Is Eb 5 Visa Still Available

Imagine a bustling marketplace, not of fruits and vegetables, but of dreams and opportunities. Investors from around the globe, each carrying a vision of a better future, carefully consider their options. They are drawn by the allure of the American dream, now perhaps more accessible than ever through the EB-5 visa program.

At the heart of the matter lies a crucial question: Is the EB-5 visa program still available? The answer is a resounding yes, revitalized and reformed, offering a pathway to U.S. residency through investment, though with some key changes that potential applicants need to know.

A Program Reborn: The EB-5 Visa After Reform

The EB-5 Immigrant Investor Program, established in 1990, allows foreign nationals to obtain a green card (permanent residency) in the United States by investing a certain amount of capital in a U.S. business that creates or preserves jobs. However, the program faced challenges and lapsed for a period, leaving many potential investors in limbo.

The good news is that the program was reauthorized and reformed by the EB-5 Reform and Integrity Act of 2022 (RIA). This act brought significant changes aimed at enhancing program integrity, increasing investor protection, and streamlining the application process.

Key Changes Under the Reform and Integrity Act

One of the most important changes introduced by the RIA is the concept of high unemployment areas, known as Targeted Employment Areas (TEAs). Investing in projects located in TEAs allows for a lower minimum investment threshold. The RIA has redefined how these areas are designated, giving the Department of Homeland Security (DHS) sole authority to determine TEA eligibility.

Another significant improvement is the enhanced protection for investors. The RIA includes provisions for more rigorous background checks and audits of Regional Centers, the entities that pool EB-5 investments for larger projects. This is to safeguard investors from fraud and mismanagement. The legislation mandates regular audits and compliance checks, bringing greater transparency and accountability to the program.

The RIA has also introduced specific integrity fund fees to be paid by Regional Centers. These fees are earmarked for fraud detection and prevention efforts. They are also for administration and compliance measures to ensure the EB-5 program operates with greater transparency and accountability.

Concurrent filing is another major benefit afforded to investors. Concurrent filing allows investors already in the United States on another visa, such as an E-2 or H-1B, to file their I-485 (Application to Adjust Status) concurrently with their I-526E petition (Immigrant Petition by Alien Investor). This permits them to receive work and travel permits while their EB-5 petition is being processed. This reduces the period of uncertainty faced by many applicants.

Investment Amounts and Job Creation Requirements

The minimum investment amount depends on the location of the project. For investments in TEAs, the minimum is currently $800,000. For projects located outside TEAs, the minimum investment is $1,050,000.

The program's fundamental requirement remains the creation of at least ten full-time jobs for U.S. workers as a direct or indirect result of the investment. This job creation requirement is critical to the EB-5 program's purpose: stimulating the U.S. economy.

