Is Global Life Insurance A Pyramid Scheme

Whispers of suspicion have long circulated regarding the structure and practices of the global life insurance industry, with some critics even labeling it a sophisticated pyramid scheme. These accusations, often fueled by misunderstandings of actuarial science and complex financial instruments, raise serious questions about the sustainability and ethical foundations of an industry that manages trillions of dollars in assets and promises financial security to millions worldwide.

This article aims to objectively examine the arguments leveled against the life insurance industry, dissecting the claims that its reliance on continuous recruitment and premium payments resembles a pyramid scheme. We will analyze the industry's business model, regulatory oversight, and the role of actuarial science in determining its financial viability, seeking to determine whether the criticisms hold water or are simply unfounded anxieties stemming from a lack of understanding.

Understanding the Accusations

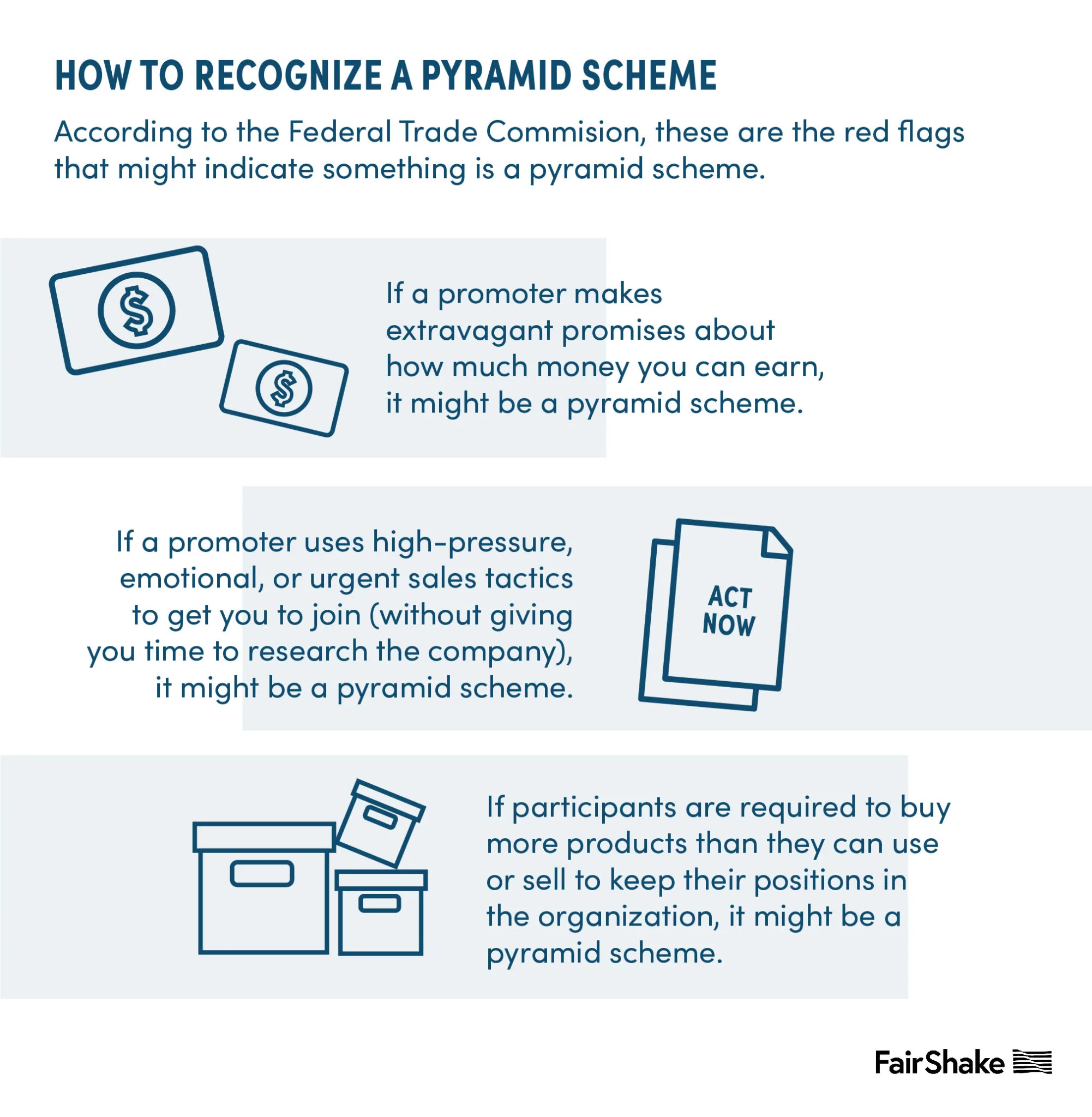

The core accusation against the life insurance industry revolves around the idea that its financial health depends on a constant influx of new policyholders paying premiums. Critics argue that if new policy sales decline, the industry's ability to pay out claims to existing policyholders could be jeopardized, mirroring the collapse of a pyramid scheme when recruitment dries up.

