Is It Hard To Get A Citi Credit Card

Citigroup, one of the largest financial institutions globally, offers a wide array of credit cards catering to diverse consumer needs. But the question remains: How difficult is it to obtain a Citi credit card? The answer, as with many financial products, is nuanced and depends on several factors related to the applicant's creditworthiness and financial profile.

This article will examine the criteria Citi uses for approving credit card applications, analyze the approval rates for different card tiers, and explore strategies to improve your chances of getting approved. Understanding these factors can empower consumers to make informed decisions and increase their likelihood of successfully obtaining a Citi credit card.

Citigroup's Credit Card Landscape

Citi offers a diverse portfolio of credit cards, ranging from secured cards designed for those with limited or no credit history, to premium rewards cards that cater to high-spending, creditworthy customers. These include cards with travel rewards, cash-back incentives, and balance transfer options. The eligibility requirements vary significantly depending on the specific card and its associated benefits.

Key Factors Influencing Approval

Like most major credit card issuers, Citi assesses several key factors when evaluating credit card applications. These include credit score, credit history, income, and debt-to-income ratio. A higher credit score generally indicates a lower risk of default, making applicants more attractive to Citi.

A long and positive credit history, demonstrating responsible credit management over time, is also crucial. Sufficient income is necessary to demonstrate the ability to repay debts, and a low debt-to-income ratio indicates a healthy balance between income and existing financial obligations.

"We evaluate each application based on its own merits, considering a holistic view of the applicant's financial profile," a Citi spokesperson stated.

This holistic approach emphasizes that while a high credit score is beneficial, other factors are also considered. Citi aims to assess the overall risk associated with each applicant.

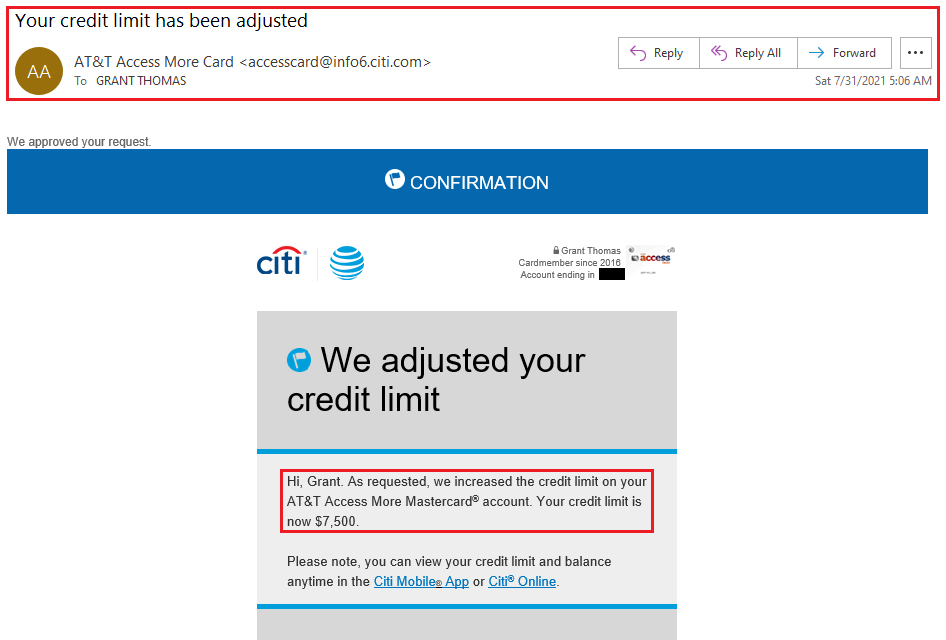

Approval Rates and Card Tiers

Approval rates for Citi credit cards vary significantly depending on the card tier. Secured cards, designed for those with limited or no credit, typically have higher approval rates. These cards require a security deposit, which reduces the risk for the issuer.

