Is A Credit Score Of 629 Good

In a world increasingly governed by algorithms, a single three-digit number can unlock or barricade access to essential financial services. This number, your credit score, dictates everything from loan interest rates to apartment rentals and even job opportunities.

A score of 629, while not rock bottom, teeters on the edge, prompting the critical question: Is a 629 credit score good enough, or does it signal the need for immediate financial intervention?

This article delves into the nuances of a 629 credit score, dissecting its implications, exploring expert opinions, and providing actionable steps for improvement.

Understanding the Credit Score Landscape

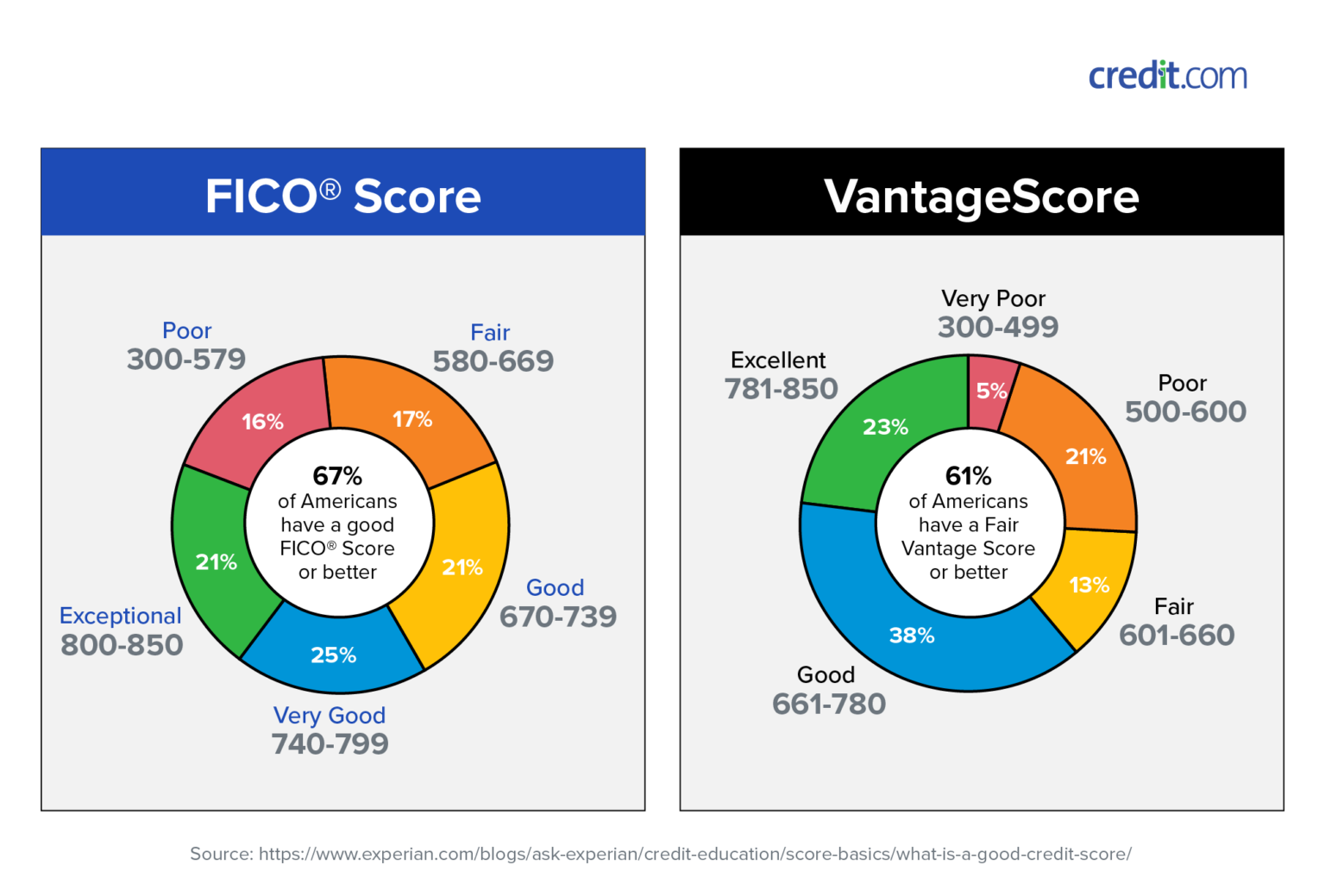

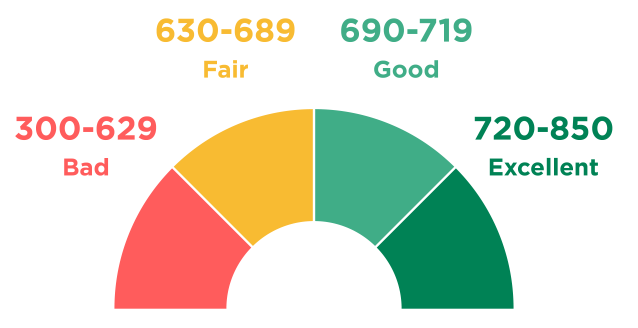

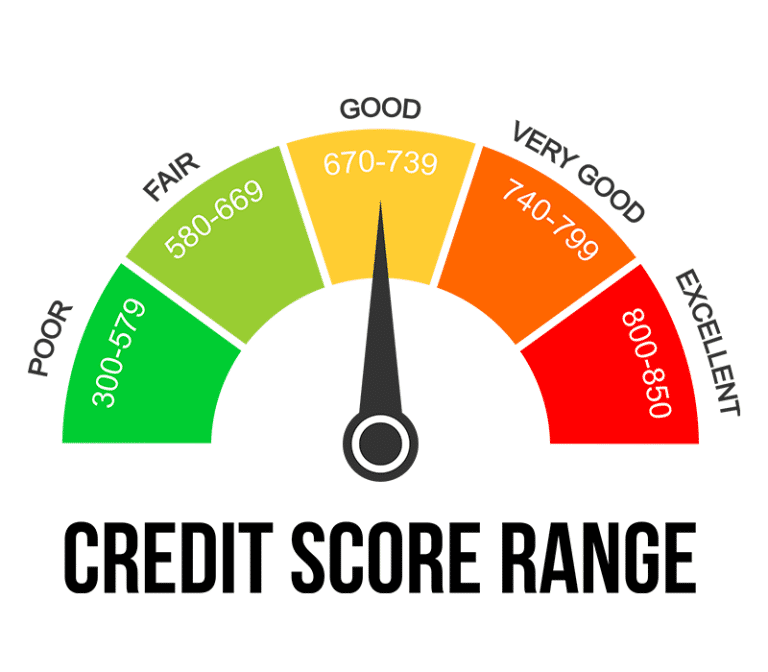

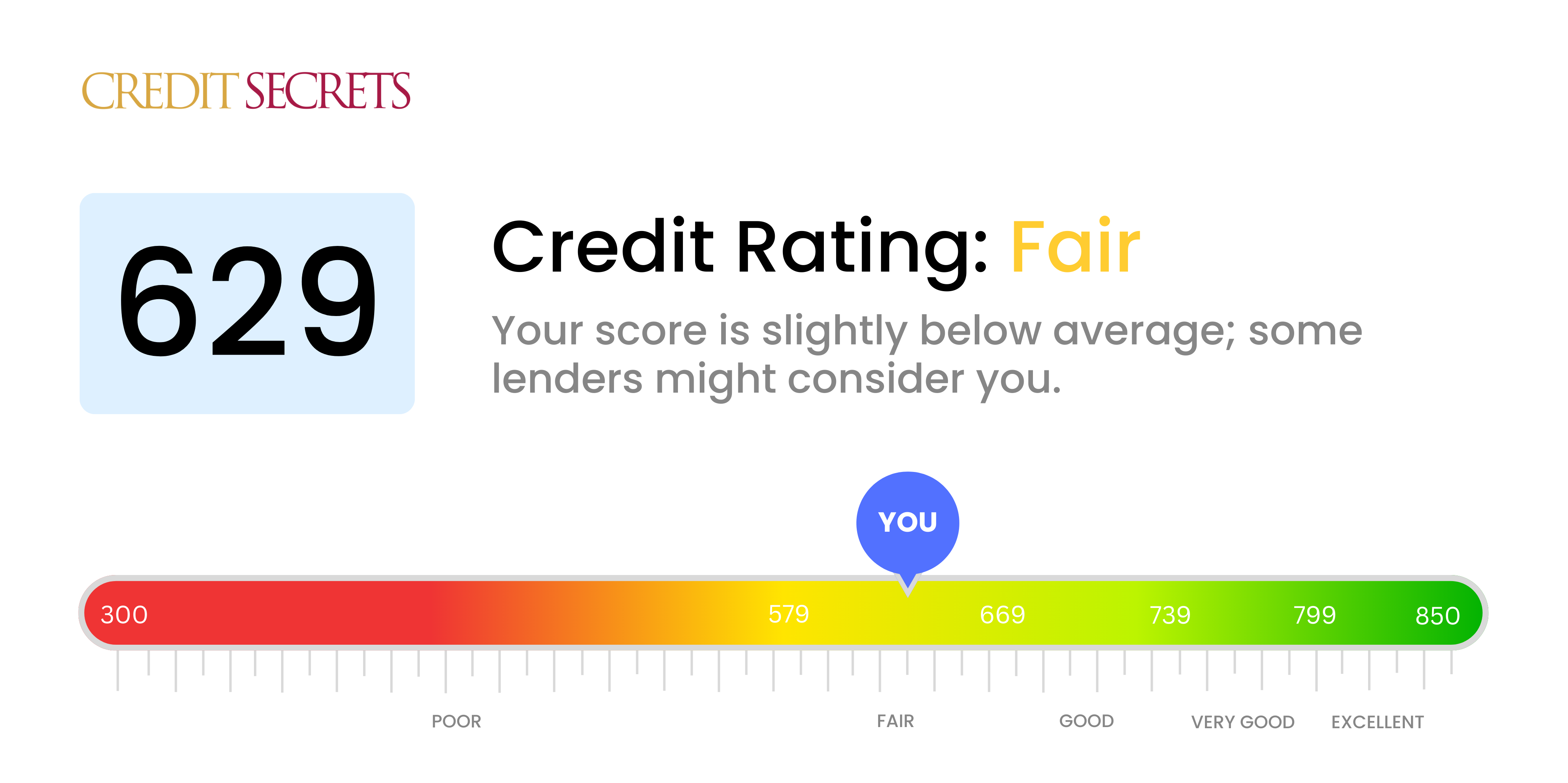

