Is Right Now A Good Time To Invest In Stocks

Imagine strolling through a vibrant farmer's market, each stall brimming with potential – a promising new crop, a handcrafted artisan good, each whispering tales of future bounty. The stock market, in many ways, mirrors this bustling scene, a dynamic arena where fortunes are sown and harvested. But amidst the noise and excitement, one question echoes loudest: Is right now a good time to invest?

Navigating the investment landscape requires careful consideration, especially in today's ever-shifting economic climate. This article aims to provide a balanced perspective, exploring key factors that influence the current market and helping you determine if now aligns with your personal investment strategy.

Understanding the Current Market Climate

The global economy is a complex tapestry woven with threads of inflation, interest rates, and geopolitical events. Understanding these threads is crucial before dipping your toes into the stock market.

Inflation, while showing signs of cooling down from its peak, remains a persistent concern for investors and policymakers alike. The Federal Reserve's monetary policy, aimed at curbing inflation through interest rate hikes, continues to ripple through the market, impacting borrowing costs and corporate earnings.

Geopolitical uncertainties, from international conflicts to trade tensions, add another layer of complexity, creating market volatility and influencing investor sentiment.

Economic Indicators to Watch

Keeping a close eye on key economic indicators provides valuable insights into the market's overall health. The Gross Domestic Product (GDP) growth rate, for instance, offers a snapshot of the economy's expansion or contraction.

Unemployment figures reflect the strength of the labor market, influencing consumer spending and investor confidence. Consumer Price Index (CPI) is a crucial indicator, used for measuring inflation, providing signals if investment is good or not.

Assessing Your Personal Investment Strategy

Before making any investment decisions, it's essential to align your approach with your individual financial goals, risk tolerance, and time horizon. What are you hoping to achieve with your investments? Retirement savings? A down payment on a home?

Understanding your risk tolerance – your comfort level with potential losses – is paramount. Are you a cautious investor seeking stable, low-risk investments, or are you willing to take on more risk for potentially higher returns?

Your time horizon, the length of time you plan to keep your investments, also plays a crucial role. A longer time horizon allows you to weather market fluctuations and potentially benefit from long-term growth.

Diversification and Long-Term Investing

Diversification is a cornerstone of sound investment strategy. Spreading your investments across different asset classes, industries, and geographical regions can help mitigate risk.

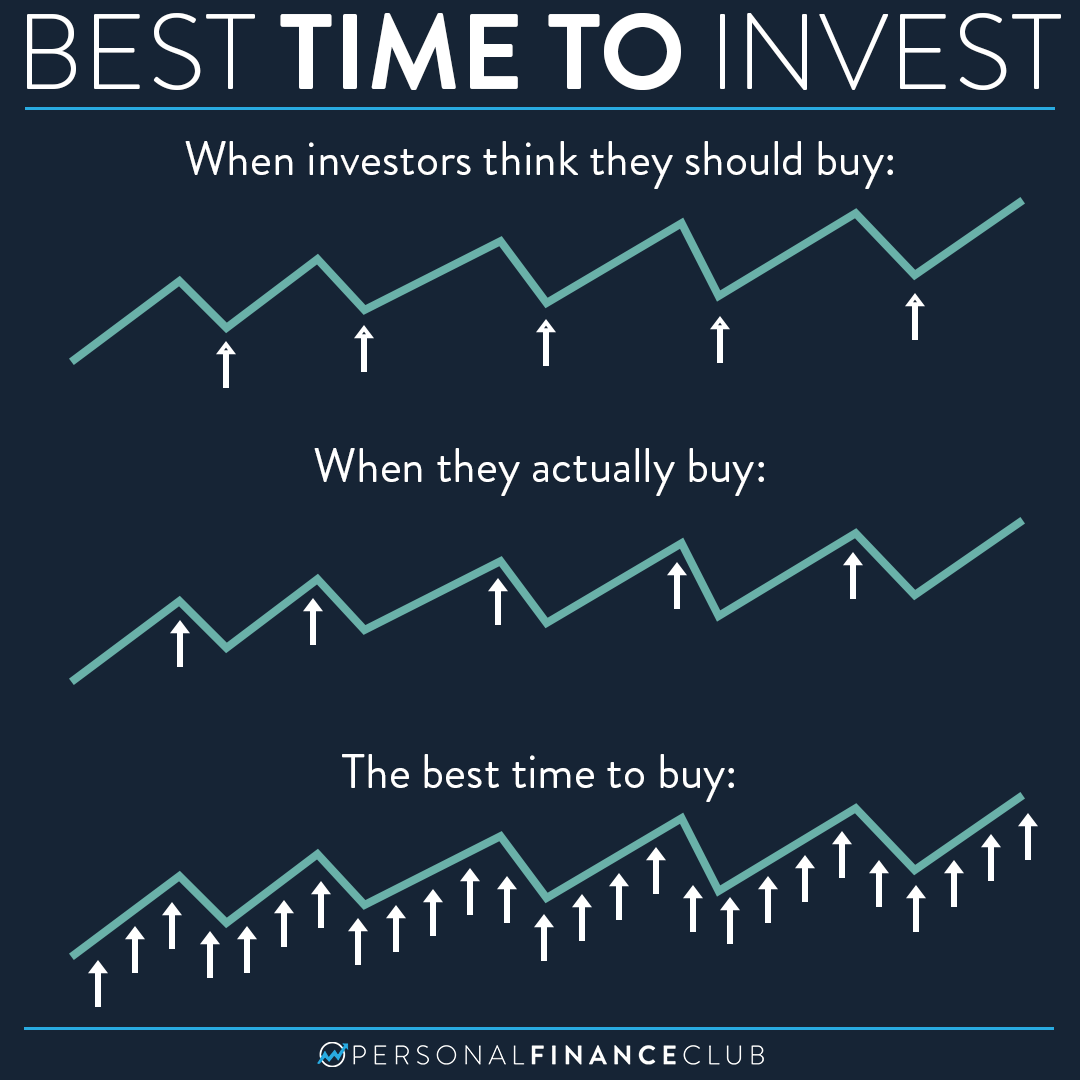

Instead of trying to time the market – a notoriously difficult task – consider adopting a long-term investment perspective. Historically, the stock market has demonstrated an upward trajectory over extended periods, rewarding patient investors.

Seeking Professional Advice

Navigating the complexities of the stock market can be daunting, especially for novice investors. Consulting a qualified financial advisor can provide personalized guidance tailored to your specific circumstances and goals.

A financial advisor can help you assess your risk tolerance, develop a comprehensive investment plan, and stay informed about market trends and potential opportunities.

Don't hesitate to seek expert advice before making any significant investment decisions.

Conclusion: A Time for Prudence and Patience

Ultimately, the decision of whether or not to invest in stocks right now is a personal one. There is not a single magic formula, but with patience and prudence, one can come to a proper decision.

Remember, investing is a marathon, not a sprint. By carefully considering your personal circumstances, staying informed about market trends, and seeking professional guidance when needed, you can navigate the investment landscape with confidence and work towards achieving your financial goals.