Is Trip Insurance Worth It Delta

Imagine: the scent of sunscreen still clinging to your skin, the taste of salt lingering on your lips. You're unpacking souvenirs, the vibrant colors of your Hawaiian shirt a stark contrast to the gray skies gathering outside your window. But then, a notification – a text from Delta – your connecting flight is canceled. A wave of anxiety washes over you, visions of missed meetings and mounting expenses clouding the glow of your vacation memories.

In an increasingly unpredictable world, where weather patterns shift erratically and unforeseen events can disrupt even the best-laid travel plans, the question of whether or not to purchase trip insurance arises more frequently. Specifically, when flying with a major carrier like Delta, is the added expense of trip insurance truly worth the peace of mind it promises?

The Allure of Protection: What Trip Insurance Offers

Trip insurance, at its core, is a safety net designed to protect travelers from financial losses incurred due to unforeseen circumstances. These circumstances can range from flight cancellations and lost luggage to medical emergencies and even mandatory evacuations.

A comprehensive policy typically covers trip cancellation or interruption, providing reimbursement for non-refundable expenses like airfare and hotel bookings if you have to cancel your trip before departure or cut it short due to a covered reason. It also offers coverage for medical expenses, emergency medical transportation, and lost or delayed baggage, providing a financial cushion against unexpected costs while you're away from home.

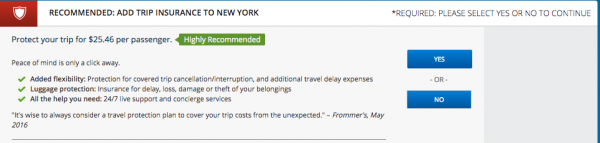

Many policies include coverage for travel delays, reimbursing you for meals and accommodation expenses incurred as a result of delayed flights. Delta, like other major airlines, offers its own version of trip insurance, often through partnerships with established insurance providers.