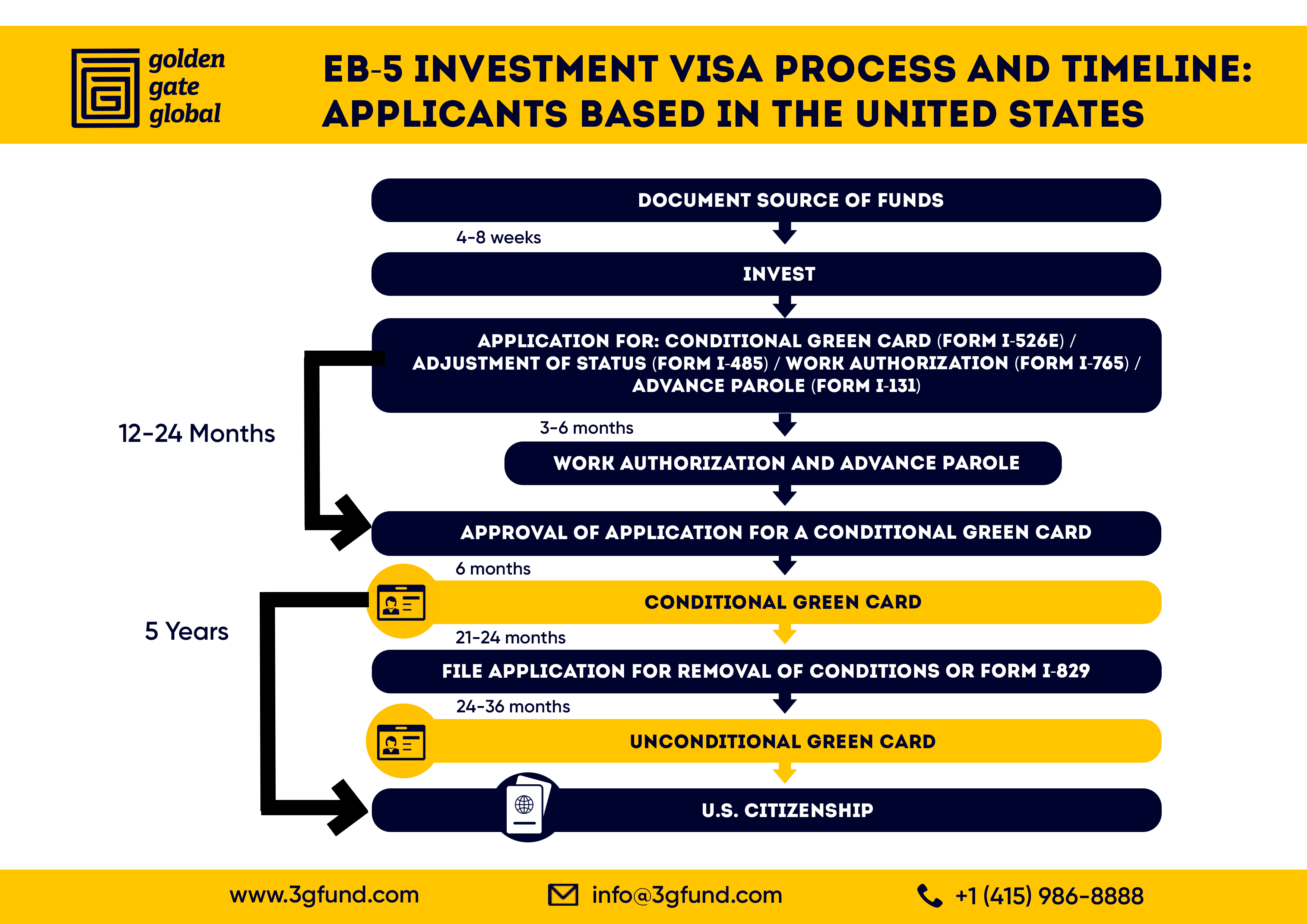

Navigating the Application Process

The EB-5 application process is complex and requires careful planning and documentation. Investors must first identify a suitable investment project that meets the program's requirements.

Once an investment is made, the investor files Form I-526E with U.S. Citizenship and Immigration Services (USCIS). This form demonstrates that the investor has made the required investment and that the project meets the job creation requirements.

If the I-526E petition is approved, and assuming a visa is available, the investor can then apply for conditional permanent residency. This application is submitted either through an Adjustment of Status (Form I-485) if the investor is already in the U.S. or through consular processing at a U.S. embassy or consulate abroad.

After two years of conditional residency, the investor can file Form I-829 to remove the conditions on their green card. This application requires demonstrating that the investment has created the required jobs and that the investor has sustained the investment throughout the conditional residency period. Upon approval of the I-829, the investor becomes a permanent resident of the United States.

The Role of Regional Centers

Most EB-5 investors choose to invest through Regional Centers. These are USCIS-approved entities that manage EB-5 projects. Regional Centers pool investments from multiple investors to fund larger projects, such as real estate developments, infrastructure projects, or manufacturing facilities.

Investing through a Regional Center can simplify the job creation requirement because indirect job creation is allowed. This means that jobs created as a result of the project's economic activity, rather than directly by the business itself, can be counted toward the ten-job requirement.

However, choosing the right Regional Center is crucial. Investors should carefully research and vet potential Regional Centers, assessing their track record, management team, and project viability. The RIA's enhanced oversight measures provide additional security, but due diligence remains essential.

“The EB-5 Reform and Integrity Act of 2022 has breathed new life into the program,” says Sarah Miller, an immigration attorney specializing in EB-5 visas. “It has brought increased transparency, improved investor protections, and streamlined processes, making it a more attractive and reliable pathway to U.S. residency for many foreign investors.”

Current Processing Times and Visa Availability

Processing times for EB-5 petitions can vary depending on the investor's country of origin and the USCIS processing workload. Investors from countries with high demand, such as China and India, may face longer waiting times due to visa backlogs.

USCIS provides updated processing times on its website, but prospective investors should consult with an experienced immigration attorney for the most accurate and up-to-date information. Visa availability is another crucial factor to consider. Each year, a limited number of EB-5 visas are allocated, and the number of visas available for investors from specific countries can fluctuate.

A Word of Caution

While the reformed EB-5 program offers promising opportunities, it is not without risks. Investors should be aware that there is no guarantee of approval. The success of an EB-5 petition depends on meeting all of the program's requirements, including job creation and investment sustainability.

It is essential to work with qualified professionals, including immigration attorneys, financial advisors, and business consultants, to navigate the complexities of the EB-5 program and to mitigate potential risks. Due diligence is paramount. Ensure thorough research on both the Regional Center and the project you are investing in.

Looking Ahead

The EB-5 visa program stands as a testament to the enduring appeal of the American dream. Refreshed and reformed, the program is ready to welcome investors. It promises economic growth and job creation for the United States, as well as opportunities for individuals and families seeking a new life.

The journey towards obtaining an EB-5 visa may be complex. But with careful planning, informed decision-making, and expert guidance, it is a journey that can lead to a brighter future.

So, is the EB-5 visa still available? Yes, and it's evolving, stronger, and more transparent than ever before. The marketplace of dreams is open for business.