Interest Rates Are Expressed As A Percentage Of

Imagine strolling through a bustling marketplace. Vendors call out prices for their wares – "Two apples for a dollar!" or "This scarf, half the price!" Each transaction boils down to a simple, yet profound concept: value relative to a whole. Similarly, in the vast and often intimidating world of finance, a seemingly simple phrase, "interest rates are expressed as a percentage of," underpins nearly every borrowing, lending, and investment decision we make.

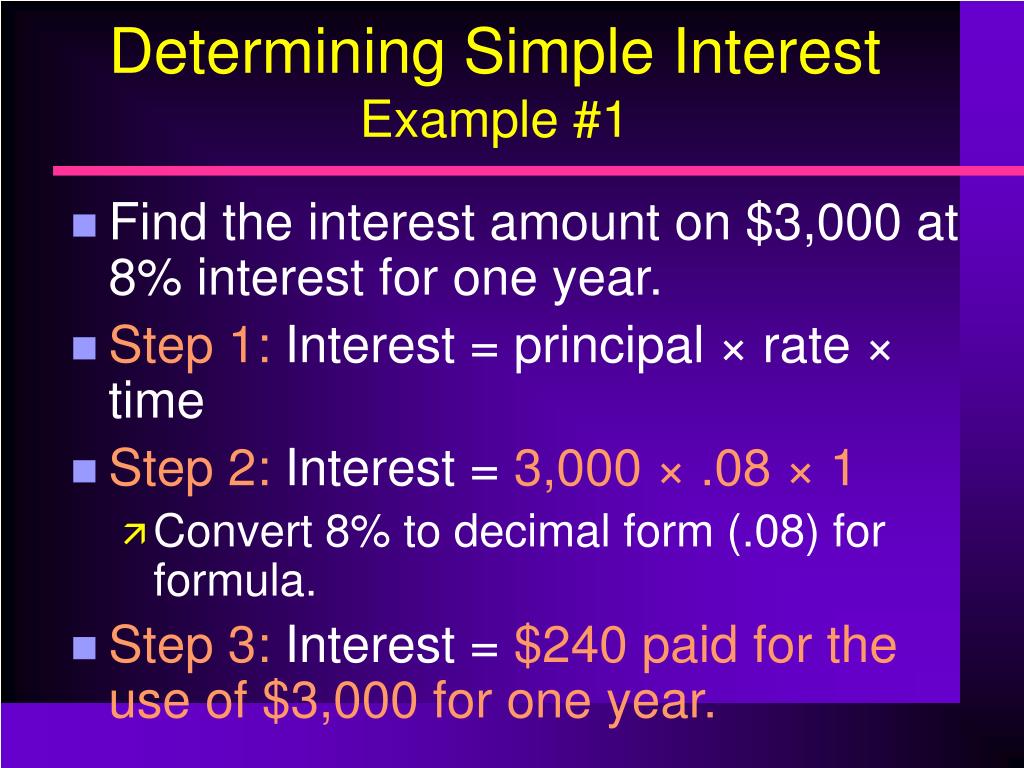

At its core, the statement "interest rates are expressed as a percentage of" means that the cost of borrowing money, or the reward for lending it, is calculated as a proportion of the principal amount. This percentage represents the annual rate at which interest accrues, offering a standardized and universally understood way to compare different financial products and make informed decisions.

Decoding the Percentage: A Foundation of Finance

To understand why expressing interest rates as a percentage is so crucial, we need to delve into the fundamental purpose of interest. Interest serves two primary roles: compensating the lender for the risk of not being repaid and accounting for the time value of money – the idea that money available today is worth more than the same amount in the future due to its potential earning capacity.

Without a standardized way to express this compensation, comparing loans and investments would be nearly impossible. Imagine trying to choose between two loans: one charging "a lot" and another charging "a bit more." The ambiguity makes informed decision-making a nightmare.

A Historical Perspective

The concept of interest, and its expression in a standardized form, has roots stretching back to ancient civilizations. Early forms of lending, often involving agricultural products, involved compensation for the use of those goods, effectively acting as an early form of interest. As societies developed, so did financial instruments, requiring clearer and more consistent methods of calculating and communicating the cost of borrowing.

The rise of modern banking in the medieval and Renaissance periods solidified the need for standardized interest rate calculations. Merchants and financiers needed a clear way to understand the cost of loans and the returns on investments, leading to the development of sophisticated financial systems that relied heavily on percentage-based interest rates.

How Interest Rates Impact Our Lives

Interest rates, expressed as a percentage, ripple through nearly every aspect of our financial lives. They influence the cost of mortgages, car loans, credit card debt, and even the returns on our savings accounts and investments. Understanding how these rates work is essential for making sound financial choices.

For example, a lower mortgage interest rate, even by a fraction of a percentage point, can save tens of thousands of dollars over the life of a loan. Similarly, a higher interest rate on a savings account can significantly boost your returns over time, allowing your money to grow more quickly.

The Role of Central Banks

Central banks, such as the Federal Reserve in the United States or the European Central Bank, play a critical role in influencing interest rates within an economy. They use various tools, including adjusting the federal funds rate or the discount rate, to manage inflation, promote economic growth, and maintain financial stability.

When a central bank raises interest rates, it becomes more expensive for businesses and individuals to borrow money. This can help to slow down inflation by reducing spending and investment. Conversely, lowering interest rates can stimulate economic activity by making borrowing more attractive.

Different Types of Interest Rates

While the fundamental concept remains the same, interest rates manifest in various forms, each serving a specific purpose. Understanding these different types is crucial for navigating the financial landscape.

Fixed-rate interest rates remain constant throughout the term of a loan or investment, providing predictability and stability. Variable-rate interest rates, on the other hand, fluctuate based on changes in a benchmark rate, such as the prime rate or LIBOR (though LIBOR is being phased out).

Annual Percentage Rate (APR) is a broader measure of the cost of borrowing that includes not only the interest rate but also any fees or charges associated with the loan. It provides a more comprehensive picture of the true cost of borrowing.

"The power of understanding interest rates, expressed as a percentage, lies in its ability to empower individuals to make informed financial decisions. It's about taking control of your financial future."

The Future of Interest Rates

The future of interest rates is a topic of constant debate and speculation among economists and financial experts. Factors such as inflation, economic growth, technological advancements, and geopolitical events all play a role in shaping the trajectory of interest rates.

Currently, many economies are grappling with high inflation, leading central banks to raise interest rates in an attempt to curb price increases. However, these rate hikes also carry the risk of slowing down economic growth and potentially triggering a recession.

Navigating the Uncertainties

In an environment of fluctuating interest rates, it's more important than ever to carefully consider your financial decisions. Diversifying your investments, managing your debt wisely, and seeking professional financial advice can help you navigate the uncertainties and achieve your financial goals.

Furthermore, staying informed about economic trends and central bank policies can provide valuable insights into the potential direction of interest rates. Understanding the factors that influence these rates can empower you to make proactive adjustments to your financial strategy.

A Final Thought

The simple statement, "interest rates are expressed as a percentage of," unlocks a deeper understanding of the financial world. It's a key that opens doors to better borrowing, smarter investing, and ultimately, greater financial security.

By grasping this fundamental concept, we can move beyond being passive observers of the financial system and become active participants, shaping our own financial destinies. It's not just about numbers; it's about empowerment.

.jpg)

+NOMINAL+I%25:+interest+rate+expressed+in+terms+of+annual+amounts+currently+charged+for+interest%3B+not+adjusted+for+inflation..jpg)