Income Tax Slab India 2017 18 Calculator

The aroma of freshly brewed chai filled the air as Mrs. Sharma, a retired school teacher, hunched over a stack of papers illuminated by the soft glow of a desk lamp. The year is 2017, and like millions of Indians, she’s meticulously calculating her income tax for the financial year 2017-18. A slight furrow etched on her brow speaks volumes - navigating the nuances of tax slabs can be quite the annual ritual.

Understanding the income tax slabs for the financial year 2017-18 in India is crucial for every taxpayer to accurately compute their tax liability and plan their finances effectively. This article aims to demystify those slabs, providing clarity and context to help you understand your tax obligations during that period.

The Income Tax Landscape in 2017-18

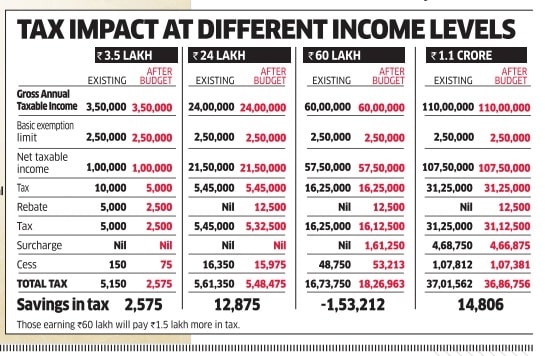

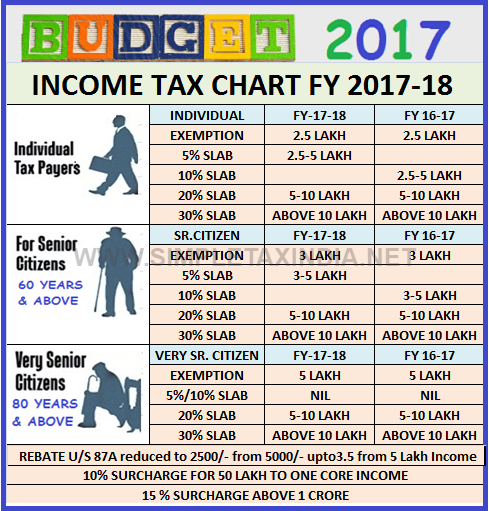

The financial year 2017-18 (Assessment Year 2018-19) was a period of relative stability in India’s tax regime, without any major structural changes from the previous year.

The tax rates and slabs remained consistent, providing a predictable framework for taxpayers.