Credit scores, primarily FICO scores, range from 300 to 850. The higher the score, the lower the perceived risk for lenders. This translates to better loan terms and increased financial opportunities.

According to Experian, one of the major credit bureaus, the scoring ranges are typically categorized as follows: Poor (300-579), Fair (580-669), Good (670-739), Very Good (740-799), and Exceptional (800-850).

A 629 score falls squarely within the "Fair" range. While not disastrous, it's a yellow flag indicating areas for improvement.

The Implications of a 629 Credit Score

A "Fair" credit score of 629 presents several tangible disadvantages. One of the most significant impacts is on loan interest rates. Lenders view individuals with fair credit as riskier borrowers.

This increased risk is offset by higher interest rates on credit cards, auto loans, and mortgages. The difference in interest rates between a "Fair" and "Good" credit score can amount to thousands of dollars over the life of a loan.

Beyond interest rates, a 629 score can also limit access to certain financial products. Some lenders may be hesitant to approve loans for individuals with scores below a certain threshold.

This can make it difficult to purchase a home, finance a car, or even secure a personal loan for necessary expenses. Furthermore, landlords often check credit scores when evaluating rental applications. A fair credit score might lead to denial or require a larger security deposit.

In some cases, employers may also review credit reports as part of the hiring process. While the practice is controversial and restricted in some states, a lower credit score can, unfairly, impact job prospects.

Expert Opinions on Credit Score Improvement

Financial experts universally agree that improving a fair credit score is a worthwhile endeavor. The benefits, from lower interest rates to increased financial opportunities, are substantial.

