Is Robinhood Good For Roth Ira

Robinhood's Roth IRA offering sparks debate: Is it the key to unlocking retirement savings or a risky gamble? Investors face critical decisions navigating the platform's features and potential pitfalls.

The surge in popularity of Robinhood's Roth IRA raises crucial questions about its suitability for long-term retirement planning. This article dissects the pros and cons, helping you determine if it aligns with your financial goals.

Accessibility and Affordability: A Powerful Draw

Robinhood's no-commission trading and user-friendly interface are undeniably attractive to new investors. The ease of opening and managing a Roth IRA on the platform makes retirement saving more accessible, particularly for younger demographics. The appeal is clear: start saving now, without the burden of fees.

According to a 2023 survey by J.D. Power, customer satisfaction with Robinhood's investment tools ranks high, especially among first-time investors. This underscores the platform's success in lowering the barrier to entry.

Limited Investment Options: A Potential Constraint

While Robinhood offers stocks, ETFs, and options, its selection is more limited compared to traditional brokerage firms. This restricted range of investments might hinder diversification, a cornerstone of sound retirement planning. Investors looking for mutual funds or bonds might find the options lacking.

A report by Morningstar highlights the importance of diversification in mitigating risk within a Roth IRA. Robinhood's limited scope could present challenges in achieving optimal diversification.

The Allure of Options Trading: A Double-Edged Sword

Robinhood's platform makes options trading readily available, which can be tempting for inexperienced investors. While options can potentially generate higher returns, they also carry significant risk, potentially jeopardizing retirement savings. The ease of access doesn't equate to ease of mastery.

The Securities and Exchange Commission (SEC) has issued warnings regarding the risks associated with options trading, particularly for novice investors. Prudence and thorough understanding are paramount.

Robo-Advisor Features: A Helping Hand or a Crutch?

Robinhood offers a robo-advisor service that automatically manages your investments based on your risk tolerance. This feature can be beneficial for hands-off investors, but it's crucial to understand the underlying algorithms and investment strategies. Are you truly relinquishing control wisely?

According to Robinhood's website, the robo-advisor uses a pre-defined model portfolio based on user input. Investors should carefully evaluate the model's asset allocation to ensure it aligns with their individual goals and risk appetite.

Tax Implications: Understanding the Roth Advantage

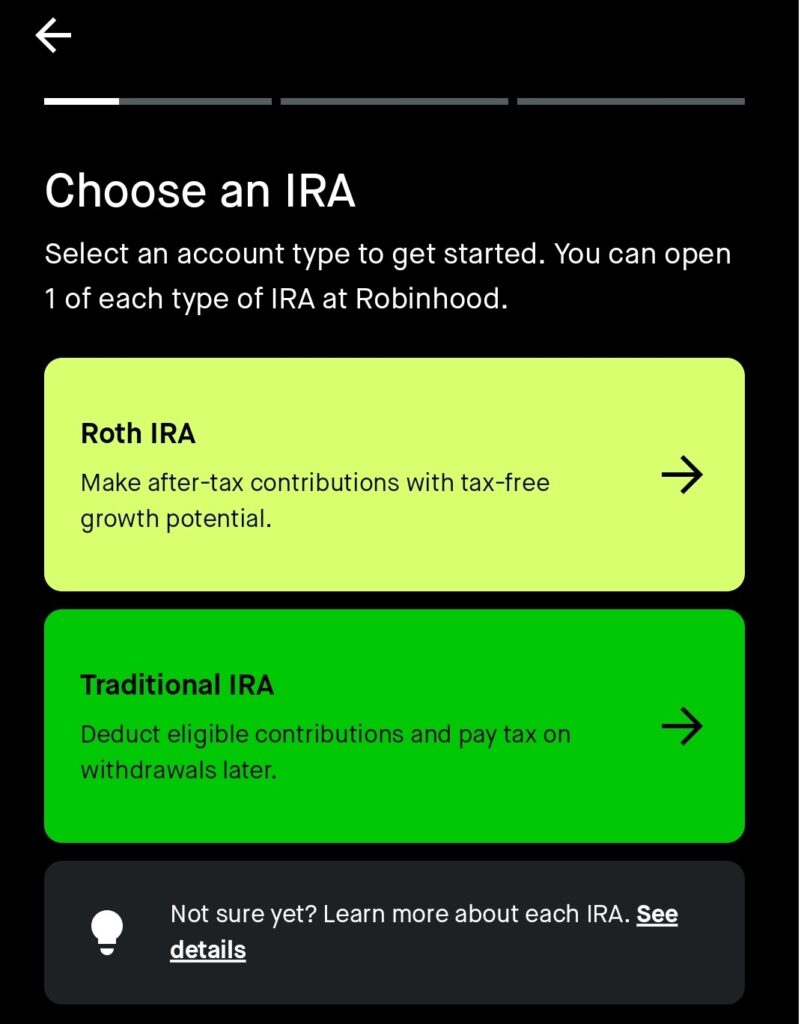

A Roth IRA offers tax-advantaged growth and withdrawals in retirement. Contributions are made with after-tax dollars, but qualified withdrawals in retirement are tax-free. This can be a significant benefit, especially if you anticipate being in a higher tax bracket in retirement.

The IRS provides detailed information on Roth IRA rules and regulations. Understanding these rules is crucial to avoid penalties and maximize the tax benefits.

Security and Regulation: Protecting Your Future

Robinhood is regulated by the SEC and the Financial Industry Regulatory Authority (FINRA). This oversight provides a level of protection for investors, but it's essential to understand the limits of that protection. No platform is immune to cybersecurity threats.

In 2021, Robinhood faced scrutiny from regulators regarding its handling of customer orders and disclosures. While the company has taken steps to address these concerns, vigilance remains crucial.

Weighing the Pros and Cons: Is Robinhood Right for You?

Robinhood's Roth IRA offers accessibility and affordability, making it appealing to new investors. However, limited investment options and the ease of access to high-risk investments like options raise concerns. A critical evaluation of your financial knowledge, risk tolerance, and investment goals is essential.

Consider your own financial literacy and time horizon. Are you a passive investor or do you actively manage your portfolio? The answer will dictate whether Robinhood aligns with your retirement strategy.

Next Steps: Due Diligence is Paramount

Before opening a Roth IRA on Robinhood, conduct thorough research on the available investment options. Understand the risks associated with each investment, especially options. Consult with a financial advisor if needed to ensure your strategy aligns with your long-term goals.

Keep a close eye on regulatory updates and any potential changes to Robinhood's platform. The landscape of online brokerage is constantly evolving, so staying informed is crucial for protecting your retirement savings. Regularly review your portfolio and adjust your strategy as needed.