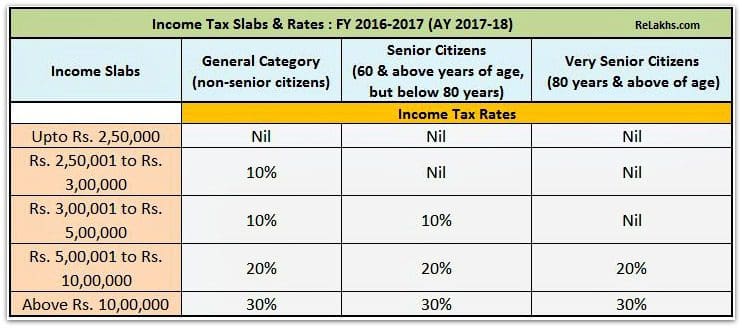

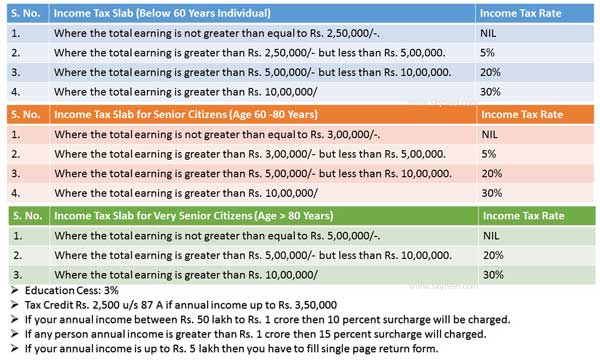

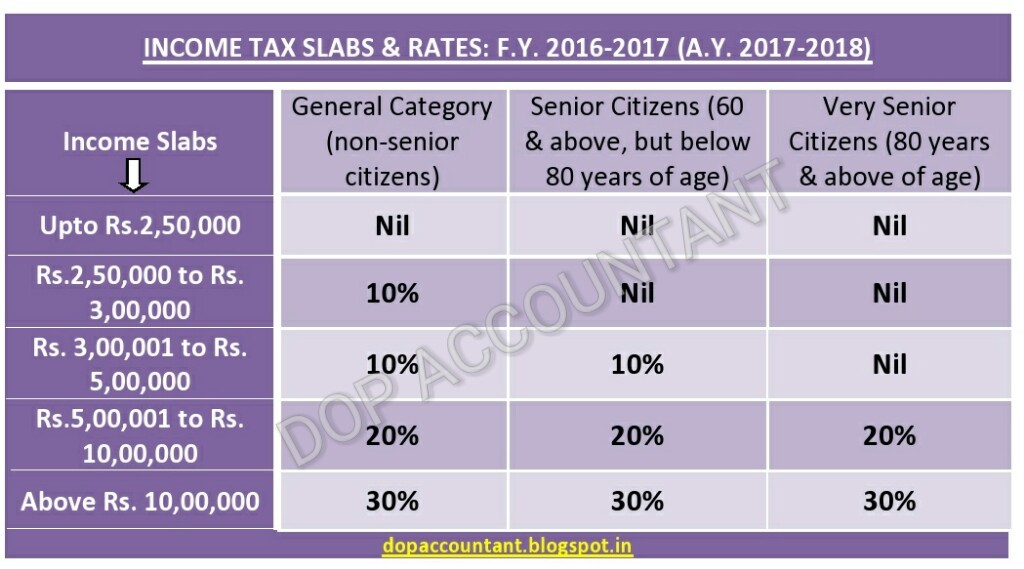

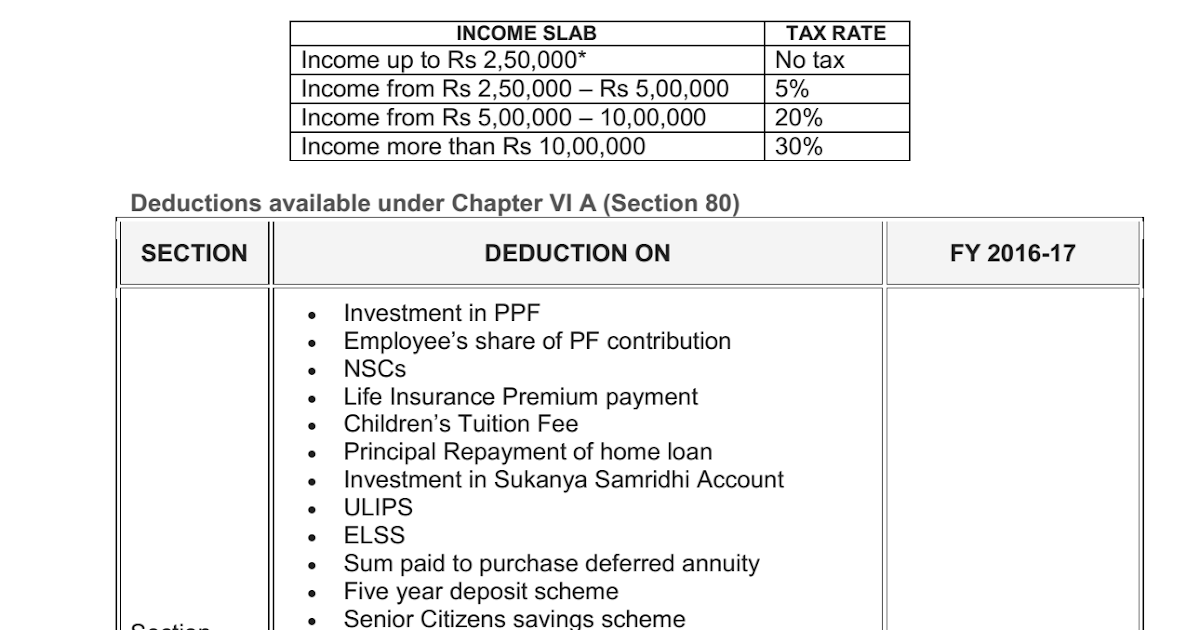

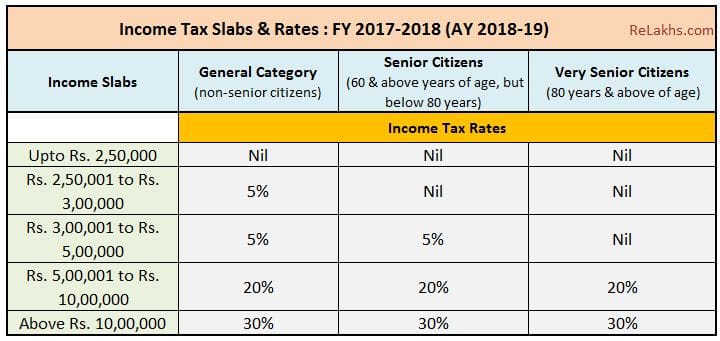

Income Tax Slabs for Individuals Below 60 Years

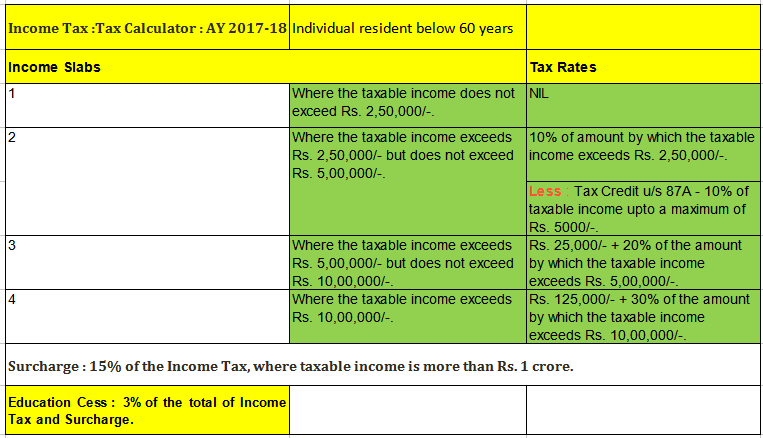

For individuals below the age of 60, the income tax slabs were structured as follows:

* Up to ₹2,50,000: Nil

* ₹2,50,001 to ₹5,00,000: 5%

* ₹5,00,001 to ₹10,00,000: 20%

* Above ₹10,00,000: 30%

A 3% education cess was also applicable on the income tax amount.

Income Tax Slabs for Senior Citizens (60-80 Years)

Senior citizens, aged between 60 and 80 years, enjoyed a slightly higher basic exemption limit.

This was a measure to provide some financial relief to this age group.

* Up to ₹3,00,000: Nil

* ₹3,00,001 to ₹5,00,000: 5%

* ₹5,00,001 to ₹10,00,000: 20%

* Above ₹10,00,000: 30%

Again, the 3% education cess applied to the calculated tax.

Income Tax Slabs for Super Senior Citizens (Above 80 Years)

Super senior citizens, those above 80 years of age, had the highest basic exemption limit.

This offered them the most significant tax benefit.

* Up to ₹5,00,000: Nil

* ₹5,00,001 to ₹10,00,000: 20%

* Above ₹10,00,000: 30%

The 3% education cess was also applicable.

Using an Income Tax Calculator

Given the slabs and various deductions available, calculating income tax manually can be tedious. Many online income tax calculators were available during that period, provided by both government and private entities.

These calculators simplified the process by automatically applying the correct tax rates and slabs based on the user's input of their income and eligible deductions.

