Independent Auditors Express An Opinion On The

The financial stability of GlobalTech Industries hangs in the balance as independent auditors issue a qualified opinion on the company's latest financial statements. The revelation has sent shockwaves through the investment community, raising serious questions about the accuracy and reliability of GlobalTech's reported earnings and asset valuations. This development could trigger a domino effect, impacting shareholder confidence, regulatory scrutiny, and the overall future of the multinational corporation.

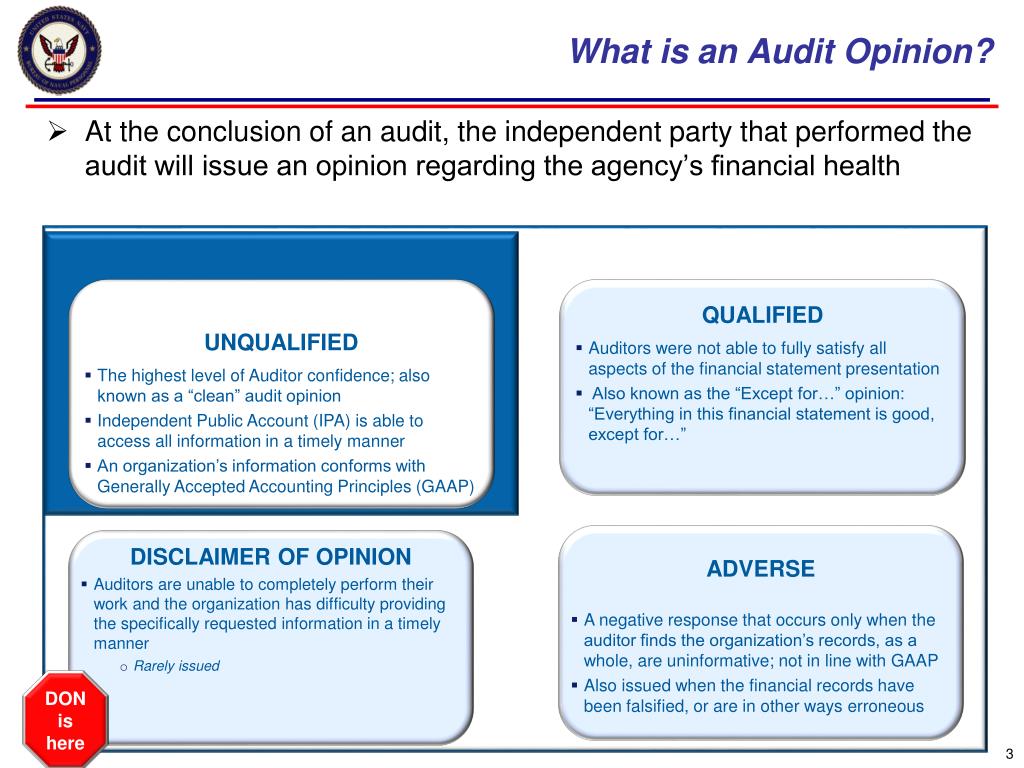

At the heart of this controversy is a divergence of opinion between GlobalTech's management and the independent auditing firm, Miller & Zois. A qualified opinion, as opposed to an unqualified or "clean" opinion, signifies that the auditors found material misstatements or were unable to obtain sufficient appropriate audit evidence to form an opinion on certain aspects of the financial statements. This article delves into the specific areas of concern highlighted by Miller & Zois, examines the potential repercussions for GlobalTech and its stakeholders, and analyzes the broader implications for corporate governance and financial transparency.

Key Concerns Raised by the Auditors

Miller & Zois's qualified opinion centers primarily around GlobalTech's accounting practices related to its overseas subsidiaries. Specifically, the auditors expressed reservations regarding the valuation of assets held by GlobalTech's operations in South America. They were unable to independently verify the fair market value of certain land holdings and equipment due to political instability and lack of reliable market data in the region.

