Included In The Statement Of Stockholders' Equity Are

Investor alert! Significant shifts are occurring in how companies present stockholder equity data, demanding immediate attention from analysts and shareholders.

This shift impacts transparency and the ability to accurately assess a company's financial health.

Understanding the Statement of Stockholders' Equity: A Critical Update

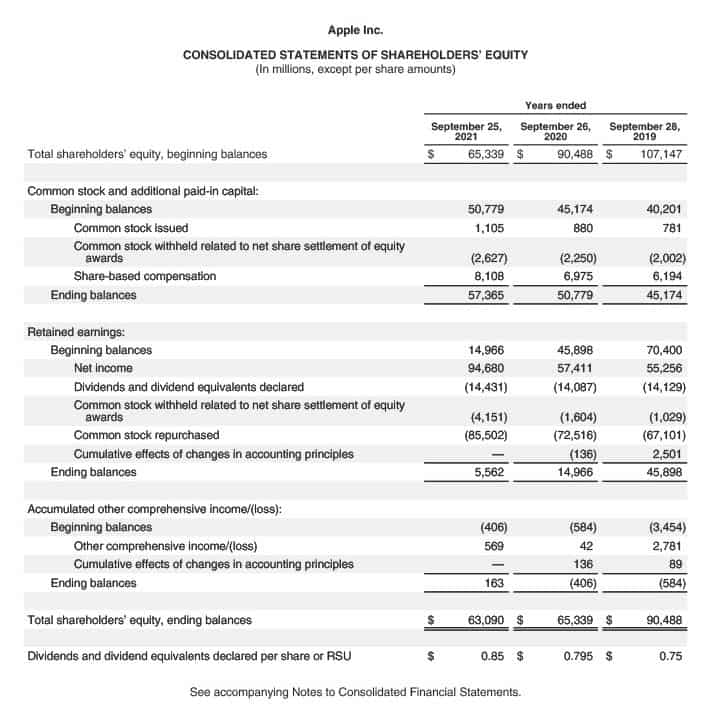

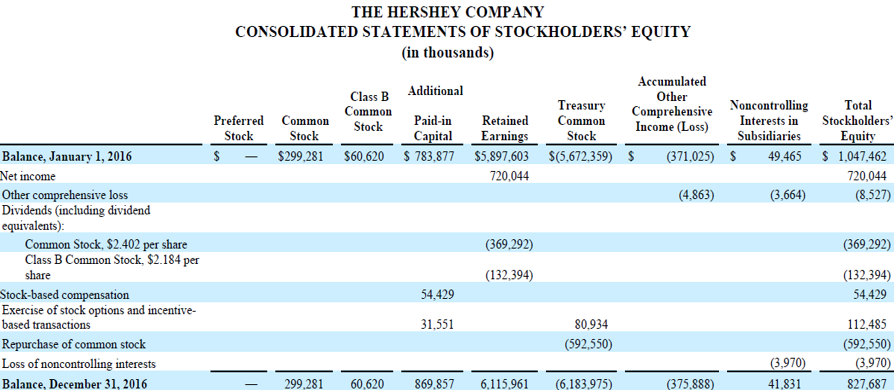

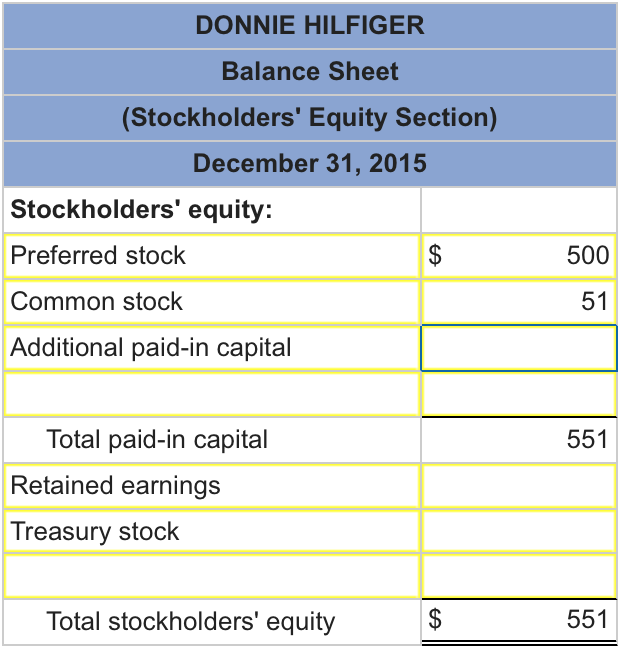

The Statement of Stockholders' Equity provides a detailed reconciliation of the changes in a company's equity accounts over a specific period.

Key components include contributed capital, retained earnings, accumulated other comprehensive income (AOCI), and treasury stock.

Recent regulatory adjustments and evolving accounting practices are changing how these elements are reported, triggering concerns about potential misinterpretations.

Contributed Capital: Beyond Initial Offerings

Contributed capital reflects the total amount of money received from investors in exchange for stock.

This includes the par value of the shares plus any additional paid-in capital.

New guidelines require more granular disclosure of stock option exercises and employee stock purchase plans (ESPPs), impacting the overall reported value.

Retained Earnings: A Closer Look at Profitability

Retained earnings represent the accumulated profits of a company, less any dividends paid out to shareholders.

The statement details how net income or loss affects this crucial account.

Companies are now mandated to provide more transparent disclosures about the impact of accounting changes and prior-period adjustments on retained earnings.

Accumulated Other Comprehensive Income (AOCI): Hidden Values Revealed

AOCI includes items that bypass the income statement, such as unrealized gains and losses on available-for-sale securities, foreign currency translation adjustments, and certain pension adjustments.

The Financial Accounting Standards Board (FASB) is pushing for enhanced disclosure of AOCI components.

Investors must carefully analyze these elements to understand a company's true financial performance.

Treasury Stock: Buybacks and Their Implications

Treasury stock refers to shares that a company has repurchased from the open market.

These repurchases reduce the number of outstanding shares and can impact earnings per share (EPS).

Companies must now provide more detailed information about the cost and quantity of treasury shares, as well as the reasons for the buyback program.

Impact on Financial Analysis

The changes in the reporting of stockholders' equity demand a revised approach to financial analysis.

Traditional metrics like book value per share and return on equity (ROE) may be significantly affected.

Analysts need to scrutinize the footnotes and supplemental disclosures to fully understand the implications of these adjustments.

Specific Examples of Reporting Changes

Several publicly traded companies, including Apple and Microsoft, have already begun incorporating these changes into their financial statements.

Apple's recent 10-Q filing, for example, features more detailed information on stock-based compensation and its impact on contributed capital.

Microsoft's reporting reflects enhanced disclosure of AOCI components, particularly foreign currency translation adjustments.

The Role of Regulatory Bodies

The Securities and Exchange Commission (SEC) is actively monitoring the implementation of these new reporting requirements.

The goal is to improve the transparency and comparability of financial statements across different companies.

Companies failing to comply with these standards face potential penalties and legal repercussions.

Challenges and Opportunities

While these changes enhance transparency, they also present challenges.

Some companies may struggle to accurately implement the new requirements, leading to potential errors in financial reporting.

However, these changes also offer opportunities for investors to gain a deeper understanding of a company's financial position and make more informed decisions.

Next Steps and Ongoing Developments

Investors should immediately familiarize themselves with the revised reporting requirements for the Statement of Stockholders' Equity.

Consulting with financial advisors and carefully reviewing company filings are crucial steps.

The FASB is expected to issue further guidance on this topic in the coming months, so stay informed.

.jpg)