Is Robinhood A Good Roth Ira

Imagine turning the key to your very own financial garden, a place where seeds of investment grow, sheltered from the taxman's reach. Now picture tending that garden using an app on your phone, simple and intuitive, promising commission-free trading. This is the promise of Robinhood's Roth IRA: a convenient portal to a potentially prosperous future. But is this digital Eden truly as bountiful as it seems, or are there hidden thorns among the roses?

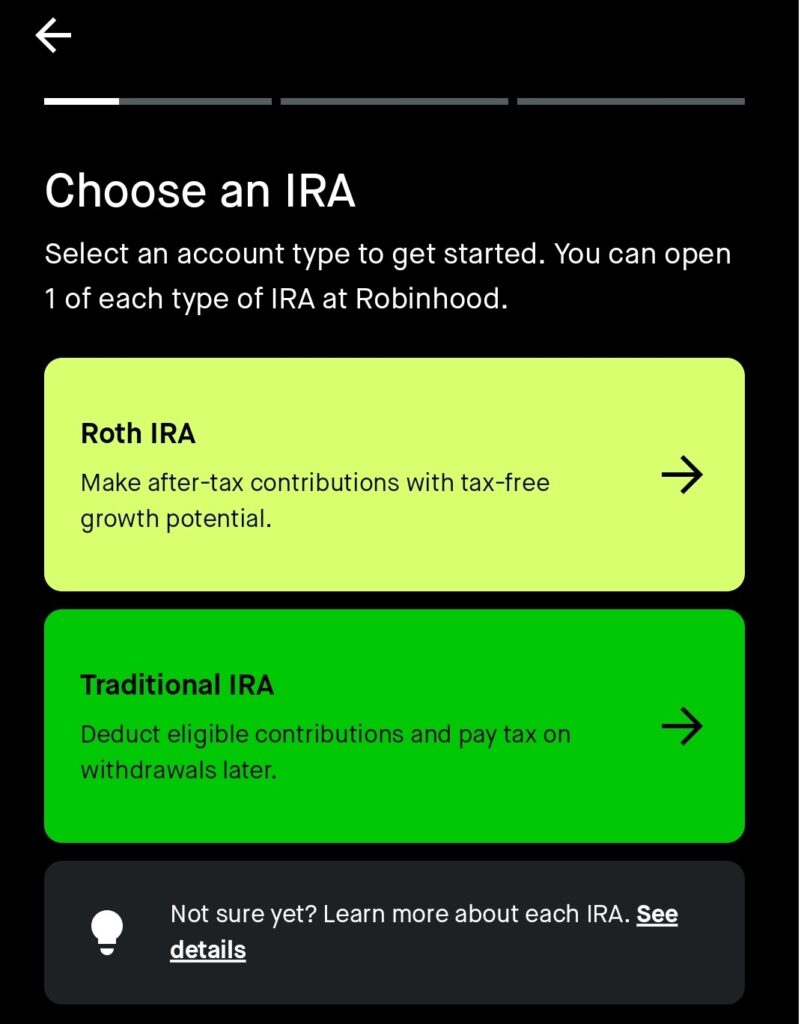

The central question is whether opening a Roth IRA with Robinhood is a sound financial decision. While Robinhood offers a user-friendly platform and commission-free trading, potential investors need to carefully consider factors like limited investment options, potential conflicts of interest, and the platform's history of controversies before entrusting their retirement savings.

The Rise of Robinhood and the Roth IRA

Robinhood burst onto the scene in 2013, democratizing investing with its sleek mobile app and commission-free trading. Suddenly, investing felt less like a Wall Street privilege and more like something anyone could do from their couch.

The appeal was undeniable, especially to younger generations eager to participate in the stock market. Their mission has been to democratize finance for all.

A Roth IRA, on the other hand, has been a cornerstone of retirement planning for decades. It's a retirement account where you contribute after-tax dollars, your investments grow tax-free, and withdrawals in retirement are also tax-free. This makes it an incredibly powerful tool for long-term wealth building.

The Allure of Combining Convenience and Tax Benefits

The combination of Robinhood's accessibility and the tax advantages of a Roth IRA is undeniably attractive. The prospect of managing your retirement savings with a few taps on your phone, while also shielding those gains from taxes, is a compelling proposition.

It promises to empower individuals to take control of their financial futures.

Potential Benefits of a Robinhood Roth IRA

Commission-free trading is perhaps the most prominent benefit. This eliminates the per-trade fees that can eat into returns, especially for those making frequent or small investments.

Robinhood’s user-friendly interface makes investing less intimidating, particularly for beginners. The app's design is clean and straightforward, making it easy to buy and sell stocks, ETFs, and other assets.

They offer fractional shares, allowing investors to buy a portion of a share of expensive stocks. This can be advantageous for those with limited capital.

Weighing the Risks and Limitations

While Robinhood boasts several advantages, it's crucial to acknowledge its potential drawbacks. One significant limitation is the relatively limited investment options compared to traditional brokerages.

Robinhood primarily focuses on stocks, ETFs, and options. You won't find mutual funds or bonds, which are essential for a diversified retirement portfolio.

Another concern is the platform's history of controversies, including the 2021 GameStop saga, which raised questions about its order execution practices and potential conflicts of interest. These events eroded trust for some investors.

Conflicts of Interest and Order Execution

Robinhood generates revenue through payment for order flow (PFOF), where they receive compensation for directing customer orders to specific market makers. This practice can potentially lead to less favorable execution prices for customers.

Some argue that Robinhood's incentive to maximize PFOF revenue could conflict with its obligation to provide the best possible execution prices for its users. While Robinhood maintains that they prioritize best execution, the potential for conflict remains a valid concern.

It is crucial for investors to understand the intricacies of order execution and how PFOF might impact their returns.

Customer Service and Educational Resources

Robinhood's customer service has been a frequent point of criticism. Many users have reported difficulties getting timely assistance with account issues or technical problems.

While Robinhood has made efforts to improve its educational resources, they may still be insufficient for novice investors. A solid understanding of investment principles and risk management is crucial before investing in a Roth IRA.

Alternative Roth IRA Providers

Before settling on Robinhood, it's wise to explore alternative Roth IRA providers. Established brokerages like Vanguard, Fidelity, and Charles Schwab offer a wider range of investment options, robust research tools, and generally more comprehensive customer support.

These brokerages also have a long track record of regulatory compliance and a strong commitment to investor education. While they may not all offer commission-free trading, the added benefits could outweigh the costs for some investors.

Consider your individual investment needs and risk tolerance when choosing a Roth IRA provider.

Due Diligence is Key

Regardless of where you choose to open your Roth IRA, thorough research is essential. Understand the fees associated with the account, the investment options available, and the provider's track record.

Diversification is crucial for long-term investment success. Ensure that your Roth IRA portfolio is well-diversified across different asset classes to mitigate risk.

Regularly monitor your portfolio and make adjustments as needed to align with your investment goals and risk tolerance.

Conclusion: A Garden Requiring Careful Cultivation

Opening a Roth IRA with Robinhood can be a viable option for some investors, particularly those who value convenience and commission-free trading. However, it's not a decision to be taken lightly.

Potential investors must carefully weigh the benefits against the risks, considering factors like limited investment options, potential conflicts of interest, and the platform's customer service record. A Robinhood Roth IRA can be a good starting point, but it's essential to cultivate your financial literacy and monitor your investments diligently.

Ultimately, the best Roth IRA is the one that aligns with your individual needs, risk tolerance, and investment goals. Whether that garden is tended through Robinhood's app or a more traditional brokerage, the key is to nurture it with knowledge, patience, and a long-term perspective.