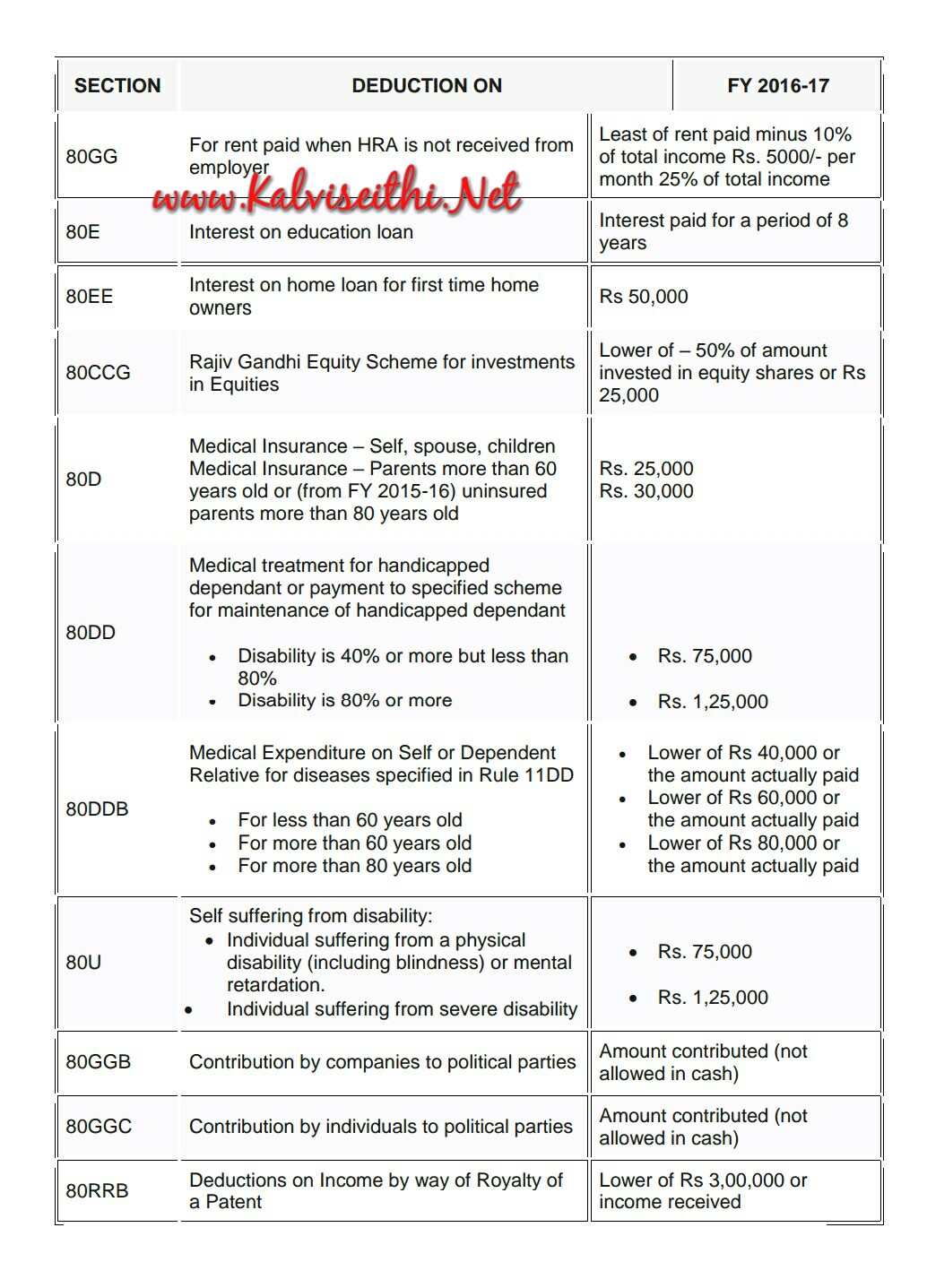

Understanding the applicable deductions under sections like 80C, 80D, and others was also vital for minimizing tax liability.

The Significance of Tax Planning

Effective tax planning is not just about calculating your tax liability; it's about optimizing your financial strategy to minimize your tax burden legally.

Understanding the provisions of the Income Tax Act, making informed investment decisions, and claiming all eligible deductions are crucial components of sound tax planning.

Individuals like Mrs. Sharma understood the value of meticulous documentation and claiming every legitimate deduction.

Looking Back

While the income tax slabs of 2017-18 are now a matter of record, they highlight the continuous need for financial literacy and responsible tax planning.

Taxation policies evolve, but the principles of understanding your obligations and managing your finances wisely remain constant.

As Mrs. Sharma finishes her calculations, a sense of accomplishment washes over her. It’s not just about paying taxes; it’s about contributing to the nation’s progress and securing her own financial future.

![Income Tax Slab India 2017 18 Calculator Income Tax Calculator for FY 2017-18 [AY 2018-19] - Excel Download](http://apnaplan.com/wp-content/uploads/2017/02/Income-Tax-Slab-for-FY-2017–18-AY-2018-19-1024x441.png)

![Income Tax Slab India 2017 18 Calculator Download Income Tax Calculator for FY 2016-17 [AY 2017-18]](https://i2.wp.com/apnaplan.com/wp-content/uploads/2016/02/Income-Tax-Slabs-for-FY-2016–17-1024x426.png?fit=757%2C315)