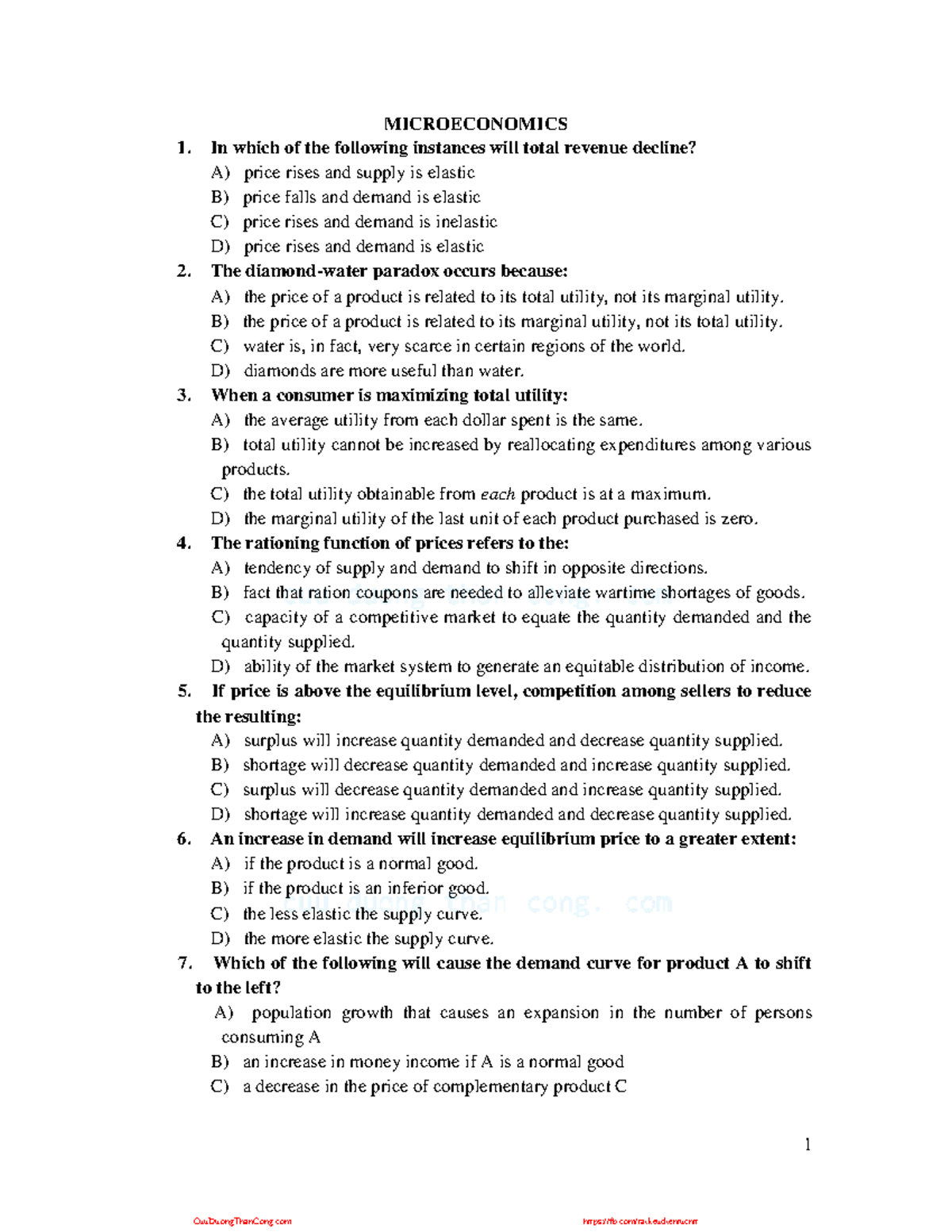

In Which Of The Following Instances Will Total Revenue Decline

For businesses, understanding the delicate dance between price, demand, and revenue is crucial for survival. A key concept is identifying scenarios where increasing sales volume doesn't necessarily translate to higher profits. In fact, in some instances, boosting the amount of products sold can actually lead to a decline in total revenue.

This raises a critical question for business owners and economists alike: In which specific instances will total revenue decline? This article will delve into the dynamics of price elasticity of demand and how businesses navigate these scenarios to maintain profitability.