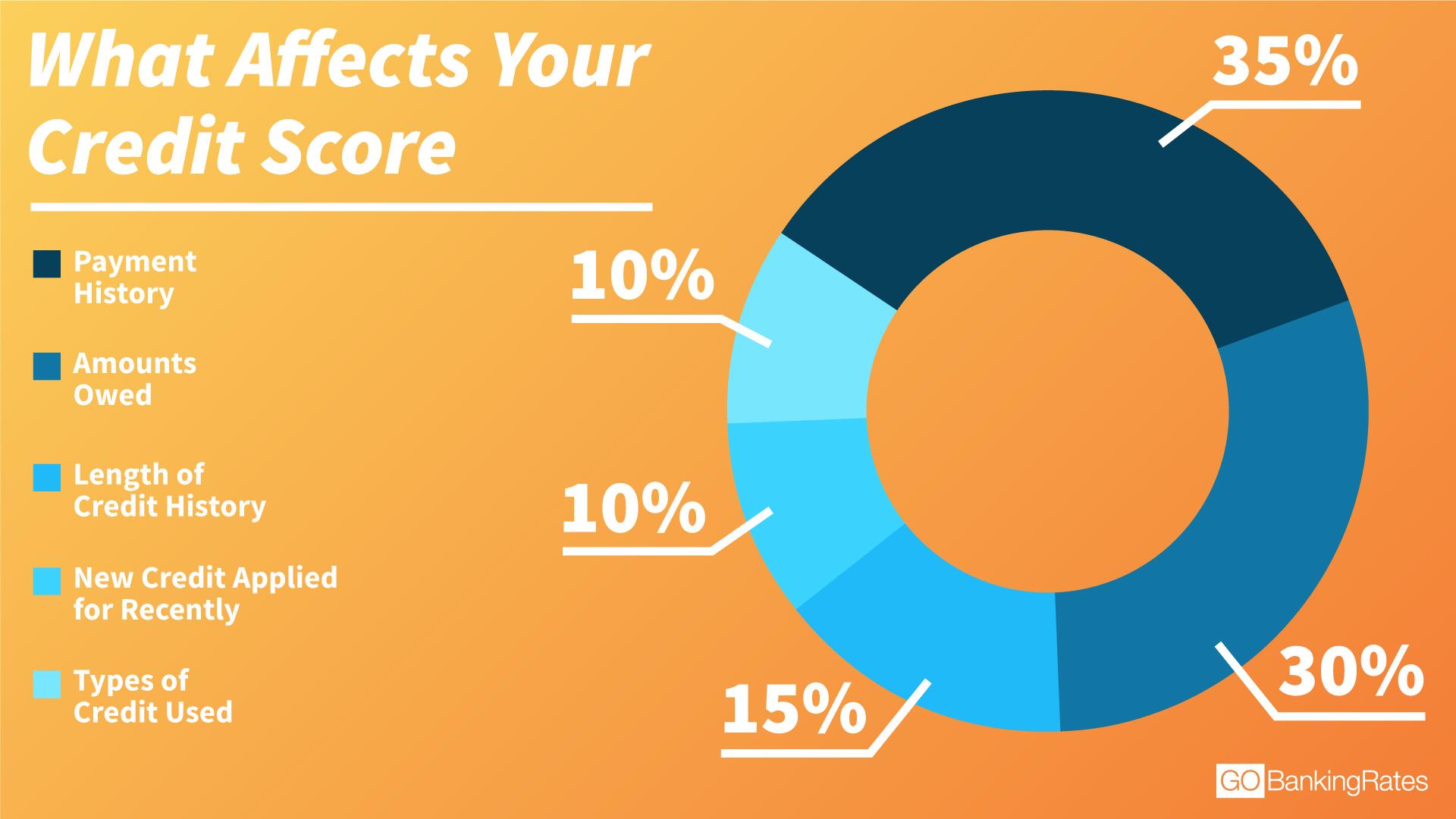

Ted Rossman, a senior industry analyst at CreditCards.com, emphasizes the importance of understanding the factors that influence your credit score. These factors typically include payment history, amounts owed, length of credit history, credit mix, and new credit.

“The first step is to obtain a copy of your credit report from each of the three major credit bureaus: Experian, Equifax, and TransUnion," says Rossman. "Carefully review these reports for any errors or inaccuracies.”

Disputing errors can lead to a quick boost in your credit score. Rod Griffin, Senior Director of Public Education and Advocacy at Experian, advises focusing on responsible credit management.

"The most important thing you can do to improve your credit score is to pay your bills on time, every time," Griffin states. "Payment history has the biggest impact on your credit score."

Keeping credit card balances low, ideally below 30% of the credit limit, is another crucial step. High credit utilization ratios signal increased risk to lenders. Avoid opening too many new credit accounts in a short period, as this can also negatively impact your score.

Strategies for Boosting Your Credit Score

Several strategies can be employed to improve a 629 credit score. One option is to become an authorized user on a credit card held by someone with a good credit history. This allows you to benefit from their responsible credit management.

However, it's important to choose someone you trust, as their credit behavior will impact your score. Another strategy is to apply for a secured credit card. These cards require a security deposit, which typically serves as the credit limit.

Responsible use of a secured credit card can help build or rebuild credit. Credit builder loans are another option. These loans are designed to help individuals with limited or poor credit establish a positive payment history.

The funds borrowed are held in a secured account, and the borrower makes regular payments. Once the loan is repaid, the funds are released, and the positive payment history is reported to the credit bureaus.

Tools like Experian Boost can also contribute to score improvements. Experian Boost allows you to link your bank accounts to your Experian credit report, adding on-time utility, cell phone, and streaming service payments to your credit history.

The Road Ahead: Improving Your Financial Future

While a 629 credit score isn't ideal, it's not a permanent sentence. With diligent effort and strategic planning, it's possible to improve your score and unlock better financial opportunities.

The key is to focus on building a positive credit history through responsible credit management. Regularly monitor your credit reports, address any errors, and prioritize on-time payments.

Improving your credit score is an investment in your financial future, paving the way for lower interest rates, greater access to credit, and increased financial stability. The journey may take time, but the rewards are well worth the effort.