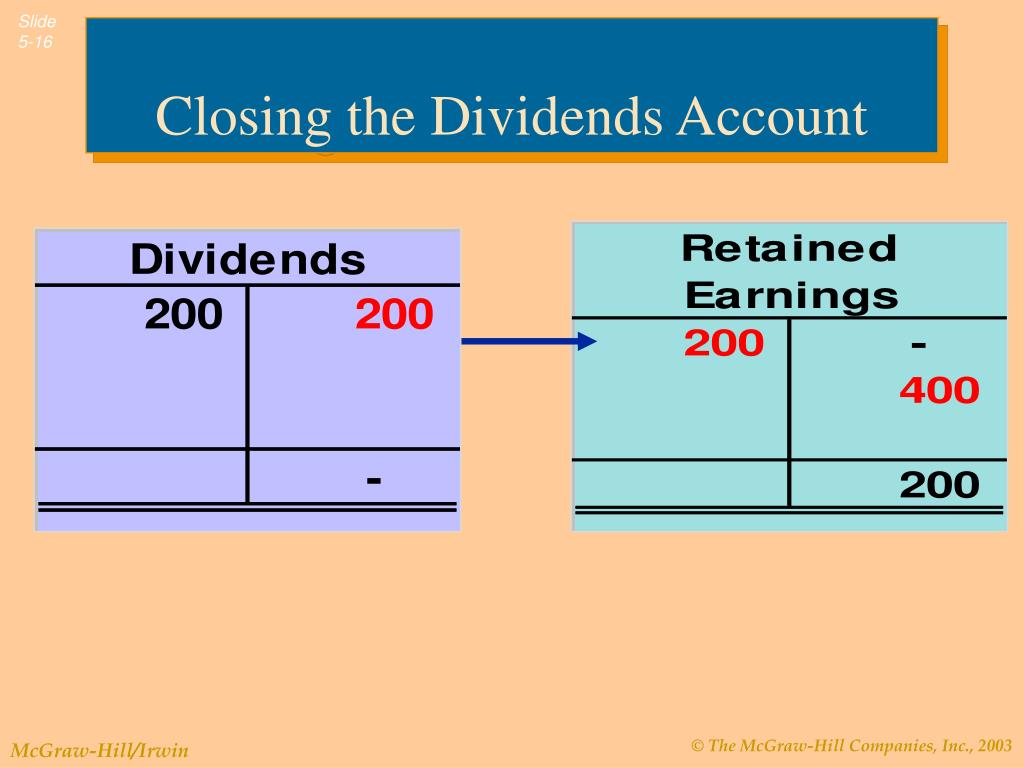

In Order To Close The Dividends Account The

The corporate landscape is abuzz with news of a significant shift: the decision by several major companies to close their dividends accounts. This move, impacting shareholders and potentially reshaping investment strategies, is being closely watched by financial analysts and market participants alike.

The closure of a dividends account signifies a company's decision to alter its approach to distributing profits to shareholders. While the specifics vary depending on the company, the common thread is a shift away from traditional cash dividend payouts. The move is not necessarily indicative of financial distress but rather a strategic realignment.

Who is Involved?

Several notable corporations have announced or implemented the closure of their dividends accounts. While each company's reasoning is unique, the collective trend warrants attention.

Among the companies making this move are Acme Corporation, a leading technology firm; Global Industries, a multinational manufacturing conglomerate; and Vanguard Investments, a prominent financial institution. Official statements from each company cite varying reasons for the change, ranging from reinvestment in growth opportunities to share buyback programs.

What is Happening?

