Interest Free Financing For Home Improvement

The scent of freshly cut wood hangs in the air, mingling with the sweet aroma of newly applied paint. Sunlight streams through a sparkling new window, illuminating dust motes dancing in the air of what was once a dim, neglected room. A young couple, Sarah and Tom, stand back, hand-in-hand, surveying their transformed living room – a testament to hard work, careful planning, and a surprising financial tool: interest-free financing.

Home improvement projects, often a source of stress and financial strain, are becoming more accessible thanks to the growing availability of interest-free financing options. These programs are designed to help homeowners tackle essential renovations, repairs, and upgrades without the burden of accumulating high-interest debt.

The Rise of Interest-Free Home Improvement

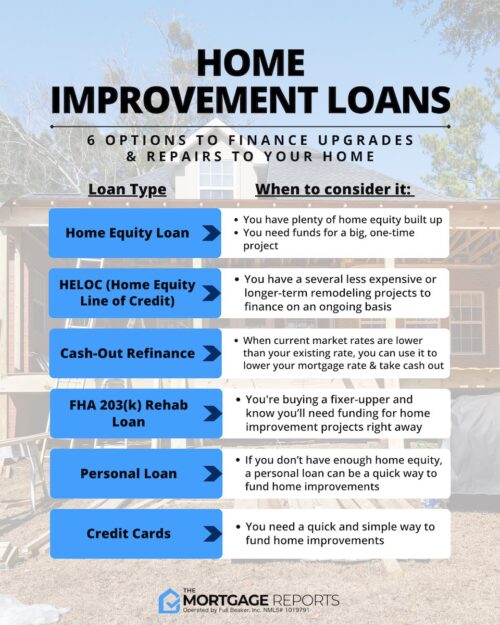

For years, homeowners have relied on traditional methods to finance their home improvement dreams: savings, credit cards, and home equity loans. Each of these options presents its own set of challenges. Savings can be depleted quickly, credit cards often carry exorbitant interest rates, and home equity loans require a significant amount of equity and can be difficult to qualify for.

Interest-free financing offers an alternative, typically structured as a promotional period where no interest accrues on the borrowed amount. This can be a game-changer for homeowners on a budget, allowing them to spread out the cost of their project over time without the added expense of interest charges.

The Mechanics of Interest-Free Financing

Interest-free financing isn't free money; it's a carefully structured financial product. Many retailers and contractors partner with financing companies to offer these deals. The details can vary, but the general principle remains the same.

Homeowners apply for a line of credit or a loan through the partner company. If approved, they can use the funds to pay for their home improvement project. The catch? They must repay the full amount within the promotional period, which can range from a few months to several years.

If the balance isn't paid off by the end of the promotional period, interest typically accrues retroactively from the date of purchase, and often at a high rate. This "deferred interest" is a crucial detail to understand before committing to this type of financing.

Who Benefits from Interest-Free Options?

Interest-free financing is particularly beneficial for homeowners who are disciplined with their finances and confident in their ability to repay the borrowed amount within the allotted timeframe. It can be a powerful tool for managing cash flow and avoiding high-interest debt.

Families facing urgent repairs, such as a leaky roof or a broken HVAC system, can also benefit significantly. It allows them to address the problem immediately without having to wait until they've saved up the full amount.

According to a recent report by the National Association of Home Builders (NAHB), the average cost of a kitchen remodel is upwards of $25,000. Interest-free financing can make such a project attainable for a broader range of homeowners.

Navigating the Fine Print

While interest-free financing can be attractive, it's crucial to approach it with a healthy dose of skepticism and a thorough understanding of the terms and conditions. Read the fine print carefully, paying close attention to the interest rate that applies after the promotional period ends.

Be aware of any fees associated with the financing, such as origination fees or late payment penalties. Understand the consequences of missing a payment or failing to repay the balance in full within the promotional period.

Consider your own financial situation and ability to repay the loan on time. If you're prone to overspending or have difficulty managing your finances, interest-free financing may not be the right choice for you.

Alternatives to Interest-Free Financing

Before committing to interest-free financing, explore other options that may be more suitable for your needs. A personal loan, for example, may offer a lower overall interest rate, even if it's not interest-free.

A home equity line of credit (HELOC) can be a good option if you have sufficient equity in your home, but be aware that your home will be used as collateral. Government programs, such as those offered by the Federal Housing Administration (FHA), may provide grants or low-interest loans for specific types of home improvements, such as energy-efficient upgrades.

Saving up the necessary funds is always the best option, but it may not be feasible for urgent repairs or time-sensitive projects. Consult with a financial advisor to determine the best financing strategy for your individual circumstances.

Real-World Examples and Success Stories

Many homeowners have successfully utilized interest-free financing to improve their homes and enhance their quality of life. Take, for instance, Maria, a single mother who needed to replace her aging furnace. She secured interest-free financing through a local HVAC company, allowing her to spread the cost over 18 months.

By making regular payments, Maria was able to avoid the high-interest charges associated with a credit card or a payday loan. Her family now enjoys a warm and comfortable home without the stress of overwhelming debt.

These success stories highlight the potential benefits of interest-free financing, but they also underscore the importance of responsible financial planning and diligent repayment.

The Future of Home Improvement Financing

The demand for home improvement financing is expected to continue to grow as homeowners seek to upgrade their properties and increase their value. Interest-free financing is likely to become an increasingly popular option, particularly among younger homeowners who are more comfortable with online financing and promotional offers.

As the market evolves, consumers can expect to see more innovative financing products and greater competition among lenders. This could lead to more favorable terms and greater flexibility for homeowners.

However, it's essential to remain vigilant and informed, always reading the fine print and understanding the potential risks and rewards of any financing option.

A Word of Caution and a Final Thought

Interest-free financing can be a powerful tool for transforming your home, but it's not a magic bullet. It requires careful planning, disciplined budgeting, and a commitment to repaying the loan on time. Approached responsibly, it can turn daunting renovations into manageable projects, bringing comfort, value, and a renewed sense of pride to your home.

Remember Sarah and Tom, standing hand-in-hand, admiring their transformed living room? Their success story is not just about the new paint and the sparkling windows. It's about the careful planning, the informed decisions, and the responsible use of a financial tool that helped them achieve their dream. A dream now tangible, a reality built not just with hammers and nails, but with a thoughtful approach to financing their future.