Is Oxford Lane Capital Corp A Good Investment

Oxford Lane Capital Corp. (OCSL) is under intense scrutiny. Investors are urgently assessing whether its high dividend yield outweighs its inherent risks and volatile performance.

This article cuts through the complexity surrounding OCSL. It delivers a concise analysis of its financials, investment strategy, and market position to help you determine if it's a fit for your portfolio.

OCSL: A Quick Overview

Oxford Lane Capital Corp. (OCSL) is a closed-end management investment company. They primarily invest in collateralized loan obligations (CLOs).

CLOs are securities backed by a pool of debt, often corporate loans. OCSL aims to generate income through distributions from these CLO investments.

The Allure of High Yield

OCSL boasts a significantly high dividend yield. This is a key attraction for income-seeking investors. But this high yield comes with considerable risk.

The current dividend yield often surpasses the average for comparable investments. However, this should be evaluated to other risks that are associated with it.

Understanding the Risks

Investing in CLOs involves complexities. The performance of OCSL is directly tied to the health of the underlying loan market.

Economic downturns can lead to loan defaults. This would negatively impact the value of CLOs and OCSL's distributions.

Rising interest rates, as seen recently, can also pressure CLOs.

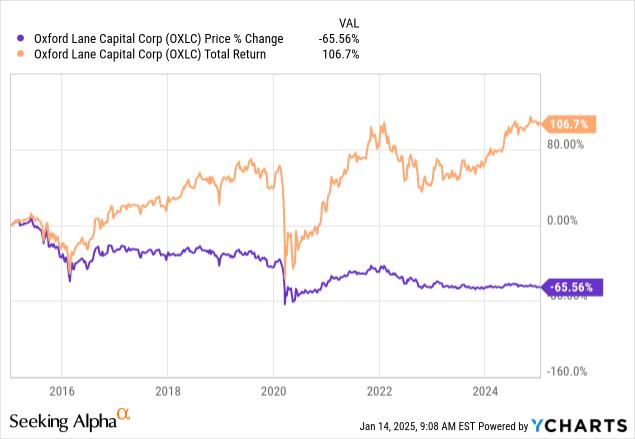

Financial Performance

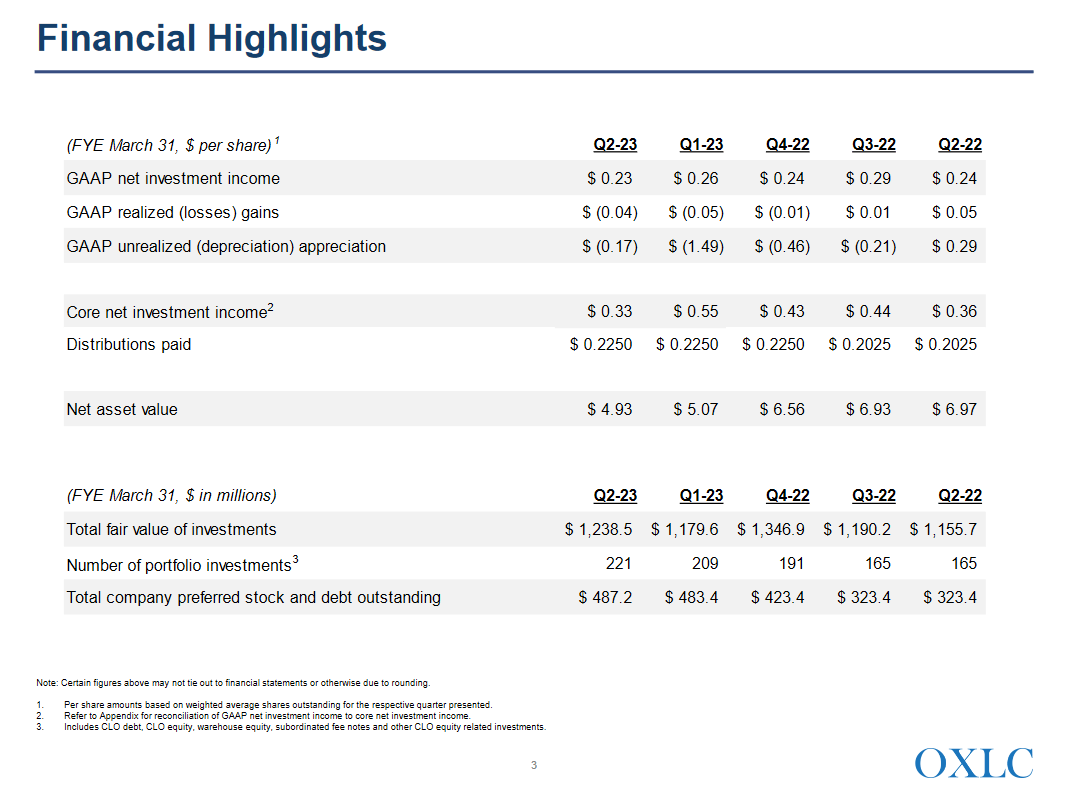

OCSL's financial statements are vital for assessment. Analyze its net asset value (NAV) per share over time.

NAV fluctuations can indicate the stability of its CLO holdings. A declining NAV raises concerns about the sustainability of dividends.

Examine OCSL's income statements for revenue trends. Scrutinize expense ratios to understand how much management fees impact returns.

