Is Cash Advance America A Legitimate Company

Cash Advance America faces persistent scrutiny regarding its legitimacy, raising concerns for consumers seeking short-term financial solutions. Accusations of predatory lending practices plague the company, demanding careful evaluation before engaging with their services.

This article delves into the core of these allegations, examining Cash Advance America's operations, legal history, and customer experiences to provide a clear assessment of its legitimacy and potential risks to borrowers.

Background: Who is Cash Advance America?

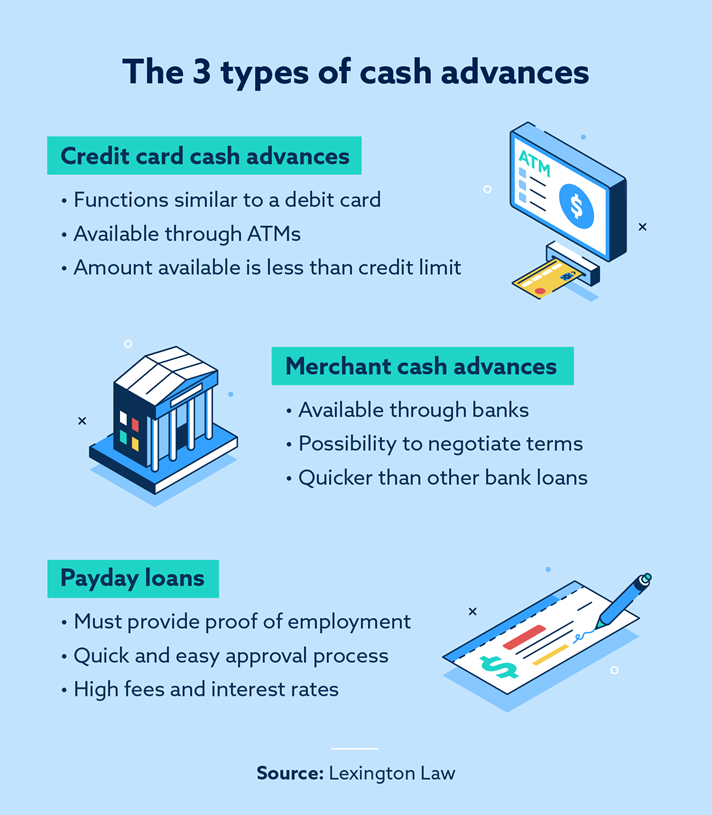

Cash Advance America, also operating under other names like Advance America, is a national provider of short-term loans, including payday loans, installment loans, and lines of credit. The company boasts a significant physical presence with brick-and-mortar stores across numerous states, alongside its online lending platform.

Founded in 1997, the company has grown into a major player in the non-bank financial services sector, catering to individuals with urgent cash needs and limited access to traditional banking options. This convenience, however, often comes at a high price.