Delta's Trip Insurance Options: A Closer Look

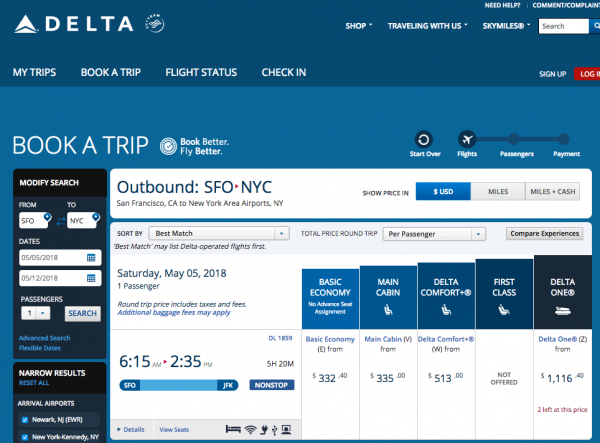

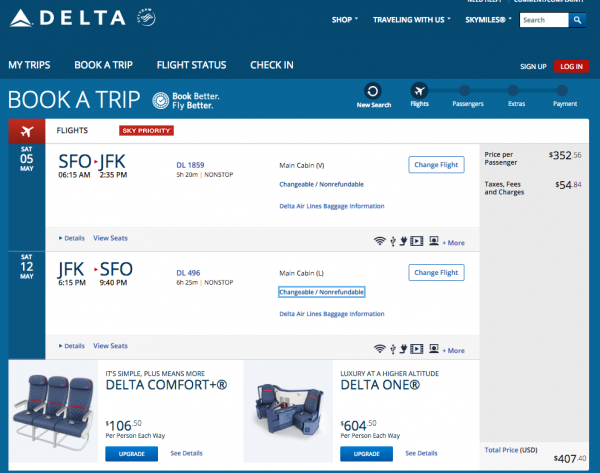

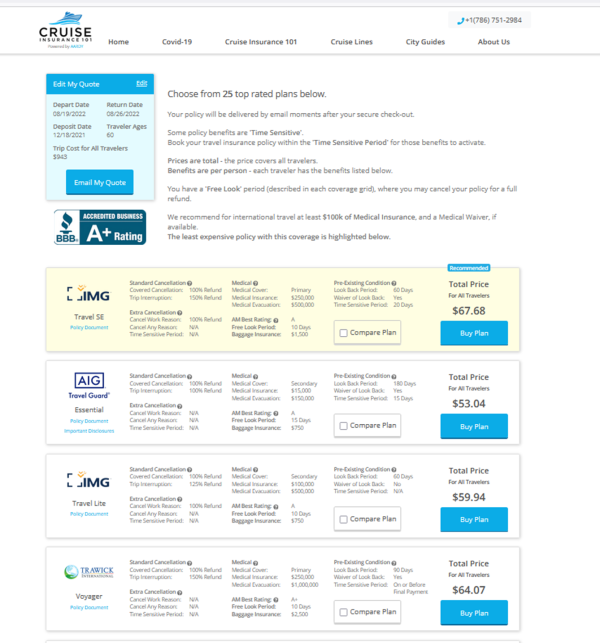

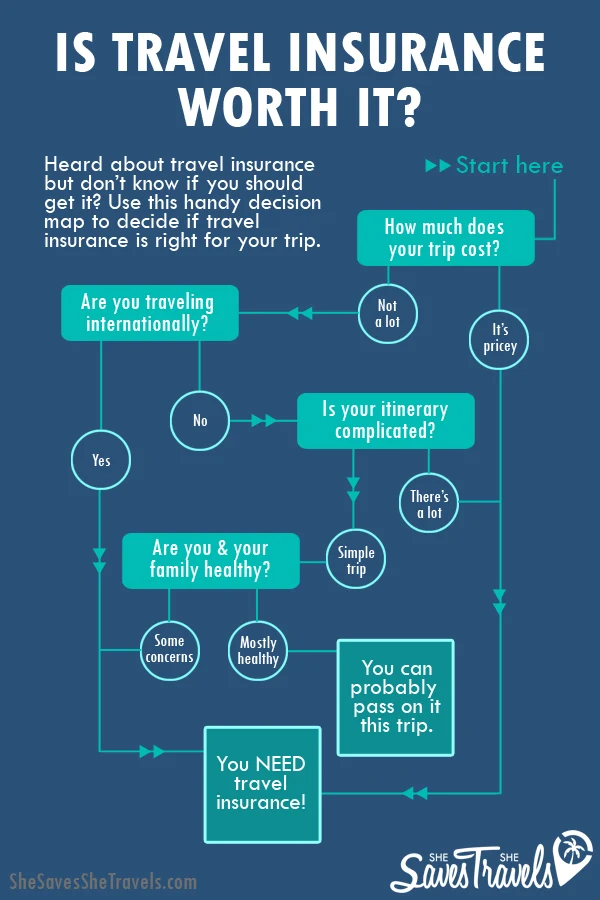

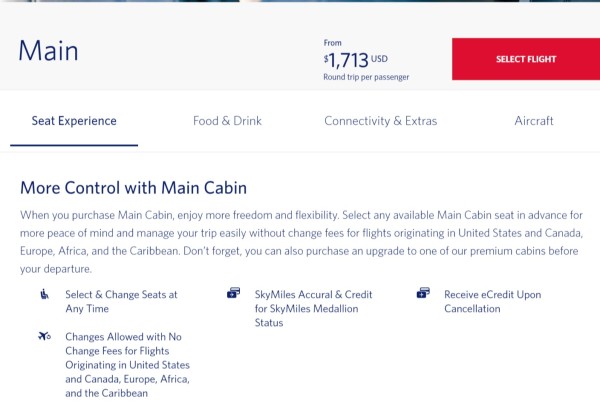

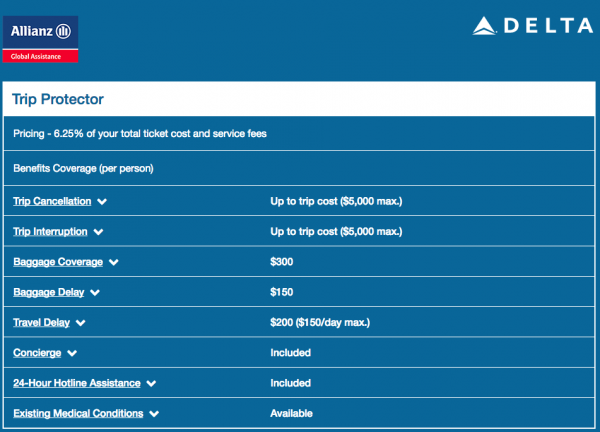

Delta Air Lines partners with various insurance companies to offer trip protection plans to its passengers. These plans usually come in different tiers, each offering varying levels of coverage and different price points.

A basic plan might primarily cover trip cancellation and interruption due to covered medical reasons. A more comprehensive plan, on the other hand, might add coverage for baggage loss, travel delays, and even pre-existing medical conditions (subject to specific terms and conditions).

According to Delta's website and partner insurance providers, the cost of trip insurance is typically calculated as a percentage of the total trip cost. Factors such as the traveler's age, destination, and the level of coverage selected also influence the premium.