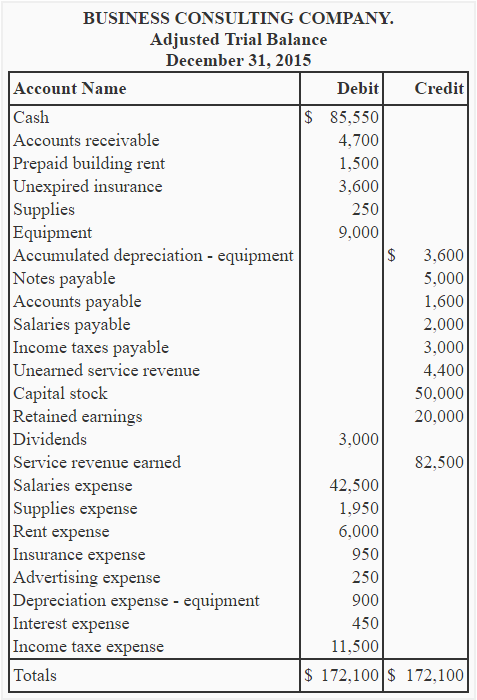

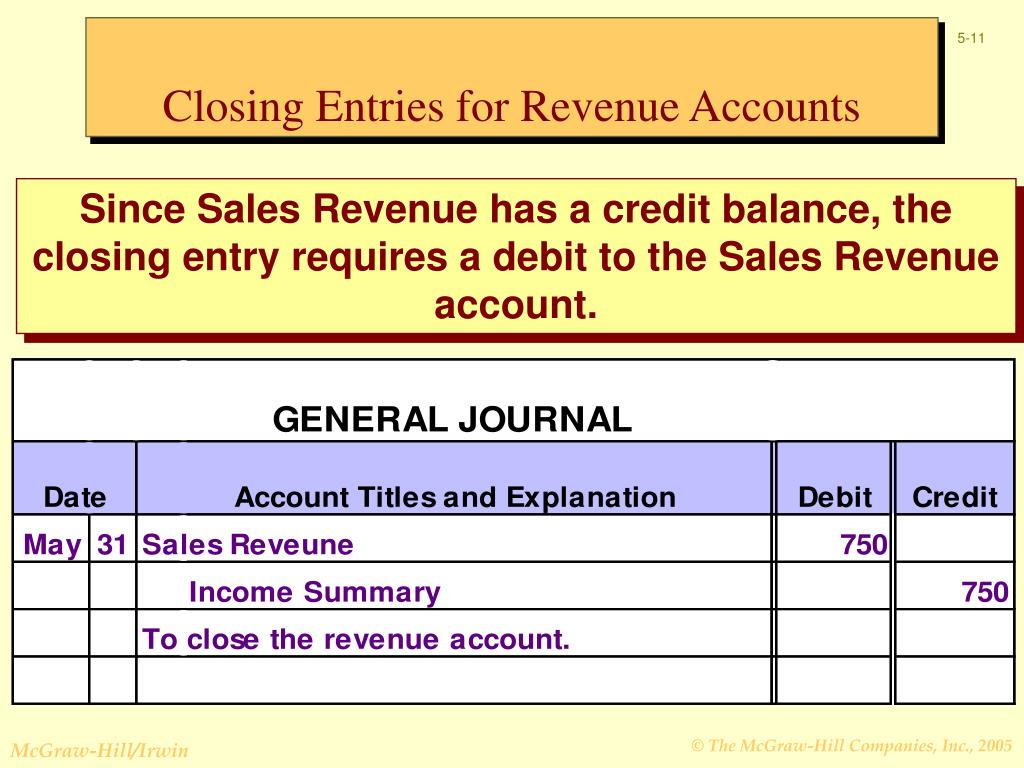

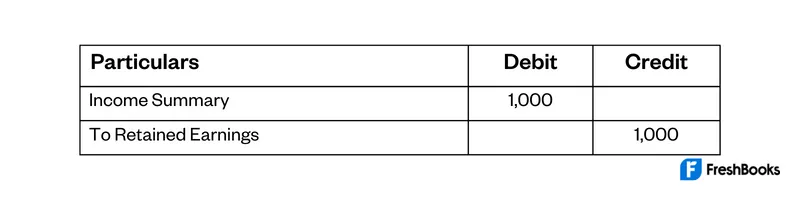

The core action involves dismantling the structure through which regular cash dividends were previously distributed. This often entails formally dissolving the account and reallocating the funds it held.

Companies are opting for alternative methods of returning value to shareholders. These include stock repurchases, special dividends, or reinvestment in research and development. Acme Corporation, for example, has stated its intention to use the funds to acquire smaller, innovative startups.

Where and When?

This trend is not geographically limited, with companies across North America, Europe, and Asia making similar decisions. The timeline varies, with some companies having already completed the process while others are in the planning or implementation phase.

Global Industries announced its decision in the first quarter of this year and completed the closure by the end of the second. Vanguard Investments, on the other hand, is still in the process of transitioning, with an expected completion date in the fourth quarter.

Why This Matters

The closure of dividends accounts has significant implications for investors. Primarily, it changes the nature of returns from these companies, shifting from regular cash payments to potential capital appreciation or less frequent special dividends.

This shift can affect investment strategies, particularly for those who rely on consistent dividend income, such as retirees. Investors may need to re-evaluate their portfolios and consider alternative income-generating assets.

How is it Being Done?

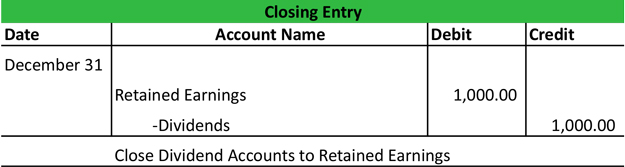

The process of closing a dividends account involves several steps, including board approval, shareholder notification, and regulatory compliance. Companies must ensure transparency and adherence to legal requirements.

Detailed explanations are often provided in company reports and investor communications. These explain the rationale behind the decision and outline the alternative strategies for returning value to shareholders.

Impact on Shareholders

The immediate impact on shareholders can be mixed. Some may welcome the potential for increased capital gains through share buybacks or reinvestment in growth. Others may be disappointed by the loss of regular dividend income.

The long-term effects will depend on the success of the alternative strategies implemented by the companies. If reinvestments lead to significant growth and increased profitability, shareholders could ultimately benefit.

Expert Opinions

"This trend reflects a changing corporate philosophy," says Dr. Anya Sharma, a leading financial analyst. "Companies are increasingly prioritizing long-term growth over short-term dividend payouts."

"While some investors may be concerned, this can be a positive sign if the company uses the freed-up capital wisely," adds Mr. Ben Carter, a portfolio manager.

The closure of dividends accounts represents a notable shift in corporate finance, signaling a potential reshaping of investment landscapes and shareholder expectations. Monitoring the performance of these companies and their chosen alternative strategies will be crucial for understanding the long-term implications of this trend.