This argument often stems from a misunderstanding of how life insurance companies generate revenue. Premiums are not the sole source of income. Life insurance companies invest premiums in a variety of assets, such as stocks, bonds, and real estate. These investments generate returns that contribute significantly to the company's ability to meet its obligations.

Furthermore, actuarial science plays a crucial role in mitigating the risk of insufficient funds. Actuaries are professionals who use statistical models and data analysis to predict mortality rates and calculate the premiums needed to cover future claims. They ensure that premiums are set at a level that, when combined with investment returns, will be sufficient to pay out claims even if new policy sales fluctuate.

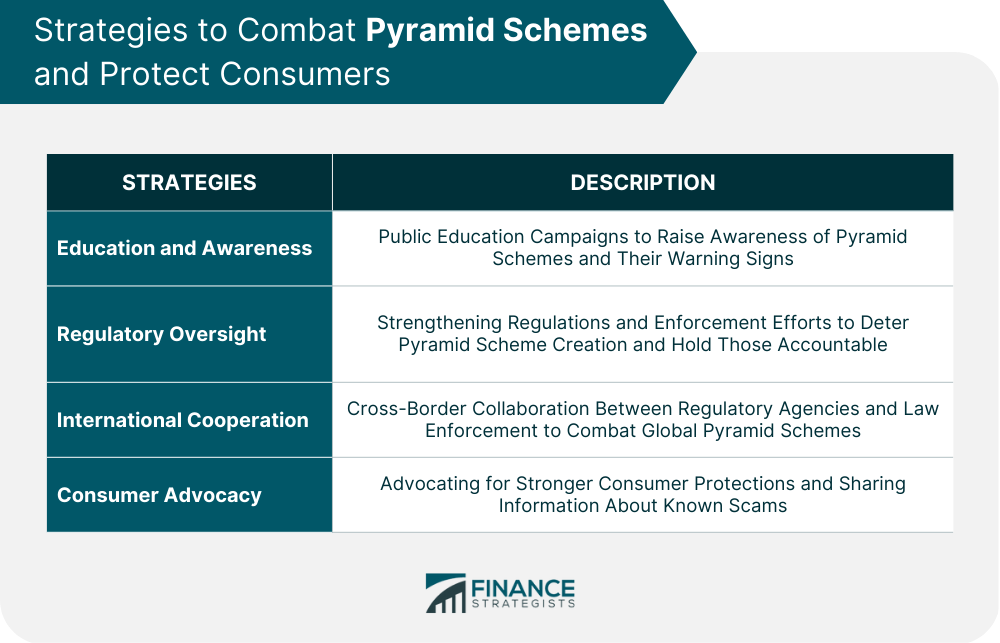

The Role of Regulatory Oversight

Unlike unregulated pyramid schemes, the life insurance industry is subject to rigorous regulatory oversight in most countries. These regulations are designed to protect policyholders and ensure the solvency of insurance companies.

Regulatory bodies, such as the National Association of Insurance Commissioners (NAIC) in the United States, set minimum capital requirements for insurance companies. These requirements mandate that companies hold a certain amount of assets in reserve to cover potential claims, even in adverse economic conditions.

Furthermore, regulators conduct regular audits and examinations of insurance companies to assess their financial health and compliance with regulations. These oversight mechanisms provide a safety net for policyholders and help to prevent the kind of collapse that is characteristic of pyramid schemes.