Furthermore, the auditors raised concerns about the recognition of revenue from several large contracts. Miller & Zois stated that they lacked sufficient evidence to confirm that revenue recognition criteria, as outlined in accounting standards, had been consistently applied. These contracts, which represent a significant portion of GlobalTech's reported revenue, are now under intense scrutiny.

Adding to the complexity, the qualified opinion also mentions inadequate internal controls related to financial reporting at some of GlobalTech's international offices. This raises concerns about the potential for errors and irregularities in the company's financial statements. The auditors emphasized the need for GlobalTech to strengthen its internal control environment to ensure accurate and reliable financial reporting in the future.

GlobalTech's Response

In response to the qualified opinion, GlobalTech issued a statement defending its accounting practices. The company maintains that its financial statements accurately reflect its financial position and results of operations. They also stated that they are working diligently to address the concerns raised by Miller & Zois and are confident that they can resolve the issues in a timely manner.

"We are fully cooperating with Miller & Zois to provide them with the information they need to complete their audit," said John Smith, GlobalTech's Chief Financial Officer, in the company's official statement. "We believe that our accounting practices are sound and in accordance with generally accepted accounting principles."

However, this response has done little to quell the anxiety among investors and analysts. Many are skeptical of GlobalTech's reassurances, particularly given the seriousness of the concerns raised by the independent auditors.

Impact on Stakeholders

The qualified opinion has had an immediate and significant impact on GlobalTech's stakeholders. The company's stock price plummeted following the announcement, wiping out billions of dollars in market capitalization. Investors are now facing substantial losses, and many are questioning the long-term viability of their investment in GlobalTech.

Beyond shareholders, the qualified opinion also poses a threat to GlobalTech's employees. A decline in the company's financial performance could lead to layoffs and reduced compensation. The uncertainty surrounding the company's future is creating anxiety among the workforce.

The repercussions extend to GlobalTech's customers and suppliers as well. Customers may be hesitant to enter into long-term contracts with a company facing financial uncertainty. Suppliers may be concerned about the company's ability to pay its bills, potentially disrupting the supply chain.

Regulatory Scrutiny and Potential Legal Ramifications

The qualified opinion is likely to attract the attention of regulatory agencies, including the Securities and Exchange Commission (SEC). The SEC has the authority to investigate companies that may have violated securities laws. If the SEC finds evidence of wrongdoing, it could impose significant penalties on GlobalTech and its executives.

In addition to regulatory scrutiny, GlobalTech also faces the risk of shareholder lawsuits. Shareholders who have suffered losses as a result of the qualified opinion may file lawsuits against the company, alleging that it misled investors about its financial condition. Such lawsuits could be costly to defend and could result in substantial damages being awarded to shareholders.

The qualified opinion also raises questions about the role and responsibilities of the audit committee of GlobalTech's board of directors. The audit committee is responsible for overseeing the company's financial reporting process and ensuring that the company's financial statements are accurate and reliable. The committee's oversight will undoubtedly come under scrutiny in the wake of this development.

Looking Ahead: Restoring Confidence and Ensuring Transparency

GlobalTech faces a challenging path forward. The company must take decisive action to address the concerns raised by Miller & Zois and to restore confidence among its stakeholders. This will require a commitment to transparency, accountability, and ethical behavior.

The first step is for GlobalTech to conduct a thorough review of its accounting practices and internal controls. The company must identify and correct any weaknesses in its financial reporting system. It must also ensure that its employees are properly trained and equipped to comply with accounting standards.

Ultimately, the future of GlobalTech depends on its ability to regain the trust of its stakeholders. By demonstrating a commitment to transparency, accountability, and ethical behavior, the company can begin to rebuild its reputation and restore its financial stability.

However, this situation serves as a stark reminder of the importance of independent audits and the crucial role they play in ensuring the integrity of financial markets. It also highlights the need for companies to prioritize strong internal controls and to maintain open and honest communication with their auditors.