The Core Issue: Predatory Lending Allegations

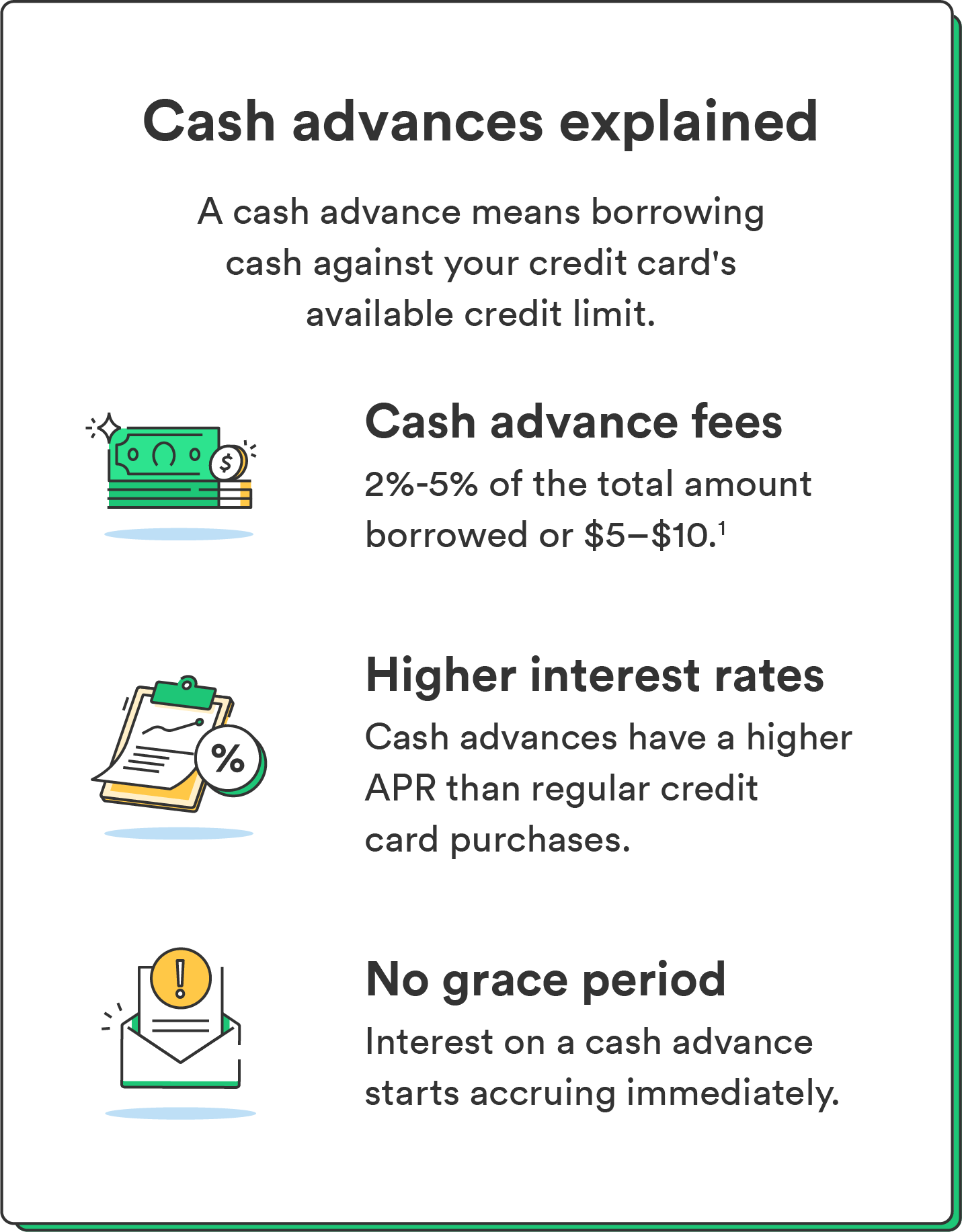

The central controversy surrounding Cash Advance America revolves around accusations of predatory lending. Critics argue that the company's high interest rates and fees trap borrowers in a cycle of debt, making it difficult to repay the loan and forcing them to take out additional loans to cover expenses.

Payday loans, in particular, are often cited as problematic due to their short repayment periods and extremely high Annual Percentage Rates (APRs), sometimes exceeding 300% or even higher. This financial burden can quickly escalate, causing significant hardship for vulnerable borrowers.

Legal Scrutiny and Settlements

Cash Advance America has faced numerous legal challenges and regulatory actions over the years related to its lending practices. Several states have investigated the company for violating usury laws, which set limits on interest rates.

In 2005, Advance America agreed to pay $18.75 million to settle a class-action lawsuit alleging that it charged excessive interest rates in Pennsylvania. Other settlements have been reached in different states, demonstrating a pattern of legal challenges related to lending practices.

Furthermore, the Consumer Financial Protection Bureau (CFPB) has actively scrutinized payday lenders, including Cash Advance America, implementing regulations aimed at protecting consumers from predatory lending practices. The effectiveness of these regulations remains a subject of debate.

Customer Experiences: A Mixed Bag

Customer reviews of Cash Advance America are mixed, reflecting the inherent risks associated with payday lending. Some customers praise the company for providing quick access to funds during emergencies, highlighting the convenience and speed of the loan application process.

However, many other customers report negative experiences, citing high interest rates, aggressive collection tactics, and a lack of transparency regarding loan terms. These complaints often echo concerns about the predatory nature of the loans.

Important Considerations: APRs and Loan Terms

Before considering a loan from Cash Advance America, it is crucial to understand the Annual Percentage Rate (APR). The APR reflects the true cost of the loan, including interest rates and fees, expressed as an annual rate. Compare APRs from multiple lenders to ensure you are getting the best possible deal.

Carefully review the loan terms and repayment schedule. Be certain you can afford to repay the loan on time to avoid late fees and further debt accumulation. Consider alternatives, such as borrowing from friends or family or seeking assistance from local charities, before resorting to payday loans.

Borrowing from Cash Advance America carries significant financial risks. Weigh the potential benefits against the high costs and potential for debt traps before making a decision.

Current Status and Future Developments

Cash Advance America continues to operate nationwide, navigating the complex regulatory landscape governing short-term lending. Ongoing debates about payday lending regulations at both the state and federal levels will likely impact the company's future operations.

Consumers are encouraged to stay informed about their rights and options when seeking short-term financial assistance. Consult with financial advisors and consumer protection agencies to make informed decisions and avoid predatory lending practices.

The debate surrounding the legitimacy and ethical implications of payday lending, including practices of companies like Cash Advance America, is ongoing. Continued scrutiny from regulators, advocacy groups, and the public is essential to protecting vulnerable borrowers.

![Is Cash Advance America A Legitimate Company What Is a Cash Advance? [Definition, Types & Cost]](https://review42.com/wp-content/uploads/2022/02/feature-image-48-what-is-a-cash-advance.jpg)