Is Optima Tax Relief A Legitimate Company

Imagine a weight lifted off your shoulders, the constant worry of tax debt fading into the background. For many, this is the promise offered by tax relief companies, holding out a lifeline to those navigating the murky waters of IRS obligations. But is that promise a reality, or just a mirage in the desert of financial stress? Today, we delve into the specifics of one such company, Optima Tax Relief, to discern fact from fiction and offer clarity to those seeking a path towards tax resolution.

At the heart of this investigation lies a crucial question: Is Optima Tax Relief a legitimate company that genuinely helps individuals and businesses navigate their tax problems, or is it simply another entity preying on financial vulnerability? This article aims to provide a balanced and informed perspective, examining the company's services, history, customer feedback, and legal standing to empower readers to make informed decisions about their tax relief options.

Understanding the Tax Relief Landscape

The world of tax resolution is complex and often overwhelming. Individuals facing tax debt, penalties, or audits often feel lost and desperate, making them vulnerable to scams and misleading promises.

Many companies promise quick fixes and guaranteed results, but the reality is that tax resolution is a nuanced process that requires expertise, diligence, and a deep understanding of IRS regulations. Therefore, it's critical to approach any tax relief company with caution and do your research.

Optima Tax Relief: A Closer Look

Optima Tax Relief is a tax resolution firm that assists individuals and businesses with various tax-related issues, including tax debt, penalties, audits, and wage garnishments. Founded in 2012, the company has grown to become one of the larger players in the tax relief industry.

They employ a team of enrolled agents, CPAs, and attorneys who work with clients to develop and implement personalized tax resolution strategies. Their services generally involve an initial consultation, followed by a thorough review of the client's tax situation and the development of a customized plan.

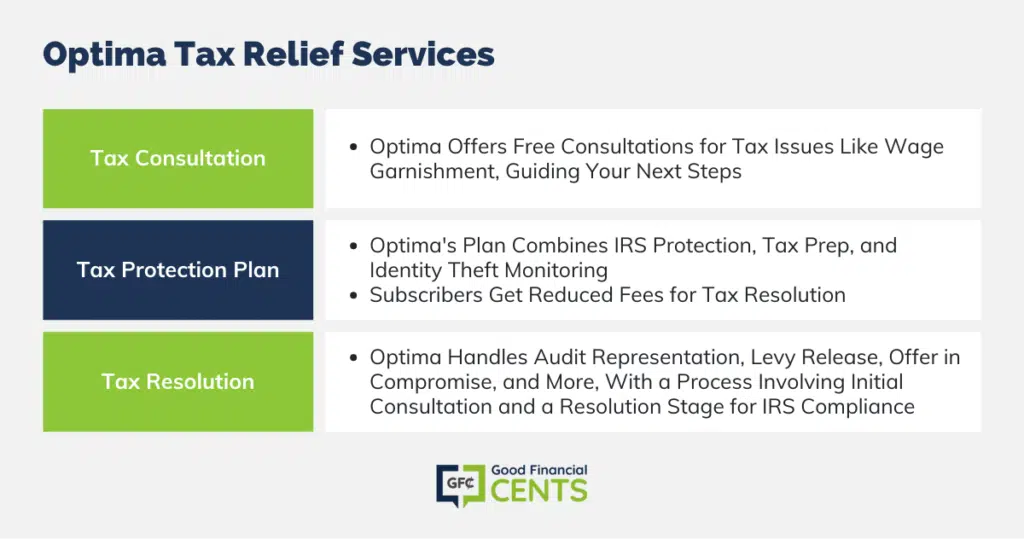

Services Offered by Optima Tax Relief

Optima Tax Relief offers a range of services designed to help clients resolve their tax issues. These services often involve negotiating with the IRS or state tax agencies on behalf of the client.

Some of the key services include: Offer in Compromise (OIC) negotiation, installment agreements, penalty abatement, innocent spouse relief, and audit representation.

An Offer in Compromise (OIC) allows certain taxpayers to resolve their tax liability with the IRS for a lower amount than what they originally owed. An installment agreement sets up a payment plan to pay off the tax debt over time. Penalty abatement helps to eliminate or reduce penalties assessed by the IRS.

Customer Feedback and Reputation

Customer feedback is a crucial indicator of a company's legitimacy and effectiveness. A wide range of reviews and testimonials regarding Optima Tax Relief exist online.

While some clients report positive experiences, praising the company's professionalism, communication, and ability to achieve favorable outcomes, others express concerns about high fees, unmet expectations, and difficulties with customer service.

It is crucial to read a variety of reviews from different sources to get a balanced perspective. Sites like the Better Business Bureau (BBB) and ConsumerAffairs offer platforms for consumers to share their experiences and rate companies.

Legal and Regulatory Standing

A key indicator of a tax relief company's legitimacy is its legal and regulatory standing. Optima Tax Relief has faced scrutiny from regulatory bodies in the past.

In 2022, the Federal Trade Commission (FTC) filed a complaint against Optima Tax Relief, alleging that the company deceptively marketed its services and charged consumers upfront fees before determining whether they qualified for tax relief. The lawsuit is still ongoing and Optima Tax Relief is defending itself against the allegations.

It is critical to note that the FTC's allegations have not been proven in court, and the company maintains that it operates ethically and provides valuable services to its clients.

Important Considerations Before Hiring Any Tax Relief Company

Before engaging any tax relief company, including Optima Tax Relief, it's essential to do your homework. Verify their credentials and read reviews.

Always check if the company's representatives are enrolled agents, CPAs, or tax attorneys. Inquire about their fees, payment structure, and cancellation policies. Be wary of companies that make guaranteed promises or pressure you into signing up immediately.

It is often helpful to seek a second opinion from another tax professional or consult with a non-profit credit counseling agency.

Alternatives to Tax Relief Companies

Tax relief companies are not the only option for resolving tax issues. Depending on your situation, you may be able to resolve your tax problems yourself by working directly with the IRS.

The IRS offers various programs and resources to help taxpayers, including payment plans, penalty relief, and assistance for low-income taxpayers. The IRS website provides detailed information on these options, and you can also contact the IRS directly by phone or mail.

In addition, several non-profit organizations offer free or low-cost tax assistance to individuals and families. The Volunteer Income Tax Assistance (VITA) program and the Tax Counseling for the Elderly (TCE) program provide free tax help to those who qualify.

Making an Informed Decision

Navigating the complexities of tax debt and resolution can be overwhelming. When considering a tax relief company like Optima Tax Relief, it's vital to be an informed consumer.

Weigh the potential benefits of their services against the costs, risks, and alternatives. Research the company's reputation, legal standing, and customer feedback. Do not allow fear or desperation to cloud your judgement.

Ultimately, the decision of whether to hire a tax relief company is a personal one. By carefully considering your options and conducting thorough research, you can make the best choice for your individual circumstances and take control of your financial future.