In The Past The Study Of Finance Has Included

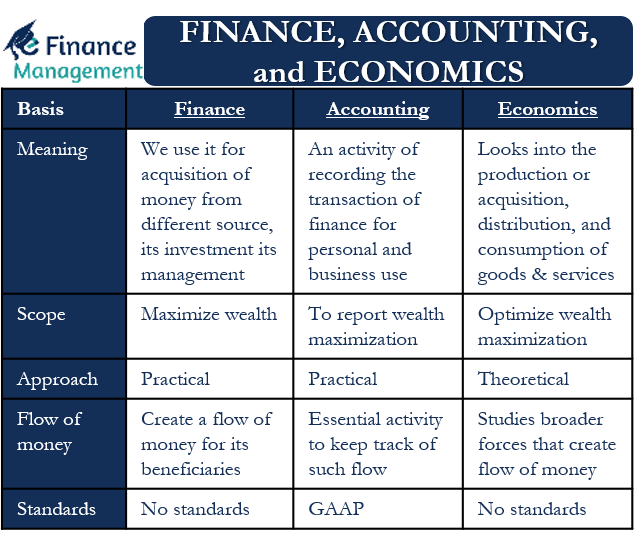

For decades, the study of finance has centered on core principles like asset pricing, corporate valuation, and portfolio management, shaping generations of financial professionals. However, an evolving global landscape and technological advancements are prompting a re-evaluation of traditional curricula, adding new dimensions to the field.

This shift reflects a growing recognition that finance is no longer solely about maximizing shareholder value, but also about navigating complex ethical considerations, understanding macroeconomic trends, and leveraging data-driven insights. Universities and training programs are adapting to equip students with the skills needed to thrive in a rapidly changing financial world.

The Traditional Foundation

Historically, finance education heavily emphasized quantitative analysis and theoretical models. Courses focused on discounted cash flow analysis, the Capital Asset Pricing Model (CAPM), and the efficient market hypothesis formed the bedrock of the curriculum.

Students learned to analyze financial statements, evaluate investment opportunities, and construct diversified portfolios based on risk-return profiles. Professor William Sharpe's work on CAPM, for instance, was (and often still is) a cornerstone of understanding risk and return relationships.

Corporate finance courses delved into capital budgeting decisions, dividend policy, and mergers and acquisitions, preparing graduates for roles in investment banking and corporate treasury. The focus was largely on maximizing profitability and shareholder wealth.

The Expanding Horizon

The 2008 financial crisis served as a stark reminder of the limitations of purely quantitative models and the importance of understanding systemic risk. This event, alongside increasing global interconnectedness, spurred a demand for a more holistic approach to finance education.

Consequently, programs are now incorporating behavioral finance, which examines the psychological factors that influence investor decisions.

Understanding biases like loss aversion and confirmation bias is now considered crucial for effective risk management.

Furthermore, the rise of sustainable and impact investing has led to the integration of environmental, social, and governance (ESG) factors into investment analysis. Students are increasingly expected to assess the ethical implications of financial decisions and consider the long-term impact on stakeholders.

The Digital Revolution

FinTech, or financial technology, has revolutionized the industry, creating new opportunities and challenges. The explosion of data and the advent of artificial intelligence (AI) are transforming how financial institutions operate.

Finance programs are now incorporating data analytics, machine learning, and blockchain technology into the curriculum. Students are learning to analyze vast datasets, develop algorithmic trading strategies, and understand the implications of cryptocurrencies and decentralized finance (DeFi).

For example, many institutions are now offering specialized courses or even entire degree programs focused on FinTech and data science in finance. These programs aim to bridge the gap between technical expertise and financial knowledge.

Ethics and Regulation

Increased scrutiny of financial institutions has also highlighted the importance of ethics and regulatory compliance. Courses on financial ethics and regulation are becoming increasingly prevalent in finance curricula.

Students are learning about insider trading, conflicts of interest, and the responsibilities of fiduciaries. They are also being educated on the legal and regulatory frameworks that govern the financial industry, such as the Sarbanes-Oxley Act and the Dodd-Frank Act.

The goal is to instill a strong sense of ethical responsibility and to equip graduates with the knowledge and skills to navigate complex regulatory landscapes.

A Human-Interest Angle

Dr. Anya Sharma, a finance professor at a leading university, emphasizes the importance of incorporating real-world case studies into her teaching. "Students need to understand how these theoretical models and ethical considerations apply to real-life situations," she explains.

She incorporates case studies involving companies facing ethical dilemmas or navigating complex market conditions. This approach allows students to develop critical thinking skills and to apply their knowledge in a practical context.

Dr. Sharma also mentors students interested in careers in social finance, helping them connect with organizations focused on addressing social and environmental challenges. This approach allows students to explore how finance can be used as a tool for positive change.

The Future of Finance Education

The ongoing evolution of finance education reflects a broader trend toward interdisciplinary learning and the integration of technology. As the financial landscape continues to evolve, finance programs will need to adapt to meet the changing needs of the industry.

This includes fostering critical thinking skills, promoting ethical decision-making, and equipping students with the technical expertise to navigate a rapidly changing world. The integration of diverse perspectives and backgrounds will also be crucial for fostering innovation and addressing complex global challenges.

Ultimately, the future of finance education lies in preparing graduates who are not only technically proficient but also ethically responsible and capable of contributing to a more sustainable and equitable financial system.

:max_bytes(150000):strip_icc()/Term-Definitions_Finance-d53e01ed39994c7e959f028374c20ff1.jpg)