Weighing the Costs and Benefits: A Personalized Decision

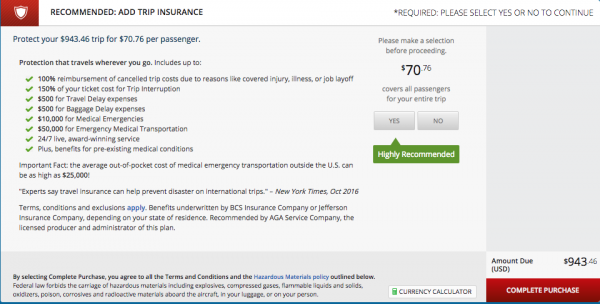

Determining whether trip insurance is worth the investment requires a careful assessment of individual circumstances and risk tolerance. Consider these factors when making your decision:

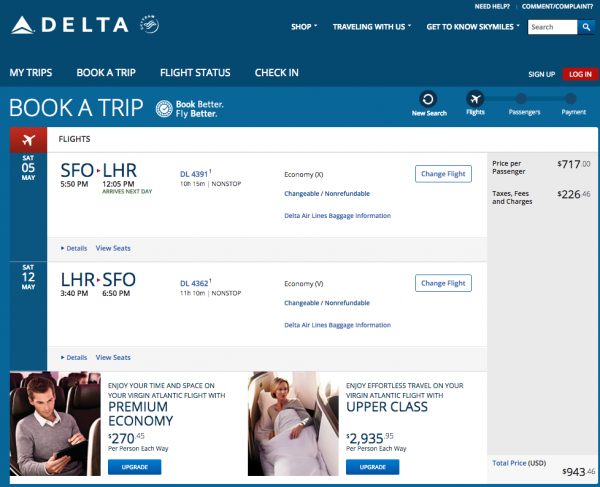

The cost of your trip: The more expensive your trip, the greater the potential financial loss if something goes wrong. A non-refundable cruise or an international tour with significant upfront costs might warrant the added protection of trip insurance.

Your health: If you have pre-existing medical conditions or are traveling with someone who does, trip insurance with medical coverage becomes even more important. It can help cover unexpected medical expenses and emergency medical transportation, which can be incredibly costly in foreign countries.

The destination: Traveling to regions prone to natural disasters or political instability increases the risk of travel disruptions. Trip insurance can provide coverage for evacuations or trip cancellations due to such events.

Delta's cancellation policies: Delta, like other airlines, has policies in place for flight cancellations and delays, particularly those caused by factors within their control, such as mechanical issues or staffing shortages. They may offer refunds, rebooking options, or compensation in such cases.

Existing coverage: Check your existing credit card benefits and homeowners or renters insurance policies. You might already have some travel-related coverage, such as baggage loss protection or travel accident insurance.

Reading the Fine Print: Understanding Exclusions and Limitations

Before purchasing trip insurance, it's crucial to carefully read the policy's terms and conditions, paying particular attention to exclusions and limitations. Common exclusions may include:

Pre-existing medical conditions: Many policies have limitations or exclusions for pre-existing conditions, meaning they may not cover medical expenses related to these conditions unless specific requirements are met.

Known events: Trip insurance typically doesn't cover events that were already known or foreseeable at the time of purchase, such as a hurricane that was already forecast to impact your destination.

"Fear of travel": Most policies don't cover cancellations due to a simple change of heart or fear of traveling.

Understanding these limitations ensures that you're aware of what the policy covers and what it doesn't, preventing disappointment and unexpected expenses down the line. Some policies may offer a "cancel for any reason" add-on, but these typically come at a higher premium and may only reimburse a percentage of the trip cost.

Beyond the Policy: Delta's Customer Service and Support

While trip insurance provides financial protection, Delta's customer service and support can also play a significant role in mitigating the impact of travel disruptions. Delta strives to provide assistance to passengers affected by flight cancellations or delays, offering rebooking options, meal vouchers, and accommodation assistance when appropriate.

Many passengers also use credit cards that offer travel protection as a benefit. These benefits may overlap or complement trip insurance, offering additional layers of security.

However, relying solely on Delta's customer service or credit card benefits might not be sufficient in all situations, especially when dealing with significant medical emergencies or complex travel disruptions.

Making an Informed Decision: A Balancing Act

Ultimately, the decision of whether or not to purchase trip insurance when flying Delta is a personal one, weighing the potential risks against the cost of the policy. There is no universal right or wrong answer.

Consider your individual circumstances, the specifics of your trip, and your risk tolerance. If you are traveling during hurricane season, have a pre-existing medical condition, or are investing a significant amount of money in a non-refundable trip, trip insurance might offer valuable peace of mind.

By carefully evaluating your needs and understanding the terms and conditions of the policy, you can make an informed decision that aligns with your travel style and budget. And perhaps, more importantly, you can embark on your journey with a greater sense of confidence, knowing that you've taken steps to protect yourself against the unexpected.