Understanding Price Elasticity of Demand

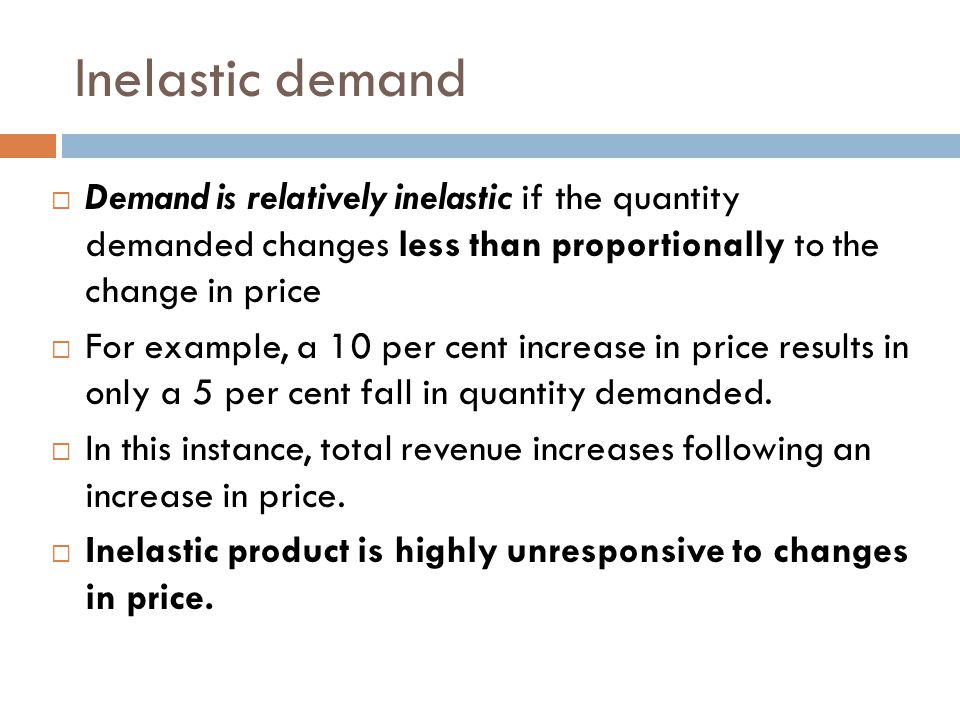

The key to understanding revenue decline lies in the concept of price elasticity of demand. This economic principle measures how much the quantity demanded of a good or service changes in response to a change in its price. It's a ratio that indicates the responsiveness of consumers to price fluctuations.

If demand is elastic, a small change in price leads to a relatively large change in the quantity demanded. Conversely, if demand is inelastic, a change in price has a smaller impact on the quantity demanded.

When demand is elastic, a price decrease can actually lead to a decrease in total revenue. This counterintuitive result occurs because the increase in quantity sold isn't enough to offset the lower price per unit.

The Scenario: Elastic Demand and Price Reductions

Imagine a company selling a luxury item, such as designer handbags. Let's say they initially sell 100 handbags at $500 each, resulting in a total revenue of $50,000. Suppose they decide to lower the price to $400 in an effort to boost sales.

Because demand for luxury goods is generally elastic, a lower price significantly increases demand. Assume that the quantity demanded jumps to 150 handbags after the price reduction.

However, the new total revenue is 150 handbags * $400 = $60,000. This means their revenue will increase instead of decrease. Now assume the increased demanded is only 110, with the new calculation the total revenue would be $44,000, a decrease compared to the initial total revenue.

The total revenue has decreased from $50,000 to $44,000, illustrating how a price decrease, when demand is elastic, can harm a company's bottom line.

The Scenario: When the Product has many Substitutes

A classic example involves products with numerous substitutes. When a specific brand lowers its price, it might attract customers from competitors, leading to increased sales volume.

If this product has many substitutes, lowering the price may not increase the demand enough to offset the decrease in price.

This happens when the amount of substitutes causes customers to easily move to an alternative instead of purchasing the product. Making the demand for the product highly sensitive to price changes, so it is important to consider whether or not it can sustain total revenue.

The Importance of Market Research

Businesses must conduct thorough market research to understand the price elasticity of demand for their products. This includes analyzing historical sales data, surveying consumers, and monitoring competitor pricing strategies. By understanding consumer behavior, companies can make informed decisions about pricing that maximize revenue.

Several factors influence the price elasticity of demand, including the availability of substitutes, the necessity of the product, and the proportion of a consumer's budget spent on the item.

If a product is a necessity and has few substitutes, demand is likely to be inelastic. If it's a luxury item with many alternatives, demand will likely be elastic.

The Role of Branding and Differentiation

Companies can also influence the price elasticity of demand through branding and product differentiation. A strong brand with a loyal customer base can command a premium price, making demand less sensitive to price changes.

By creating a unique product or service, businesses can reduce the availability of substitutes and increase customer loyalty, shifting demand towards inelasticity.

This will mean their revenue can be sustained even if the price decrease isn't enough to offset the decrease in price, which can benefit total revenue.

The Broader Economic Impact

Understanding price elasticity is crucial not only for individual businesses but also for policymakers. Governments use this concept to predict the impact of taxes and subsidies on consumer behavior.

For example, a tax on a product with inelastic demand, such as cigarettes, is likely to generate significant revenue for the government, as consumption will not decrease dramatically.

Conversely, a subsidy on a product with elastic demand, such as renewable energy, can significantly increase adoption and promote environmental sustainability.

In conclusion, total revenue will decline when demand is elastic and a company lowers its price. Businesses can avoid this pitfall by conducting thorough market research, understanding consumer behavior, and developing strong brands that command customer loyalty. Ignoring the principles of price elasticity can have serious consequences for a company's profitability and long-term success.

+Decreases+in+the+stock+market+decrease+aggregate+demand+by+decreasing+which+of+the+following.jpg)