Invesco India Small Cap Fund Review

Investors, take note: The Invesco India Small Cap Fund is under scrutiny. Performance dips and market volatility demand immediate attention from those invested in or considering this fund.

This review provides a snapshot of the fund’s recent performance, key portfolio changes, and expert opinions to help investors make informed decisions amidst uncertain market conditions. We break down the critical factors influencing the fund’s trajectory.

Fund Performance: A Closer Look

The Invesco India Small Cap Fund has experienced fluctuating returns in the past year. Recent data indicates a period of underperformance compared to its benchmark, the NIFTY Smallcap 250 TRI.

Specifically, the fund’s 1-year return is reported at approximately 28.34% (as of October 31, 2024) while the benchmark return for the same period is about 33.26%. This difference raises concerns among investors.

Over a 3-year horizon, the fund has delivered returns of 26.67%, while the benchmark has delivered 29.28%. Longer-term performance, however, is still respectable, but the recent trend warrants careful consideration.

Portfolio Adjustments: Key Changes

Invesco has made several adjustments to the fund's portfolio allocation in recent months. These shifts reflect the fund manager’s strategy to navigate the evolving market landscape.

Notably, there has been a reduction in exposure to sectors like consumer discretionary and an increase in sectors like healthcare and industrials. These tactical changes are aimed at capitalizing on emerging opportunities and mitigating risks.

Significant holdings within the portfolio include companies like Tube Investments of India Ltd and Blue Star Ltd. Changes in these holdings can significantly influence the fund's overall performance.

Expert Opinions: What Analysts are Saying

Market analysts are divided on the future prospects of the Invesco India Small Cap Fund. Some believe the recent underperformance is a temporary blip, while others suggest a more cautious approach.

“The small-cap space is inherently volatile,” notes analyst Rohan Mehta from Credence Analytics. “Investors should be prepared for short-term fluctuations, but long-term growth potential remains.”

Conversely, Priya Sharma of Quantum Securities advises, “Investors should review their risk tolerance and consider diversifying their portfolio if the fund's performance does not align with their investment goals.”

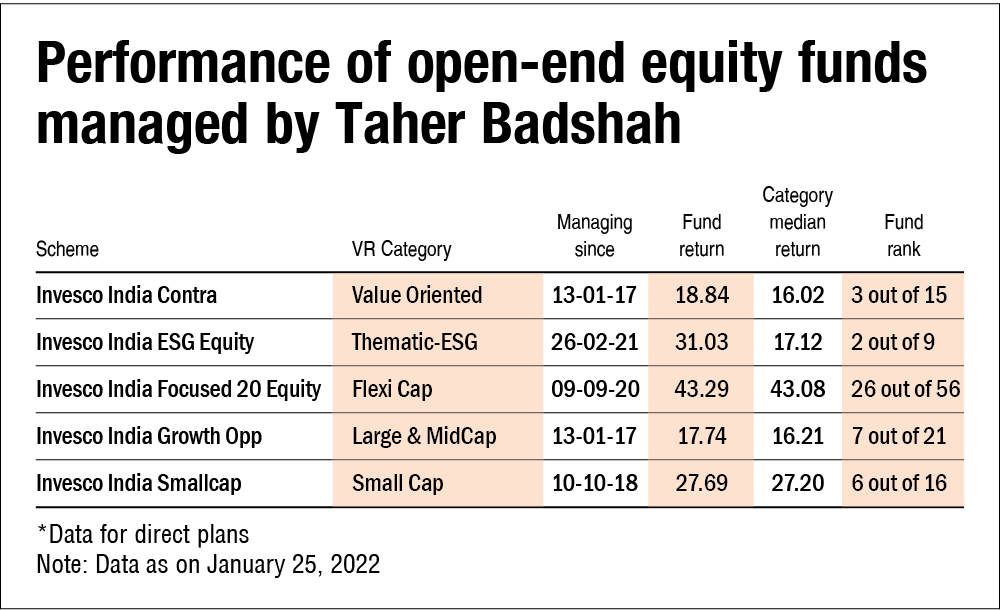

Expense Ratio and Fund Management

The fund's expense ratio stands at approximately 2.02% (as of October 31, 2024), which is relatively high compared to some of its peers. This factor eats into the overall returns.

The fund is managed by Taher Badshah. His investment decisions and stock-picking abilities are critical to the fund’s future performance.

Investors should closely monitor the fund manager's commentary and strategy updates to stay informed about the fund’s direction.

What Investors Should Do Now

Given the current situation, investors should carefully review their investment objectives and risk tolerance. Consider consulting with a financial advisor.

Continuously monitor the fund’s performance against its benchmark and peer group. Stay informed about any further portfolio adjustments.

The Invesco India Small Cap Fund's future hinges on its ability to adapt to market dynamics and deliver consistent returns. Watch for upcoming announcements from Invesco regarding fund strategy and performance reviews.