The Business Model of Life Insurance

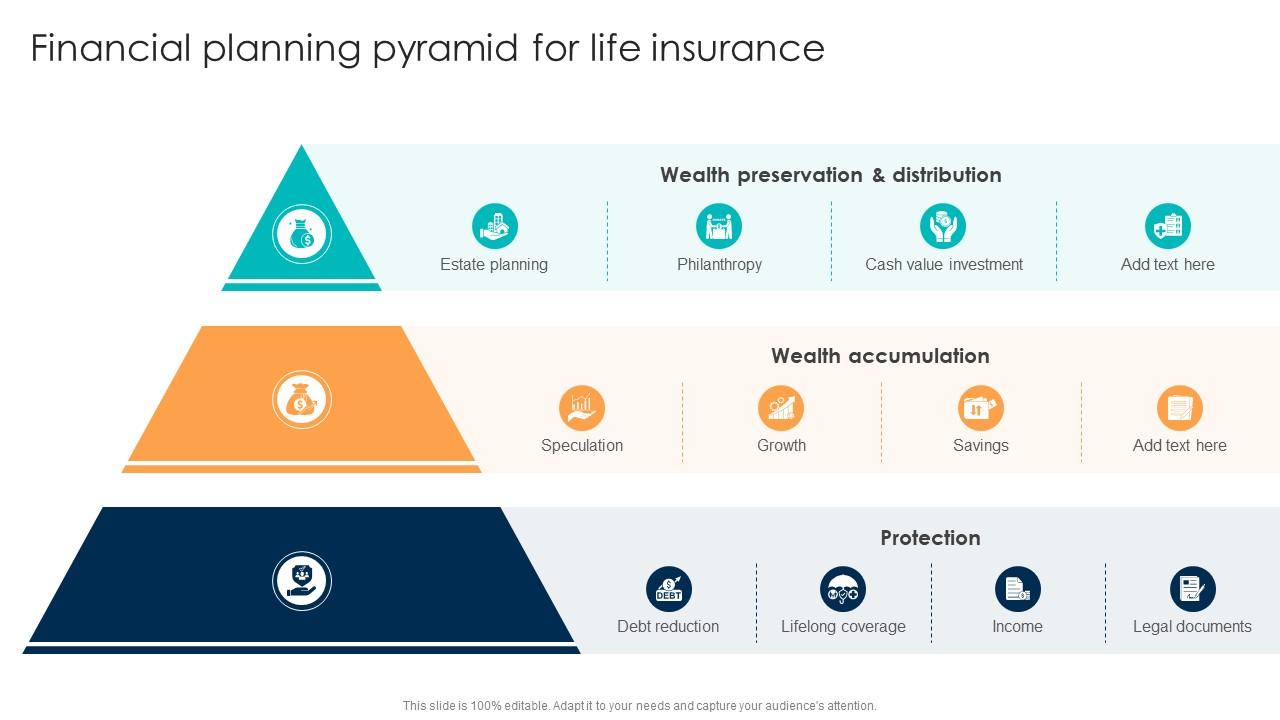

The business model of life insurance is based on the principle of risk pooling. Policyholders pay premiums into a common pool, and the insurance company uses these funds to pay out claims to those who experience covered events, such as death or disability.

This differs fundamentally from a pyramid scheme, where early investors are paid out with money from later investors, with no underlying economic activity or creation of value. Life insurance, in contrast, provides a genuine financial service by transferring risk from individuals to the insurance company.

Moreover, life insurance policies accumulate cash value over time, offering policyholders a savings component that can be accessed through policy loans or withdrawals. This feature further distinguishes life insurance from a pyramid scheme, which offers no such benefits.

A Human Perspective

While the debate about whether life insurance is a pyramid scheme often revolves around financial technicalities, the human impact of life insurance is undeniable. Many families rely on life insurance payouts to cope with the financial consequences of losing a loved one.

Consider the story of Maria Rodriguez, a single mother who tragically passed away unexpectedly. Thanks to a life insurance policy she had purchased, her children were able to continue their education and maintain their home, preventing them from falling into poverty.

Stories like Maria's highlight the vital role that life insurance plays in providing financial security and peace of mind to families in times of crisis. While concerns about the industry's practices are valid, it is important to recognize the positive impact it has on countless lives.

Conclusion

Based on the evidence, the assertion that the global life insurance industry is a pyramid scheme appears to be an oversimplification and a misrepresentation of its business model and regulatory framework. While the industry does rely on the continuous sale of policies to maintain its financial health, it is subject to rigorous regulation and oversight, employs sophisticated actuarial science to manage risk, and provides a genuine financial service to policyholders.

The industry's reliance on new premium income should not be equated with the unsustainable structure of a pyramid scheme, which depends solely on recruitment and lacks any underlying economic activity or legitimate product. Ultimately, while there is always room for improvement in transparency and ethical practices within the industry, the fundamental principles of life insurance are sound and serve a valuable purpose in providing financial security to individuals and families worldwide.

