Is It Safe To Open Ppf Account In Hdfc Bank

Imagine strolling through a bustling marketplace, the scent of spices and the lively chatter of vendors filling the air. Each stall represents a choice, a potential investment in your future. Among them, a reliable haven stands out: the Public Provident Fund, or PPF. As you consider safeguarding your savings, a question arises: Is it safe to open a PPF account in HDFC Bank?

This article delves into the safety and reliability of opening a PPF account with HDFC Bank, addressing concerns and providing clarity on the security of your investments. We'll explore the backing behind this popular savings scheme and how HDFC Bank fits into the equation, ensuring your financial future remains bright and secure.

Understanding the Public Provident Fund (PPF)

The PPF is a long-term savings scheme backed by the Indian government. It's a popular choice for individuals seeking a secure and tax-efficient investment avenue.

Its appeal lies in its EEE (Exempt-Exempt-Exempt) status: contributions are tax-deductible under Section 80C of the Income Tax Act, the interest earned is tax-free, and the maturity amount is also exempt from tax.

This triple tax benefit makes it an attractive option for long-term financial planning.

Government Backing and Security

The key element ensuring the safety of your PPF investment is the sovereign guarantee provided by the Government of India. This means your investment is virtually risk-free, as the government assures the return of your principal and accrued interest.

Unlike market-linked investments, the PPF is not subject to market fluctuations, providing stability and peace of mind.

Regardless of the bank or post office where you hold your PPF account, this government backing remains constant.

HDFC Bank as a PPF Account Provider

HDFC Bank, being a scheduled commercial bank in India, is authorized to offer PPF accounts. This authorization comes with regulatory oversight from the Reserve Bank of India (RBI).

The RBI monitors HDFC Bank's operations to ensure compliance with banking regulations, including those pertaining to PPF accounts.

This regulatory framework adds another layer of security for depositors.

HDFC Bank's Stability and Reputation

HDFC Bank is one of the largest private sector banks in India, with a strong financial track record. Its robust performance and adherence to regulatory guidelines contribute to its stability and reputation.

This established presence in the financial sector provides assurance to individuals choosing to open a PPF account with them.

Data from reputable financial organizations consistently ranks HDFC Bank highly in terms of financial soundness.

Convenience and Accessibility

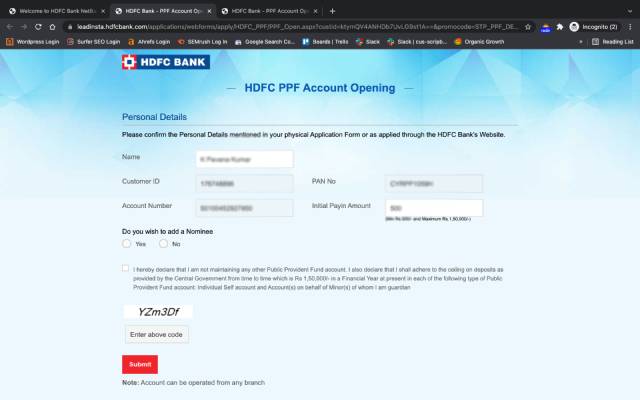

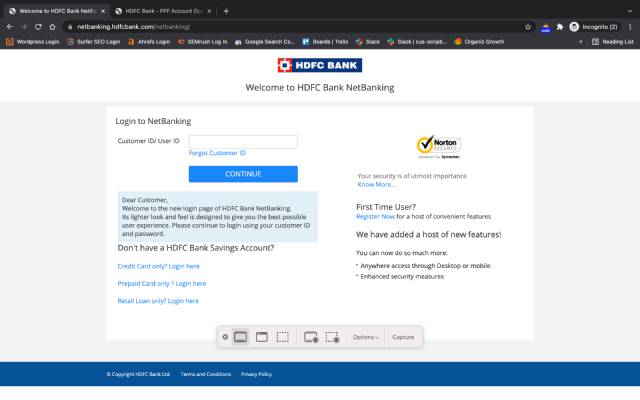

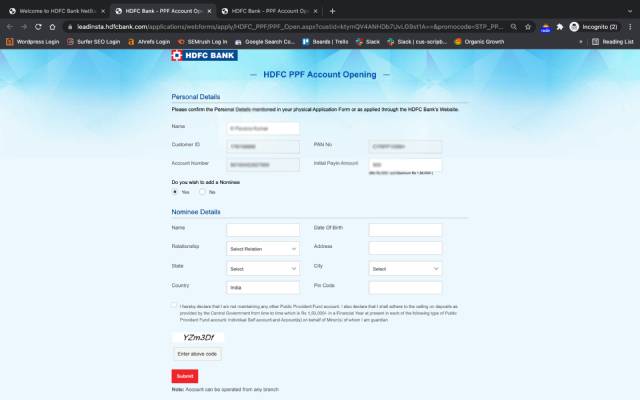

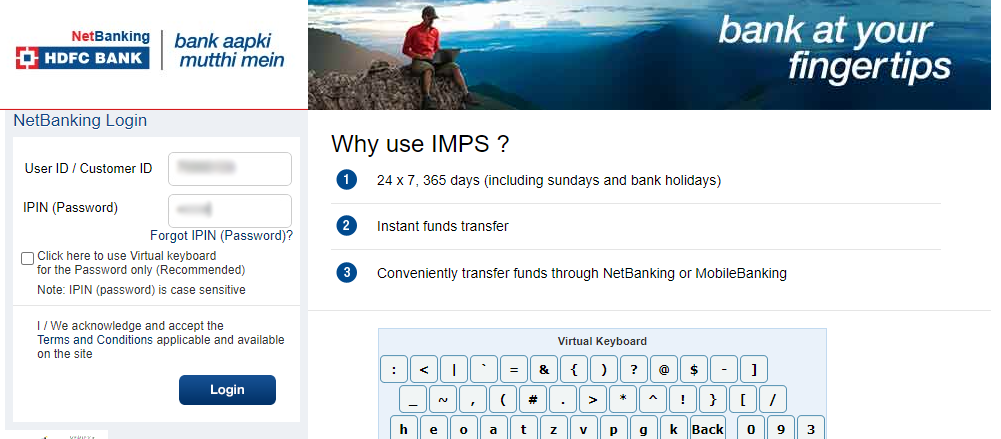

Opening a PPF account with HDFC Bank offers the convenience of managing your investment through online banking and mobile applications. This accessibility simplifies contributions, tracking your balance, and reviewing statements.

The bank also offers a wide network of branches, providing in-person assistance if needed.

This blend of digital and physical accessibility enhances the overall experience of managing your PPF account.

Addressing Potential Concerns

While the PPF scheme itself is exceptionally safe, it's natural to have concerns about the operational aspects of maintaining an account with any bank.

These concerns often revolve around customer service, transaction processing, and account management.

HDFC Bank generally receives positive reviews for its customer service, but it's always wise to research and compare experiences.

Conclusion: A Safe and Secure Choice

Opening a PPF account in HDFC Bank is indeed a safe and secure option. The government backing of the PPF scheme, combined with HDFC Bank's stability and regulatory compliance, provides a strong foundation for your long-term savings.

While individual experiences may vary, the inherent safety of the PPF and HDFC Bank's established reputation make it a reliable choice for securing your financial future.

As you navigate the marketplace of investment options, the PPF account with HDFC Bank stands as a testament to prudent planning and peace of mind, a true haven for your hard-earned savings.