In A Third-party Healthcare System The Consumer

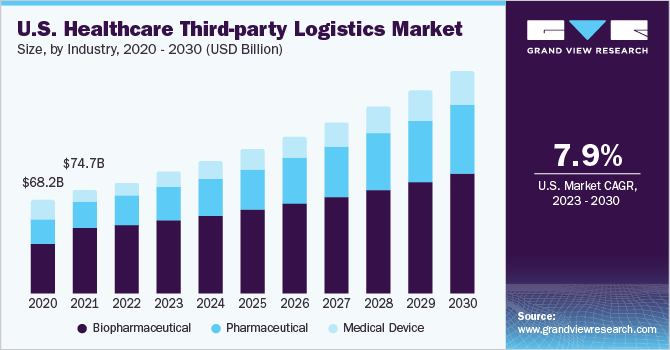

The American healthcare landscape is a complex web of insurers, providers, and patients, often leaving consumers feeling like cogs in a machine. But what happens when that machine is recalibrated, shifting towards a system where third-party payers, like employers or government entities, play an even more dominant role? The implications for consumers, in terms of cost, access, and quality of care, are profound and warrant careful examination.

This article explores the nuanced relationship between consumers and a healthcare system increasingly shaped by third-party payers. It delves into the potential benefits and drawbacks of this trend, examining how it affects individual choices, financial burdens, and overall health outcomes. We will explore expert opinions and available data to provide a comprehensive understanding of this evolving dynamic.

The Rise of Third-Party Influence

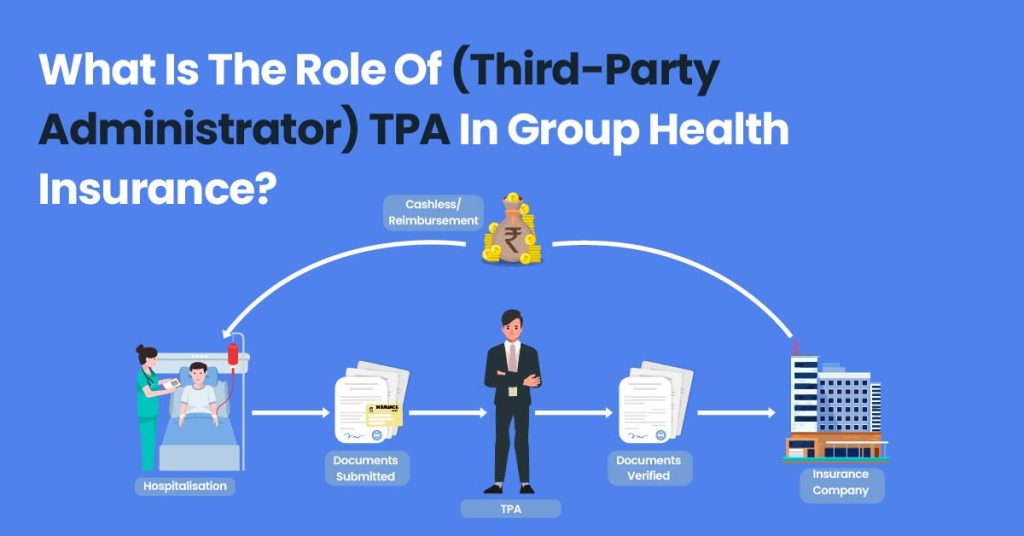

The prominence of third-party payers in healthcare is nothing new. For decades, employer-sponsored insurance has been the cornerstone of coverage for many Americans. Government programs like Medicare and Medicaid also function as major third-party payers, covering millions more.

However, recent trends suggest an even greater consolidation of power among these entities. Employers, seeking to manage rising healthcare costs, are increasingly adopting strategies like high-deductible health plans (HDHPs) and wellness programs.

The government, too, is experimenting with alternative payment models, such as bundled payments and accountable care organizations (ACOs), which incentivize providers to coordinate care and control spending.

