Is Iova A Good Stock To Buy

As market volatility continues to grip investor sentiment, many are scrutinizing individual stocks with renewed diligence. Among them is Iova, a company operating within the competitive tech sector, prompting the crucial question: is Iova a good stock to buy now?

This article dives into Iova's current financial standing, recent performance, and future projections, providing a balanced perspective on the potential risks and rewards associated with investing in the company. We'll analyze key market data, expert opinions, and relevant industry trends to arm potential investors with the information needed to make informed decisions.

Iova's Recent Performance

Iova's stock has experienced a rollercoaster ride over the past year. Initial surges fueled by innovative product launches were followed by periods of decline attributed to increased competition and supply chain disruptions.

The company's latest quarterly report, released in late October, revealed a mixed bag. While revenue growth demonstrated a promising increase of 15% year-over-year, net profits suffered a slight dip of 3% due to rising operational costs, according to the official report.

This profitability decrease raised concerns among analysts, prompting some to adjust their price targets for Iova downwards.

Industry Analysis and Competitive Landscape

Iova operates within a rapidly evolving tech landscape, facing stiff competition from established giants and agile startups alike. The sector's growth is driven by increasing demand for cloud computing, artificial intelligence, and cybersecurity solutions.

However, the same rapid growth also means that new competitors are constantly entering the fray, increasing the pressure on companies like Iova to innovate and maintain market share.

Recent industry reports indicate that Iova's market position, while still strong, is being challenged by competitors offering similar products at competitive price points. Specifically, Gartner's latest report highlighted this increasing competitive pressure.

Financial Health and Key Metrics

A closer examination of Iova's financial health reveals a company with a solid foundation but facing some potential challenges. The company's debt-to-equity ratio is within a healthy range, indicating a reasonable level of financial leverage.

However, its cash flow from operations has been fluctuating, raising questions about its ability to consistently generate revenue. Furthermore, the company's price-to-earnings (P/E) ratio currently stands at 25, which is slightly higher than the industry average.

This suggests that Iova's stock may be somewhat overvalued, requiring careful consideration of future growth prospects.

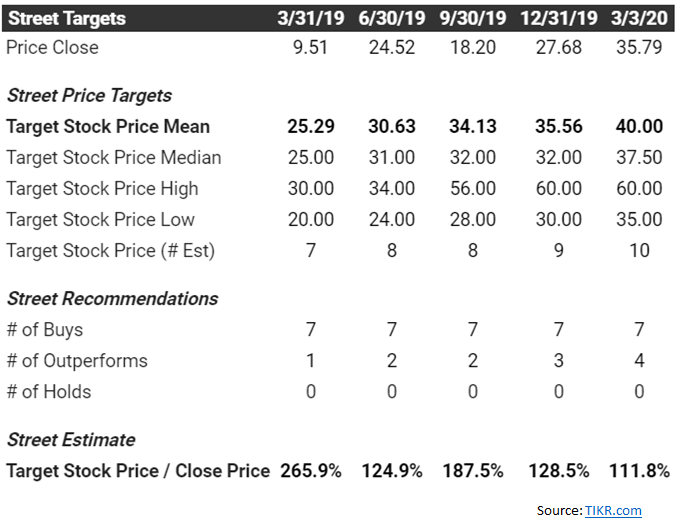

Expert Opinions and Analyst Ratings

Analyst ratings on Iova's stock are varied, reflecting the uncertainty surrounding its future performance. Some analysts maintain a "buy" rating, citing the company's potential for long-term growth and innovation.

Others have adopted a more cautious stance, issuing "hold" or "underperform" ratings, citing concerns about increasing competition and potential margin erosion. A recent report from Morgan Stanley assigned a "hold" rating, emphasizing the need for Iova to demonstrate sustainable profitability improvements.

Investors should carefully consider these differing opinions and conduct their own due diligence before making any investment decisions.

Potential Risks and Rewards

Investing in Iova presents both potential risks and rewards. On the risk side, the company faces intense competition, fluctuating cash flows, and a slightly elevated P/E ratio. Furthermore, broader economic downturns could significantly impact Iova's financial performance, like any tech firm.

On the reward side, Iova boasts a strong brand reputation, a history of innovation, and significant growth potential in key technology sectors. A successful execution of its strategic initiatives could lead to substantial returns for investors.

Iova's innovative advancements in AI and cybersecurity could also make them a leader in those categories.

The Human Angle: Impact on Employees and Communities

Beyond the financial metrics, Iova's operations have a real-world impact on its employees and the communities in which it operates. The company employs thousands of people and contributes significantly to local economies through job creation and tax revenue.

Iova's commitment to corporate social responsibility, including initiatives focused on sustainability and community development, further enhances its positive impact. However, potential investors should also be aware of any controversies or ethical concerns associated with the company's operations, which could affect its reputation and stock price.

Conclusion: Making an Informed Decision

Ultimately, the decision of whether to invest in Iova depends on an individual investor's risk tolerance, investment goals, and time horizon. While the company possesses attractive qualities, such as a strong brand and growth potential, it also faces significant challenges, including increasing competition and fluctuating cash flows.

Investors should carefully weigh these risks and rewards, conduct thorough research, and consult with a qualified financial advisor before making any investment decisions. Staying informed about market trends and company updates is crucial for navigating the complexities of the stock market and maximizing investment returns.

Careful consideration of all factors is necessary to determine if Iova is the right fit for your investment portfolio.