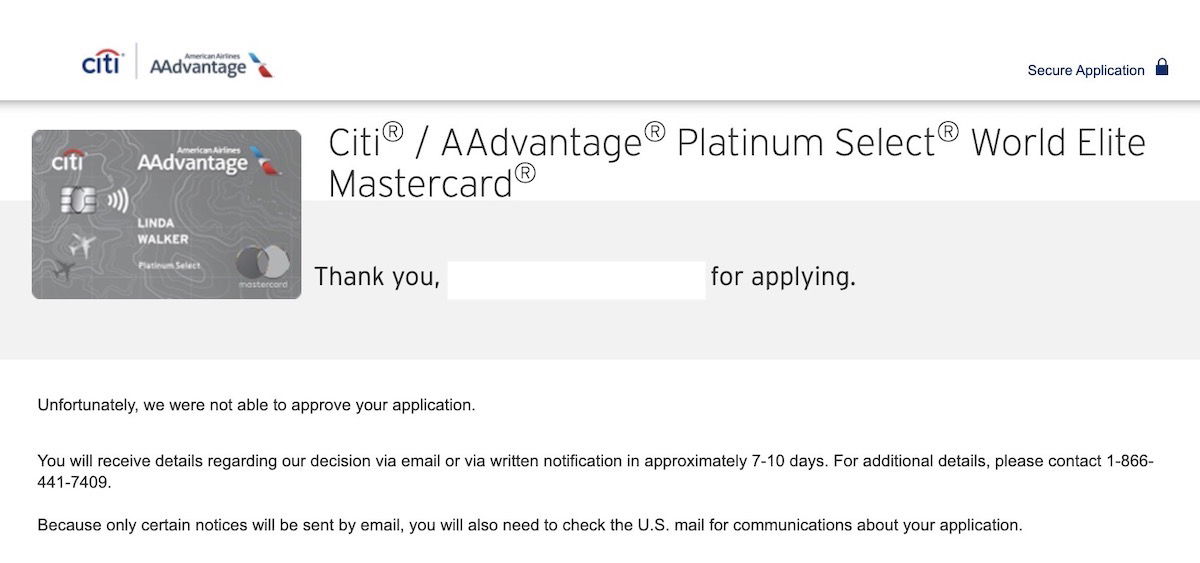

Cards targeting fair or average credit scores also tend to have relatively high approval rates, although they may come with lower credit limits and higher interest rates. Premium rewards cards, on the other hand, are more selective. Applicants typically need excellent credit scores and a strong financial profile to be approved for these cards.

Data on specific approval rates for individual Citi cards is not publicly available. However, industry analysts suggest that approval rates for premium rewards cards can be significantly lower than those for secured or entry-level cards.

Strategies to Improve Your Chances

If you're concerned about your chances of getting approved for a Citi credit card, there are several steps you can take to improve your odds. First and foremost, check your credit report for any errors and dispute them with the credit bureaus.

Paying down existing debt can improve your credit utilization ratio and lower your debt-to-income ratio. Avoiding applying for multiple credit cards within a short period can also prevent a negative impact on your credit score. Consider starting with a secured card or a card designed for those with fair credit to build or rebuild your credit history.

Ultimately, the difficulty of obtaining a Citi credit card depends on the individual applicant's financial profile and the specific card they are applying for. While excellent credit is often required for premium cards, options exist for those with less-than-perfect credit. By understanding Citi's approval criteria and taking steps to improve your creditworthiness, you can significantly increase your chances of getting approved.

:max_bytes(150000):strip_icc()/citi-rewards-plus-student-card_blue-543b1bf3450142e8805d174a8a0e5a2a.jpg)

![Is It Hard To Get A Citi Credit Card Recommended Minimum Requirements of Citi Credit Cards [2025]](https://upgradedpoints.com/wp-content/uploads/2023/01/Citi-Pre-Select.jpg?auto=webp&disable=upscale&width=1200)