Is Orchid Island Capital Going Out Of Business

Rumors and anxieties have swirled around Orchid Island Capital, a real estate investment trust (REIT) specializing in residential mortgage-backed securities (RMBS), leaving investors questioning its long-term stability. Concerns about its financial health and future prospects have been amplified by recent market volatility and shifting interest rate environments.

This article aims to provide a balanced perspective on Orchid Island Capital's current situation, examining available data and expert analysis to assess the validity of these concerns and explore the potential implications for investors and the broader market.

Understanding Orchid Island Capital's Business Model

Orchid Island Capital, traded under the ticker symbol ORC, operates as a REIT. This means it primarily invests in RMBS, aiming to generate income from the difference between the interest it earns on these assets and the cost of funding them. It is also a publicly traded company on the NYSE.

The company's profitability is heavily influenced by interest rate spreads, prepayment speeds, and its ability to manage risk effectively. A widening spread usually is correlated to high profit. Conversely, a narrowing spread could indicate loss.

Like other REITs, it is subjected to quarterly earnings reporting.

Recent Performance and Financial Health

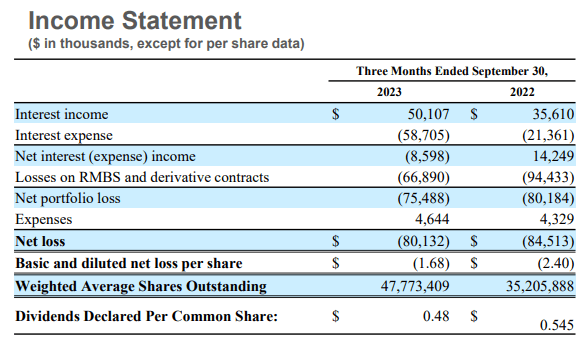

Recent quarterly reports from Orchid Island Capital reveal a complex financial picture. While the company has continued to generate income, its net interest margin – a key indicator of profitability – has faced pressure due to interest rate fluctuations.

Analysts have noted the company's relatively high dividend yield, a feature that attracts income-seeking investors. However, some express caution, highlighting the importance of assessing the sustainability of this dividend in light of the company's financial performance.

The mortgage and housing sector had been especially vulnerable during the period of increased interest rates.

Key Indicators to Watch

Net Interest Margin (NIM)

The NIM reflects the difference between the interest income Orchid Island Capital earns on its RMBS portfolio and the interest it pays on its borrowings. A declining NIM suggests increased profitability challenges.

Dividend Sustainability

Investors need to carefully assess whether the current dividend payouts are sustainable given the company's earnings and cash flow. A high yield may be tempting, but it can be a red flag if the underlying financials are not strong enough to support it.

Prepayment Rates

Prepayment rates on mortgages affect the value and expected life of RMBS. Unexpectedly high prepayment rates can negatively impact Orchid Island Capital's returns.

The Broader Economic Context

Orchid Island Capital's performance is inextricably linked to the broader economic environment, particularly interest rate policies set by the Federal Reserve. Rising interest rates can increase borrowing costs and put downward pressure on RMBS values.

Inflationary pressures and potential recessionary risks further contribute to the uncertainty surrounding the housing and mortgage markets. Investors need to consider these macroeconomic factors when evaluating Orchid Island Capital's prospects.

Uncertainty in the overall economy contributed to the stock's volatility.

Expert Opinions and Analyst Ratings

Financial analysts offer varying perspectives on Orchid Island Capital. Some maintain a neutral stance, emphasizing the company's established track record and management team. Others express concerns about the challenges facing the REIT sector as a whole.

Analyst ratings and price targets should be viewed as just one piece of the puzzle. Individual investors need to conduct their own due diligence and consider their risk tolerance before making investment decisions.

It is important to note that analyst opinions are subject to change based on market conditions and company performance.

Impact on Investors and Society

The potential financial instability of Orchid Island Capital has implications for its investors, particularly those who rely on its dividend income. A significant decline in the company's share price or a dividend cut could have a substantial impact on their portfolios.

The stability of REITs like Orchid Island Capital is important because they play a role in the broader mortgage market and housing finance system. Widespread distress in the REIT sector could exacerbate existing challenges in the housing market.

A strong REIT industry contribute to a strong economy.

Conclusion: Navigating Uncertainty

While rumors of Orchid Island Capital going out of business may be premature, the company faces real challenges in the current economic climate. Investors should carefully monitor key financial metrics, stay informed about macroeconomic developments, and consult with financial advisors to make informed decisions.

Diversification and a long-term investment perspective are essential for navigating the inherent risks associated with REITs and the broader financial markets. Investors who are risk-averse may want to stay away, but those who are more risky and understand the market could take a position.

The future of Orchid Island Capital remains uncertain, but its ability to adapt to changing market conditions and manage risk effectively will be critical to its long-term survival and success.