Investment Strategy Deep Dive

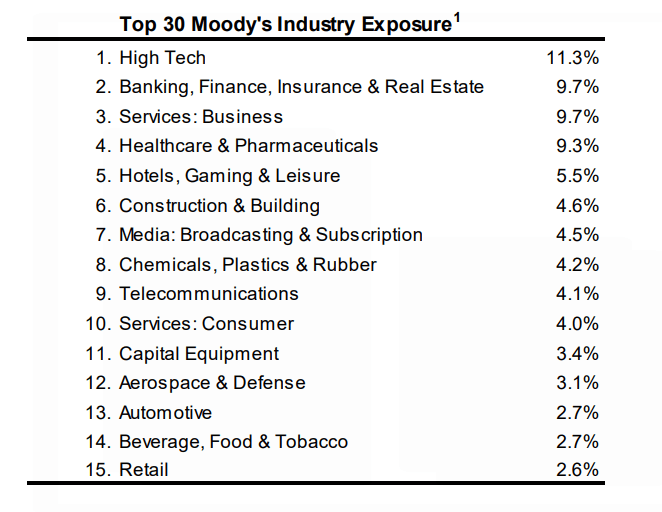

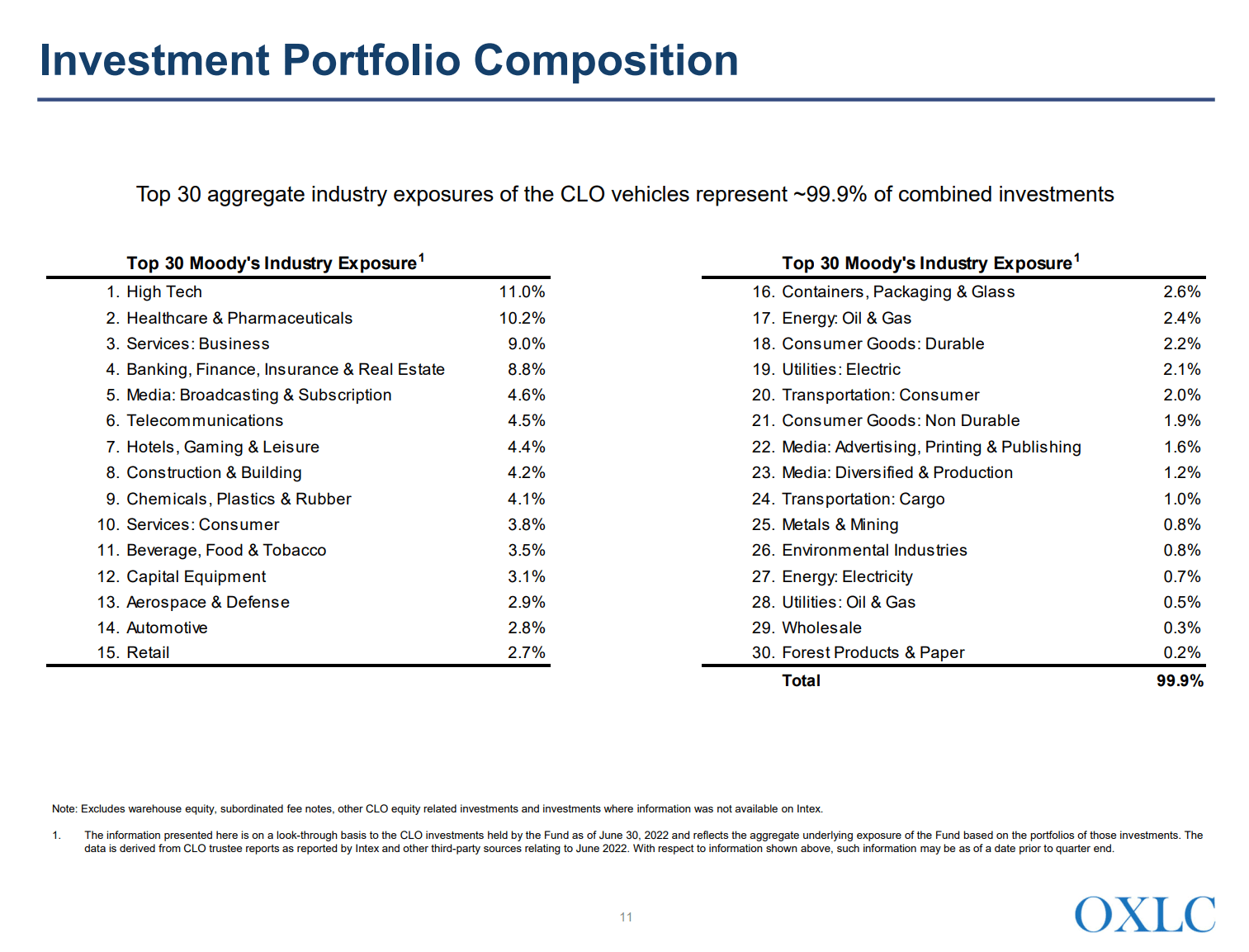

OCSL's portfolio composition is crucial. Understand the types of CLOs they hold.

Senior CLO tranches offer more protection than junior tranches. However, they typically generate lower returns.

Geographic concentration and industry exposure matter. Diversification reduces risk.

Market Position and Competition

OCSL operates in a competitive landscape. Several other investment firms focus on CLOs.

Understanding OCSL's competitive advantages is important. Assess its historical performance relative to peers.

Dividend Sustainability

Can OCSL maintain its current dividend payout? This is the million-dollar question.

Evaluate the dividend coverage ratio. This ratio compares OCSL's earnings to its dividend payments.

A ratio below 1.0 suggests the dividend may not be sustainable. It will be paid from capital or debt.

Consider any recent dividend cuts or increases. These decisions will show future dividend sustainability.

Recent Developments

Keep abreast of any company announcements from Oxford Lane. Press releases offer information about investment activity.

SEC filings, such as 10-K and 10-Q reports, contain vital financial details. Read the management's discussion and analysis section.

Expert Opinions

Analyst ratings provide insights from Wall Street experts. However, rely on multiple sources to form your own conclusion.

Institutional ownership can signal confidence (or lack thereof) in OCSL. Monitor changes in institutional holdings.

The Verdict

Whether OCSL is a good investment depends on your risk tolerance. It also depends on your investment goals.

Its high yield is appealing, but only suitable for risk-tolerant investors. Make sure you understand all the factors.

Next Steps

Before investing, conduct thorough due diligence. Consult with a qualified financial advisor.

Monitor OCSL's performance and financial news closely. The market is constantly evolving.

Stay informed about economic trends and CLO market dynamics. This is essential for making sound investment decisions.