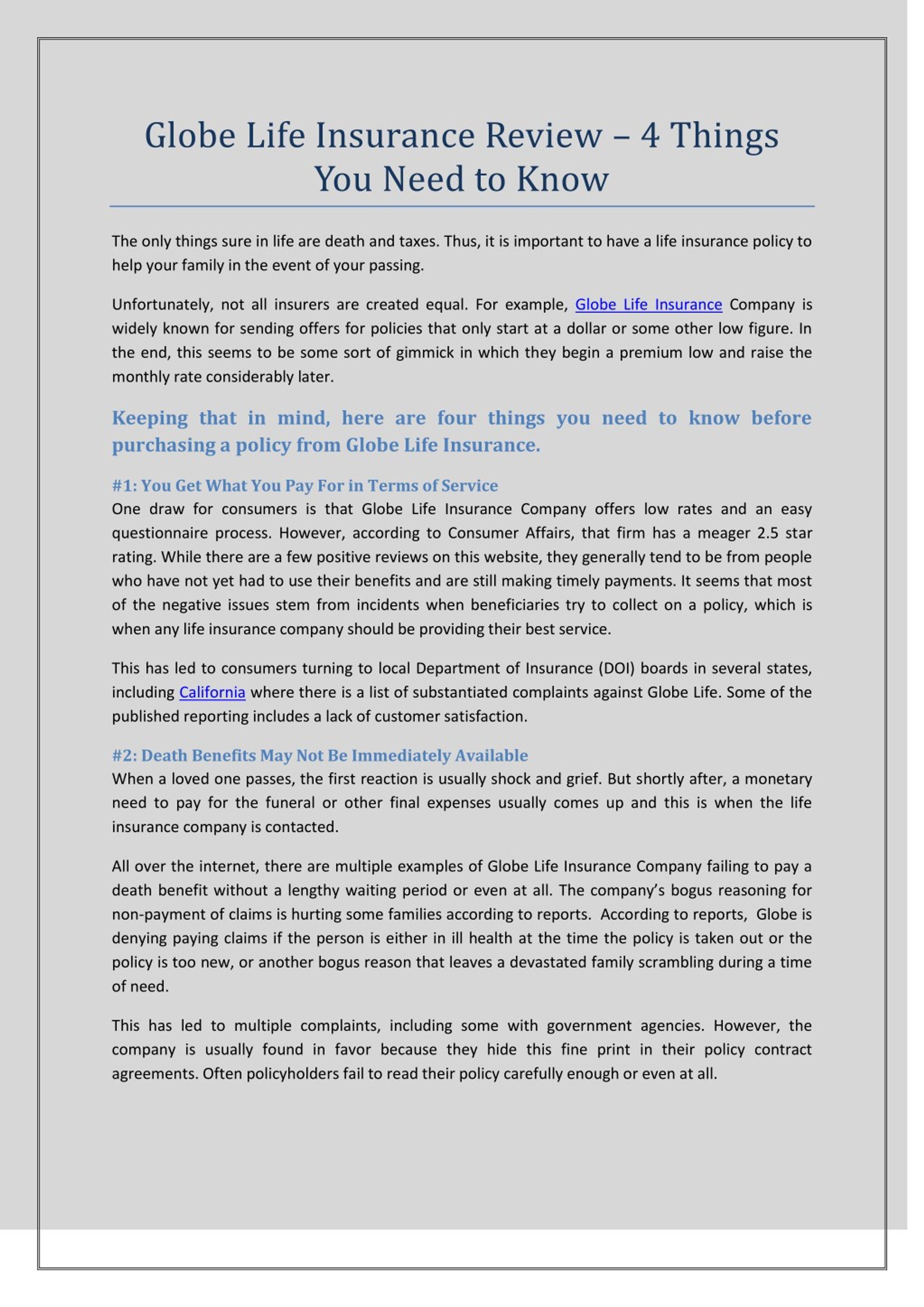

However, consumers should always conduct thorough research, understand the terms and conditions of their policies, and seek independent financial advice before purchasing life insurance. This proactive approach will ensure that they are making informed decisions and protecting their financial future.

:max_bytes(150000):strip_icc()/PyramidScheme2-0d87385edc144cd5848a8a283afbb059.png)

:max_bytes(150000):strip_icc()/DeterminingRiskandtheRiskPyramid3-1cc4e411548c431aa97ac24bea046770.png)