Is 636 A Good Credit Score To Buy A House

For many Americans, owning a home represents the pinnacle of financial stability and the fulfillment of a lifelong dream. But navigating the complexities of mortgage applications can be daunting, particularly when it comes to understanding the role of credit scores.

A common question among prospective homebuyers is: "Is a 636 credit score good enough to buy a house?" The answer, as with many financial inquiries, isn't a simple yes or no, but rather depends on a multitude of factors. Understanding these nuances is crucial for anyone hoping to secure a mortgage with favorable terms.

Understanding the Credit Score Landscape

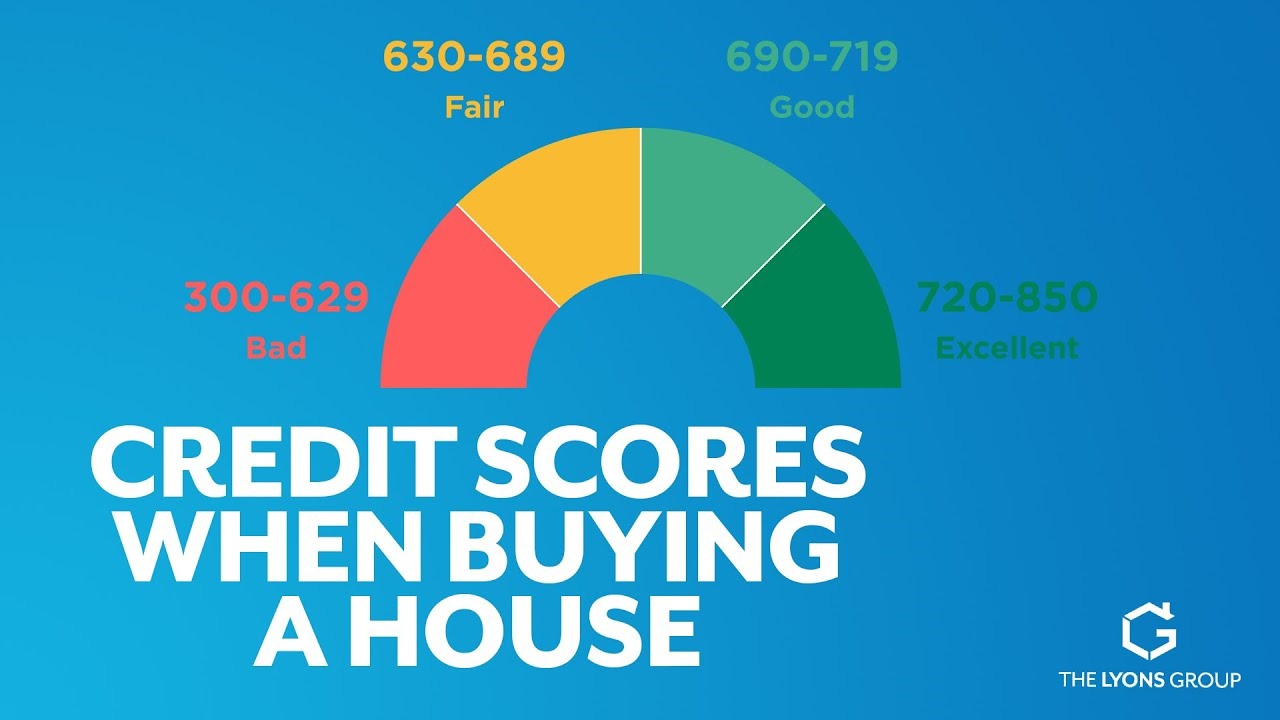

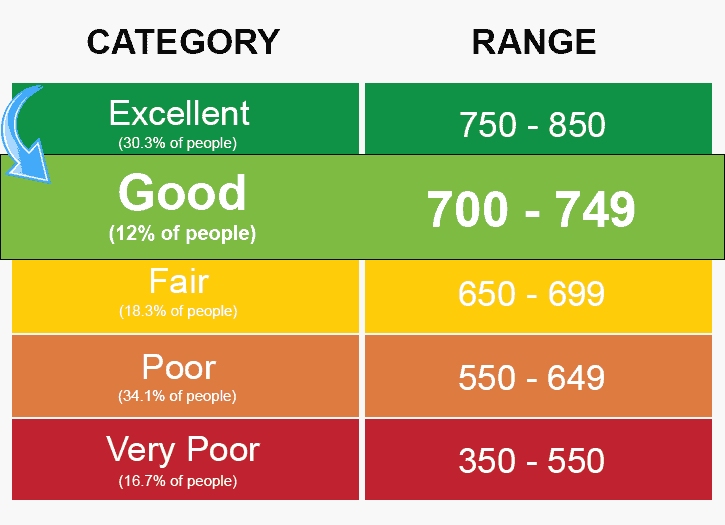

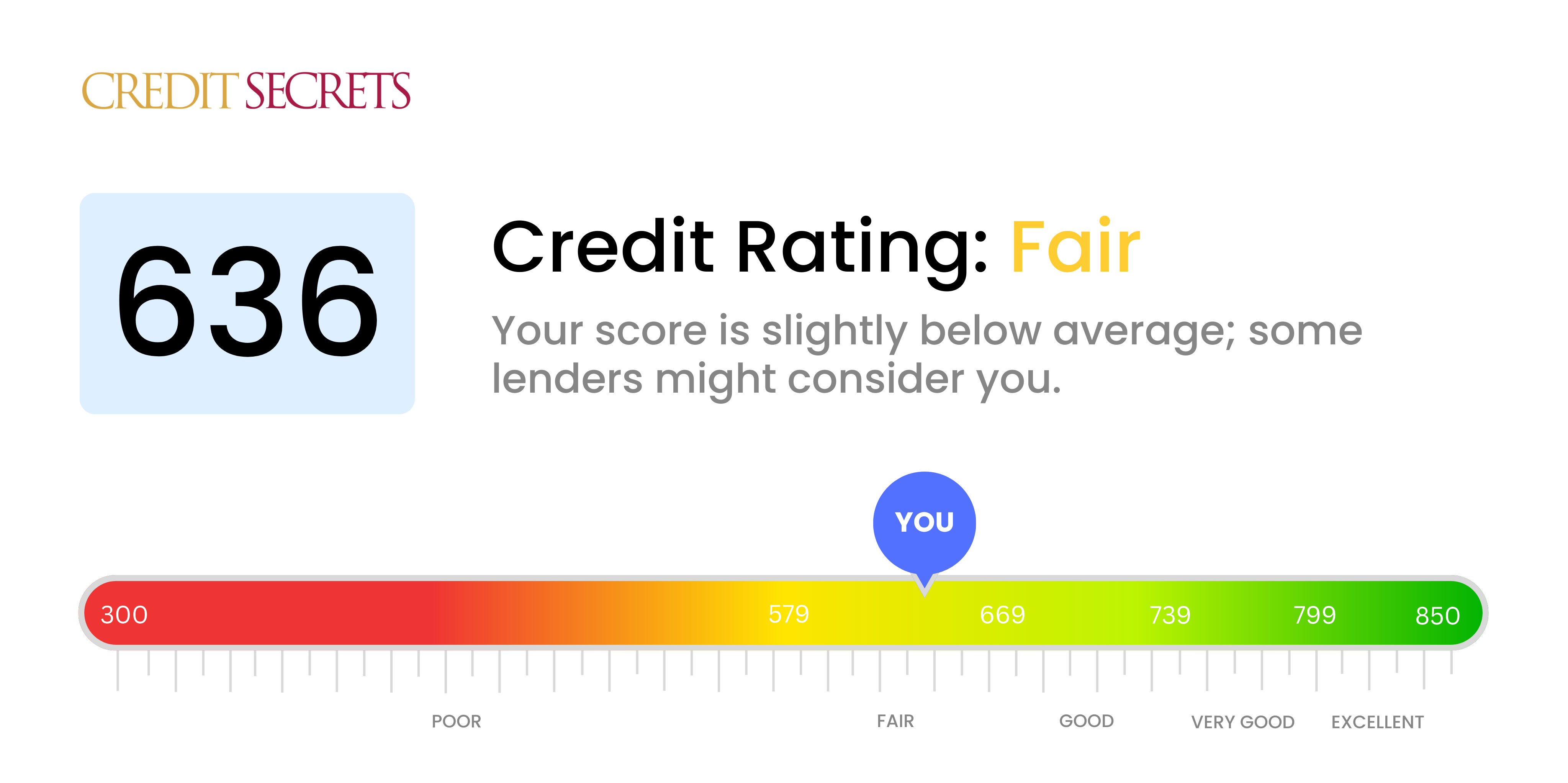

A 636 credit score falls within the "fair" credit score range, according to the widely used FICO scoring model. This score is above the subprime range but below what lenders consider "good" or "excellent." It signifies to lenders that while you have some credit history, there's also a moderate risk associated with lending you money.

