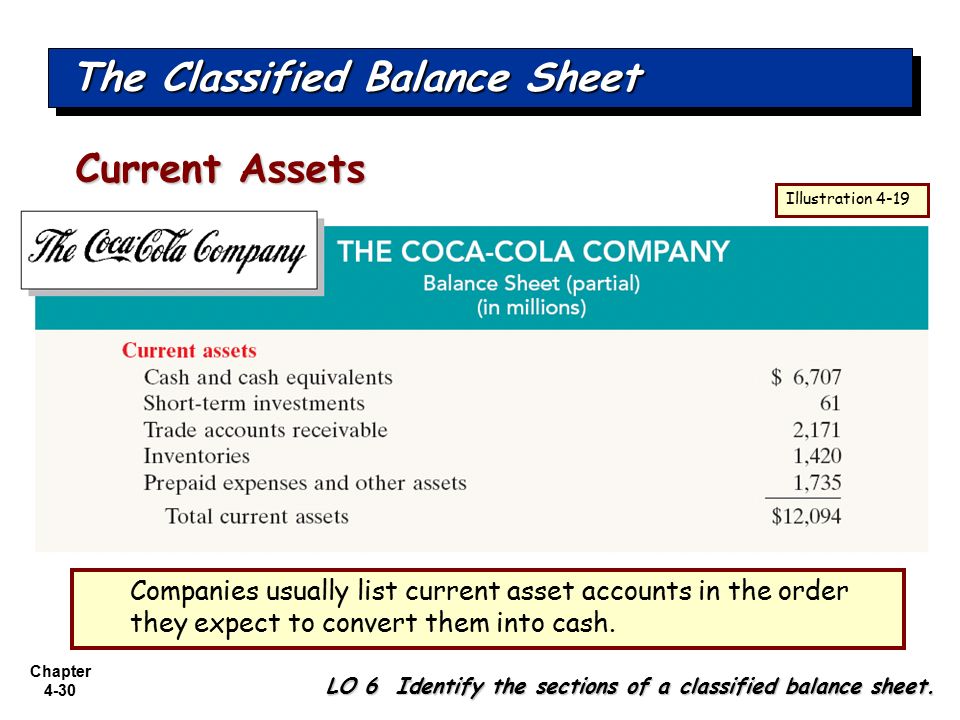

Specifically, assets are usually classified according to their liquidity. Current assets are those expected to be converted to cash or used up within one year or the operating cycle, whichever is longer. Conversely, non-current assets include long-term investments, property, plant, and equipment (PP&E), and intangible assets, such as patents and goodwill.

Deviation from these norms – especially in classified balance sheets of entities handling confidential or sensitive data – can make it difficult to assess their financial stability and operational efficiency.

The Who, Where, and When

The entities implicated span various sectors, from technology companies holding intellectual property to government contractors managing classified information. The geographical scope is global, with observed discrepancies arising across international jurisdictions. The timeframe is ongoing, with scrutiny intensifying recently due to increased audit oversight and stricter enforcement of accounting standards.

Accountants, auditors, financial analysts, and regulators are all deeply involved in trying to resolve these discrepancies and enhance transparency. The issue impacts any entity that prepares or uses financial statements based on classified information.

The Problem with Non-Standard Classifications

Using non-standard asset classifications obscures the true picture of a company’s financial position. It can lead to an overestimation or underestimation of liquidity, hindering accurate financial analysis. This issue directly impacts investor confidence and could potentially facilitate financial mismanagement or fraud.

For example, classifying a long-term investment as a current asset could give the impression of greater liquidity than actually exists. Conversely, inappropriately classifying current assets as non-current can mask short-term financial vulnerabilities.

The How: Examples of Misclassification

Common instances of misclassification include improper categorization of inventory, receivables, and investments. Inventory that isn't readily saleable might be wrongly classified as current. Similarly, long-term receivables could incorrectly appear as current assets.

Another common pitfall is misclassifying restricted cash. Cash that is restricted for specific purposes and not available for immediate use should not be categorized as a current asset.

The Role of GAAP and IFRS

Both GAAP and IFRS offer guidance on proper asset classification. However, interpreting these guidelines in the context of classified balance sheets presents unique challenges. Ambiguities can arise when dealing with assets whose very nature is confidential.

“The key lies in balancing the need for transparency with the protection of sensitive information,” emphasized Dr. Anya Sharma, a leading accounting expert.

Immediate Action and Next Steps

Regulators are expected to issue further guidance to clarify asset classification requirements in classified balance sheets. Companies are advised to review their current accounting practices and consult with qualified auditors to ensure compliance. This review should include a thorough examination of all asset classifications, considering both their intended use and applicable accounting standards.

The Securities and Exchange Commission (SEC) and other regulatory bodies may conduct more frequent and stringent audits. Increased scrutiny is anticipated, particularly for entities operating in sensitive sectors. Any organization dealing with classified assets should promptly engage with accounting experts to guarantee compliance and transparency.

The ongoing effort to reconcile transparency with confidentiality continues, with potential future developments including sector-specific guidance and enhanced auditing protocols. This is a developing situation, and businesses must remain vigilant and proactive in ensuring compliance.

![In A Classified Balance Sheet Assets Are Usually Classified As Free Printable Classified Balance Sheet Templates [Excel, PDF] Example](https://www.typecalendar.com/wp-content/uploads/2023/08/Classified-Balance-Sheet-Format.jpg?gid=912)

![In A Classified Balance Sheet Assets Are Usually Classified As Free Printable Classified Balance Sheet Templates [Excel, PDF] Example](https://www.typecalendar.com/wp-content/uploads/2023/08/Sample-Classified-Balance-Sheet.jpg?gid=912)

![In A Classified Balance Sheet Assets Are Usually Classified As Free Printable Classified Balance Sheet Templates [Excel, PDF] Example](https://www.typecalendar.com/wp-content/uploads/2023/08/Printable-Classified-Balance-Sheet.jpg)