Impact on Consumer Choice

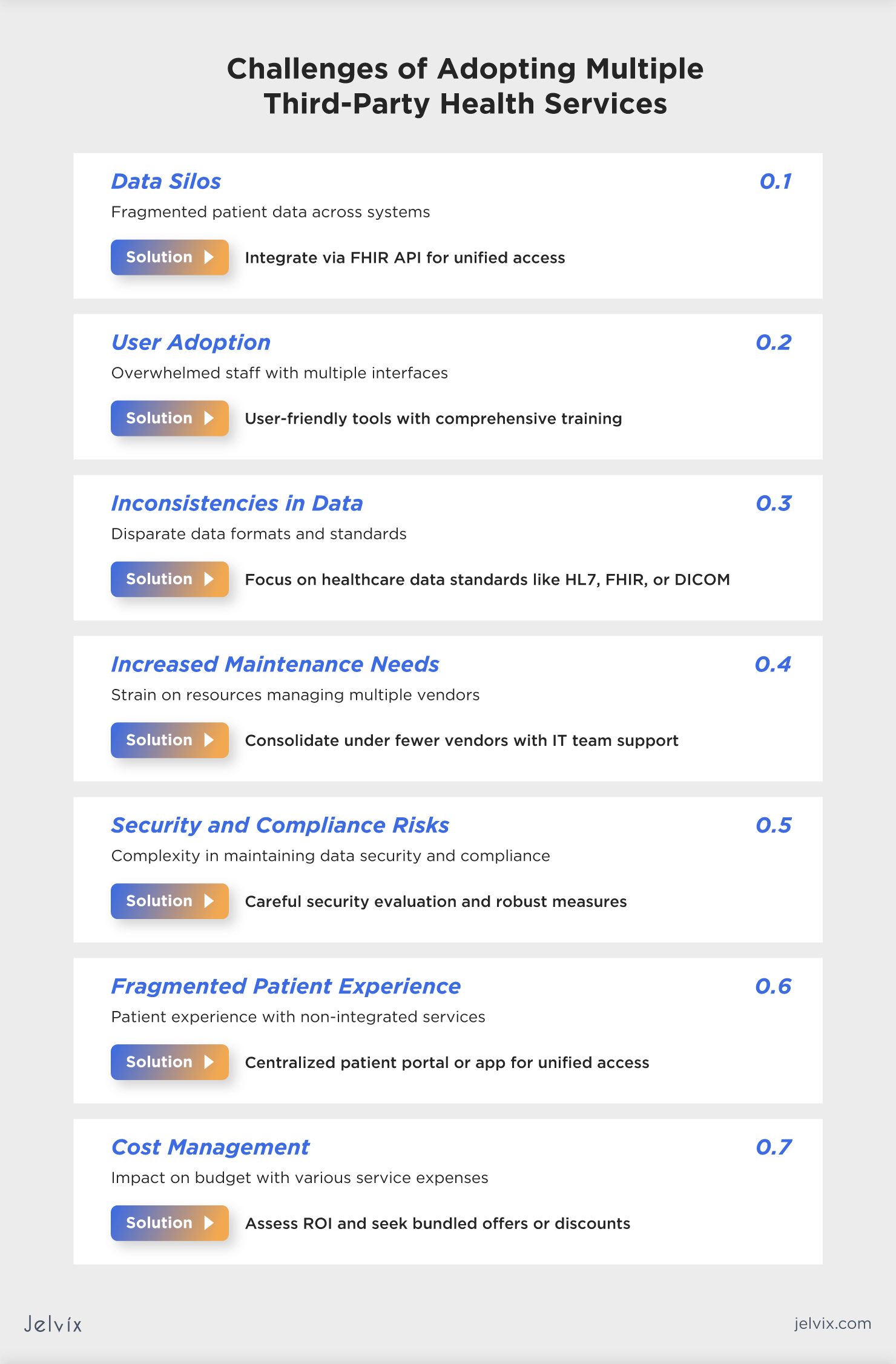

One of the most significant impacts of a third-party dominated system is the potential limitation of consumer choice. When insurance companies or employers negotiate contracts with healthcare providers, they often create networks that restrict where patients can seek care.

While these networks may offer cost savings, they can also limit access to specialists or preferred hospitals. A 2022 study by the Kaiser Family Foundation found that nearly one in five adults with employer-sponsored insurance had difficulty finding a doctor or specialist within their network.

For individuals with chronic conditions or complex healthcare needs, these limitations can be particularly burdensome. Furthermore, the rise of HDHPs, while intended to encourage consumerism, can lead individuals to delay or forgo necessary care due to high out-of-pocket costs.

The Cost Conundrum

The promise of third-party involvement is often lower costs, but the reality is more complex. While these entities may be able to negotiate lower rates with providers, those savings are not always passed on to consumers.

Administrative overhead, profit margins, and the sheer complexity of the billing process can eat into any potential cost reductions. A report by the Commonwealth Fund in 2020 found that the United States spends significantly more on healthcare administration than other developed nations, largely due to the involvement of numerous third-party payers.

Moreover, the shift towards value-based care, while promising in theory, has yet to demonstrate consistent cost savings. The complexity of measuring and rewarding value can create unintended consequences and further complicate the payment system.

Quality and Access Considerations

Beyond cost, the influence of third-party payers can also impact the quality and accessibility of care. For example, ACOs incentivize providers to improve care coordination and reduce unnecessary hospital readmissions.

However, there are concerns that these models may also lead to undertreatment or a focus on metrics that don't accurately reflect patient outcomes. Medicaid managed care, another form of third-party payment, has been shown to improve access to some services but can also create barriers for certain populations, particularly those with complex needs.

The emphasis on efficiency and cost control can sometimes overshadow the individual needs of patients, leading to a more standardized and less personalized approach to care.

Navigating the System: Empowering the Consumer

Despite the challenges, consumers are not entirely powerless in a third-party dominated healthcare system. By becoming more informed and proactive, individuals can navigate the complexities and advocate for their own needs.

Understanding your insurance plan, including its coverage limitations, network restrictions, and cost-sharing requirements, is crucial. Comparison shopping for healthcare services, when possible, can also help to lower costs.

Finally, actively engaging in your own care, asking questions, and seeking second opinions can ensure that you receive the best possible treatment.

Conclusion

The role of third-party payers in healthcare is likely to continue to expand. Understanding the potential impacts on cost, choice, quality, and access is essential for consumers. By becoming informed advocates for their own health, individuals can navigate the complexities of the system and ensure that their needs are met.

The future of healthcare depends on a collaborative approach, where consumers, providers, and third-party payers work together to create a system that is both efficient and patient-centered.