According to Experian, the average FICO score in the United States hovers around 715. This places a 636 score noticeably below the national average, potentially impacting mortgage interest rates and loan options.

Impact on Mortgage Approval and Interest Rates

While a 636 credit score doesn't automatically disqualify you from obtaining a mortgage, it will likely limit your options and lead to higher interest rates. Lenders view borrowers with lower credit scores as higher risk, and they compensate for that risk by charging more in interest.

Freddie Mac data consistently shows a direct correlation between credit scores and mortgage rates. Borrowers with lower credit scores typically pay significantly more over the life of their loan compared to those with excellent credit.

The difference can be substantial. For instance, a borrower with a 760 credit score might qualify for a 6% interest rate, while someone with a 636 score might face rates closer to 7.5% or higher, depending on the lender and the prevailing market conditions. This seemingly small difference can translate to tens of thousands of dollars in additional costs over a 30-year mortgage.

Factors Beyond the Credit Score

Your credit score is not the only factor that lenders consider. Other crucial elements include your debt-to-income ratio (DTI), down payment amount, and employment history.

A lower DTI, meaning you have less debt compared to your income, can offset the risk associated with a lower credit score. A larger down payment also demonstrates financial stability and reduces the lender's exposure to potential losses. Consistent employment history is equally important as it proves the applicant’s ability to repay the loan.

The U.S. Department of Housing and Urban Development (HUD) offers resources and programs to assist first-time homebuyers, particularly those with less-than-perfect credit. These programs may provide down payment assistance or offer alternative lending options.

Strategies for Improvement

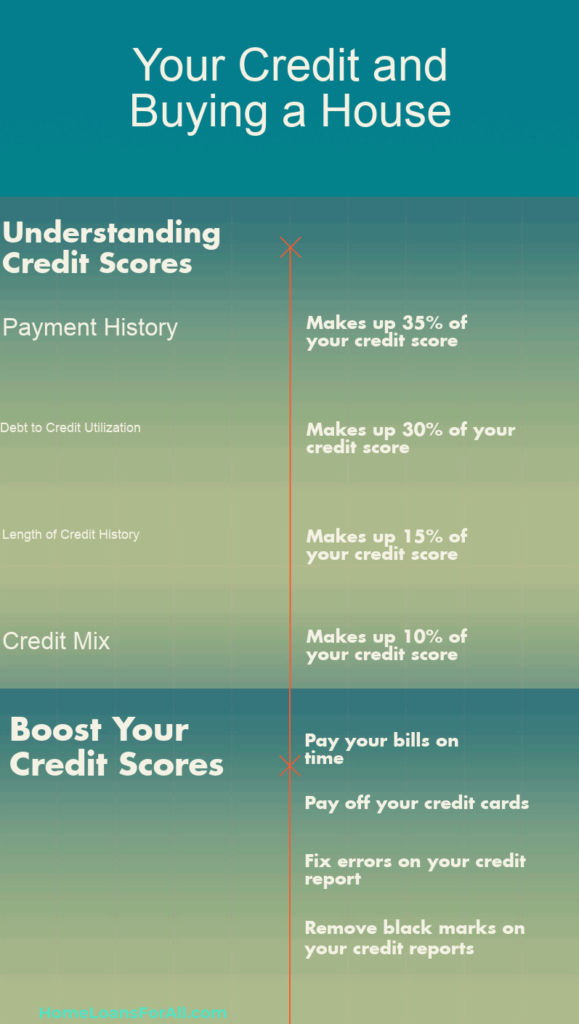

If you have a 636 credit score and are planning to buy a house, there are steps you can take to improve your score before applying for a mortgage. These actions can lead to better rates and more favorable loan terms.

Focus on paying down debt, especially credit card balances, as this has a significant impact on your credit utilization ratio. Check your credit report for errors and dispute any inaccuracies. Avoid opening new credit accounts in the months leading up to your mortgage application.

Consider working with a credit counseling agency to develop a personalized plan for improving your credit. These agencies can provide valuable guidance and support as you navigate the complexities of credit management.

Conclusion

While a 636 credit score is not ideal for securing the best mortgage rates, it doesn't necessarily preclude you from buying a home. By understanding the factors that lenders consider and taking steps to improve your creditworthiness, you can increase your chances of approval and secure a mortgage that aligns with your financial goals.

Prospective homebuyers with "fair" credit should explore all available options, including government-backed loan programs, and carefully compare offers from multiple lenders. With diligent planning and proactive credit management, the dream of homeownership can still be within reach.